The Market That Never Goes Down?

This market just doesn’t quit. That doesn’t mean risk disappeared.

The Markets

The rally continues—broad, unrelenting, and increasingly frustrating for shorts.

After a one-day dip on Wednesday, today’s bounce confirms the strength: hammer candles held, buyers stepped in, and indexes powered higher into the close.

There’s not much to say that the charts aren’t already screaming:

Every dip is getting bought.

Breadth is strong.

Volatility is low.

And sentiment is starting to feel invincible.

When markets feel this easy, they tend to become more dangerous—not less.

The Charts

All pushing higher— SPY and QQQ floating above their 8-day MAs. IWM continues to flag just above its 200-day. DIA is quietly grinding higher, with the 21-day MA catching up to price.

SPY bouncing quickly to new highs after yesterday’s brief dip.

QQQ doing the same.

IWM is building a nice consolidation — this time on the upper side of its 200-day MA.

DIA with a bullish consolidation pattern as the 21-day MA catches up.

Crypto?

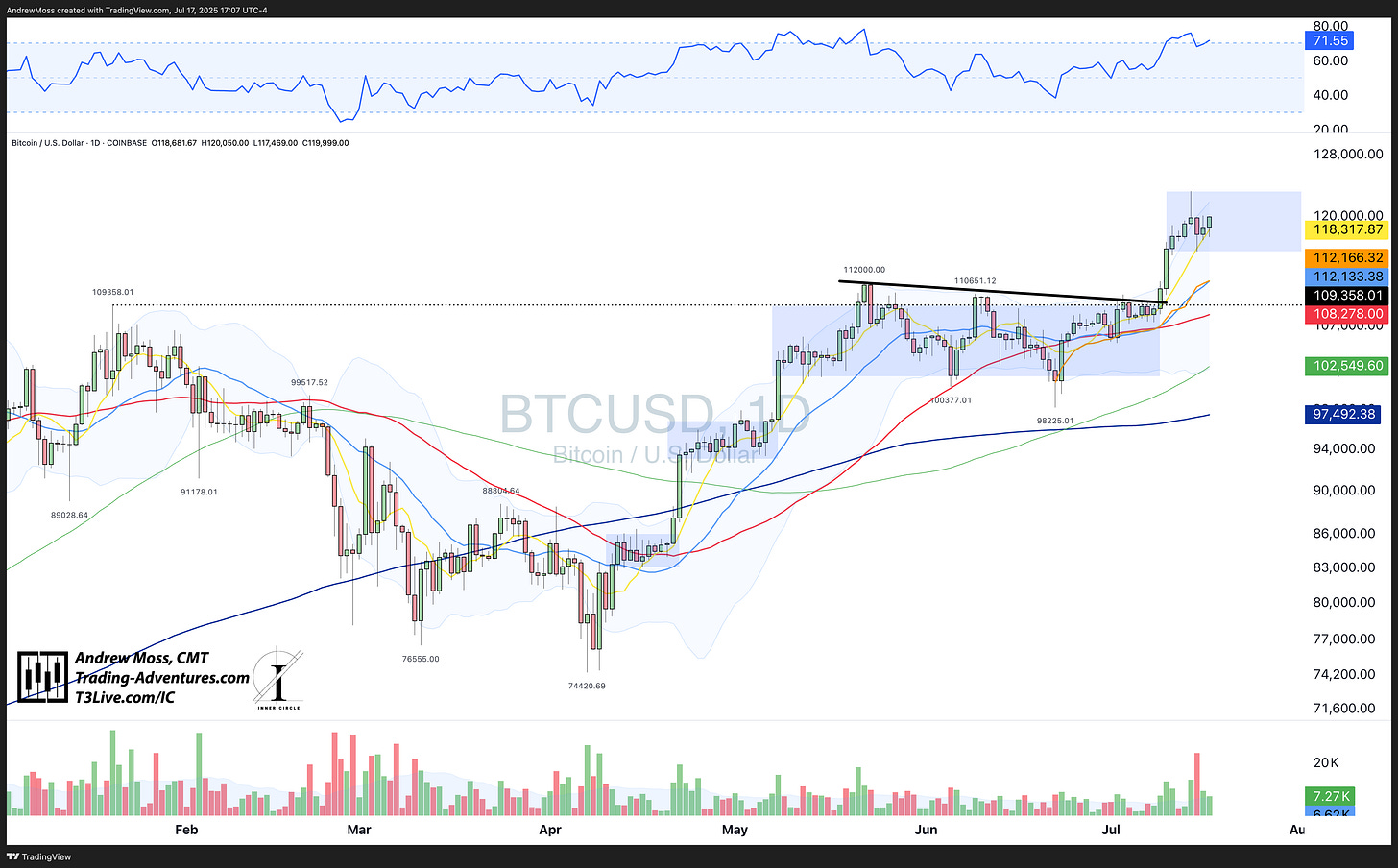

BTC made a new high and is now coiling. ETH, XRP—all holding steady near highs. The whole crypto complex is acting like a leader.

BTCUSD is in a new, higher box. Building the staircase one step at a time.

ETH is still moving higher from the breakout and testing pivots along the way.

XRP is quickly back to the $3.40 pivot highs.

The Trade

Here’s the hard truth: trading a market like this can be deceptively difficult.

Because everything works… until it doesn’t.

This is where traders start to over-size, over-stay, and over-think. It’s when fear of missing out overtakes the process. So stay disciplined:

Let charts tell you where the strength is holding.

Keep risk defined—even when it feels unnecessary.

Don’t assume the melt-up will last forever.

Seasonal Winds Picking Up? While momentum remains strong, it’s worth remembering that even the most persistent rallies eventually cool off. Jeff Hirsch of The Stock Trader’s Almanac recently pointed out that mid-July has historically marked the beginning of the market’s summer retreat—particularly for indices like the Nasdaq and S&P 500.

“Since 1990, August and September have been the worst-performing months of the year… and weakness often begins in mid-July.”

Read the full post →

Does that mean a pullback is guaranteed? Of course not. But it’s a timely reminder that strength like this can create risk by lulling traders into overconfidence.

Stay sharp.

📩 If you’re enjoying these updates, make sure you’re subscribed:

Want to support the work even more? Paid subscriptions are available for a very modest dollar amount. $7/mo, or $84/year, goes a long way toward keeping the charts flowing, the lights on, and the time justified.

No paywalls. No gated content. Just a way to say thanks. 🙏

🧠 ICYMI — New article from earlier this week → Stops Are for Suckers

Looking For More?

Elevate Your Trading Adventure Even Further With These Offerings.

EpicTrades Options Newsletter

Real-time trade ideas and insights, providing actionable trading insights focusing on options trades with short-term horizons, aiming to capitalize on weekly market movements.

The approach includes detailed reasoning for trades, specific options, and profit targets. It focuses on quick gains with a minimal time commitment from subscribers.

The Inner Circle

The Inner Circle is a Virtual Trading Floor (VTF) at T3 Live. I’ve been working and trading with this group since 2022. You may have noticed the logo in the watermarks on my charts.

Founded by David Prince and led by him, Rick March, and Kira Turner, the Inner Circle is a community of elite traders, including hedge fund managers, family office heads, corporate executives, financial advisors, and even professional poker players.

Fundamental, Macro, and Technical Analysis all combine to find and discuss the best opportunities in current markets.

The Disclosures

***This is NOT financial advice. This is NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.

Will go, as always.

A natural wave MUST have ups and downs