$TSLA Day

Weekly Market Update

The Markets

Yesterday, Tesla announced quarterly earnings of $0.72 per share, beating estimates of $0.58-$0.60. The options market was pricing a move of roughly $17 a share. Today, the stock is up more than $46 — nearly 22%.

The recent pivot high of $271 is less than 5% higher now.

Is it an easy buy here? Not exactly a low-risk setup. However, the results change the company's characteristics, as evidenced by the drastic repricing.

Put this one on the pullback watch list.

Bonus: notice that the bounce started precisely at the AVWAP from the April pivot low. I'm not advocating the start of a long position just before an earnings announcement — just pointing out another example of the timely relevance of an AVWAP.

The rest of the market reacted with a shrug. There were pockets of strength for the day (biotech), and the indexes were mostly green, but they didn’t travel far.

Now, a quick announcement before we go to the charts.

I am pleased to announce the launch of reader-supported subscriptions to Trading-Adventures.com. For just $15 a month, you can further support this work and enhance your Trading Adventure.

What You Can Expect

Simply, more.

Go deeper than the indexes to analyze market moves beneath the surface.

More charts, more analysis, and more education to improve your trading and enhance your success.

Subscribe now to support this Trading Adventure and take a significant step forward on your own. It's all available for less than a cup of coffee each week.

This is just the beginning.

Been here a while and enjoy the freebies?

No worries. The current publishing schedule is not changing. Free subscribers will continue to receive the Market Update articles twice a week.

Thank you for considering a paid subscription to Trading Adventures. I look forward to supporting you on your trading journey!

The Charts

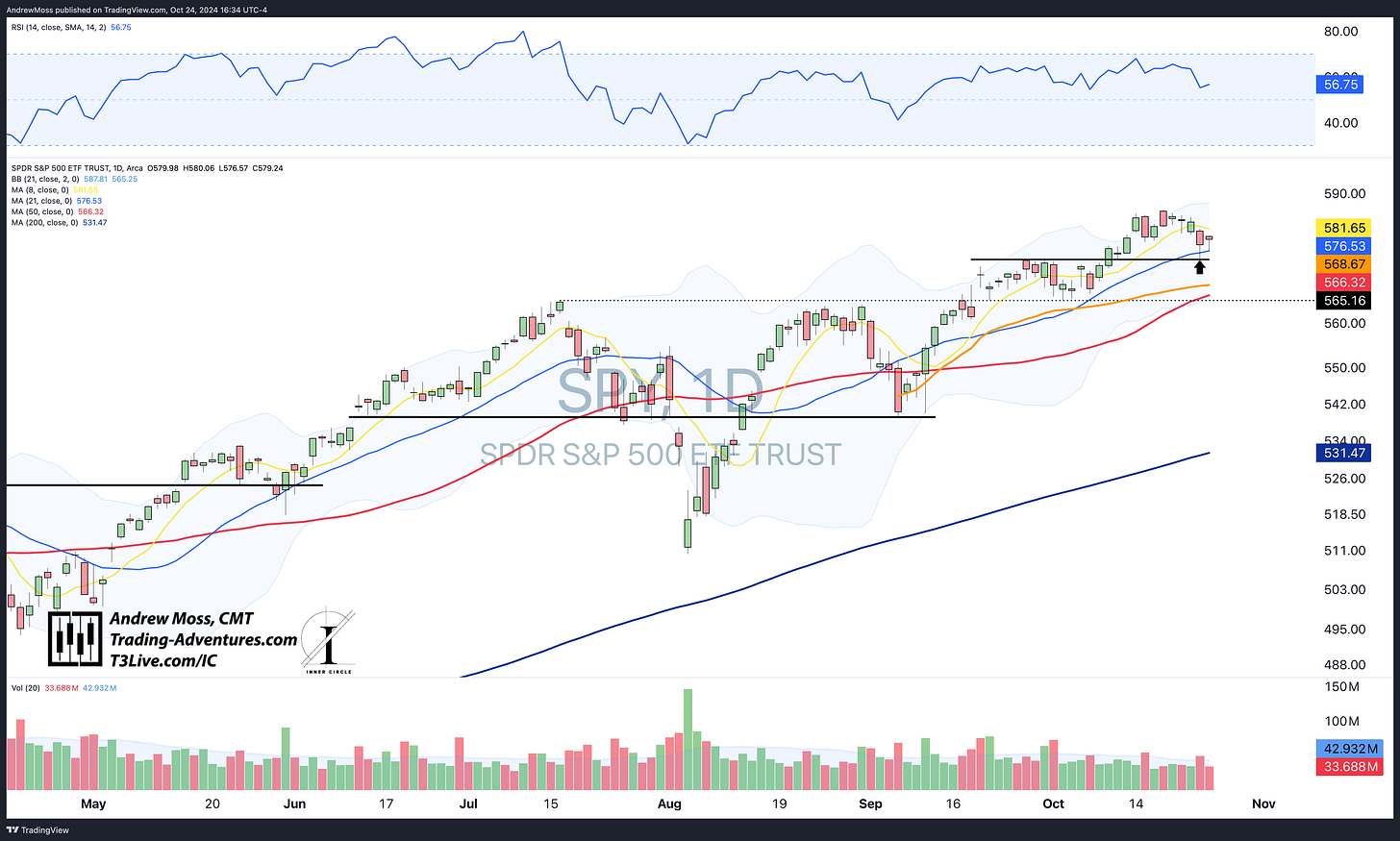

SPY has an inside day after finding support yesterday at the pivot/breakout level. The 21-day MA provided a floor for prices as the consolidation builds. Volume was lighter than average, and the RSI remains in bullish territory.

QQQ likewise had an inside day, staying just below the breakout level. It spanned the gap between the 8 and 21-day MAs as it too, continues to trade in a consolidation range.

IWM has pulled back more than most bulls would like and spent day two beneath the 21-day MA. Lasting directional moves continue to be unobtainable for the more volatile small-cap index.

DIA was the lone negative stock index today as it moved further below the 21-day MA and near the consolidation range of mid-September and October.

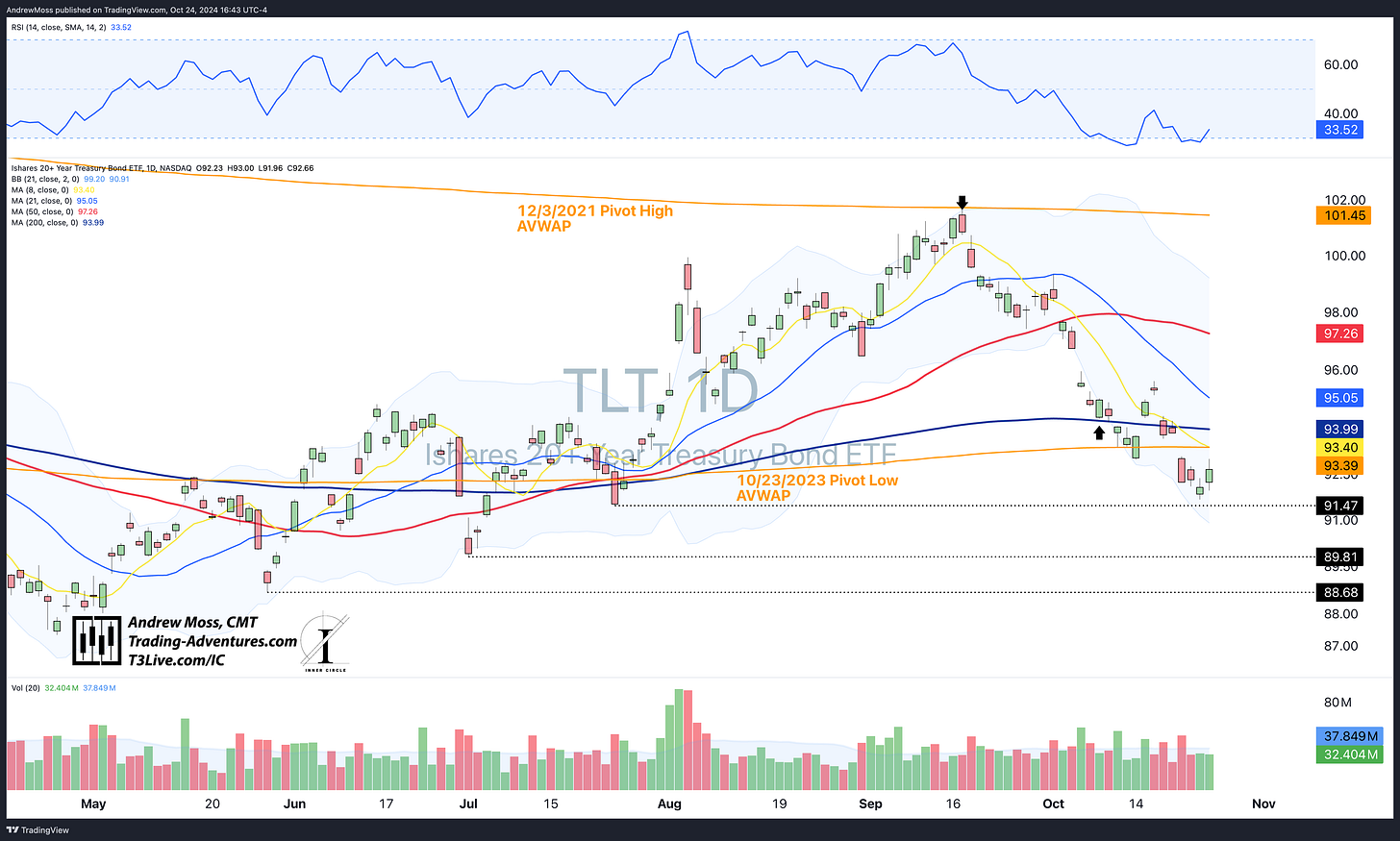

TLT finally had some positive price action after getting very close to the $91.47 pivot level yesterday. It has many layers of potential resistance overhead — an AVWAP and the 8 and 200-day MAs.

DXY US Dollar Futures had an outside day and one of a few red candles on this recent rise. Will we see a reversal with follow-through?

BTCUSD confirmed yesterday’s hammer candle with a rise above the 8-day MA and a move of +2.36% for the day so far. We can watch $68,380 for another potential breakout move.

The Trade

Stock indexes have pulled back to logical support levels and are still having a bit of a rest. Bonds (TLT) are trying to stop the bleeding. And Bitcoin continues to tease, looking to be just on the cusp of a significant move higher.

The TSLA news has changed its situation. After being confined to a range (albeit a wide one) since mid-summer, this stock now looks like it has the potential to get into a new area. We’ll watch it and be ready for any pullbacks or other low-risk entry setups.

Bitcoin and the crypto space are still intriguing. Both the currency and the related names continue to show promise.

Look for more on both of these themes coming next week.

Looking For More? Elevate Your Trading Even Further With These Offerings

More education, training, and support for your Trading Adventure.

EpicTrades Options Newsletter

Real-time trade ideas and insights focusing on options trades with short-term horizons, aiming to capitalize on weekly market movements.

The approach includes detailed reasoning for trades, specific options plays, profit targets, and risk management guidance throughout the trade.

The Inner Circle

The Inner Circle is a Virtual Trading Floor (VTF) at T3 Live. It’s the group I’ve been working and trading with since 2022. You may have noticed the logo in the watermarks on my charts.

Founded by David Prince and led by him, Rick March, and Kira Turner, the Inner Circle is a community of elite traders, including hedge fund managers, family office heads, corporate executives, financial advisors, and even professional poker players.

Fundamental, Macro, and Technical Analysis all combine to find and discuss the best opportunities in current markets.

The Disclosures

***This is NOT financial advice. This is NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.