The Lifecycle of Trade Risk: From Acceptance to Management to Compression

How professionals reshape their risk exposure as trades evolve — step by step

Subscriber Note

Over the coming days, I’ll be sharing a private update with Trading Adventures subscribers. If you’d like to receive it, be sure you’re subscribed.

Trim and trail

You’ve heard it a hundred times.

“Trim and trail.”

It’s one of the most common pieces of advice in trading.

But what does it actually mean?

And more importantly — what does it do for you?

Because it’s not just about protecting profits.

It’s about reshaping your entire risk profile.

Mathematically.

And mentally.

Most traders are taught to define the risk before entering a trade. And that only makes sense. That’s only step one — the beginning, not the end.

Managing the trade after the initial entry is just as critical — if not more so.

R = Risk

Most traders think of 1R — one risk unit — as a fixed cost of doing business. You define your stop. Size your position. Enter the trade. And accept the possibility of losing 1R if it fails. Simple enough.

But in a professional, risk-managed system, that’s not the whole story.

The truth is:

1R is the initial allocation.

It’s not a sentence you’re obligated to serve.

Well-structured trades, managed with intention, don’t typically stay exposed to full risk for long.

And they shouldn’t.

The goal isn’t just to define risk.

It’s to reduce it — quickly, responsibly, systematically.

Step One - Accepting and Assuming Risk

Every Trade Begins With Assumed Risk

When you size a trade, you’re doing more than just picking a number.

You’re aligning the trade’s structure with a clear stop.

You’re plotting tolerances — financial and emotional.

You’re giving the market space to prove you right or wrong.

That initial 1R unit? It matters immensely.

It defines the cost of participation.

It keeps sizing objective.

It enforces discipline.

Once the trade is active, the clock starts ticking.

And your job shifts from allocation to compression.

What you do after the entry — how you manage, reduce, and adapt that risk — is what separates the pros from the rest.

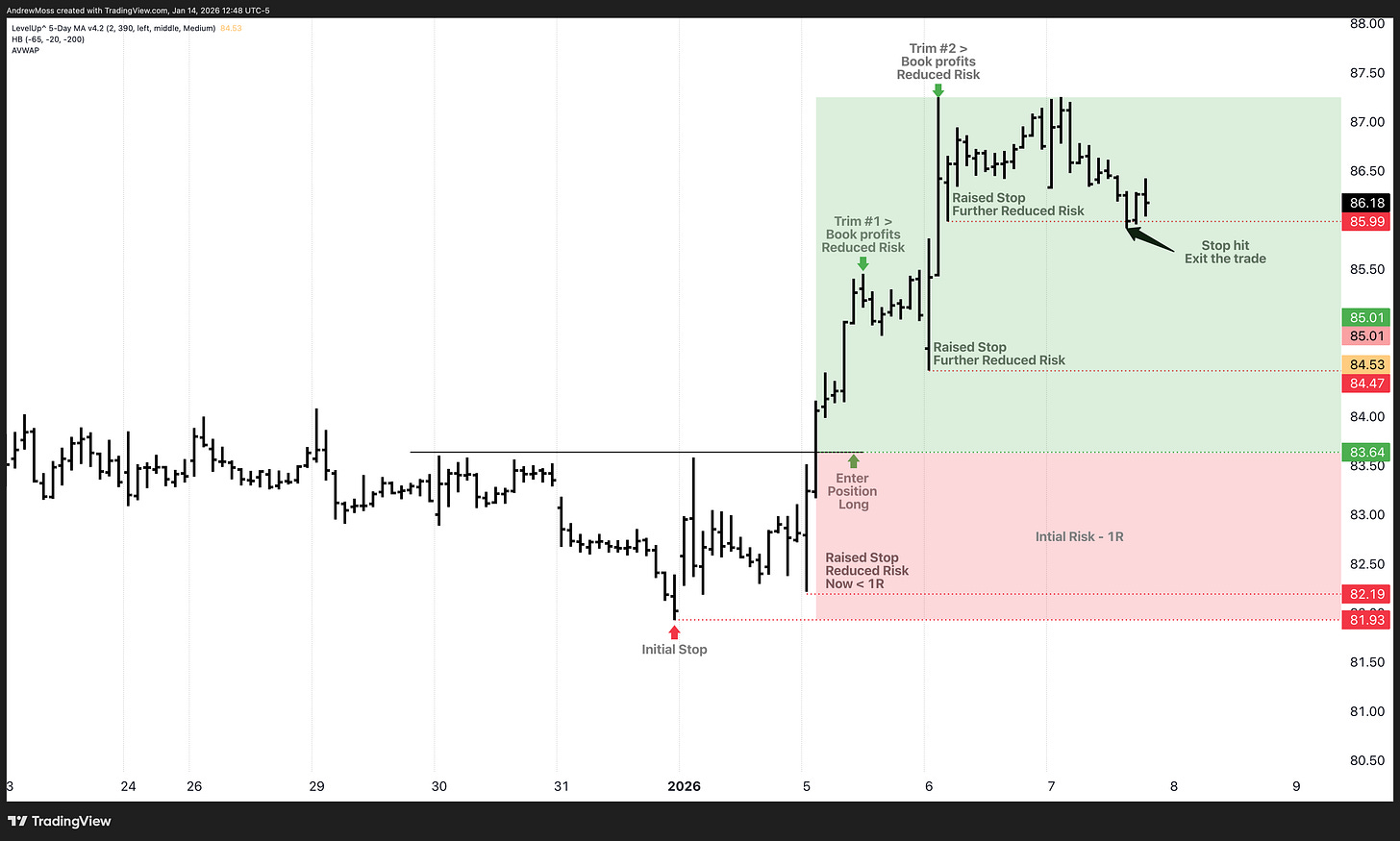

Step Two - Managing and Compressing Risk

Why Risk Should Shrink — Quickly

Here’s a technical reality: As price moves in your favor, the distance between your entry and your stop grows. And your reward-to-risk ratio shrinks. What may have started as 3 to 1 can quickly become 2 to 1, 1 to 1, or worse.

If you do nothing, that advantage decays.

Leave the stop untouched long enough — especially in fast names — and you’re sitting on full exposure.

Professionals don’t let that happen.

Two simple steps:

Trim into early strength.

Raise stops under structure.

You start with 1R.

But as price confirms, you shrink that risk:

From 1R to 0.7R…

Then to 0.3R…

Then to zero — or even better.

You’re still in the trade.

You still have upside.

But you’re no longer fully exposed to downside.

That isn’t theory.

That’s execution.

Each move reduces exposure.

Each step keeps you in control.

The Mental Shift

The Mental Shift: From Static Risk to Dynamic Exposure

This takes a mindset shift.

Most traders ask:

“Am I willing to lose 1R on this trade?”

A better question is:

How quickly can I reduce this to a fraction of 1R — without disrupting the trade?

That single shift transforms posture.

It encourages proactive decisions.

It forces you to engage with structure and respond to price.

Not sit.

Not hope.

Act.

It also builds emotional resilience.

Because when you know your risk is shrinking in real time —

You stop flinching at every tick.

You gain clarity.

You stay in control.

This isn’t over-management.

It’s stewardship.

Active > Passive

Professional trading isn’t passive.

It’s not just about having a system — it’s about working that system in real time.

Managing trades.

Adjusting exposure.

Responding to price.

It’s about shrinking risk — not just sitting in it.

That’s how you stay in control.

That’s how you stay in the game.

And the better you get at compressing exposure while the trade evolves,

The more consistent — and sustainable — your edge becomes.

That’s the job.

Not just taking risk — managing it.

Important: This content is provided for educational purposes only. If you’re reading this online, please review the full disclosure here.

A very clear picture of the responsible decision-making processes that every trader must face in order to become/remain successful in the long term!

Thank you very much, Andy!