Tariffs, Tech, and Tumbling Oil: A Triple Threat to Markets

Monday Market Update: Thursday, February 27, 2025

The Markets

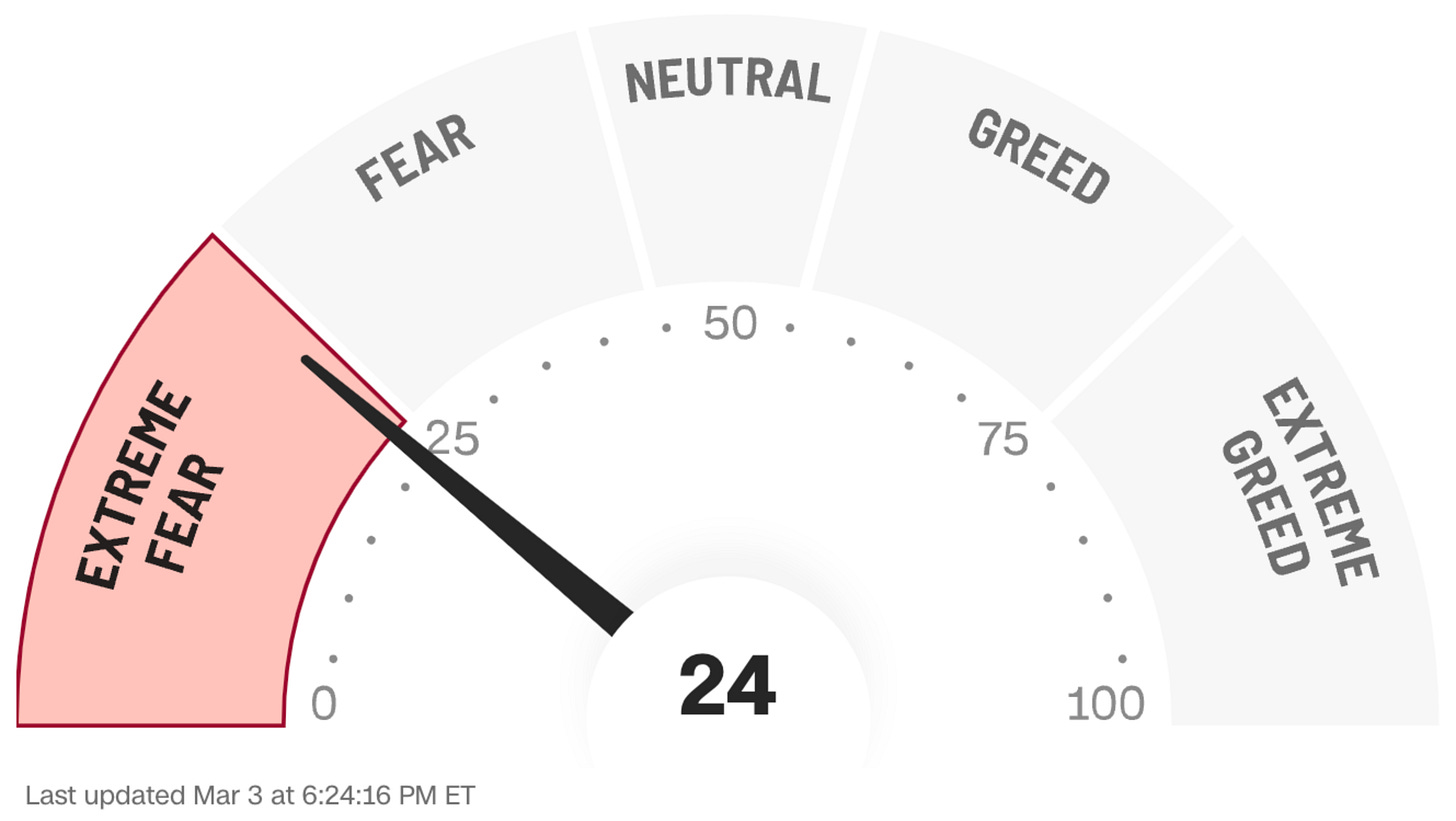

Tariffs Ignite Market Jitters: Trump’s confirmation of 25% tariffs on Canada and Mexico, plus an extra 10% on China, effective March 4, sent shockwaves through the market today. The S&P 500 tanked 1.7%, the Nasdaq slid 2.6%, and the Dow dropped nearly 650 points as investors dumped stocks amid fears of trade war fallout. Sentiment flipped from post-election optimism to “extreme fear,” wiping out recent gains and signaling choppy waters ahead for risk assets.

Tech Takes a Beating: The tech sector bore the brunt of the sell-off, with Nvidia cratering over 8% and the “Magnificent 7” stocks—like Amazon (-3%) and Tesla (-2%)—dragging the Nasdaq below its 200-day moving average. Tariff-driven supply chain worries and fading momentum from last week’s earnings hype fueled the rout. For traders, this could mark a technical breakdown, with growth stocks now on shaky ground.

Oil Sinks to Yearly Lows: Energy markets weren’t spared, as oil prices fell 2% to their 2025 bottom after OPEC’s plan to boost output by 138,000 barrels daily starting April, alongside whispers of Russia sanctions relief. U.S. crude hovered near $69.76 last Friday, pressuring energy stocks and hinting at cheaper fuel ahead—but today, it just added fuel to the market’s volatility fire.

Crude Oil Futures

The Charts

SPY Hit the August low AVWAP today, adding to a growing list of issues testing that level (AMZN, BTC, QQQ). It did so while completely engulfing and erasing Friday’s rally. Volume remains high and RSI low, though not overbought.

Below the AVWAP support, should it fail on subsequent tests, is a pivot at $575.35 and the 200-day MA near $570.85.

On the upside, $595-$600 strengthens as a potential resistance area with the 8/21/50-day MAs all there. Plus, that general area has been the lid for each of the last five trading days.

QQQ came back down to undercut last week’s low, pierce the August pivot low AVWAP, and nearly hit the 200-day MA. Below that is a pivot down at $483.75, giving some space to fill before the next potential support.

Overhead, $520-$523 looks like it would be nearly impossible to break through without many days of consolidating action ahead of that level.

IWM is picking up steam on its plunge further below the support levels. Wider price ranges and higher volume illustrate the heightened uncertainty and volatility.

DIA also demonstrates uncertainty by showing a broadening formation, often called a megaphone pattern. 📣

TLT is testing its flat 200-day MA while looking for more room to the upside. RSI is > 67, so it's bullish but not overdone.

DXY The dollar was lower today, but it was clearly not enough to help stocks.

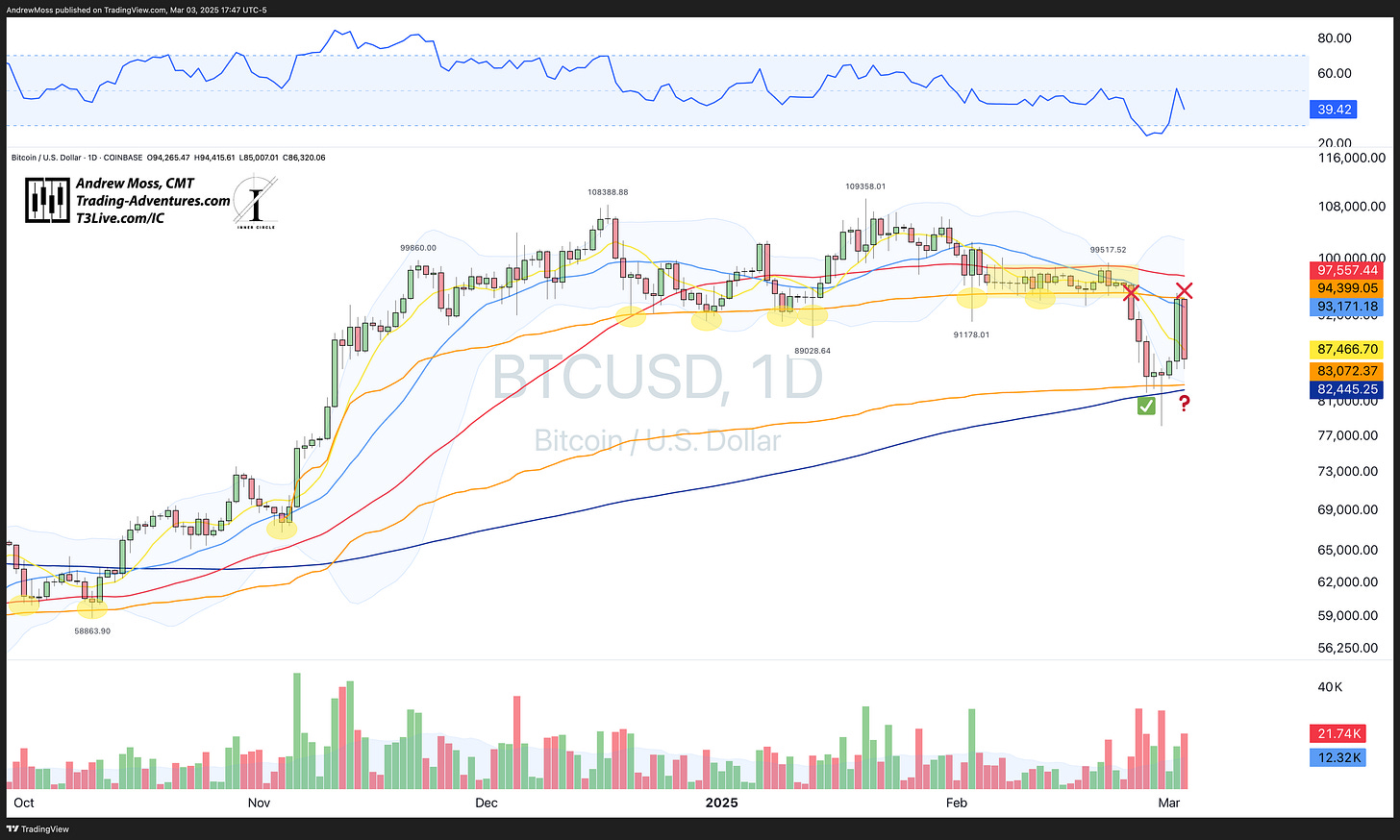

BTCUSD giving back 100% of the rally - in one day - and on heavier volume is not a good sign. Support remains between $82,400 (the 200-day MA) and $83,000 (August pivot low AVWAP). It held once. Can it do it again?

The Trade

It’s still a quick market. Fast moves win, while hesitation gets smoked.

Short-term trades are finding some footing—quick buys on dips or sells on bounces have been working, but the tariff news keeps swings unpredictable. Tech’s stumble (NVDA down 8%, Nasdaq testing its 200-day) tells us that growth plays aren’t finished taking a breather; momentum’s faded for now.

Oil’s drop offers a faint glimmer for energy bulls, though volatility’s still the boss. Small-caps remain sidelined—no spark there yet.

Watch S&P 5,800 as a guidepost: if it holds, we might stabilize; if it folds, more pressure builds.

Longer-term traders and investors will want to sit tight while letting the tariff storm pass.

Looking For More?

Elevate Your Trading Adventure Even Further With These Offerings.

EpicTrades Options Newsletter

Real-time trade ideas and insights, providing actionable trading insights focusing on options trades with short-term horizons, aiming to capitalize on weekly market movements.

The approach includes detailed reasoning for trades, specific options, and profit targets. It focuses on quick gains with a minimal time commitment from subscribers.

The Inner Circle

The Inner Circle is a Virtual Trading Floor (VTF) at T3 Live. I’ve been working and trading with this group since 2022. You may have noticed the logo in the watermarks on my charts.

Founded by David Prince and led by him, Rick March, and Kira Turner, the Inner Circle is a community of elite traders, including hedge fund managers, family office heads, corporate executives, financial advisors, and even professional poker players.

Fundamental, Macro, and Technical Analysis all combine to find and discuss the best opportunities in current markets.

The Disclosures

***This is NOT financial advice. This is NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.