Starting The Week Off With A Bounce [Attempt]

Monday Market Update October 23, 2023

The Markets

Stocks started in the red this morning and the discount was enough to entice buyers into action, turning the indexes green.

The rally continued for a while as yields, oil, and the Dollar moved lower and the SP 500 got back on the north side of the 200-day MA. But by roughly 1:00 PM SPY had found its high for the day and started drifting lower once again. Interestingly, this daily high came in at about the same price and time of day as it did this past Friday.

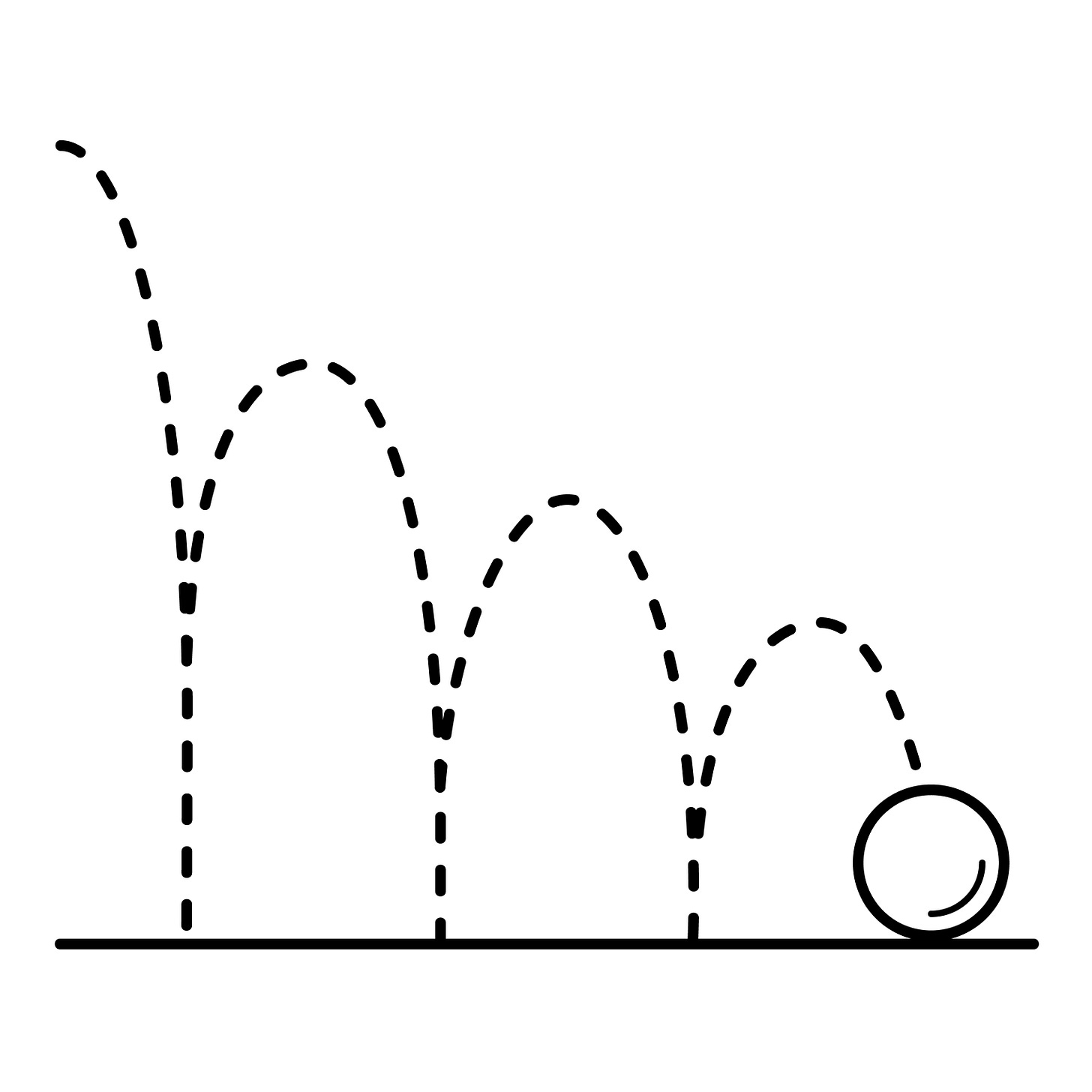

If that was an oversold relief bounce, it was very short-lived. Lately, each bounce attempt seems to have less energy than the one before, leaving the chart of SPY looking like this —

If this attempt is going to be the start of something bigger (chances seem slim) it will need lots of help, namely from some big earnings coming this week.

Moves from here will depend largely on whether or not MSFT and GOOGL can wow Wall Street with good earnings reports tomorrow after the close. With the Magnificent 7 doing much of the heavy lifting, it will be hard for SPY and QQQ to continue higher if these two stocks aren’t leading the charge.

META follows on Wednesday evening and AMZN on Thursday.

These names will have an equal impact as those previously mentioned. By Friday five of the M7 reports will be in and we should have a better idea of which way the group wants to move.

The Charts

SPY Opened just below the YTD anchored VWAP (purple line) and dipped lower before rallying past the 200-day MA and into the top of the gap area. Then it fizzled in the afternoon to close near the opening price. Not an inspiring move.

QQQ rallied back to the swing low AVWAP before giving up much of the gain. The 200-day MA and YTD AVWAP are 4.5-5% lower now.

IWM was especially ugly as the two heaviest sector components (Healthcare and Financials) dragged it down to close near the lows of the day.

DIA is trying hard to hold the lows made earlier this month.

TLT held gains better than stocks today and put in a large bullish engulfing candle. The declining 8-day MA kept a lid on things though. Watch for follow-through the rest of this week.

DXY The Dollar was another bright spot today as it moved back down to previous support and confirmed the lower high price action.

Bonus Chart

BTCUSD is moving higher and very close to a breakout level on renewed hopes of SEC approval for an Exchange Traded Fund (ETF).

The Closing Bell

Back with more on Thursday afternoon when we can see if four of the big M7 earnings reports helped or hurt the markets.

The Disclosures

***This is NOT financial advice. NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.

Andrew Moss is an associated member of T3 Trading Group, LLC (“T3TG”) a SEC registered broker/dealer and member of FINRA/SIPC. All trades placed by Mr. Moss are done through T3TG.

Statements in this article represent the opinions of that person only and do not necessarily reflect the opinions of T3TG or any other person associated with T3TG.

It is possible that Mr. Moss may hold an investment position (or may be contemplating holding an investment position) that is inconsistent with the information provided or the opinion being expressed. This may reflect the financial or other circumstances of the individual or it may reflect some other consideration. Readers of this article should take this into account when evaluating the information provided or the opinions being expressed.

All investments are subject to the risk of loss, which you should consider in making any investment decisions. Readers of this article should consult with their financial advisors, attorneys, accountants, or other qualified investors prior to making any investment decision.

POSITION DISCLOSURE

October 23, 2023, 4:00 PM

Long: —

Short: —

Options symbols are denoted as follows:

Ticker, Date, Call/Put, Strike Price

Example: VXX1218C30 = VXX 12/18 Call with a $30 strike