The Charts

Just a few important charts for today’s update.

IWM The Small Cap breakout appears to be the real deal as IWM screams higher and beyond the critical $200 level.

It hasn’t been quick or easy, but price has finally crossed the mark, adding depth to the bull market. And it’s done so while large-cap counterparts SPY & QQQ have an off day. Healthy rotation.

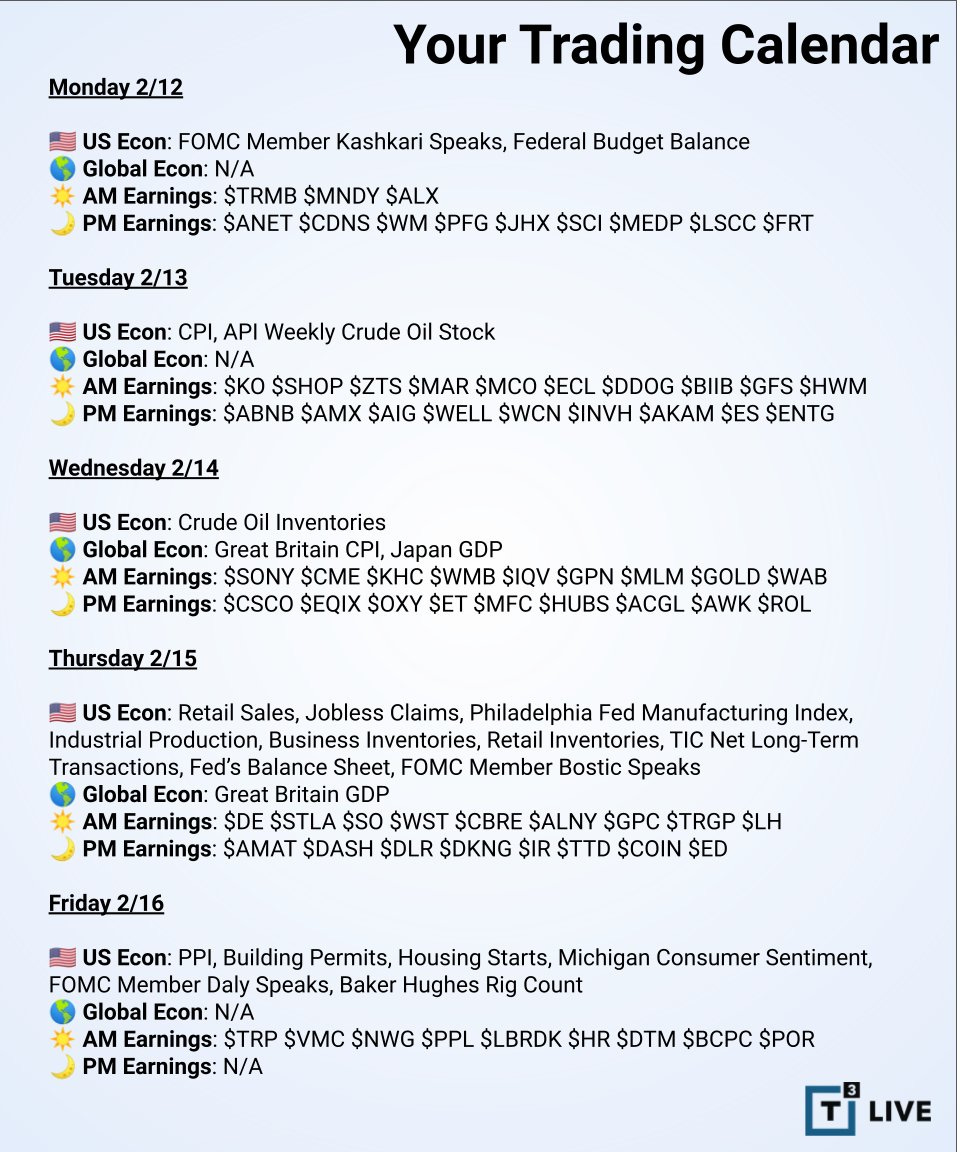

That’s the ‘get above’ part. Now we see if it can ‘stay above’ $200. Inflation data in the form of CPI (Tuesday, Feb. 12) and PPI (Friday, Feb. 16) this week could make or break it.

BTCUSD moved past the $50k mark, giving yet another signal that the ‘risk-on’ appetite is alive and hungry.

Both of these things were able to happen without a big supporting move in rates and the Dollar.

TLT is stable, but it's not jumping higher to give relief in interest rates.

DXY US Dollar futures are also stable, riding along the July low anchored VWAP.

In recent weeks and months, we often needed to see strong, supporting moves in these two areas for stocks to have good action. Now that stocks are moving while US Bonds and the Dollar simply stay stable, maybe we are seeing further evidence of a changing relationship.

The Closing Bell

We have CPI and PPI numbers this week, some Fed speakers, and many more earnings reports.

Keep an eye on those items.

And -

Please go to X for the Weekly Chart thread if you haven’t already. Type Andrew Moss, CMT, or @Andy__Moss into the search bar.

Elevate Your Trading

Education, training, and support for your Trading Adventure.

Options Trades - Weekly trade ideas are delivered to your email or text messages in language you can easily understand.

Check out EpicTrades from David Prince and T3 Live. Epic Trades from David Prince

Community - Are you an experienced trader seeking a community of professionals sharing ideas and tactics? Visit The Inner Circle, T3 Live’s most exclusive trading room - designed for elite, experienced traders.

The Inner Circle at T3 Live

Prop Trading - Or perhaps you are tested and ready to explore a career as a professional proprietary trader? 3 Trading Group has the technology and resources you need.

Click here to start the conversation:

T3TradingGroup.com

The Disclosures

***This is NOT financial advice. This is NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.

Andrew Moss is an associated member of T3 Trading Group, LLC (“T3TG”), an SEC-registered broker/dealer and member of FINRA/SIPC. All trades placed by Mr. Moss are done through T3TG.

Statements in this article represent that person’s opinions only and do not necessarily reflect those of T3TG or any other person associated with T3TG.

Mr. Moss may hold an investment position (or may be contemplating holding an investment position) that is inconsistent with the information provided or the opinion being expressed. This may reflect the financial or other circumstances of the individual, or it may reflect some other consideration. Readers of this article should consider this when evaluating the information provided or the opinions being expressed.

All investments are subject to the risk of loss, which you should consider in making any investment decisions. Readers of this article should consult with their financial advisors, attorneys, accountants, or other qualified investors before making any investment decision.

POSITION DISCLOSURE

February 12, 2024, 4:00 PM

Long: C0314C55, PYPL0301P59, SQ0223C70, TWLO0216C75

Short:

Options symbols are denoted as follows:

Ticker, Date, Call/Put, Strike Price

Example: VXX1218C30 = VXX 12/18 Call with a $30 strike