The Markets

As prices continue the usual back-and-forth action, one thing continues on in a straight line.

The bull/bear market debate.

The topic has been covered ad nauseam so there is a reluctance to revisit. But it's fascinating how many seem so determined to win the argument. As if that is where profits come from.

New Bull Market

On the 'new bull market' side we have some statistics from Ryan Detrick.

"Today is the 100th trading day of the year. S&P 500 is up more than 7% YTD as of now and this would be the best start to a year since 2021 and 2019 before that. When >7% on day 100? Rest of yr up another 9.4% on avg and higher nearly 89% of the time."

Read the original on Twitter. Detrick goes into more detail in this article.

He also points out this from Bespoke as a counterpoint to the somewhat tiresome 'narrow breadth' argument. The chart is showing different stocks in different sectors hitting new 52-week highs in May. Sure technology is leading, and sure Energy and Real Estate are notably absent, but clearly the moves aren't limited to 5 or 10 stocks.

Now consider the equal-weight Nasdaq 100. With prices above all the key moving averages, a series of higher highs and higher lows in place, and the RSI in the bullish upper half, this chart appears perfectly healthy.

QQEW

Bear Market Rally

On the 'bear market rally' side we have another chart from Bespoke showing that several sectors are hitting new lows relative to the SP 500. More than half of the SP Sectors are underperforming the index as a whole. That is not exactly a bullish participation rate.

Looking at it another way, it's hard to make a bullish case for the equal-weight SP 500. This index is below all of the key moving averages, below the March ‘20 anchored VWAP, the RSI is in the lower half, and the price is chopping around with no pattern of higher highs and higher lows.

RSP

Then, of course, we must consider the number of stocks in an uptrend. This is easily done by checking the percentage of SP 500 stocks above their 200-day moving average. A reading of 40.15 shows that most SPX stocks are not in uptrends.

We could go on and on about recession, rates, the debt ceiling, and a thousand other reasons why this market can’t go up.

Conclusion.

Simply put; this market has something for everyone.

Many stocks have been going up. Some have gone up a lot!

Many others have been going down. Some of those are out of business.

There is ample evidence to back up whichever side of the argument you choose to take. So maybe the best choice is to simply not take a side.

Does ‘bull’ or ‘bear’ matter? If it’s that important, then by all means, work to answer the question. If not, leave the argument alone and focus on price action and good trading.

And remember, it’s not about being right. It's about making money.

The Charts

SPY is once again testing the breakout level.

QQQ staying in the upper reaches of this impressive move is a strong, bullish resting pattern.

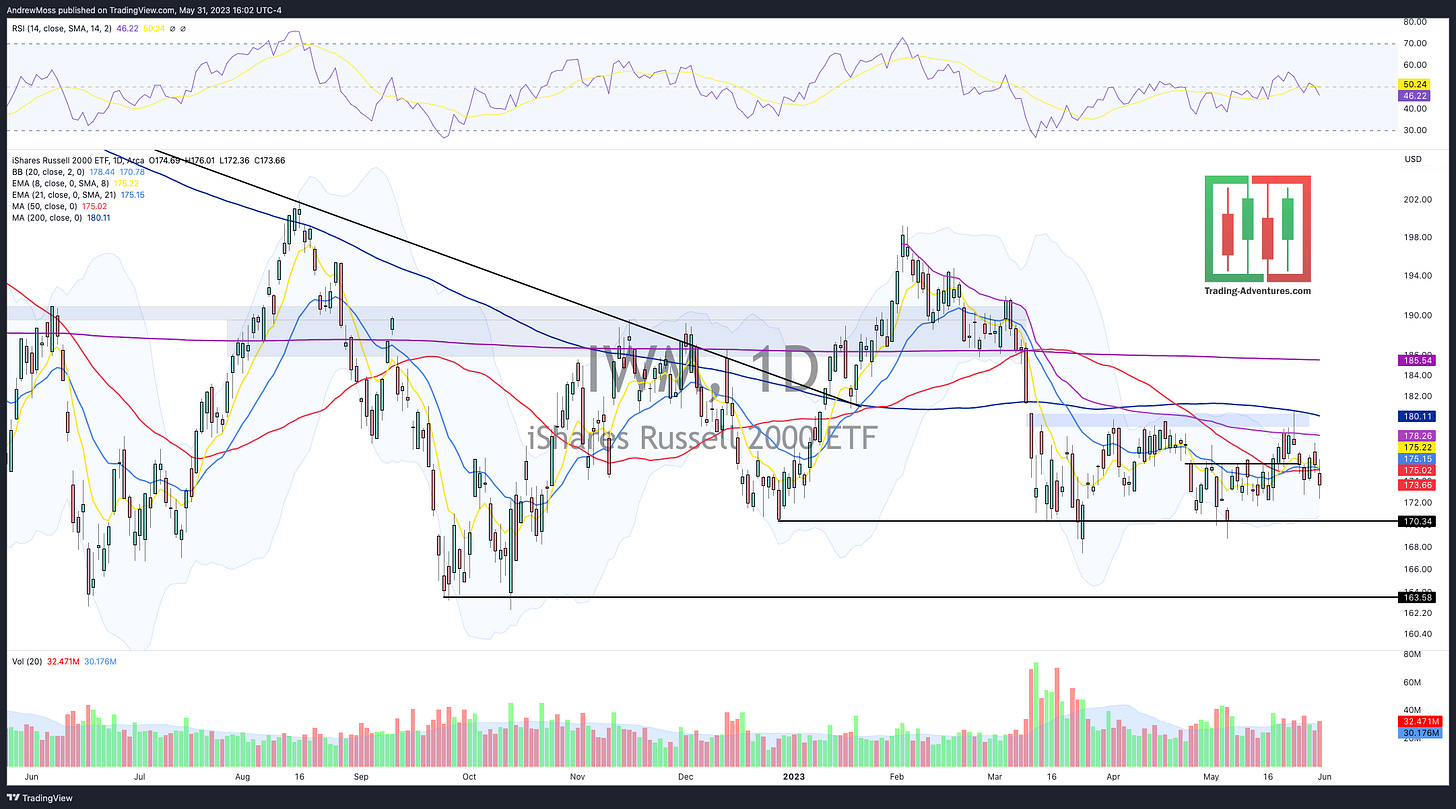

IWM There are not enough buyers in small-cap land as this one is back below all the key MAs.

DIA is searching for support in the form of the 200-day MA.

The Closing Bell

The extension in QQQ is being resolved, but tech isn’t selling off especially hard. And although we have seen some sizeable reversals in semiconductor names, most are still well above the short-term MAs and the price equilibrium though.

Buying hasn’t shifted to the lagging areas. IWM and DIA are selling off too. Not a disaster. But not the most favorable scenario.

Last thing; It’s the end of the month so tomorrow morning I’ll run through some Monthly charts on Twitter to update the really long-term view. Come and have a look.

The Disclosures

***This is NOT financial advice. NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.

Andrew Moss is an associated member of T3 Trading Group, LLC (“T3TG”) a SEC registered broker/dealer and member of FINRA/SIPC. All trades placed by Mr. Moss are done through T3TG.

Statements in this article represent the opinions of that person only and do not necessarily reflect the opinions of T3TG or any other person associated with T3TG.

It is possible that Mr. Moss may hold an investment position (or may be contemplating holding an investment position) that is inconsistent with the information provided or the opinion being expressed. This may reflect the financial or other circumstances of the individual or it may reflect some other consideration. Readers of this article should take this into account when evaluating the information provided or the opinions being expressed.

All investments are subject to the risk of loss, which you should consider in making any investment decisions. Readers of this article should consult with their financial advisors, attorneys, accountants, or other qualified investors prior to making any investment decision.

POSITION DISCLOSURE

May 31, 2023, 4:00 PM

Long: GOOGL, META

Short:

Options symbols are denoted as follows:

Ticker, Date, Call/Put, Strike Price

Example: VXX1218C30 = VXX 12/18 Call with a $30 strike

It is strange. The last few months I have just been giving my friend a bear case and a bull case price (at a decent range)/ We may have to come up with a new name for this type of market. I think, like a lot of people, we may see moves into different sectors. If tech is tapping out and sectors holding support may be bullish/ i have beed before. Thanks again for these. Nice work