Slow Down Summer

Market Update Monday August 28, 2023

The Markets

It’s a sleepy start to the week as we move toward the Labor Day holiday and the traditional end of summer. Maybe all the big institutional traders and hedge fund managers are on vacation. Whatever the case, sleepy doesn’t mean unproductive.

If you haven’t yet reviewed the Weekly Chart thread from Saturday take a look at that first to see where things stand in the bigger picture.

Drilling down further we can see that this morning’s gap and fade took stocks down to a very logical support area where they rebounded and moved back to some short-term pivot levels. This sequence played out several times throughout the day.

It’s not breath-taking action. But more time spent above the 5-day MA, which is moving higher, is better for bulls.

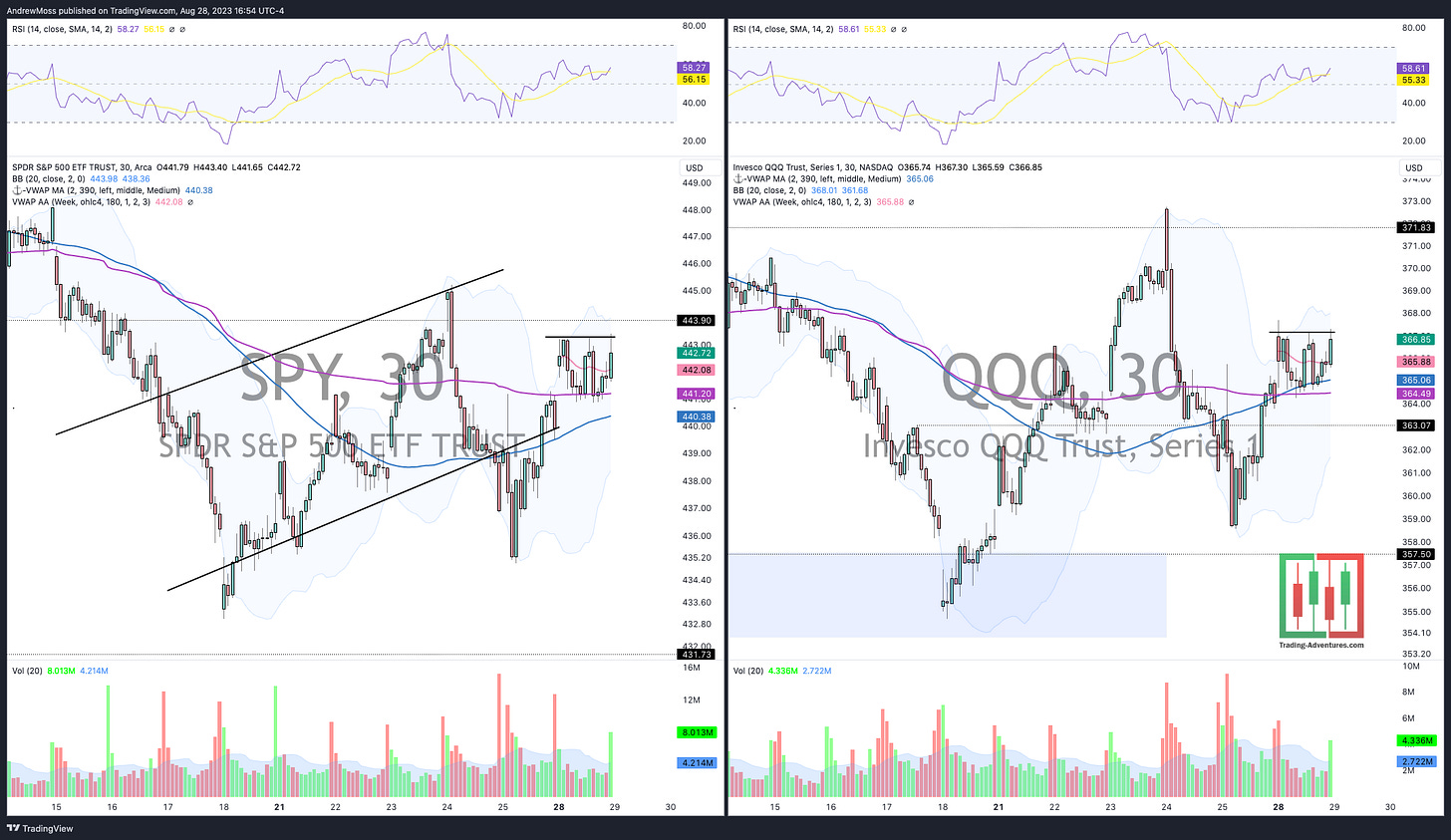

SPY & QQQ 30m chart

Notice the move lower to test an anchored VWAP (purple line) and the resumption higher, which happened several times.

Still a bit choppy. And still in the middle of the wide range of the last few days. But it is some improvement.

Moving on to the daily charts-

The Charts

SPY is looking at trendline resistance again. A move beyond that, Thursday’s opening high, and the 21 and 50-day MAs (all very close to $445) would be further evidence that we’ve seen the bottom of this dip.

QQQ made some progress higher and has the 21 and 50-day MAs overhead to deal with.

IWM still has bear flag potential.

DIA is working hard to prevent a failed breakout.

TLT Treasury Bonds are working higher and trying to clear the 21-day MA.

DXY The US Dollar so far looks like it has found resistance as price and RSI turn lower. Now follow-through is key.

The Closing Bell

The calendar is mostly quiet for the rest of this week. But we do have earnings reports still rolling in, as well as PCE data and Jobs Data (JOLTS, ADP Employment, and Nonfarm payrolls).

The Fed has been paying very close attention to these reports. When they say rate decisions are “data dependent” this is some of the data to which they are referring.

There isn’t much to do as stocks navigate the range boundaries. Prices could still break either way. And neither result would be any more surprising than the other.

So waiting, watching, and sitting on your hands is perfectly acceptable here.

Back with more Thursday.

The Disclosures

***This is NOT financial advice. NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.

Andrew Moss is an associated member of T3 Trading Group, LLC (“T3TG”) a SEC registered broker/dealer and member of FINRA/SIPC. All trades placed by Mr. Moss are done through T3TG.

Statements in this article represent the opinions of that person only and do not necessarily reflect the opinions of T3TG or any other person associated with T3TG.

It is possible that Mr. Moss may hold an investment position (or may be contemplating holding an investment position) that is inconsistent with the information provided or the opinion being expressed. This may reflect the financial or other circumstances of the individual or it may reflect some other consideration. Readers of this article should take this into account when evaluating the information provided or the opinions being expressed.

All investments are subject to the risk of loss, which you should consider in making any investment decisions. Readers of this article should consult with their financial advisors, attorneys, accountants, or other qualified investors prior to making any investment decision.

POSITION DISCLOSURE

August 28, 2023, 4:00 PM

Long:

Short:

Options symbols are denoted as follows:

Ticker, Date, Call/Put, Strike Price

Example: VXX1218C30 = VXX 12/18 Call with a $30 strike