Small Caps Take The Lead

New highs in the Russell 2000 mark expanding participation and structural progress.

Subscriber Note

A private update will be shared soon—only through Trading Adventures. Make sure you’re subscribed to receive it.

The Markets

Small caps just took the lead.

IWM closed at new all-time highs today, marking a shift in relative strength and signaling expanding participation. After years of relative weakness, this breakout marks a significant shift in participation. It reflects expanding risk appetite and confirms structural improvement.

While QQQ and SPY consolidate near highs, IWM is resolving a multi-year range and establishing leadership.

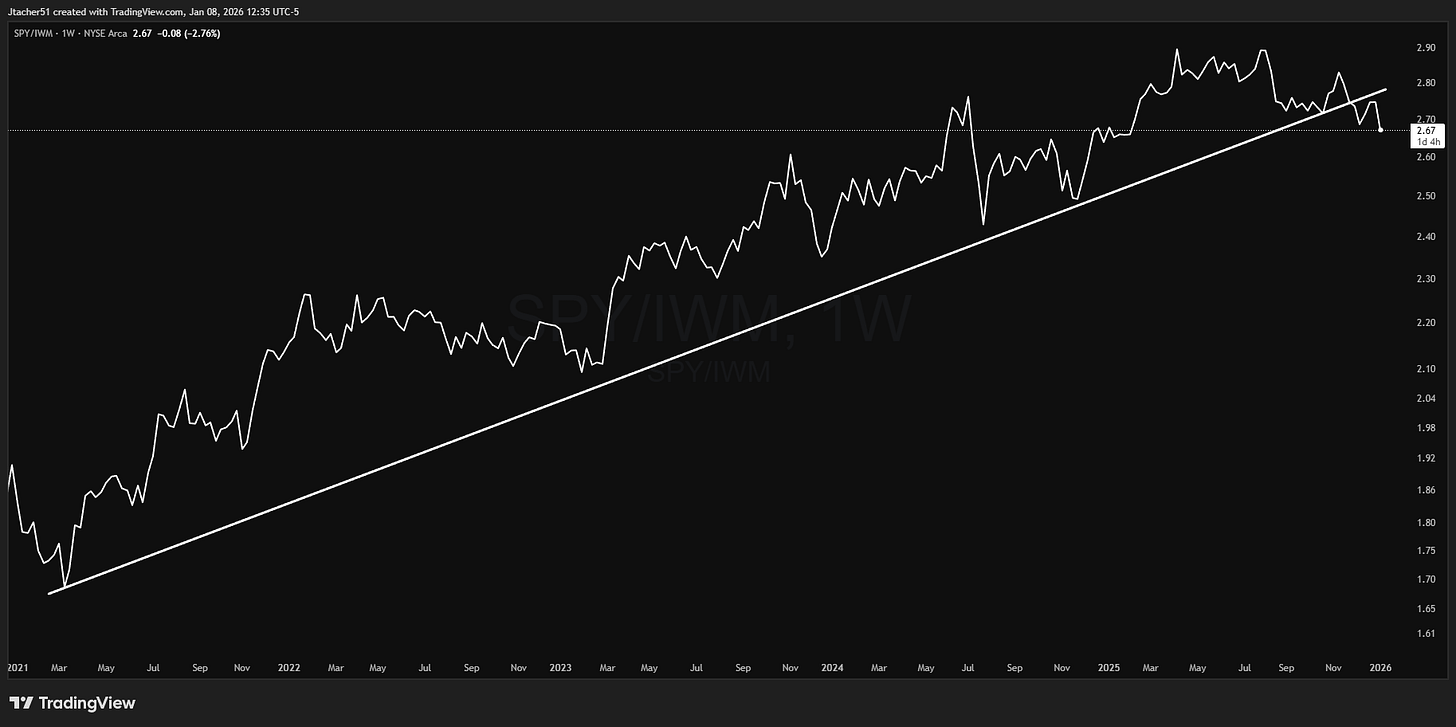

Jack (aka @alphacharts365) shared this relative strength chart of SPY vs. IWM on X today. Hat tip to him for putting it in front of us.

The chart shows that after more than four years of large cap (SP 500) leadership, the relationship is changing.

Let’s look at the indices.

The Charts

SPY is holding near the 2025 highs and above all key moving averages.

QQQ confirmed yesterday’s reversal candle and is retesting the trendline breakout. It also remains above the averages.

IWM with a strong move to new highs, capping off a big move from the 50-day average, which it tested last week. RSI isn’t close to being overbought. And the 8-day MA will likely pass above the 21-day average tomorrow, putting all the moving averages back into a bullish sequence.

DIA bounced well after yesterday’s pressure. It too is above all key moving averages, which are rising in sequence.

TLT remains stuck below it’s moving averages as once again the brief rise (one day) failed to take the RSI above 50.

DX1! is testing the declining 200-day MA again.

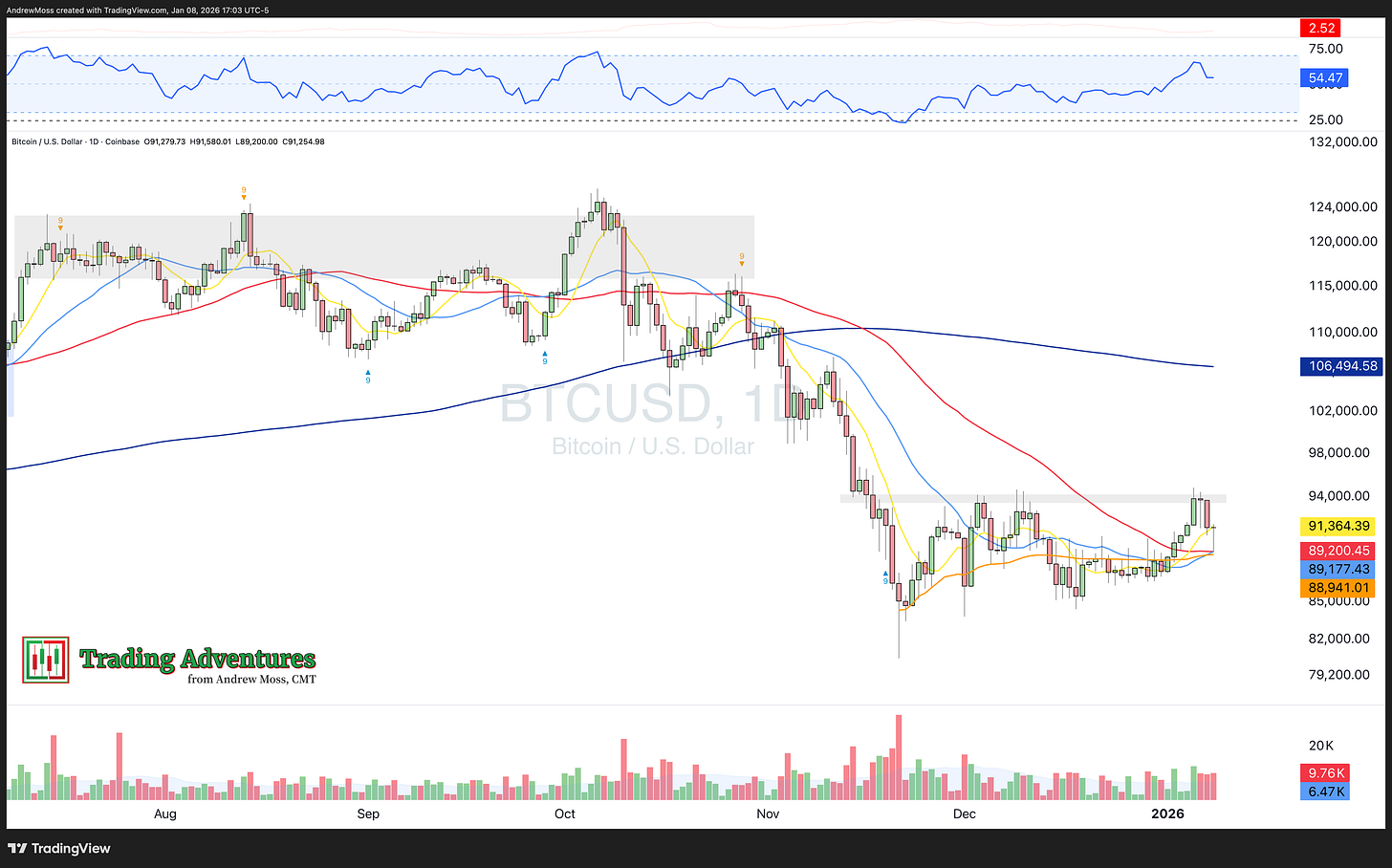

BTCUSD continued to slide after getting rejected at previous highs. Although it did find enough support for a bounce (see the long lower shadow on today’s candle) from the cluster of moving averages and the AVWAP from the recent low.

The Trade

IWM now has the technical leadership.

But it’s still a breakout, and breakouts carry risk. Price is extended in the short term, and the 8-day moving average is rising but hasn’t caught up. That puts the near-term focus on digestion and support. Some more upward movement followed by a pullback toward the breakout zone would be constructive.

As long as price holds above that area—and the moving averages—the trend remains intact. If it starts to build higher lows above that zone, the next leg higher becomes more likely with risk being defined against the breakout level.

Structure favors continuation — but patience pays.

The Disclosures

***This is NOT financial advice. This is NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.

Clarity of perspective, delivered with matching literacy. Thank you

Nice