Waiting on the Hinge

Stocks steady at critical moving averages, with PCE set to tip the balance.

The Markets

Markets continue to wrestle with support levels, waiting on tomorrow’s PCE report to provide direction. Today’s action showed resilience in some spots and pressure in others — a familiar theme in this environment of selective strength and rotation.

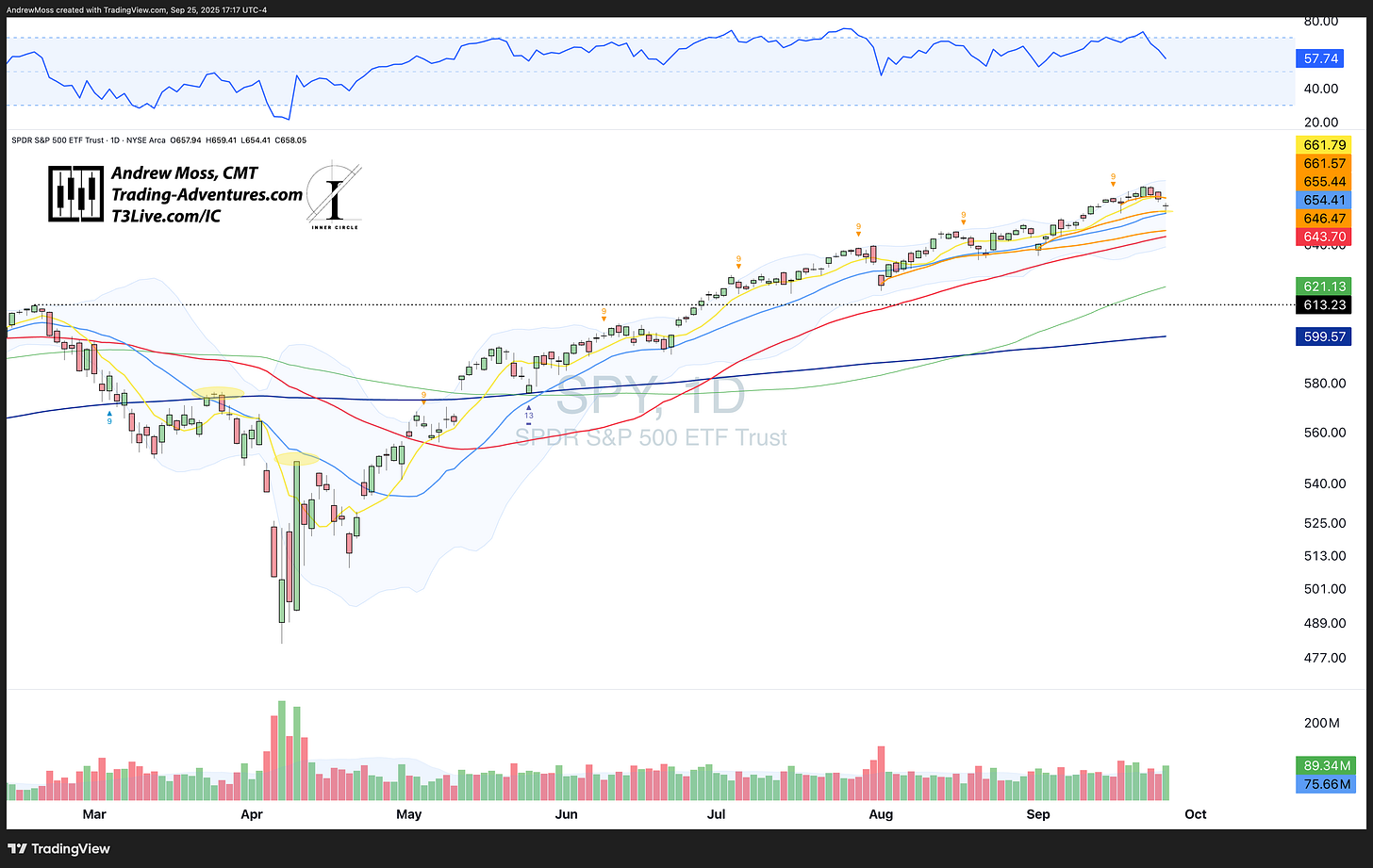

The S&P 500 (SPY) found some support at the 21-day moving average and the Anchored VWAP from the early-September low. For now, that’s the line the bulls are defending. To shift momentum back in their favor, they’ll need to push through today’s high and prove they can build from here.

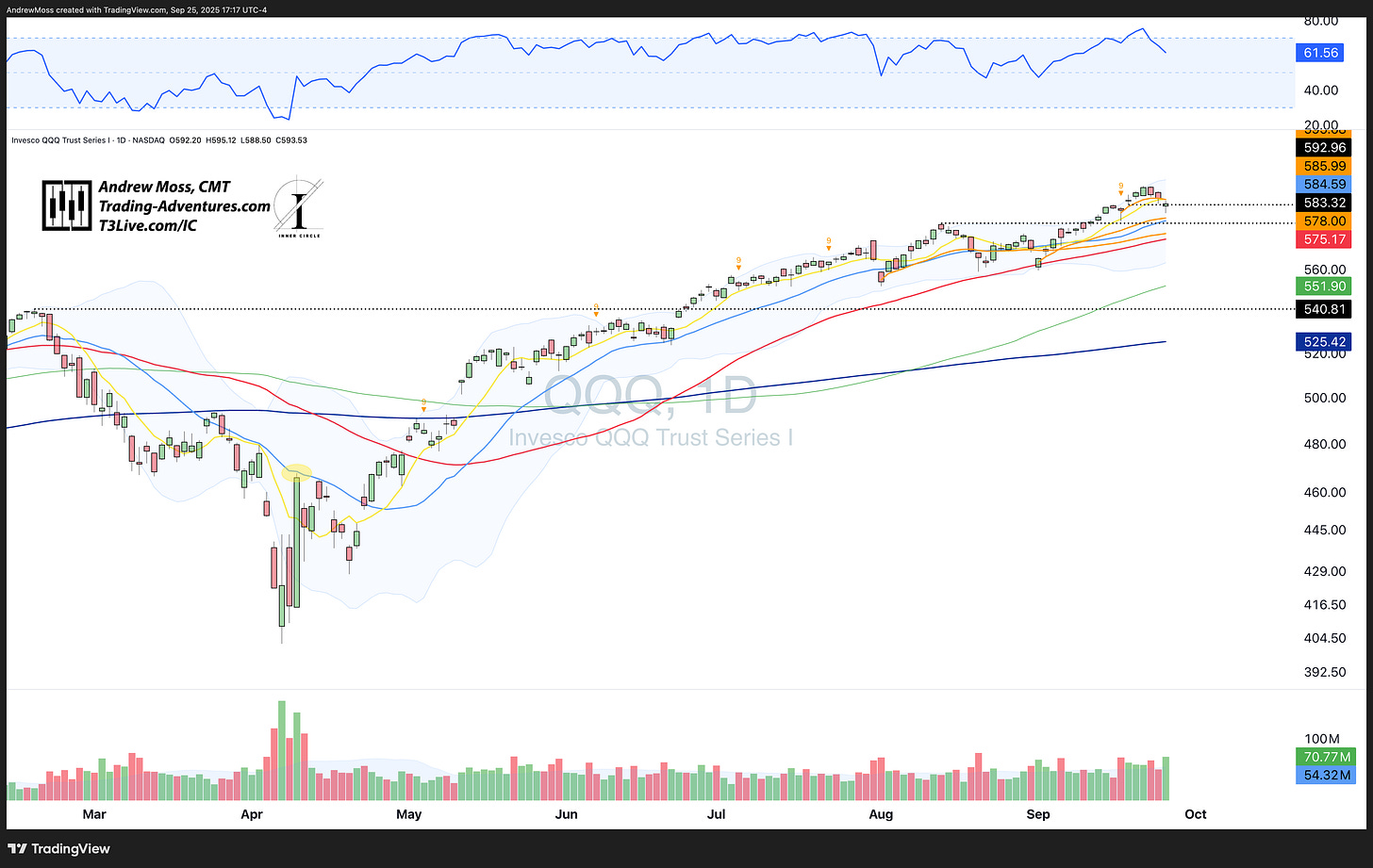

The Nasdaq 100 (QQQ) attempted a bounce but still trades below its 8-day MA. Until that level is reclaimed, the door remains open for a test of the 21-day MA. Meanwhile, both the Russell 2000 (IWM) and the Dow (DIA) are testing their 21-day moving averages, similar to SPY.

Elsewhere, crypto and quantum names stayed heavy, though some remain above their short-term 8-day averages. Housing stocks showed a different picture, with constructive intraday reversals. And in megacap tech, Apple powered into the close with strength, while Amazon continued to stumble beneath its 100-day.

The charts sharpen the picture, with major indexes leaning on their 21-day moving averages and anchored VWAPs as pivotal support.

The Charts

SPY is testing the 21-day moving average and the anchored VWAP from the September low. This is the first meaningful support zone. A hold here sets the stage for recovery, while a break would invite deeper pressure.

QQQ is further above the next support - 21-day MA and AVWAP - but did lose the 8-day MA for the first time in several weeks. $583-$586 is the area to watch for further selling.

IWM is also pulling back to its 21-day and anchored VWAP, matching the action in SPY. This makes tomorrow’s reaction more important: holding here would confirm support, while failure would reinforce relative weakness, which could take it to the ~$230-$233 area.

DIA The Dow is testing its 21-day and a prior pivot zone. This is a spot to watch for a bounce attempt. Losing it would shift leadership risk back to the downside — $451-$453.

TLT is getting pinched by the 8 and 21-day MAs, with several other potential support and resistance levels beyond those. Recent strength has not been lost, but bigger progress is still elusive and above $90-$91.

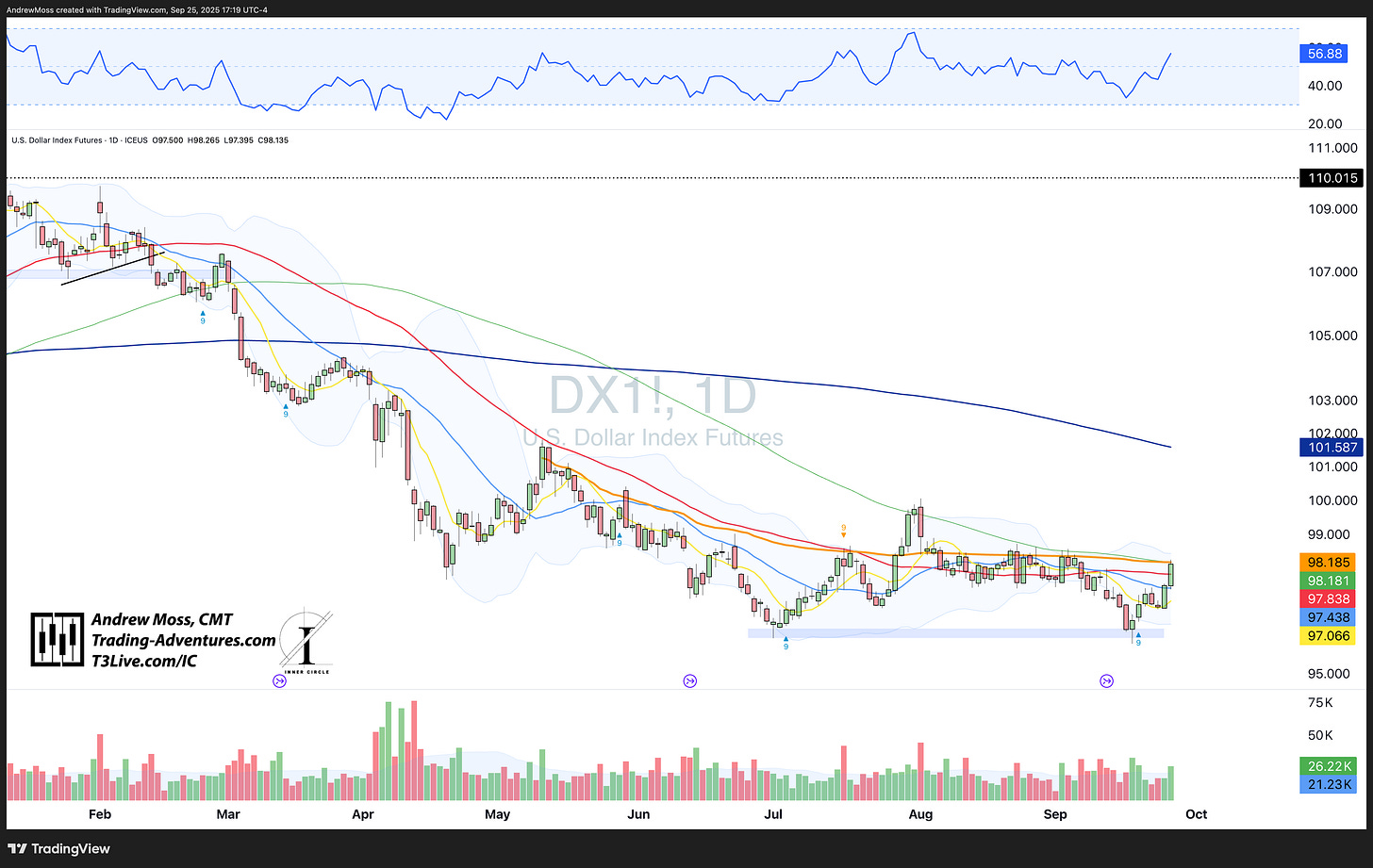

DXY The Dollar Index has firmed above its 50-day and is now pressing into short-term resistance. A push through 98.50–98.75 could confirm the strength. Until then, the bigger downtrend still dominates.

BTCUSD Bitcoin broke lower, slicing through short-term support and closing near session lows. It now sits inside the lower half of its multi-month range. The key area to defend is 109k–106k — below that, the structure weakens further.

The Trade

The PCE report is the hinge. A soft number could ease pressure and open the door for rotation into risk assets. A hot number risks another leg lower for growth and crypto.

The system gives us the levels, the market gives us the signal. Our job is to stay ready, not guess.

Markets are balanced on support, waiting for clarity. Patience remains the edge here. Tomorrow’s data may break the stalemate and open up new opportunities. Until then, discipline and defense remain the right approach.

If you find these updates useful, consider subscribing to Trading Adventures. I share these perspectives twice weekly to help traders navigate markets with clarity and confidence.

Looking For More?

Elevate Your Trading Adventure Even Further With These Offerings.

EpicTrades Options Newsletter

Real-time trade ideas and insights, providing actionable trading insights focusing on options trades with short-term horizons, aiming to capitalize on weekly market movements.

The approach includes detailed reasoning for trades, specific options, and profit targets. It focuses on quick gains with a minimal time commitment from subscribers.

The Inner Circle

The Inner Circle is a Virtual Trading Floor (VTF) at T3 Live. I’ve been working and trading with this group since 2022. You may have noticed the logo in the watermarks on my charts.

Founded by David Prince and led by him, Rick March, and Kira Turner, the Inner Circle is a community of elite traders, including hedge fund managers, family office heads, corporate executives, financial advisors, and even professional poker players.

Fundamental, Macro, and Technical Analysis all combine to find and discuss the best opportunities in current markets.

The Disclosures

***This is NOT financial advice. This is NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.