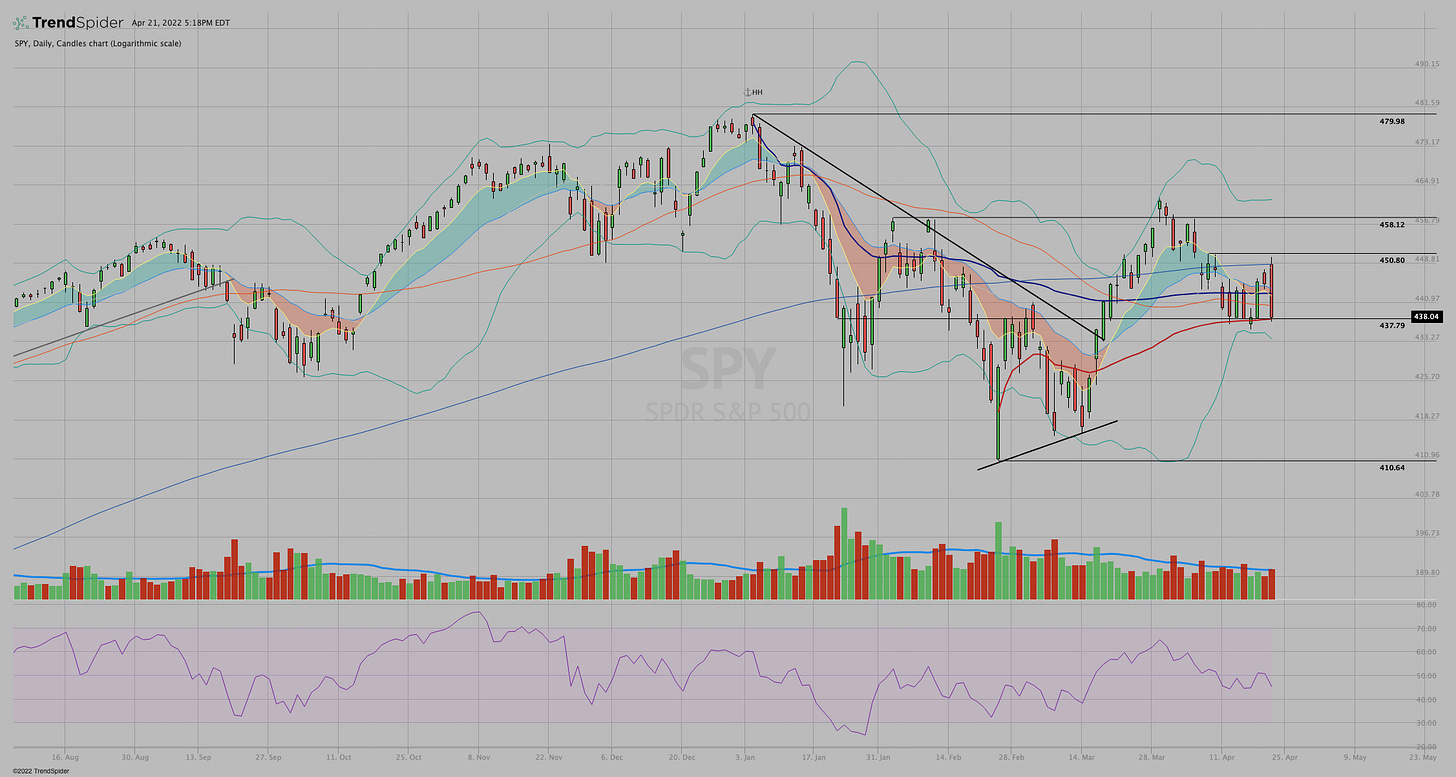

$SPY with the Shake and Bake pattern

lots of charts

This market is looking more and more suspect all the time. Here are a few reasons why I think so.

$SPY was up over 1% this morning only to close down -1.5% with a high/low range just short of 3%. Price getting loose and wide like that isn't typically a characteristic of stable, trending markets.

Sometimes AVWAP matters, and sometimes it doesn't.

Earlier today I pointed out that price had dropped back to the April 5 high anchored VWAP. If you squint really hard it almost looks like the selling slowed down there a bit. There's 1 green 15m candle.

But really it sliced right through it. Now price is on the anchored VWAP from Feb 24 low. Will it be support? We'll see. For now, it's just a point of reference.

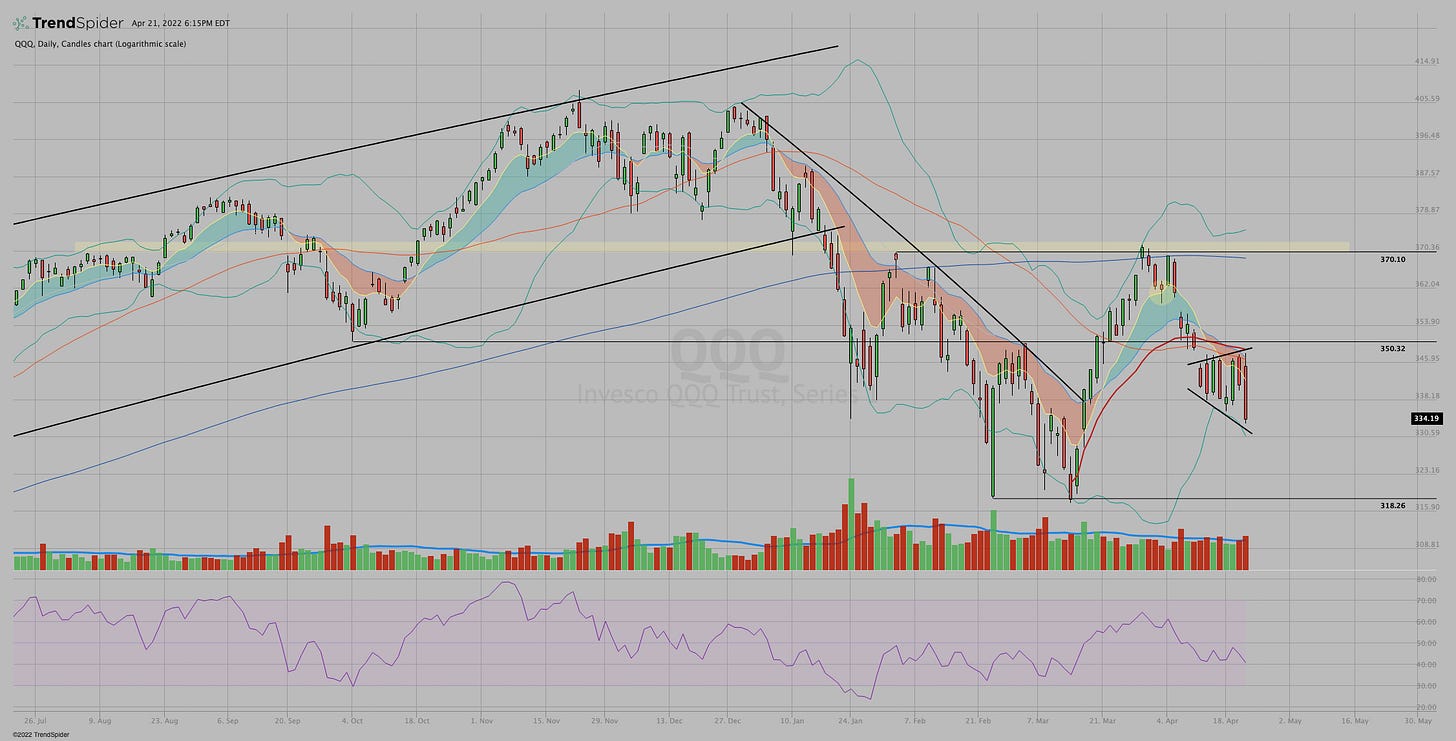

$QQQ and $IWM had massive bearish engulfing candles as well. The choppiness is turning into sloppiness.

$NVDA gave up a significant support level

Even the strong stocks and sectors got hit today with many looking like failed breakouts now. And we know failed moves often lead to fast moves in the opposite direction.

This leader is down -8.5% today and more than -13% lower than recent highs $MOS

$CF looks similar

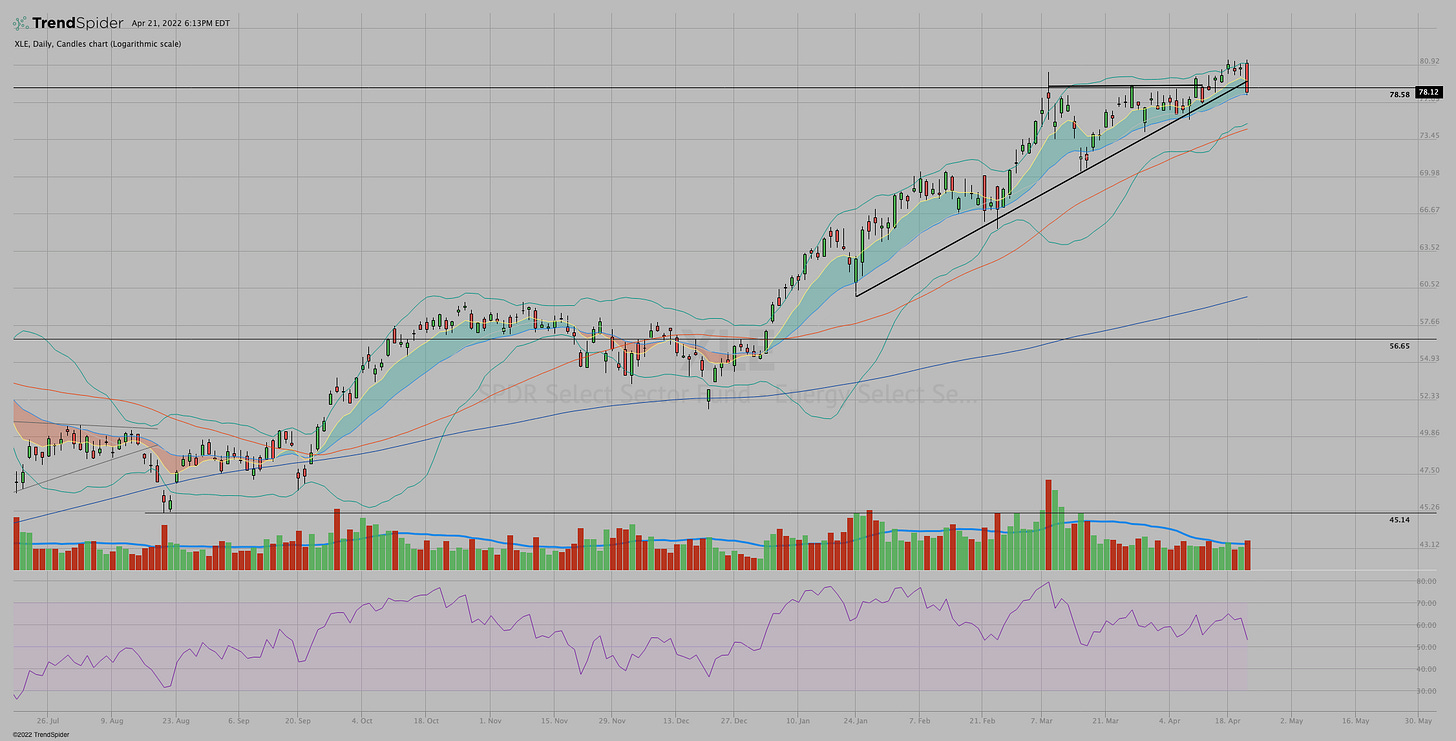

$XLE is back below this trendline and looks like a failed breakout

$OIH is the same. Notice for both of these that piercing the trendline has not been uncommon. But closing below the trendline has.

$CVX lost the breakout and the whole ascending triangle pattern

And it wasn't just oil. $DE reversed hard today

As did $HLT

And lastly, some damage in the strong Utility sector as $NEE appears to have suffered a very negative reaction to its earnings report.

I'm not screaming "the sky is falling." In this choppy environment, I wouldn’t be a bit surprised if we reversed back higher tomorrow.

I am saying, again, the market is suspect. I don't have conviction in movements in either direction. So I will be managing risk very closely.