Smoke 'em If You Got 'em

Monday Market Update -- Break Time For Stock Indexes

The Markets

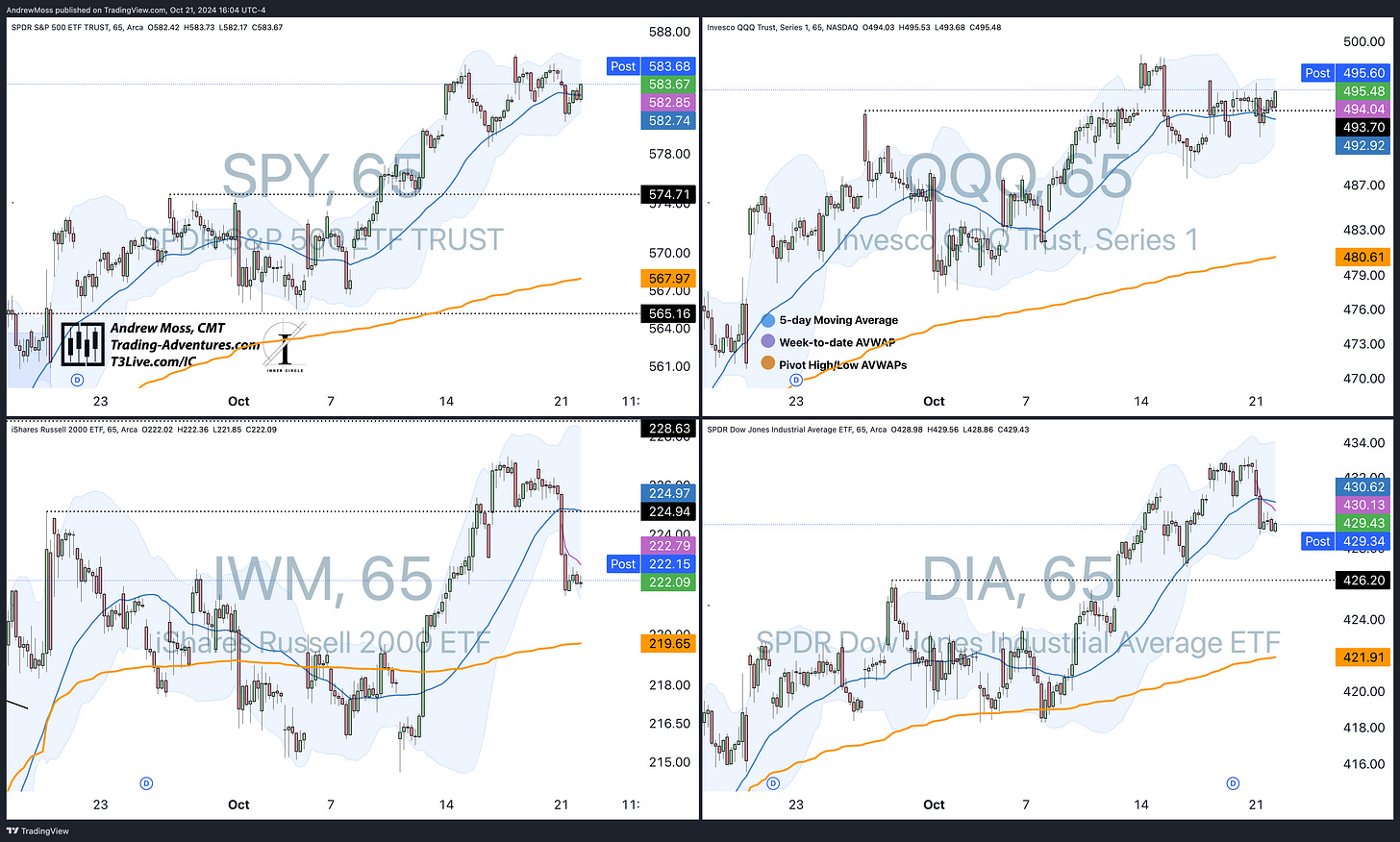

Stock indexes are mostly down today, having some ‘break time’ after last week’s rise.

Looking at the 65-minute charts, we can see the 5-day MAs all starting to curl lower, with prices at or below the average for two of the four (DIA and IWM).

IWM is leading the trip lower, which isn’t surprising since it was the biggest winner last week.

We’ll monitor the action and see how deep the pullback gets. Each index has considerable room before hitting a 21-day MA.

The economic calendar is light this week, but several notable earning reports are coming, including TSLA, LRCX, TXN, and SAP.

Here are the other usual charts, followed by a recap of a very busy week and weekend.

The Charts

TLT continues to show a complete failure move after hitting the 2021 pivot high AVWAP. This Treasury Bond ETF is now down nearly -10% as the bounce from the 2023 low AVWAP was short-lived and did not produce a bottom. There are pivot lows at $91.47, $89.81, and $88.68 to watch for potential support.

DXY Meanwhile, US Dollar Futures continue charging higher, now above the 200-day MA. RSI is overbought, and there is a pivot high at $104.56. We’ll see if/when it finds resistance.

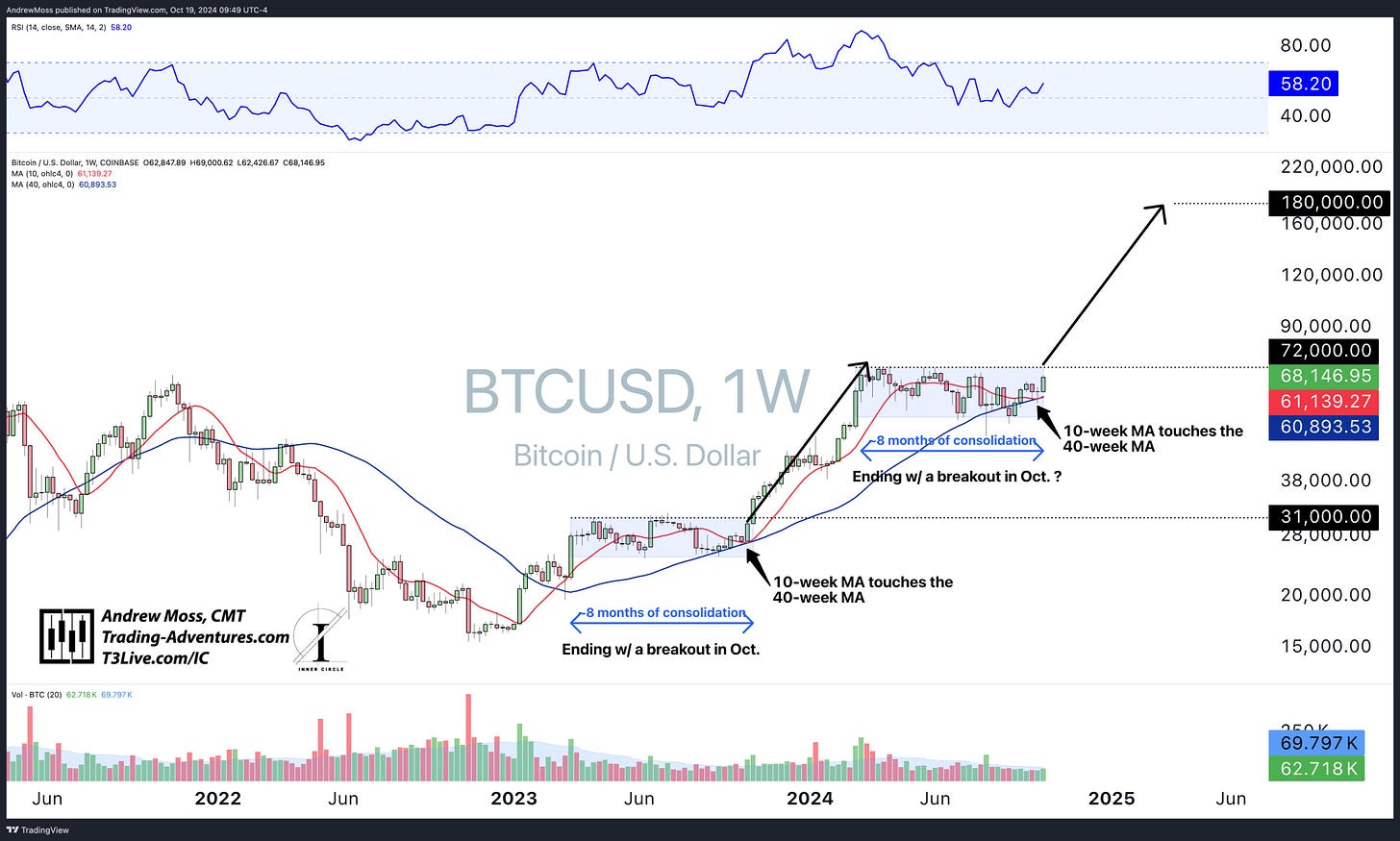

BTCUSD is getting sold a bit today after the weekend breakout, but the action is mild, and price is holding up well. More on this to follow.

Weekend Recap

The Saturday Morning 📈Weekly Chart📉 thread was big and well worth reading. Apologies for not linking it here sooner. Please take a look by clicking this link:

Saturday Morning 📈Weekly Charts📉

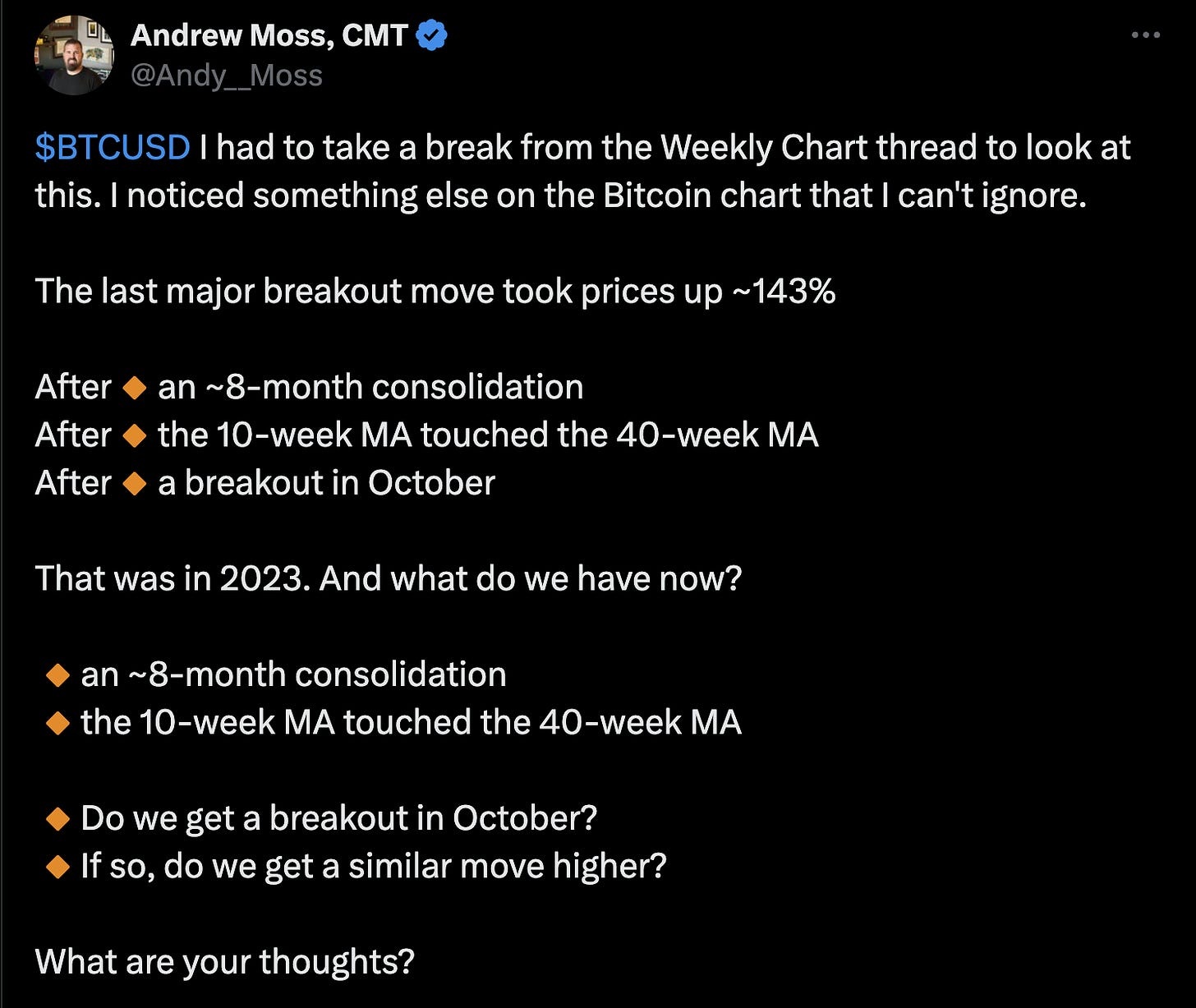

While running through those charts, I noticed something about Bitcoin.

Coincidence?

Looking further back into the week:

Tuesday, my friend Jake Wujastyk hosted David Prince and a few others on 𝕏 for a live discussion of what to look for as we head into election day.

Last (but not least 😜), I had a great time talking with friends Sean McLaughlin and Steve Strazza of the Off The Charts podcast about charts, trading, life, and getting outside.

You can watch and listen on their Stock Market TV webpage, YouTube, Spotify, Apple, or wherever you get your podcasts.

That’s a busy week. If you’ve already seen some (or all) of this, I hope you found it helpful and enjoyable.

If you missed it, take a few minutes to catch up (on some, not all; I’m a realist, after all 😉), and let me know what you think.

And be on the lookout for more charts, comments, market thoughts, and some exciting new announcements about this webpage coming soon.

Elevate Your Trading

Education, training, and support for your Trading Adventure.

Options Trading and Education - Weekly trade ideas are delivered to your email or text messages in language you can easily understand.

Check out EpicTrades from David Prince and T3 Live.

Community - Are you an experienced trader seeking a community of professionals sharing ideas and tactics? Visit The Inner Circle, T3 Live’s most exclusive trading room - designed for elite, experienced traders.

Prop Trading - Or perhaps you are tested and ready to explore a career as a professional proprietary trader? 3 Trading Group has the technology and resources you need.

Click here to start the conversation:

The Disclosures

***This is NOT financial advice. This is NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.