Short (-lived) Selling

Monday Market Update November 13, 2023

The Markets

Selling has been short-lived recently as the bears haven’t been able to stay around long. They had a chance to send prices lower on Thursday afternoon and Friday but couldn’t seal the deal.

Today’s early selling couldn’t even make it to noon before SPY went green on the day. (It did close the day -0.10% lower)

So the sequence continues to play out in a bullish fashion, moving through resistance levels and on to new tests.

✅ A strong move higher

✅ Followed by sensible consolidation

✅ Then another leg up

Inflation is still a concern. CPI data tomorrow morning could change things. But until then, markets keep going up.

The Charts

SPY is through the shaded resistance zone and into another trendline. Notice it has made a slightly higher high on each of the last six days. The moving averages are mostly pushing higher - only the 50-day still has a negative slope. RSI is far from overbought. The technical picture says to look for a continuation higher.

QQQ keeps passing its tests with persistent, methodical buying. New highs aren’t far away.

IWM will go down, but it won’t stay down. However, it’s a long way from winning the fight. A successful retest of this downtrend breakout followed by a move beyond the 8-day MA near $170 and the 50-day near $174 score a few rounds in its favor.

DIA has broken over the trendline and back into a significant support/resistance zone.

TLT continuing with mostly sideways movement adds to the case that we may be seeing a bottoming process in action.

DXY The Dollar could be in the early stages of a bear flag breakdown. Watch Friday’s high and the 21-day MA above and last Monday’s low underneath.

The Closing Bell

There’s the technical case.

Will the economic (inflation date) or fundamental (earnings) cases change things?

We’ll find out tomorrow morning with CPI at 8:30 AM and then again with PPI on Wednesday morning at the same time.

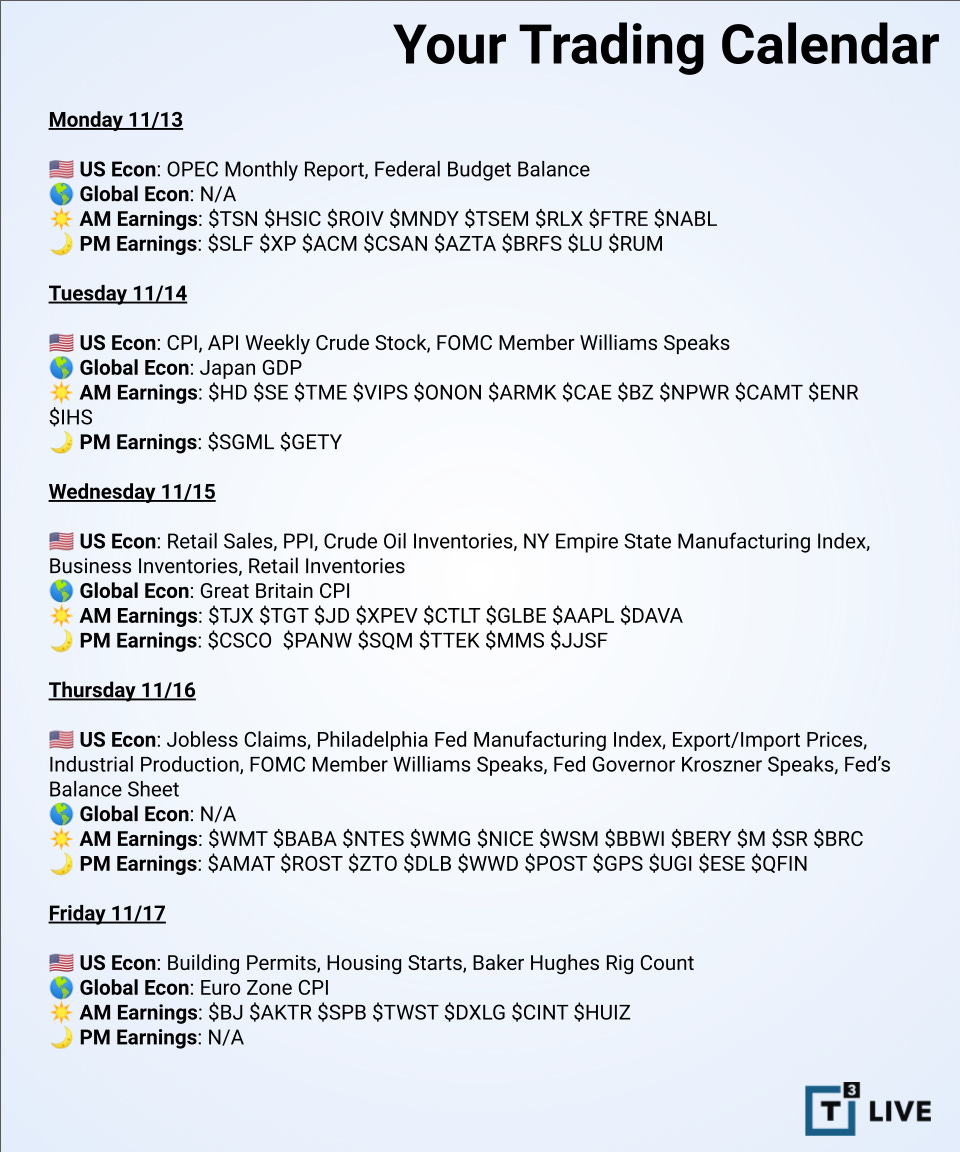

Many retail names report earnings week.

HD 0.00%↑ TJX 0.00%↑ TGT 0.00%↑ WMT 0.00%↑ BABA 0.00%↑ M 0.00%↑ ROST 0.00%↑ GPS 0.00%↑

Do we learn anything new about the strength (or weakness) of the consumer?

More to come in Thursday’s note.

The Disclosures

***This is NOT financial advice. NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.

Andrew Moss is an associated member of T3 Trading Group, LLC (“T3TG”) a SEC registered broker/dealer and member of FINRA/SIPC. All trades placed by Mr. Moss are done through T3TG.

Statements in this article represent the opinions of that person only and do not necessarily reflect the opinions of T3TG or any other person associated with T3TG.

It is possible that Mr. Moss may hold an investment position (or may be contemplating holding an investment position) that is inconsistent with the information provided or the opinion being expressed. This may reflect the financial or other circumstances of the individual or it may reflect some other consideration. Readers of this article should take this into account when evaluating the information provided or the opinions being expressed.

All investments are subject to the risk of loss, which you should consider in making any investment decisions. Readers of this article should consult with their financial advisors, attorneys, accountants, or other qualified investors prior to making any investment decision.

POSITION DISCLOSURE

November 13, 2023, 4:00 PM

Long: DDOG, SQ

Short:

Options symbols are denoted as follows:

Ticker, Date, Call/Put, Strike Price

Example: VXX1218C30 = VXX 12/18 Call with a $30 strike