Trump, Tariffs, Taxes, and Treasuries

And a Bounce?

The Markets

Trump, tariffs, taxes, and treasury bond yields have everyone on edge.

And for good reason. Rising bond yields and tariff uncertainty have fueled recent sell-offs, pushing indices toward critical levels. Web reports from Reuters and CNBC note that Trump’s 25% tariffs on Canada and Mexico, plus a 10% hike on Chinese goods, kicked in earlier this month, with retaliatory moves already in play (e.g., Canada’s planned 25% tariffs on ~$106B USD [C$155B CAD] of U.S. goods).

Some see this as a negotiation ploy (“Trump’s bluffing for leverage—markets overreacting”), while others warn of a deeper unwind (“Tariffs + yield volatility = recipe for a 10% S&P drop”).

No way to know how the story resolves. But we can always follow price action.

I don’t usually peek at weekly charts mid-week, but given how close we are to critical levels from last Saturday’s thread, I couldn’t resist. What I’m seeing screams a high-probability bounce next week—though it might not signal the ultimate bottom. Think of it as a classic oversold rally, potentially a face-ripper, before the next leg down. Persistent tariff uncertainty or a yield spike could easily spoil the party post-bounce.

Quick aside: QQQ would need to trade in the $433s to tag a -20% selloff from its December high—about a 12% drop from today’s levels. We’re not there yet, but we know how fast momentum can shift.

Here are the charts.

The Charts

IWF (Growth) vs IWD (Value): A potential hammer forming at a major support/resistance zone. Growth stocks are oversold relative to value—classic mean-reversion setup.

XLY (Consumer Discretionary) vs XLP (Staples): Same deal—a hammer on a trendline. XLY’s taken a tariff-related beating, but this suggests short-term relief could arrive soon.

SPHB (High Beta) vs SPLV (Low Volatility): High-beta names are trying to recover support. The potential for a ‘failed breakdown’ could lead to Risk-on snapping back hard.

QQQ vs QQEW (Equal Weight Tech): If we get a bounce, the favorites will be bought first. Think Mag7 and mega-cap tech. This chart also has a potential hammer forming, just under a key moving average, and with a DeMark 9 buy setup. Worth watching for a resolution higher.

SPY vs ACWX (World ex-U.S.): U.S. outperformance is stretched, but a tariff-driven flight to ‘safety’ could juice SPY short-term. On the chart, RSI < 30, price is below the lower Bollinger Band, near significant support/resistance, and with a DeMark 9 buy setup.

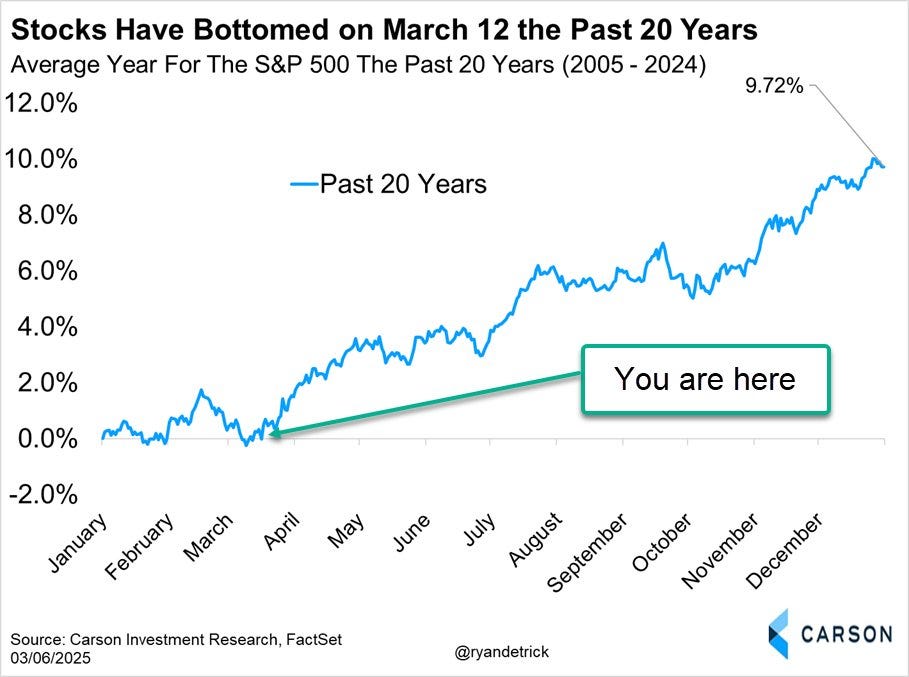

To round it out, we can add seasonality into the mix, finishing a good recipe for an oversold bounce.

Thank you, Ryan Detrick - See his post on X by clicking here.

The Trade

Keep an eye out for that bounce next week—technical setups and seasonality are aligning for a potential snapback.

But don’t get giddy just yet. In this whipsaw market, with tariffs, yields, and Trump’s next move hanging over us, patience and prudent risk management are non-negotiable.

Even if we get a face-ripping rally, it could still be a head-fake before the bigger storm—trade smart.

Looking For More?

Elevate Your Trading Adventure Even Further With These Offerings.

EpicTrades Options Newsletter

Real-time trade ideas and insights, providing actionable trading insights focusing on options trades with short-term horizons, aiming to capitalize on weekly market movements.

The approach includes detailed reasoning for trades, specific options, and profit targets. It focuses on quick gains with a minimal time commitment from subscribers.

The Inner Circle

The Inner Circle is a Virtual Trading Floor (VTF) at T3 Live. I’ve been working and trading with this group since 2022. You may have noticed the logo in the watermarks on my charts.

Founded by David Prince and led by him, Rick March, and Kira Turner, the Inner Circle is a community of elite traders, including hedge fund managers, family office heads, corporate executives, financial advisors, and even professional poker players.

Fundamental, Macro, and Technical Analysis all combine to find and discuss the best opportunities in current markets.

The Disclosures

***This is NOT financial advice. This is NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.