This Isn’t Over Yet

Dip buying and a Tariff Tweet make for a back and forth day

The Markets

Dip buyers showed up again today — stepping in early and driving a steady intraday climb across SPY, QQQ, IWM, and DIA.

But just as the tape began to firm up, another round of Trump tariff comments — this time targeting China, soybeans, and cooking oil — hit the feed and triggered another sharp late-day selloff.

The Charts

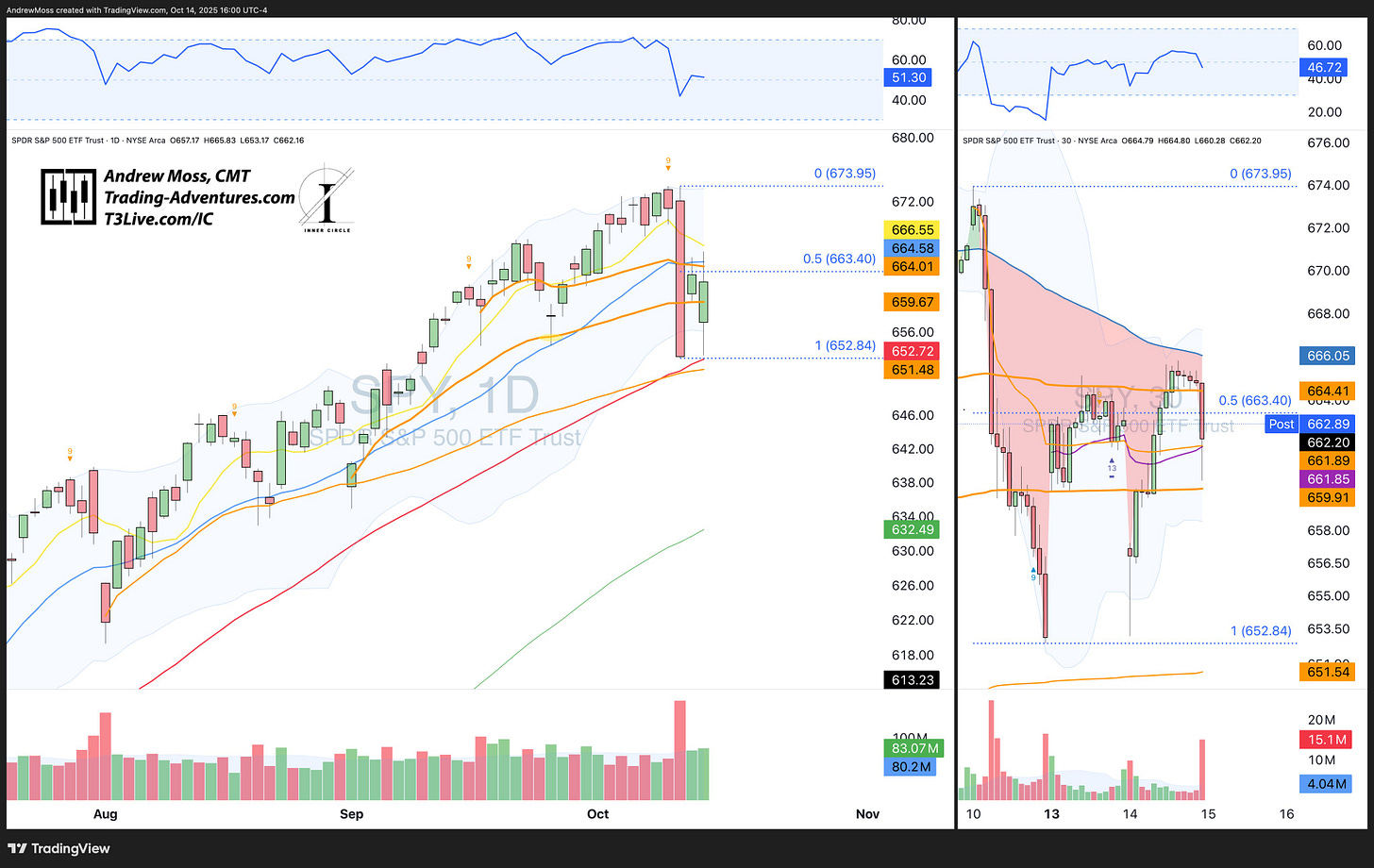

SPY

After nearing its 50-day moving average at 652.73 (low of the day 653.17), SPY bounced most of the session, reclaiming both Friday’s high anchored VWAP and the week-to-date VWAP.

Still, price remains below the 50% retracement and short-term moving averages — keeping this rebound corrective for now.

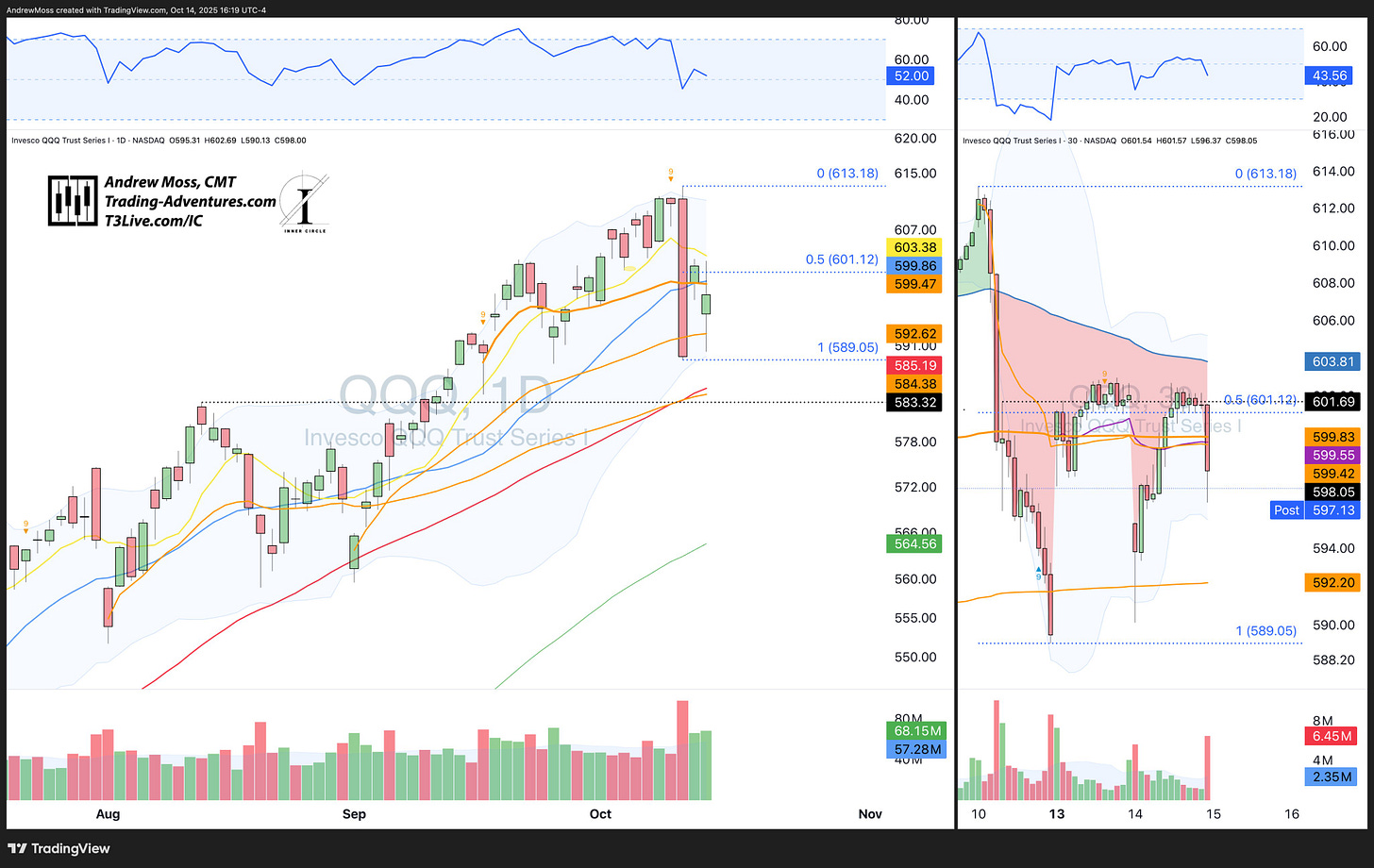

QQQ

The Nasdaq showed similar action, but QQQ ended the day not only below the 50% retracement, but also beneath the week-to-date and pivot high AVWAPs.

Tech remains the weakest of the major indices.

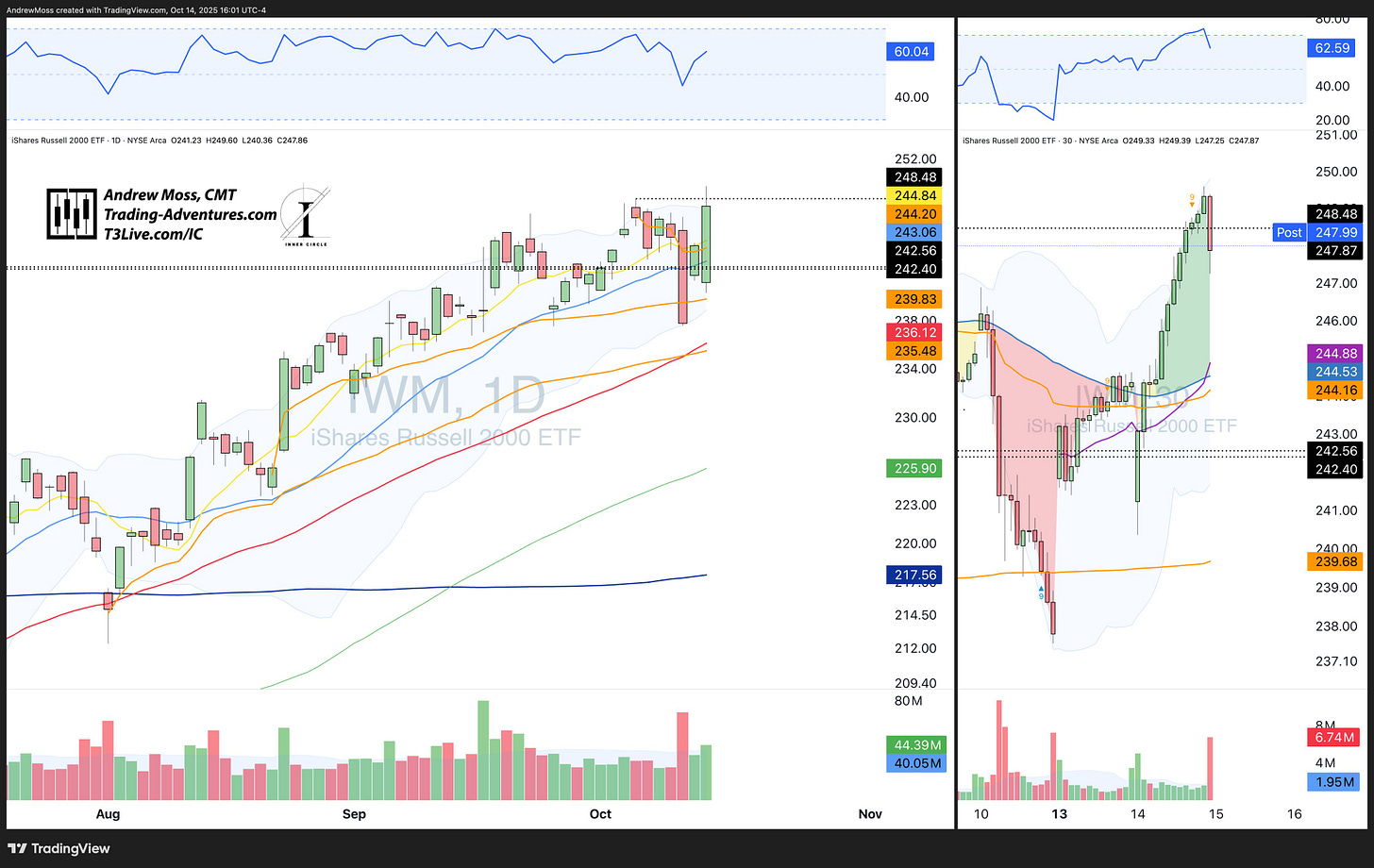

IWM

IWM continues to lead.

Small caps were the outlier again — bouncing late in the session and even hitting new highs intraday.

That relative strength is notable and worth tracking if it holds.

The Trade

Patience remains an asset.

There are still trades — Rare Earths, Quantum, and Housing all showed strength — but they’re tactical, not swing setups.

In a market that continues to produce sharp reversals out of nowhere, it pays to be nimble: take profits faster, size smaller, and let structure confirm the next move.

Bottom line:

The dip buyers are still showing up — but so are the headline shocks.

Momentum remains fragile.

Stay patient, stay tactical, and respect your levels.

💬 If you’d like to see more of these short daily recaps here on Substack, drop a quick comment or tap the ❤️ at the top of the page. Your feedback helps shape what I share next.

Looking For More?

Elevate Your Trading Adventure Even Further With These Offerings.

EpicTrades Options Newsletter

Real-time trade ideas and insights, providing actionable trading insights focusing on options trades with short-term horizons, aiming to capitalize on weekly market movements.

The approach includes detailed reasoning for trades, specific options, and profit targets. It focuses on quick gains with a minimal time commitment from subscribers.

The Inner Circle

The Inner Circle is a Virtual Trading Floor (VTF) at T3 Live. I’ve been working and trading with this group since 2022. You may have noticed the logo in the watermarks on my charts.

Founded by David Prince and led by him, Rick March, and Kira Turner, the Inner Circle is a community of elite traders, including hedge fund managers, family office heads, corporate executives, financial advisors, and even professional poker players.

Fundamental, Macro, and Technical Analysis all combine to find and discuss the best opportunities in current markets.

The Disclosures

***This is NOT financial advice. This is NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.