Tariffs, Stocks, Bonds, Oil, The Dollar

What is happening? And how does it all tie together?

In conversation with a friend earlier, we landed on this conundrum —

I’d like to see an article that ties what’s currently going on with the tariffs, stock market, bond markets, oil market, and US dollar fluctuations together in simple terms.

Should be easy, right?

So, here's a simple article tying together the current situation with tariffs, stock market, bond markets, oil market, and US dollar fluctuations, written for today, April 9, 2025.

The Markets

Tariffs Are Shaking Things Up: What’s Happening with Markets Today

The financial world is buzzing—and not in a good way. New tariffs announced by President Trump have sent shockwaves through the stock market, bond markets, oil prices, and the US dollar. Let’s break it down in plain terms so you can see how it all connects.

Tariffs: The Big Trigger

The US just slapped hefty new tariffs on imports—think 10% on lots of goods and even steeper ones, like 104% on some Chinese stuff. These are taxes on things we buy from other countries, meant to protect American businesses.

But they’re also making everyone nervous. Other countries, like China, are hitting back with their own tariffs, and it’s turning into a global trade fight.

Stock Market: A Rough Ride

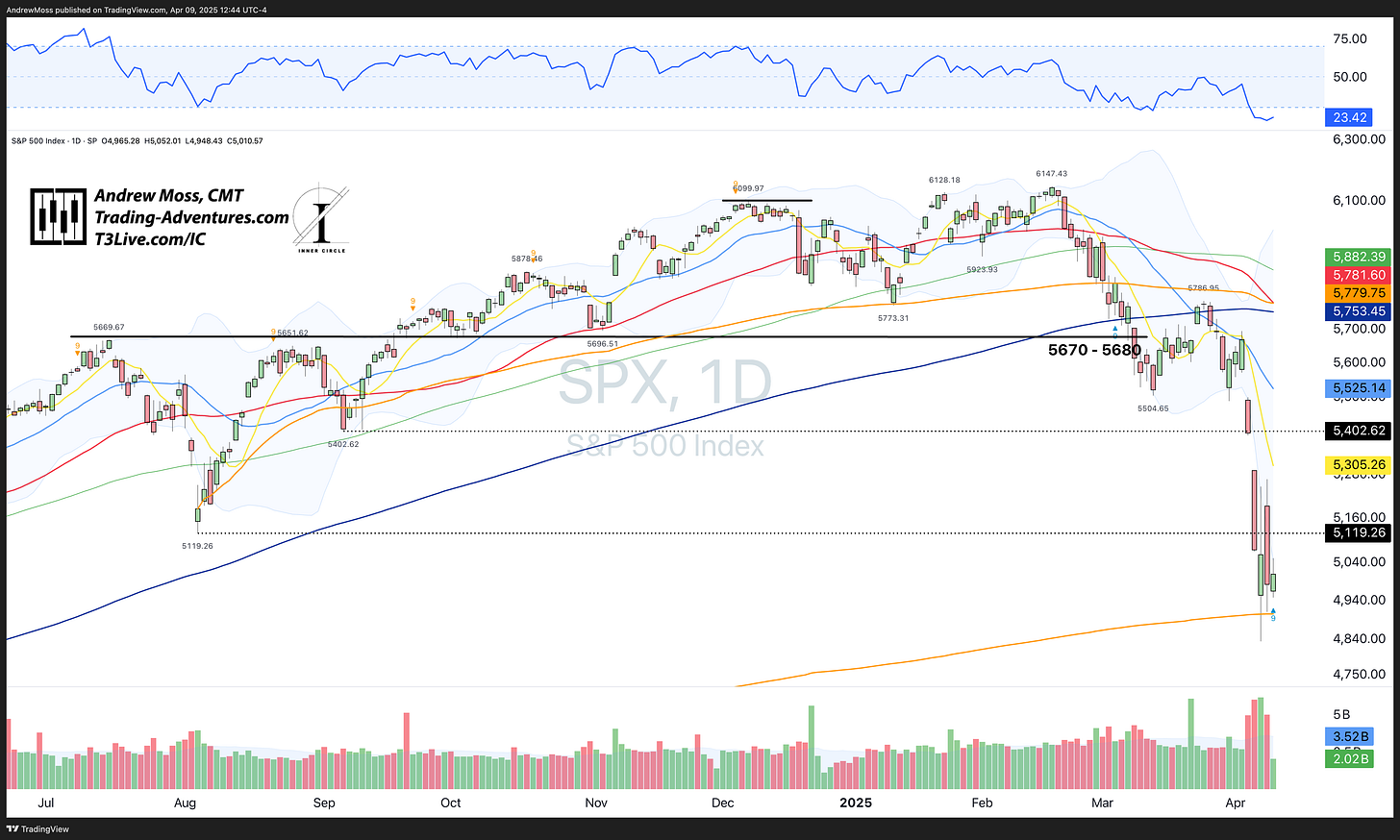

Stocks are tumbling. The S&P 500 has dropped 20% from recent highs. Why? Tariffs could make things more expensive for companies, cutting their profits. Plus, if trade slows down, the whole economy might stumble. Investors are spooked, so they’re selling stocks fast.

SPX - The S&P 500

Bond Markets: Safety First

When stocks fall, people often run to bonds—basically IOUs from the government or companies—because they feel safer. But here’s the twist: US Treasury bonds (the safest kind) are getting sold off too. That’s pushing their yields (the interest they pay) up to around 4.5%. Usually, yields drop when people want safety, but this time, it seems investors are dumping bonds to get cash or because they’re worried about a messier economy ahead.

TLT - 20 Year Treasury Bonds

Oil Market: Prices Plummet

Oil prices are crashing—Brent crude, a key benchmark, fell below $60 a barrel, the lowest in over four years. Tariffs could slow down global trade and manufacturing, meaning less demand for oil to power factories or ship goods. On top of that, OPEC+ (the oil-producing countries) just decided to pump more oil, adding to the oversupply. Less demand means more supply—prices tank.

CL/ - Crude Oil Futures

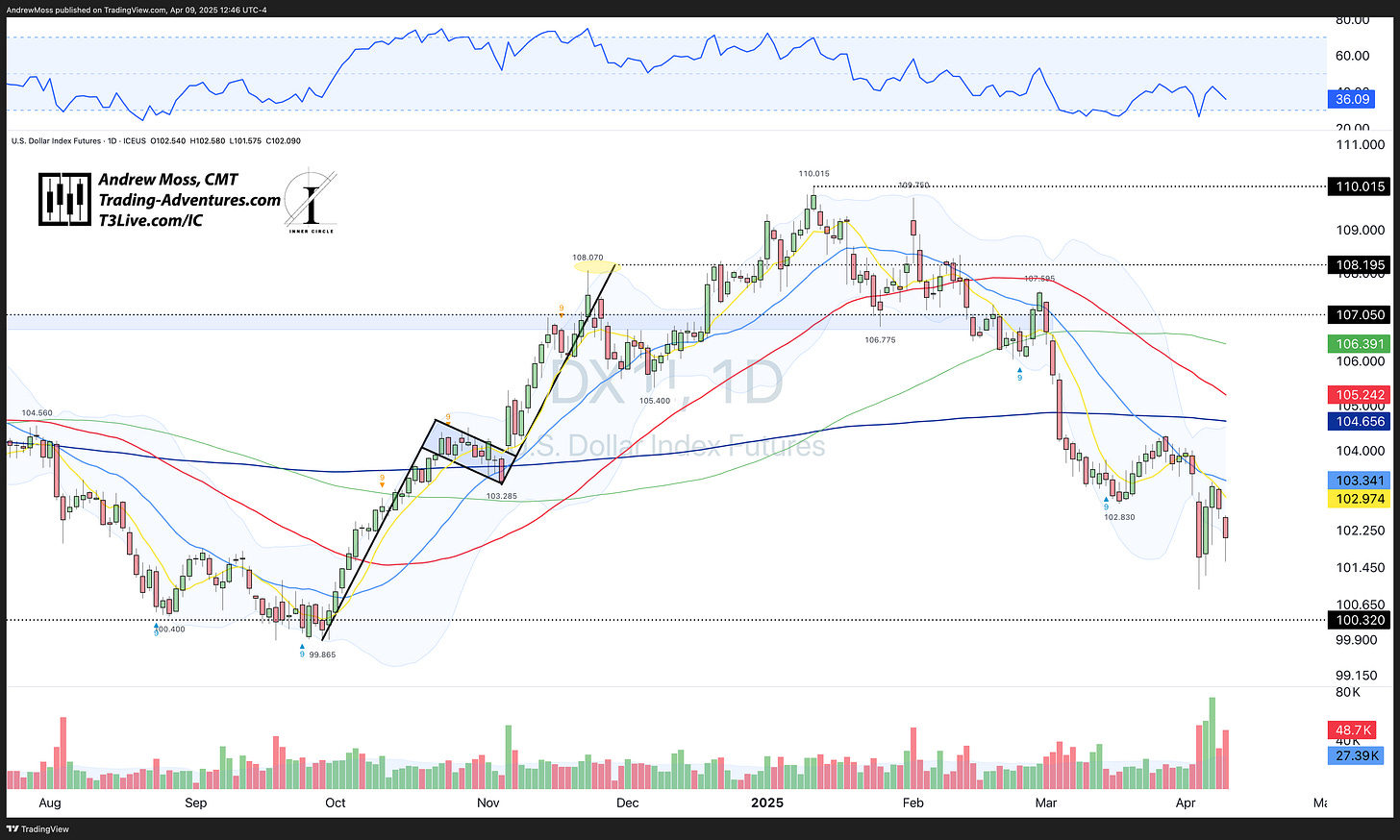

US Dollar: Up and Down

The US dollar’s been a rollercoaster. Usually, it’s a “safe haven” when things get wild—people buy it to feel secure. It spiked against currencies like the Chinese yuan as trade tensions flared. Lately, however, it’s been weakening against others, like the yen, as investors question if the US economy can handle this tariff storm. A wobbly dollar shows the uncertainty everyone’s feeling.

DX1! - US Dollar Futures

Volatility And Uncertainty

These factors have combined to produce a significant jump in fear and uncertainty, as judged by the VIX Index. The VIX Index, often called the "fear gauge," is a real-time measure of expected market volatility over the next 30 days, calculated based on the prices of options on the S&P 500 Index.

In simpler terms, it’s a snapshot of how jittery or calm investors are. Low VIX (say, 12-20) means markets are steady, and folks expect smooth sailing. High VIX (like 35 or more) signals panic—traders anticipate big moves, usually tied to uncertainty or bad news. It’s quoted as an annualized percentage but not a direct prediction; it’s more about the cost of insurance against market drops.

Here are the current levels and some other historical moments noted on a long-term chart.

VIX

How It All Ties Together

Here’s the simple version:

Tariffs are like a big rock thrown into a pond. They ripple out, making companies and shoppers nervous (stock market falls), pushing people toward safety or cash (bond markets flip), slowing down the need for energy (oil prices drop), and shaking confidence in the US economy (dollar swings). If this trade war continues, we could even see a recession—a slowdown that hits jobs and wallets.

Two More Charts

Both of these weekly charts make the case that we are in the right spot to look for a bounce. Here’s why:

Jan. '22 pivot high

Oct. '22 low AVWAP

Multiple fibonacci levels

Extremely oversold - RSI ~26

% of stocks above a 50/200-day MA is very low

Sentiment is in the gutter

Fear and Greed ~3

Soaring VIX

Imagine if we got the slightest bit of good news.

SPX Weekly

QQQ - Weekly

The Trade

For now, markets are jittery, and no one’s sure how long this will last.

Will countries negotiate and calm things down?

Or will the tariffs stick, dragging everything lower?

If you’re active and trading the bounce potential, stay nimble and take profits aggressively.

If you’re a long-term investor, remember that buying opportunities like this don’t come along every day. Yes, it’s stressful. Yes, it can be very difficult to watch account values take hits like this.

Don’t panic and sabotage the plan you’ve had in place for months/years/decades. We’ve seen it all before. The details may change, but there is nothing new in the markets.

Selloffs, corrections, and bear markets happen with sometimes surprising regularity. We will make it through this one. And we will see many more in the future.

Keep a level head through this one. And in the future, expect more of them. Prepare for them. Be ready for them. And use them to your advantage.

Stay tuned—it’s a wild ride out there.

Looking For More?

Elevate Your Trading Adventure Even Further With These Offerings.

EpicTrades Options Newsletter

Real-time trade ideas and insights, providing actionable trading insights focusing on options trades with short-term horizons, aiming to capitalize on weekly market movements.

The approach includes detailed reasoning for trades, specific options, and profit targets. It focuses on quick gains with a minimal time commitment from subscribers.

Don’t miss the next trade! Hit the link to get your real-time alerts.

The Inner Circle

The Inner Circle is a Virtual Trading Floor (VTF) at T3 Live. I’ve been working and trading with this group since 2022. You may have noticed the logo in the watermarks on my charts.

Founded by David Prince and led by him, Rick March, and Kira Turner, the Inner Circle is a community of elite traders, including hedge fund managers, family office heads, corporate executives, financial advisors, and even professional poker players.

Fundamental, Macro, and Technical Analysis all combine to find and discuss the best opportunities in current markets.

The Disclosures

***This is NOT financial advice. This is NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.