The Roadmap: My First Step Every Trading Day

How I use short-term market structure to stay aligned with the tape

The Roadmap

Every trading day starts with the roadmap.

What is the roadmap?

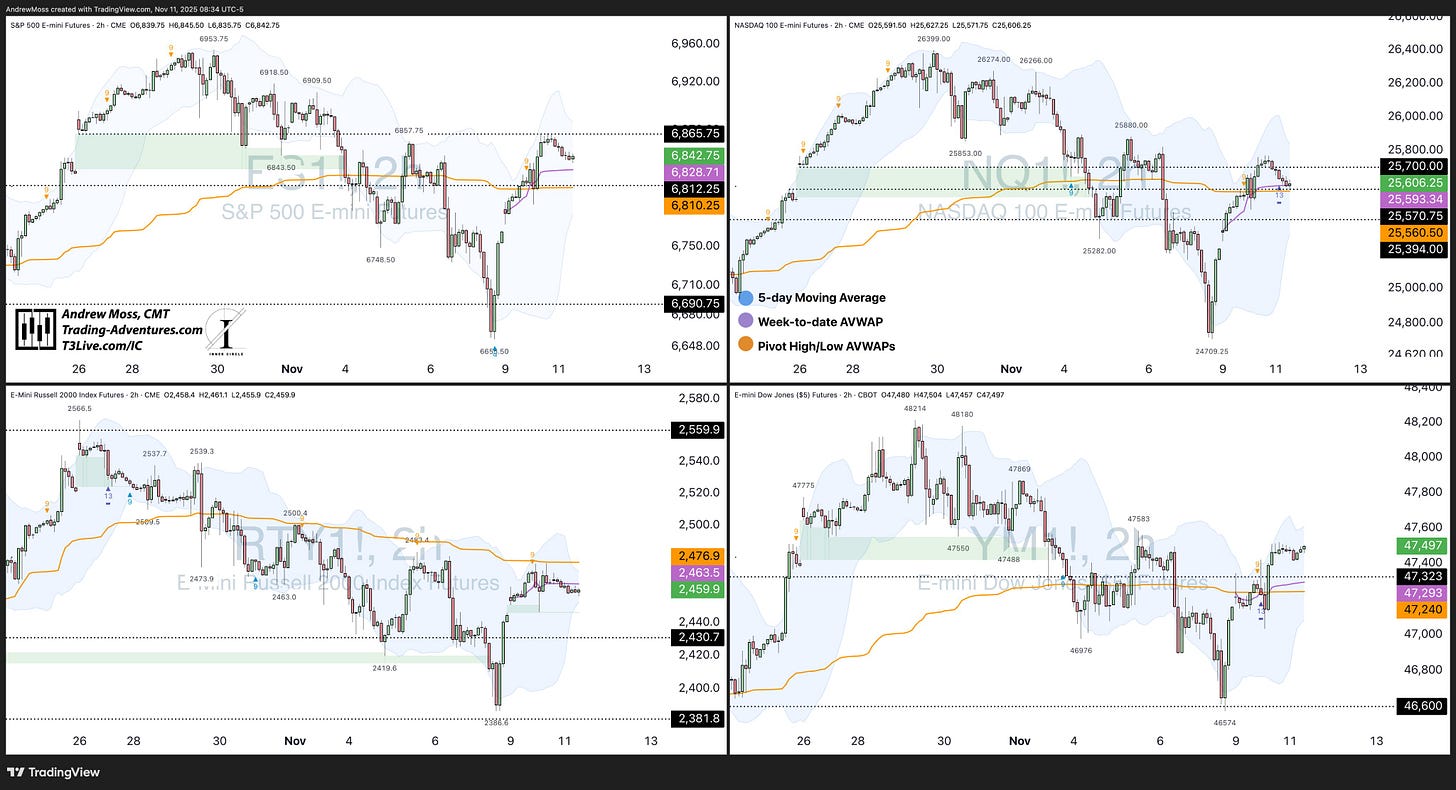

It’s a short-term view of the four major indices and/or their futures:

S&P 500, the NASDAQ 100, the Russell 2000, and the Dow Jones Industrial Average.

I check both the futures and ETF versions. Futures trade nearly around the clock, so they give a more complete context. But the ETFs—SPY, QQQ, IWM, and DIA—are the actual vehicles many traders are in. So I want to know what both sets of charts are saying.

I chart them on a four-panel grid:

Futures on a 1-hour chart

ETFs on a 15- or 30-minute chart

Each chart includes:

A 5-day moving average (blue)

A VWAP anchored to the week-to-date open (purple)

Additional VWAPs anchored to key swing highs, lows, or news events (orange)

Relevant pivot levels that have proven meaningful (black dotted lines and numerical labels)

Why?

This isn’t about predictions. It’s about navigation.

When I pull up the map, I want to see which direction the road is pointing.

Are we headed uphill?

About to hit a curve?

Is the path wide open—or are we coming up on a traffic jam?

Sometimes the road is smooth and straight—momentum is clear, levels are holding, and there’s room to run.

Other times, price is stuck in congestion between AVWAPs, MAs, and pivots. That tells me it’s time to slow down, wait for clarity, or look elsewhere for better terrain.

Here’s how it looked this morning, with notes:

$ES (SP eMini Futures) hit the gap fill and pulled back. Watch the 🟣 and 🟠 for potential support.

$NQ (NASDAQ eMini Futures) already testing its WTD AVWAP 🟣. There is a gap/pivot and an AVWAP 🟠 close by as well.

Yesterday, most of the index futures were sitting at or just below key VWAPs, with price hugging or dipping under the declining 5-day MA. That’s a caution zone. Nothing broken, but no easy drive either.

From yesterday’s post:

1/2

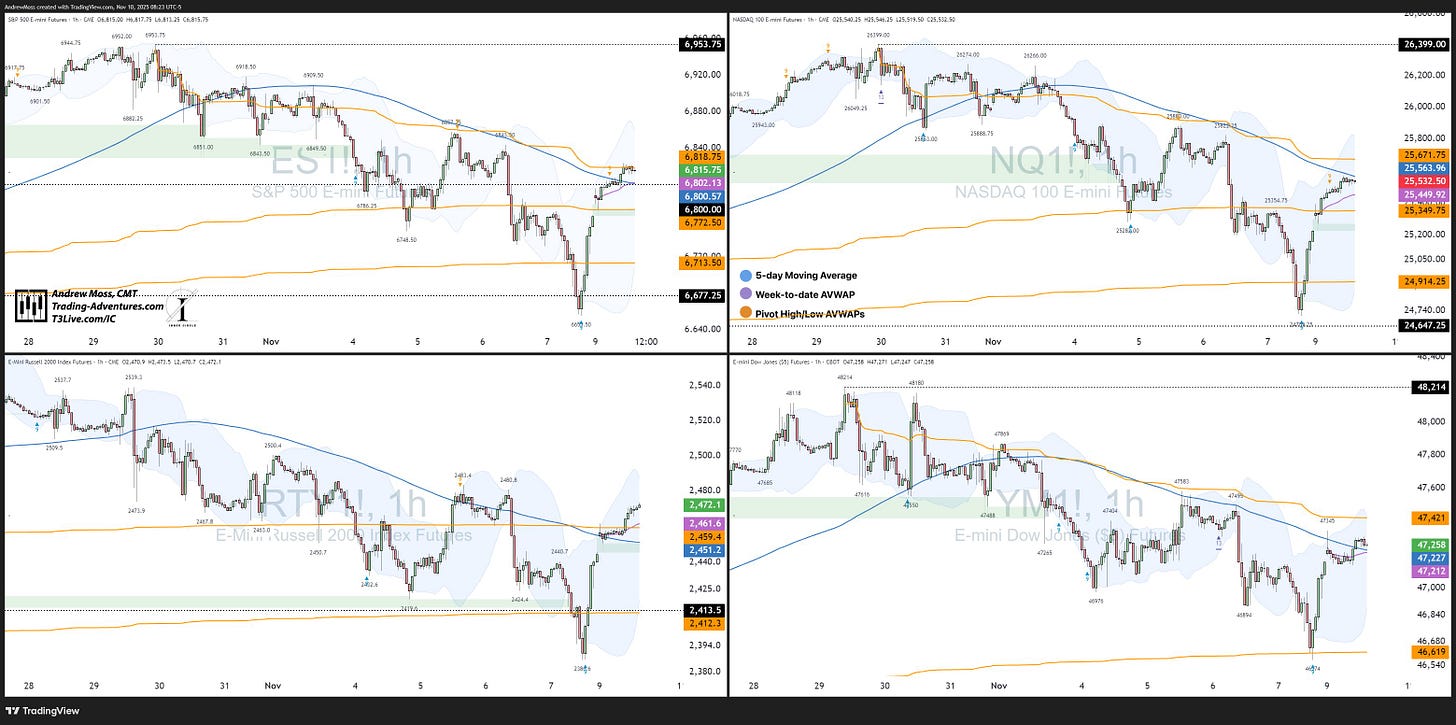

$ES is over the 5-day MA 🔵 and into the AVWAP 🟠 from the high.

$NQ is just under the 5-day MA 🔵 with the pivot high AVWAP 🟠 above at 25,671.

What to watch for: Do these levels keep a lid on the bounce?

2/2

But buying a Monday morning gap-up is almost never fun or easy.

By using those different lenses, you might have been clued in to watch for a pullback > bounce sequence. (noted with black arrows)

That’s what 3 of 4 indices did.

SPY and IWM did it very precisely. QQQ was a little messier. But the map told us where to look.

Here’s the link to the original thread on X: 🗺️Roadmap 11-11-2025

If you’re not trading SPY, QQQ, IWM, DIA, or futures, you might ask—why bother?

Because the road those vehicles take still affects the traffic everywhere else.

If I’m trying to push a trade long in a single name while the broader market is hitting resistance or rolling over, it’s like trying to merge into fast-moving traffic from a dead stop. There’s going to be friction.

But if the roadmap shows the market holding support, reclaiming key AVWAPs, or accelerating, that’s when it makes sense to press.

It’s not about forecasting every move. It’s about staying on the right road and knowing when to hit the gas—or when to wait for the next turn.

That’s why I use the roadmap. Every day.

If this daily Roadmap adds clarity to your process and you would like the see it here more often, let me know in the comments.

Looking For More?

Elevate Your Trading Adventure Even Further With These Offerings.

EpicTrades Options Newsletter

Real-time trade ideas and insights, providing actionable trading insights focusing on options trades with short-term horizons, aiming to capitalize on weekly market movements.

The approach includes detailed reasoning for trades, specific options, and profit targets. It focuses on quick gains with a minimal time commitment from subscribers.

The Inner Circle

The Inner Circle is a Virtual Trading Floor (VTF) at T3 Live. I’ve been working and trading with this group since 2022. You may have noticed the logo in the watermarks on my charts.

Founded by David Prince and led by him, Rick March, and Kira Turner, the Inner Circle is a community of elite traders, including hedge fund managers, family office heads, corporate executives, financial advisors, and even professional poker players.

Fundamental, Macro, and Technical Analysis all combine to find and discuss the best opportunities in current markets.

The Disclosures

***This is NOT financial advice. This is NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.

This is great! Thank you!

would love your thoughts on some of my stuff. follow me back, I could DM you?