Three Gaps, Six Catalysts, and Lofty Expectations

Markets have sprinted into major news. With price stretched and sentiment leaning bullish, the next move will hinge on reaction, not results.

The Markets

Three days of upside momentum.

SPY and QQQ have now gapped up three days in a row—a rare occurrence—and all three closes have been above their upper Bollinger Bands. That kind of strength speaks for itself. RSI isn’t extreme yet: SPY at 68.75, QQQ at 70.46.

But momentum is heading into heavy news.

Tomorrow brings the Fed decision at 2:00 p.m. ET, followed by the press conference at 2:30 p.m. Then, after the close, MSFT, GOOGL, and META earnings. Thursday morning: AAPL and AMZN.

That’s five of the Mag 7 reporting in a 24-hour span—with markets already extended into the events.

Notably, IWM hasn’t confirmed the strength seen in the large caps. It gapped up on Friday and Monday, but faded into the close on Monday and declined about half a percent today.

That divergence could matter if we see weakness post-Fed or post-earnings.

Let’s go to the charts.

The Charts

SPY with three sequential gaps higher. Each one resulting in new all-time highs. And each one above the upper Bollinger Band. The strength is irrefutable. RSI isn’t extended. But the gap between price and the short-term moving averages is.

Add in the DeMark 9 sell setup—note the reaction following the three prior signals—and the potential for rest or retracement increases.

QQQ is in the same situation.

IWM has been on the giving side of rotation, not the receiving side. Price action is still bullish, though —holding above the key MAs with plenty of room to the upside.

DIA see SPY and QQQ. Large-cap stocks have been moving in lockstep.

BTCUSD bounced and was briefly above all key moving averages. But strength is fading as this is being typed, taking it back below the 50 and 100-day MAs and now testing the declining 21-day.

MAGS chart mirrors the large caps—three-day surge, breakout above short-term resistance, and a fresh DeMark 9 sell setup. Included here with the Mag 7 firmly in focus this week.

MSFT nearly tagged its prior earnings high today, pushing RSI to 73. The setup differs from last quarter—this time marked by gaps and extension, not consolidation near the 8-day MA.

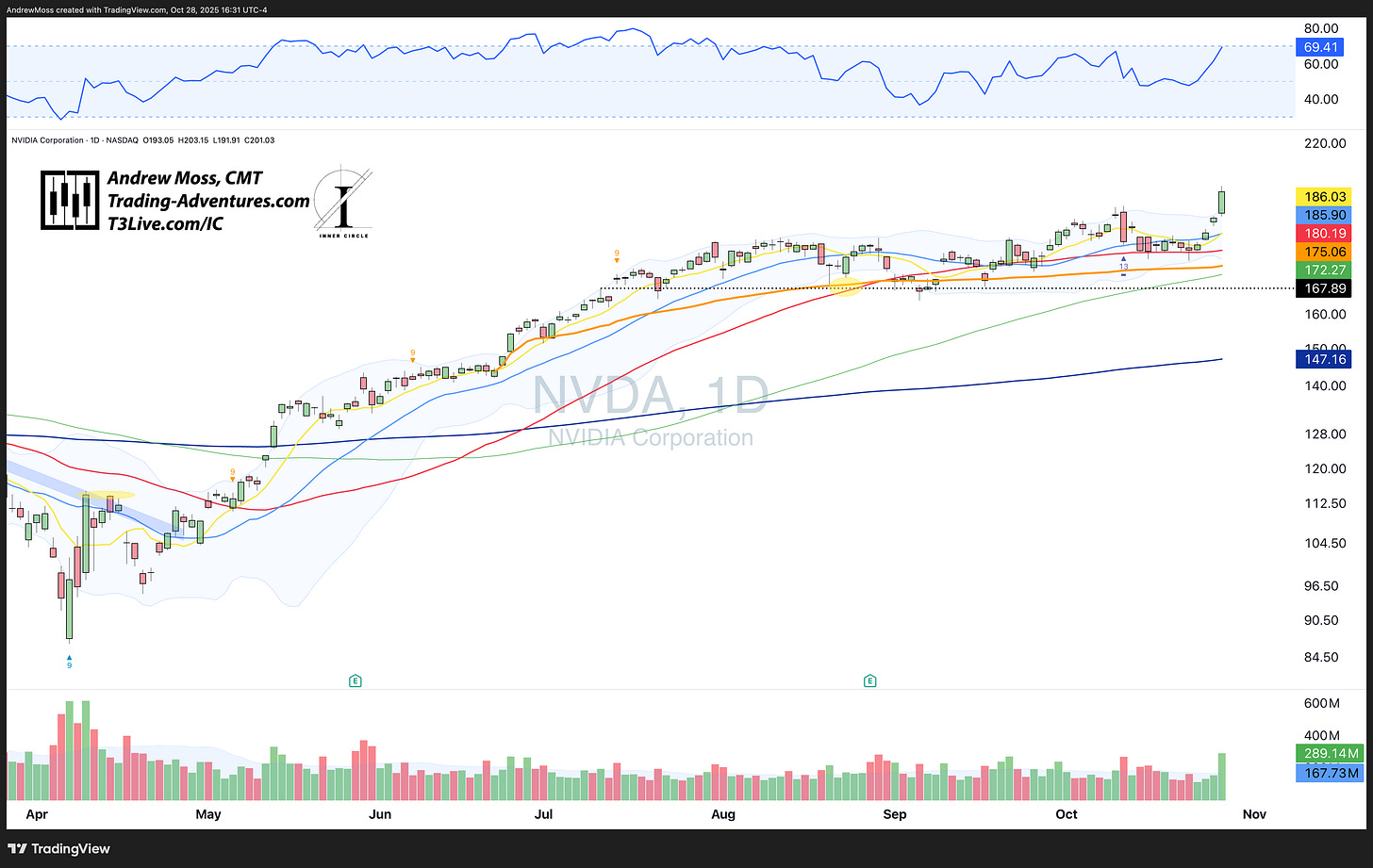

NVDA was fueled by a keynote presentation from the CEO today and celebrated a milestone. It’s above the $200 mark, closing up ~5% at $201.03

The Trade

No bearish calls here—but this does feel like a “sell the news” zone.

With this kind of strength into this kind of catalyst, consolidation would be both expected and healthy.

We also know that in the short term, it’s not the earnings results that matter—it’s how names are priced into the event and how they react. After this recent stretch, it’s going to take stellar results to impress. MSFT nearly tagged its prior earnings gap high today. SPY, QQQ, MAGS, and other large caps are all pushing highs into what many view as a “guaranteed” rate cut.

But it’s not just the cut—it’s the press conference. What does Powell signal? How confident is the forward guidance from these companies?

Those are the pieces that will shape near-term pricing. A pullback or pause here could offer a solid re-entry or add opportunity. If you’ve got setups you believe in, this is where patience and system conviction come in.

This market is strong—and the fourth quarter still sets up for strength. The next few sessions will tell us if this move still has legs—or if it needs to catch its breath.

Eyes open, size smart, and keep your spots in focus.

Looking For More?

Elevate Your Trading Adventure Even Further With These Offerings.

EpicTrades Options Newsletter

Real-time trade ideas and insights, providing actionable trading insights focusing on options trades with short-term horizons, aiming to capitalize on weekly market movements.

The approach includes detailed reasoning for trades, specific options, and profit targets. It focuses on quick gains with a minimal time commitment from subscribers.

The Inner Circle

The Inner Circle is a Virtual Trading Floor (VTF) at T3 Live. I’ve been working and trading with this group since 2022. You may have noticed the logo in the watermarks on my charts.

Founded by David Prince and led by him, Rick March, and Kira Turner, the Inner Circle is a community of elite traders, including hedge fund managers, family office heads, corporate executives, financial advisors, and even professional poker players.

Fundamental, Macro, and Technical Analysis all combine to find and discuss the best opportunities in current markets.

The Disclosures

***This is NOT financial advice. This is NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.