September 9, 2022 Weekend Market Review/Preview

Is the Bull back?

Welcome to the weekend!

If you're a new reader, first of all - Thank you! Take a minute to subscribe now.

And while you're at it why not forward this to a friend?

This week we saw something we haven't seen in a little while. Positive price action! So let's get right to it.

The market

Last week the bulls were quiet and prices were down. We looked at the charts and laid out possibilities in both directions.

The bull case is the same; there's not much of one until we see one of these potential support areas hold and help prices stop the slide.

Potential support became actual support the market was able to bounce.

Wednesday's Mid-Week Market Update had this:

Prices found some stable footing today moving higher in a relatively smooth, consistent fashion.

and

....maybe it’s a start.

It does look like a start. And one that could show some promise.

The indexes on the daily charts are back at or above the key short-term moving averages and swing low anchored VWAPs.

And the shorter term 65-minute charts are curling upward and moving through short-term resistance levels.

(See $AAPL comments below)

$DXY - The benefit of the US dollar moving lower can not be overstated. I’d like to see that continue next week.

$VIX - Volatility relaxing a bit is helpful too, of course.

Bull and bear case

So now our conditions have been met and there is a bull case taking shape. I'm not loading up on swing-long positions yet, but I'm certainly taking a closer look. Naturally, I want to be long when the market is conducive to that. Also, many potential short trade setups I've been watching have failed or have been otherwise negated.

Next week I'll watch how potential resistance levels for the market and over the weekend I will scout for individual names that look like attractive longs.

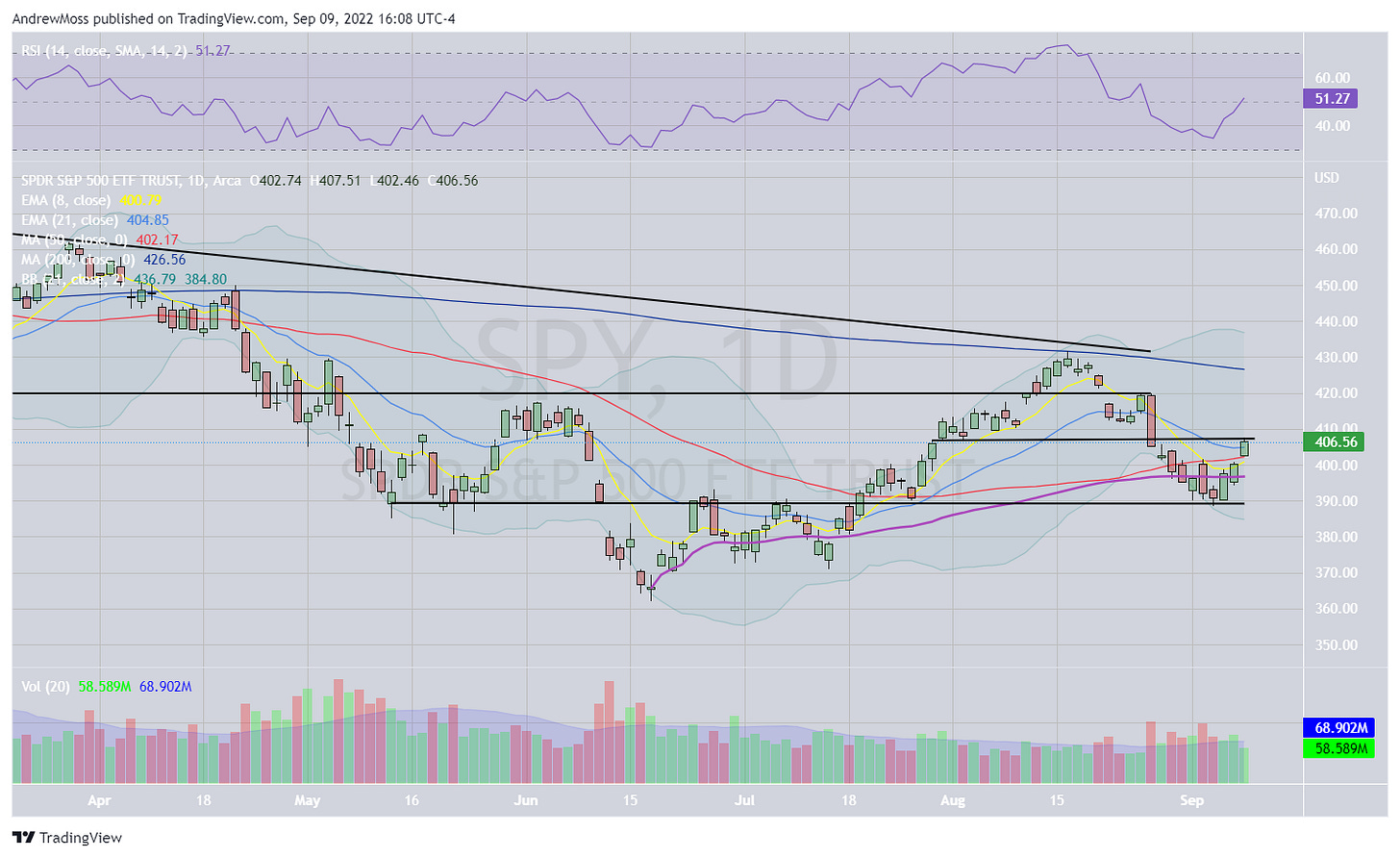

As noted by the lines on the charts:

407, 420, and 430 are areas to watch on SPY

307, 320, and 332 for QQQ

What I'm reading and listening to

This book came up in an options workshop I attended, so I decided to take a look. I'm not very far into it yet, but I really like the lesson regarding Decision Theory which has to do with 'rational vs right' decisions.

Sometimes the proper, rational decision still leads to an unfavorable outcome. And sometimes we get lucky. That is, we can make an irrational decision and get a favorable outcome.

This is as true in trading and investing as it is anywhere else in life. Maybe even more so. And as traders, athletes, professionals, or just as human beings we're judged (and judge others) based primarily on outcomes rather than process.

But to be successful in trading, investing, sports, or any other endeavor a few lucky outcomes are never going to provide lasting prosperity. We have to have a good process. This means we have to create a rational decision-making process that puts the odds in our favor, and that we can repeat with discipline and precision.

AlphaBrain: How a Group of Iconoclasts Are Using Cognitive Science to Advance the Business of Alpha Generation

From Twitter

AAPL found support this week in the form of the swing low anchored VWAP. That was an early tell that things were starting to shape up.

Here’s the daily chart. Notice the purple line - VWAP anchored to the June low.

AVWAP continues to prove its usefulness to me and I'm excited that Brian Shannon @alphatrends has a book about it coming soon.

As it happens so often, one book or article or podcast leads me to another 10 or 20 that I want to check out. Jim O’Shaughnessy’s podcast, Infinite Loops led me to his son Patrick’s podcast. In this episode, Patrick has a conversation with another podcaster, David Senra, who now has about 20 or more episodes of his show “Founders” on my playlist.

We hear it over and over, “to succeed in trading you must control your emotions.” But that can be like trying to control the weather. We can’t always limit emotions when they arise. What we can do is raise our awareness of them and the impact they have. By doing this we actually turn a disadvantage into an advantage.

On that note, here are some comments on focusing our attention toward the only thing we can control, ourselves.

Anything else?

You tell me. What else do you want to see? I'd love to hear (read) your thoughts. Drop me line by replying to this email. Or find me on Twitter.

I'll share some weekly charts there tomorrow morning. So chime in and let me know what you think.

Thanks always for reading, subscribing, and sharing with your friends and family.

I hope you have a fantastic weekend.

Cheers.

***This is NOT financial advice. NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.

Andrew Moss is an associated member of T3 Trading Group, LLC (“T3TG”) a SEC registered broker/dealer and member of FINRA/SIPC. All trades placed by Mr. Moss are done through T3TG.

Statements in this article represent the opinions of that person only and do not necessarily reflect the opinions of T3TG or any other person associated with T3TG.

It is possible that Mr. Moss may hold an investment position (or may be contemplating holding an investment position) that is inconsistent with the information provided or the opinion being expressed. This may reflect the financial or other circumstances of the individual or it may reflect some other consideration. Readers of this article should take this into account when evaluating the information provided or the opinions being expressed.

All investments are subject to risk of loss, which you should consider in making any investment decisions. Readers of this article should consult with their financial advisors, attorneys, accountants or other qualified investors prior to making any investment decision.