September 23, 2022 Weekend Market Review/Preview

Range expansion

Welcome to the weekend. I’m sure many are glad this week is over.

With proper preparation and positioning, weeks like this don’t have to be stressful. I can help.

Let’s take a look at this week and get ready for next.

If you're a new reader, first of all - Thank you! Take a minute to subscribe now.

And while you're at it why not forward this to a few friends?

What a week!

By now I'm sure you know that the market sold off heavily this week. The official number from Friday close to Friday close is -5.69%

Last week I had some comments about patience, an attribute that is becoming even more necessary. I think it is worth revisiting.

Patience pays. And it's one of the most critical attributes of successful trading. I share reminders of this every chance I get.

You can read through them here. It’s an extensive list from a variety of sources.

The markets

Looking back to CPI Wednesday comments:

Before the market opened this morning, at roughly 9:00 AM, SPY had already moved in a range of almost 7% for the week. (I take back the "snooze" comment).

Ranges have continued to expand.

At the close today the SPY had moved in another 6.68% range since Wednesday.

Volatility is picking up too. And the dollar is still moving higher and at an increasing pace.

While things are getting extended to the downside, these factors could work to accelerate the move lower.

Many have been looking for a capitulation day, thinking one good washout could finish this bear off and make way for prices to rise again.

$DXY

$VIX

Bull and bear case

"Prices still haven't stopped going down." - Captain Obvious

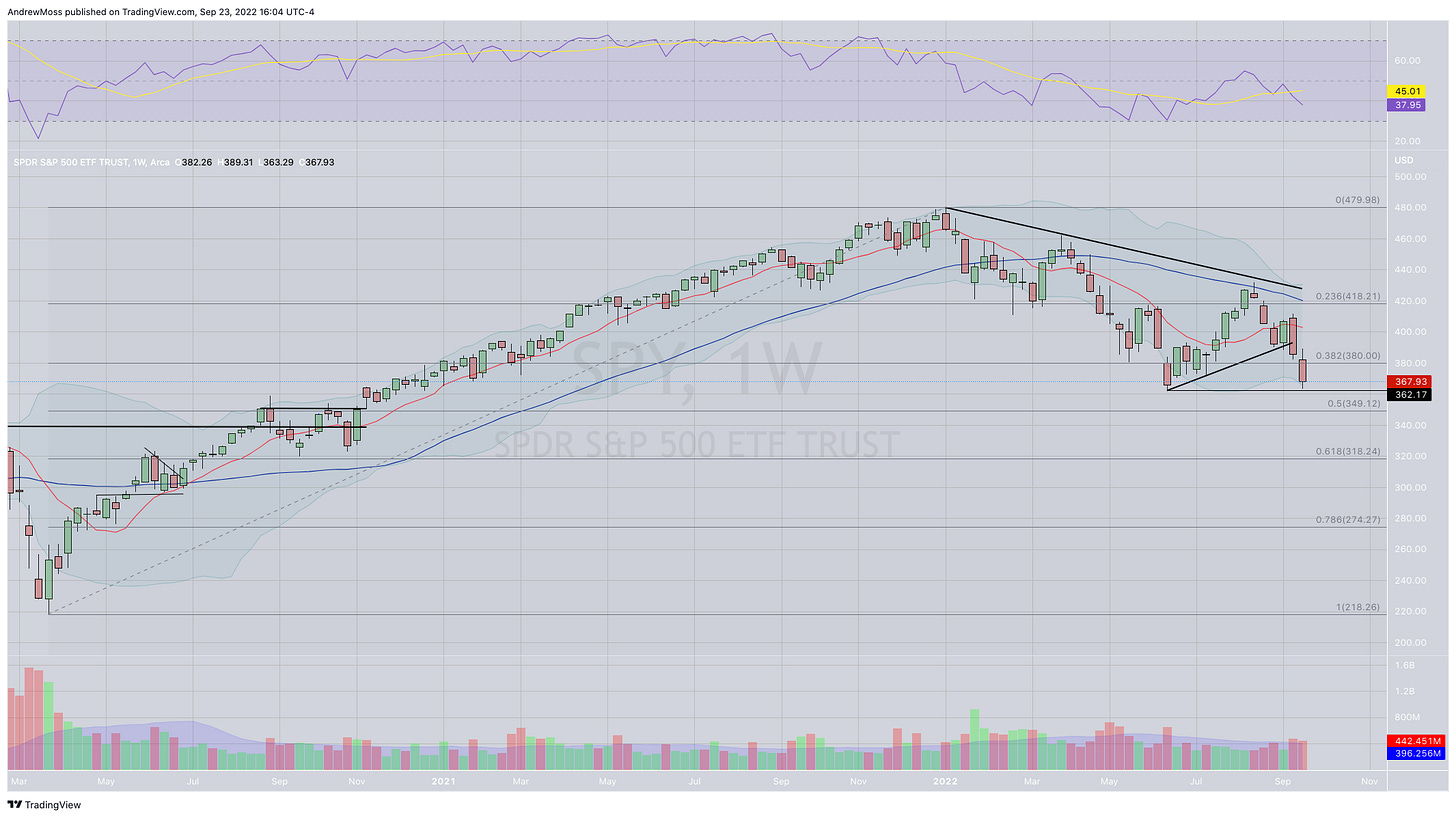

That is still hurting the bull case. But, as mentioned above, prices are getting extended from the moving averages, and the June lows are in sight. Maybe those factors will provide some support.

On the bearish side, watch out if the June 17 pivot doesn't hold.

After that, $350 is a possible support level as there are some pivots there dating from August to November of 2020. It also is very near the 50% retracement of the move from the March 2020 low to the all-time high in January 2022. Lastly, I'll point out the pre-covid high in Feb 2020.

Areas of interest.

Here’s a weekly chart of SPY

Find me on Twitter tomorrow morning for many more weekly charts.

In the markets, keep it simple. One level at a time. Have patience and take smaller risk positions, if any at all, until things firm up.

What I'm reading and listening to

I started one new book and listened to one podcast this week.

The book showed up at the perfect time. A couple of days ago I started writing and compiling a short list of must-read trading psychology books. Then, boom! Look what showed up from Steve and Holly Burns.

I’m about halfway through it so far and it’s very good. I will share the list next week.

Have you ever heard of Edwin Land? If not, you’ve certainly heard of and probably owned a Polaroid camera. No? How about a pair of polarized sunglasses? Edwin Land, a true genius and visionary, invented all of those things.

David Senra @FoundersPodcast runs through his story.

What I saw and shared on Twitter

I love this quote from Howard Lindzon;

True in any endeavor -

A little help -

Sitting on the sidelines is free!-

Sentiment is in the gutter-

Anything else?

That's all for now. Thanks always for reading, subscribing, and sharing with your friends and family.

I hope you have a fantastic weekend.

Cheers.

***This is NOT financial advice. NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.

Andrew Moss is an associated member of T3 Trading Group, LLC (“T3TG”) a SEC registered broker/dealer and member of FINRA/SIPC. All trades placed by Mr. Moss are done through T3TG.

Statements in this article represent the opinions of that person only and do not necessarily reflect the opinions of T3TG or any other person associated with T3TG.

It is possible that Mr. Moss may hold an investment position (or may be contemplating holding an investment position) that is inconsistent with the information provided or the opinion being expressed. This may reflect the financial or other circumstances of the individual or it may reflect some other consideration. Readers of this article should take this into account when evaluating the information provided or the opinions being expressed.

All investments are subject to risk of loss, which you should consider in making any investment decisions. Readers of this article should consult with their financial advisors, attorneys, accountants or other qualified investors prior to making any investment decision.

Please Note: short puts are synthetic longs, and short calls are synthetic shorts

Options symbols are denoted as follows:

Ticker, Date, Call/Put, Strike Price

Example: VXX1218C30 = VXX 12/18 Call with a $30 strike