Stocks Finish The Week At New Highs

Weekend Market Update

The Markets

Early this week, we noticed that Crude Oil, Government Bond Yields, and the US Dollar were up while Stocks continued trading flat. Support and resistance levels were identified, leaving us with two likely scenarios and the ensuing questions:

Is this a run-of-the-mill rotation with buying power that would’ve been otherwise used in stocks being soaked up by these other assets?

Or is the market trying to tell us something?

CPI, PPI, various Fed Speakers, and the beginning earnings season are behind us, and stocks seem to have liked the news.

Let’s go to the charts.

The Charts

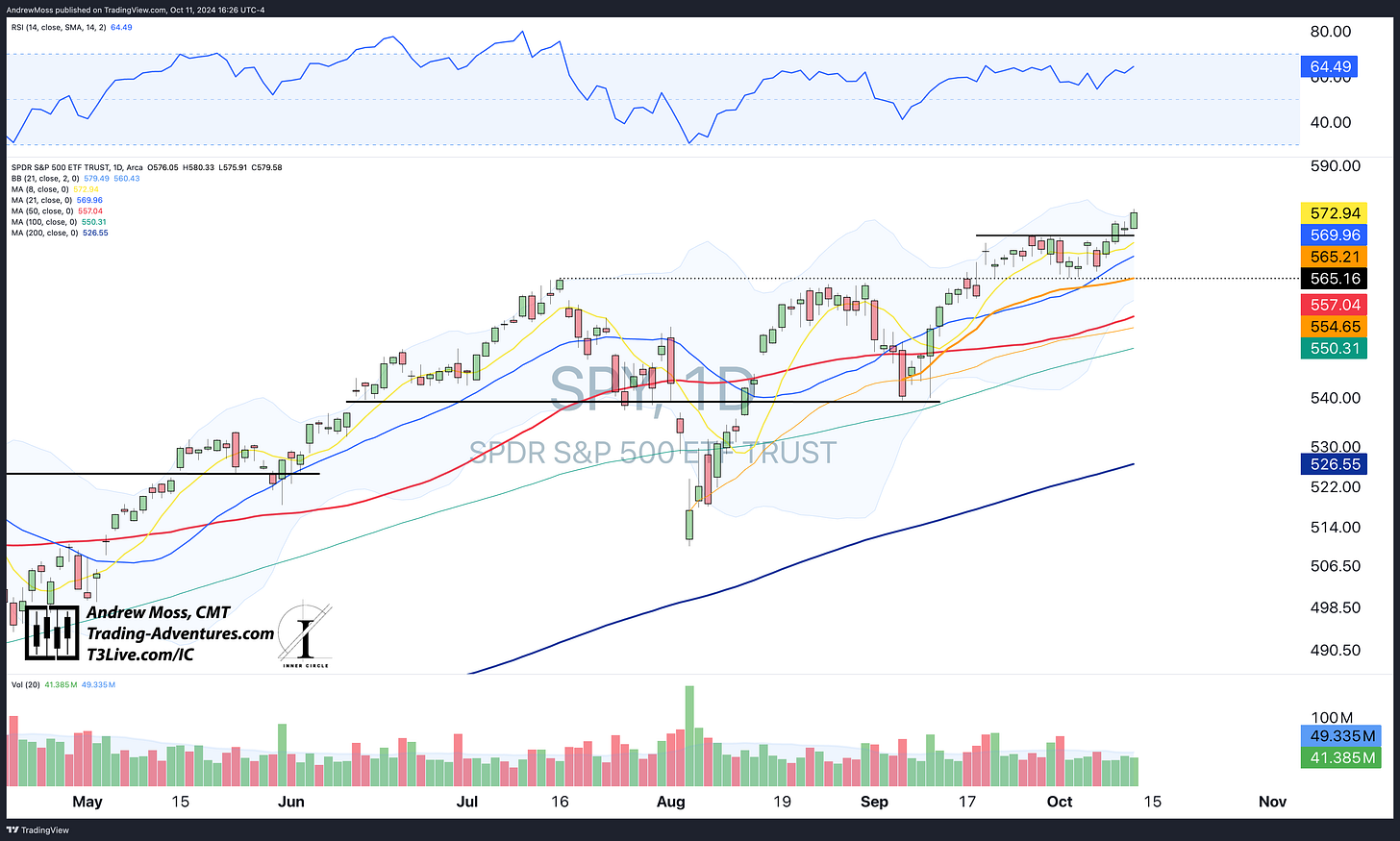

SPY is through resistance, out of the consolidation range, and making new highs while the RSI is steady.

QQQ isn’t entirely out of the woods yet, but it's very close, and a test of the recent pivot high at $503.53 looks imminent.

IWM kept us guessing for most of this week before putting in a huge green candle today. This is a breakout move from a bullish falling wedge pattern that could easily send prices back toward $226 and possibly beyond.

DIA also gave a breakout move and closed the week at new highs.

TLT continued its downward action and is now below the 200-day MA.

Bonds down = yields up.

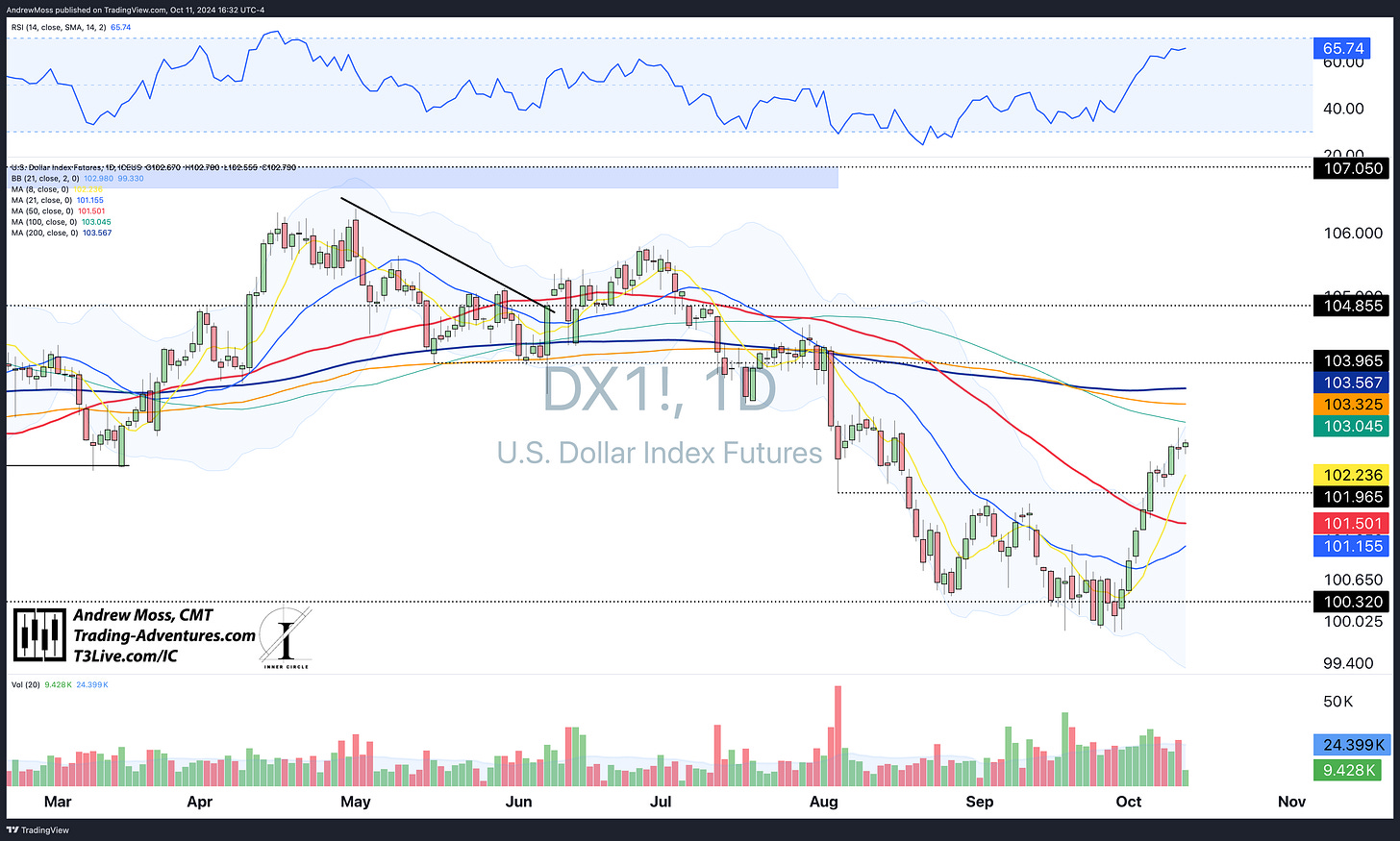

DXY also continued higher (like yields) but hasn’t kept stocks from doing the same so far.

BTCUSD is higher and testing its 21 and 200-day MAs. We’re still waiting for a higher high to confirm the higher low.

CL/ Crude oil did reverse at the 200-day MA for a sharp move lower, which is now trying to stabilize.

The Trade

Stocks held support and moved higher. Crude oil turned lower at resistance. Yields and the Dollar did not find resistance and continued to move up.

Shopping list names continue to provide opportunities and behave well.

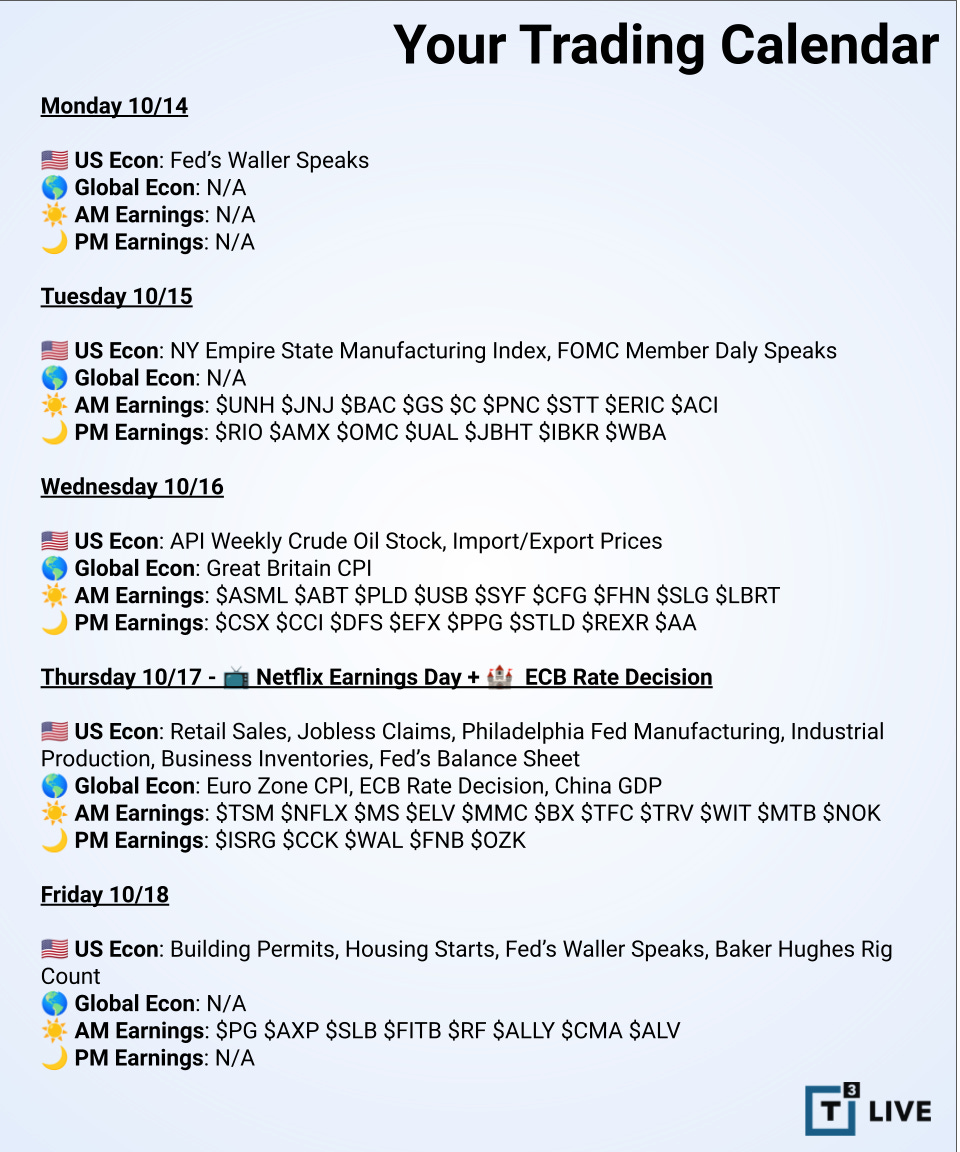

Next week is quieter on the economic news front but much busier with earnings reports. NFLX is on Thursday.

No weekly charts tomorrow morning as I’ll be traveling for a wedding.

Have a great weekend! More charts and market updates will be out on Monday.

Elevate Your Trading

Education, training, and support for your Trading Adventure.

Options Trades - Weekly trade ideas are delivered to your email or text messages in a language you can easily understand.

Check out EpicTrades from David Prince and T3 Live. Epic Trades from David Prince

Community - Are you an experienced trader seeking a community of professionals sharing ideas and tactics? Visit The Inner Circle, T3 Live’s most exclusive trading room - designed for elite, experienced traders.

The Inner Circle at T3 Live

Prop Trading - Or perhaps you are tested and ready to explore a career as a professional proprietary trader? 3 Trading Group has the technology and resources you need.

Click here to start the conversation:

T3TradingGroup.com

The Disclosures

***This is NOT financial advice. This is NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.