The AI Boom Continues

Market Update for February 22, 2024

The News

The biggest earnings report of the season has come and gone. The results were good, and the market is celebrating by sending NVDA stock higher by nearly 15%.

This is lifting the whole market as well. SPY made new highs. AMD is up 11%. And the other stock market darling, SMCI, added another third to its market capitalization, +32% on the day.

NVDA gapped up over the recent high and continued to rise all day, closing the session up +16.40%

SMCI gapped past the 8-day MA and moved higher by more than 30% for the day.

The Charts

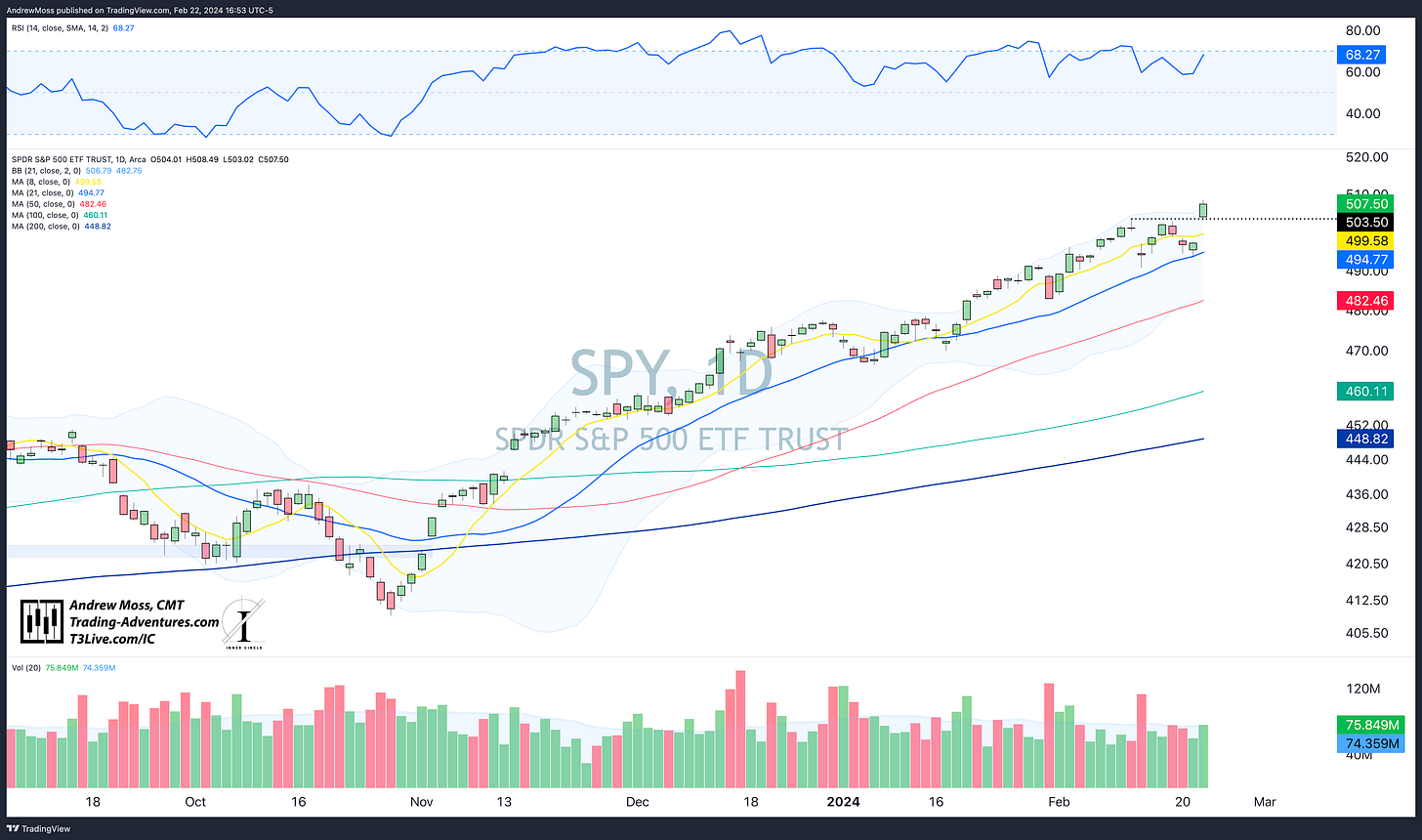

SPY followed NVDA’s lead, also gapping higher and making new highs. It now looks like one quick touch of the 21-day MA was all the rest necessary.

QQQ was up nearly 3% on the day but did not make a new high.

IWM stays in the fight while continuing to struggle with prices above $200.

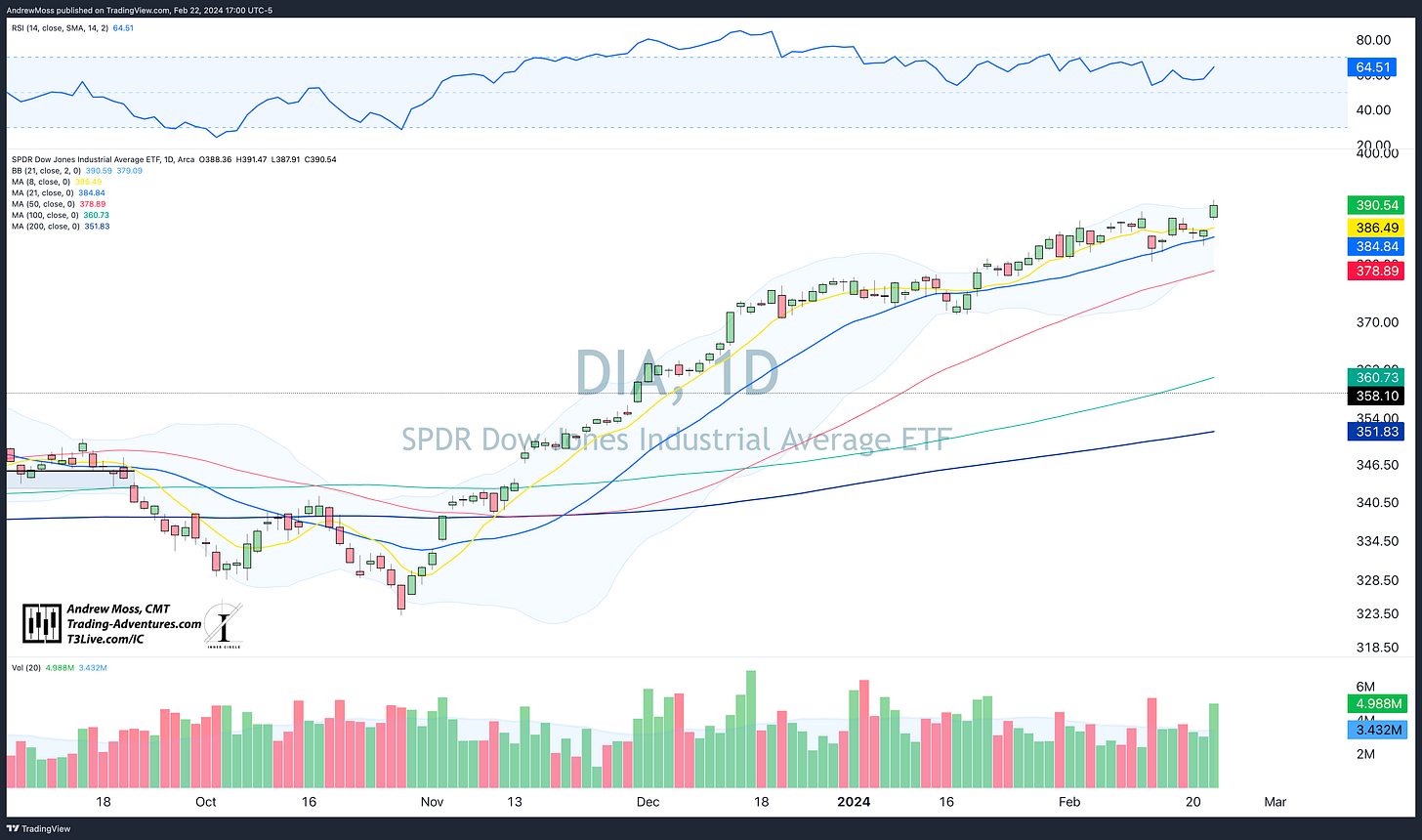

DIA seems happy about the coming addition of AMZN to the lineup.

TLT keeps building a step lower. It’s being held down by the 8-day MA and supported by the 100-day MA and a pivot level.

DXY dipped hard in the early morning hours but recovered quickly to keep it with the recent range and near all the key moving averages.

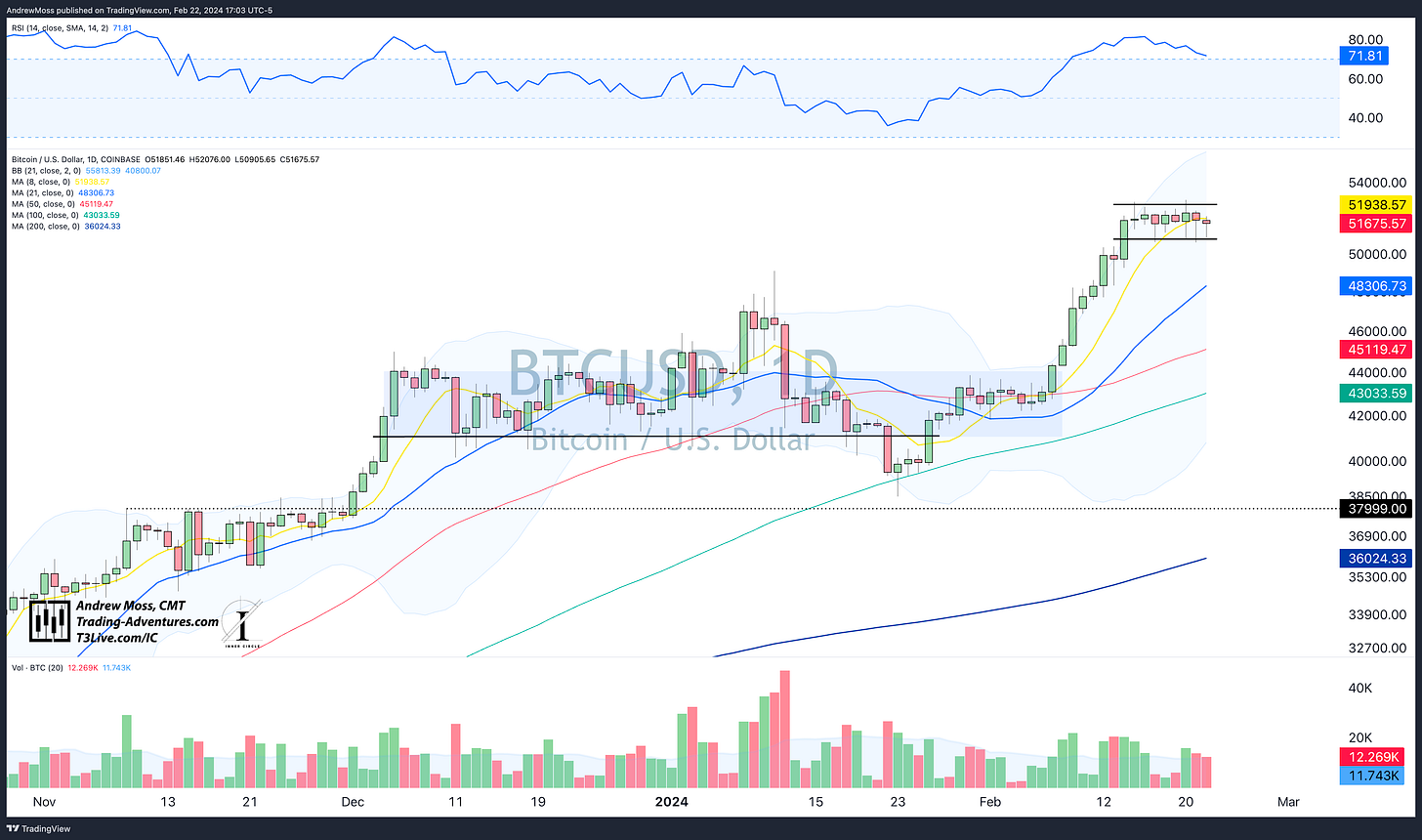

BTCUSD continues to be rangebound. These ranges have often been subject to a quick drop and recovery (a failed breakdown) before moving higher. We’ll see if that happens again.

The Closing Bell

So, the AI/chipmaker boom continues.

Market dips continue to be quickly bought despite the weaker seasonal tendencies and repeated calls by many that things are getting overdone — a good reminder that the market doesn’t care what we think should happen.

As usual, join me on Saturday morning on X to look at the bigger picture.

Elevate Your Trading

Education, training, and support for your Trading Adventure.

Options Trades - Weekly trade ideas are delivered to your email or text messages in language you can easily understand.

Check out EpicTrades from David Prince and T3 Live. Epic Trades from David Prince

Community - Are you an experienced trader seeking a community of professionals sharing ideas and tactics? Visit The Inner Circle, T3 Live’s most exclusive trading room - designed for elite, experienced traders.

The Inner Circle at T3 Live

Prop Trading - Or perhaps you are tested and ready to explore a career as a professional proprietary trader? 3 Trading Group has the technology and resources you need.

Click here to start the conversation:

T3TradingGroup.com

The Disclosures

***This is NOT financial advice. This is NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.

Andrew Moss is an associated member of T3 Trading Group, LLC (“T3TG”), an SEC-registered broker/dealer and member of FINRA/SIPC. All trades placed by Mr. Moss are done through T3TG.

Statements in this article represent that person’s opinions only and do not necessarily reflect those of T3TG or any other person associated with T3TG.

Mr. Moss may hold an investment position (or may be contemplating holding an investment position) that is inconsistent with the information provided or the opinion being expressed. This may reflect the financial or other circumstances of the individual, or it may reflect some other consideration. Readers of this article should consider this when evaluating the information provided or the opinions being expressed.

All investments are subject to the risk of loss, which you should consider in making any investment decisions. Readers of this article should consult with their financial advisors, attorneys, accountants, or other qualified investors before making any investment decision.

POSITION DISCLOSURE

February 22, 2024, 4:00 PM

Long: ADIL, AMD0223C185, GS0315C395, NVDA, XBI0315C100

Short:

Options symbols are denoted as follows:

Ticker, Date, Call/Put, Strike Price

Example: VXX1218C30 = VXX 12/18 Call with a $30 strike