Waiting On The King

Monday Market Update

The Markets

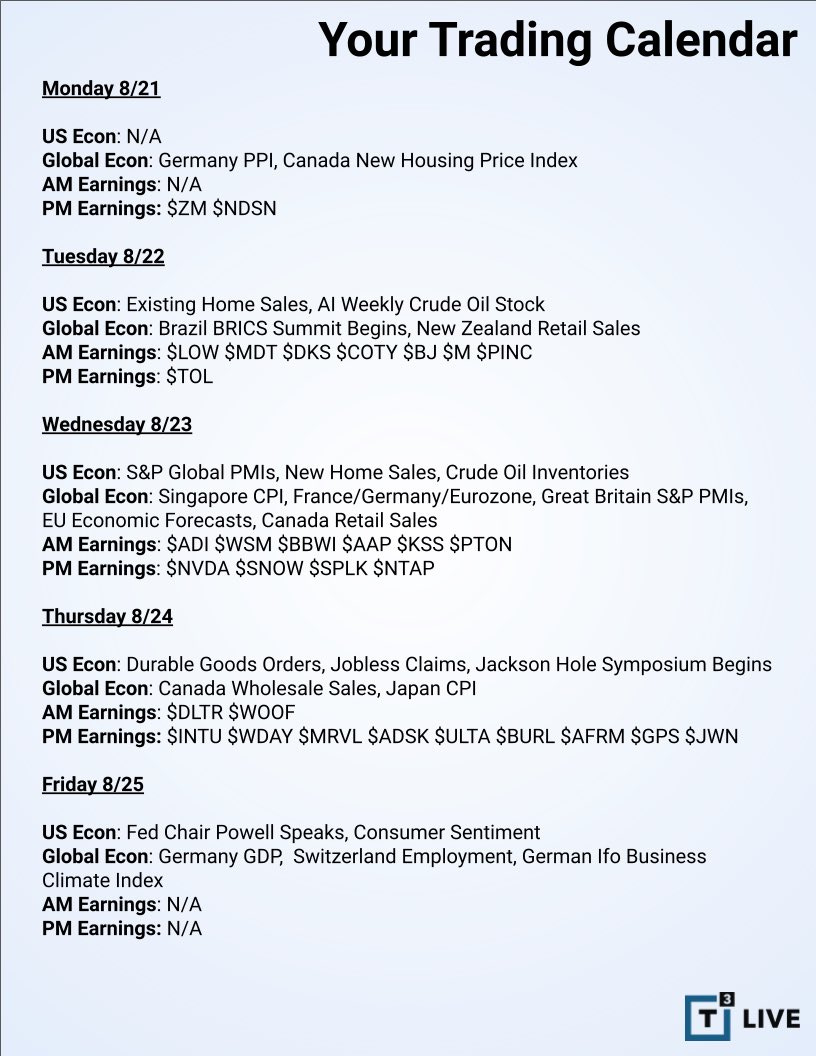

Friday’s buyers remained busy this morning as stocks gapped higher. And, as usual for a Monday morning gap, traders were quick to take some profit. Which probably makes good sense considering the calendar for the week.

This year’s King Of The Market, NVDA reports earnings Wednesday evening. The results and guidance on future earnings will surely have an impact on not only the chip sector but also on tech and markets overall.

Then on Friday Jerome Powell will be speaking at the Federal Reserve’s Economic Symposium in Jackson Hole, Wyoming.

While we can’t predict earnings or Fed Chairman comments, we can watch price action for clues. Calendar events aside, some things are trying to be more constructive today.

Friday’s note had this:

Watch for prices to recapture their 5-day moving averages by getting and staying above them.

Currently, QQQ is making an attempt as mid-morning buyers came in sending prices back near the opening highs.

30m chart

5-day MA is the blue line

There is potential pivot resistance coming into play near $363. So nothing has been proven yet.

Meanwhile, SPY isn’t quite there yet.

30m chart

For now, the waiting game continues.

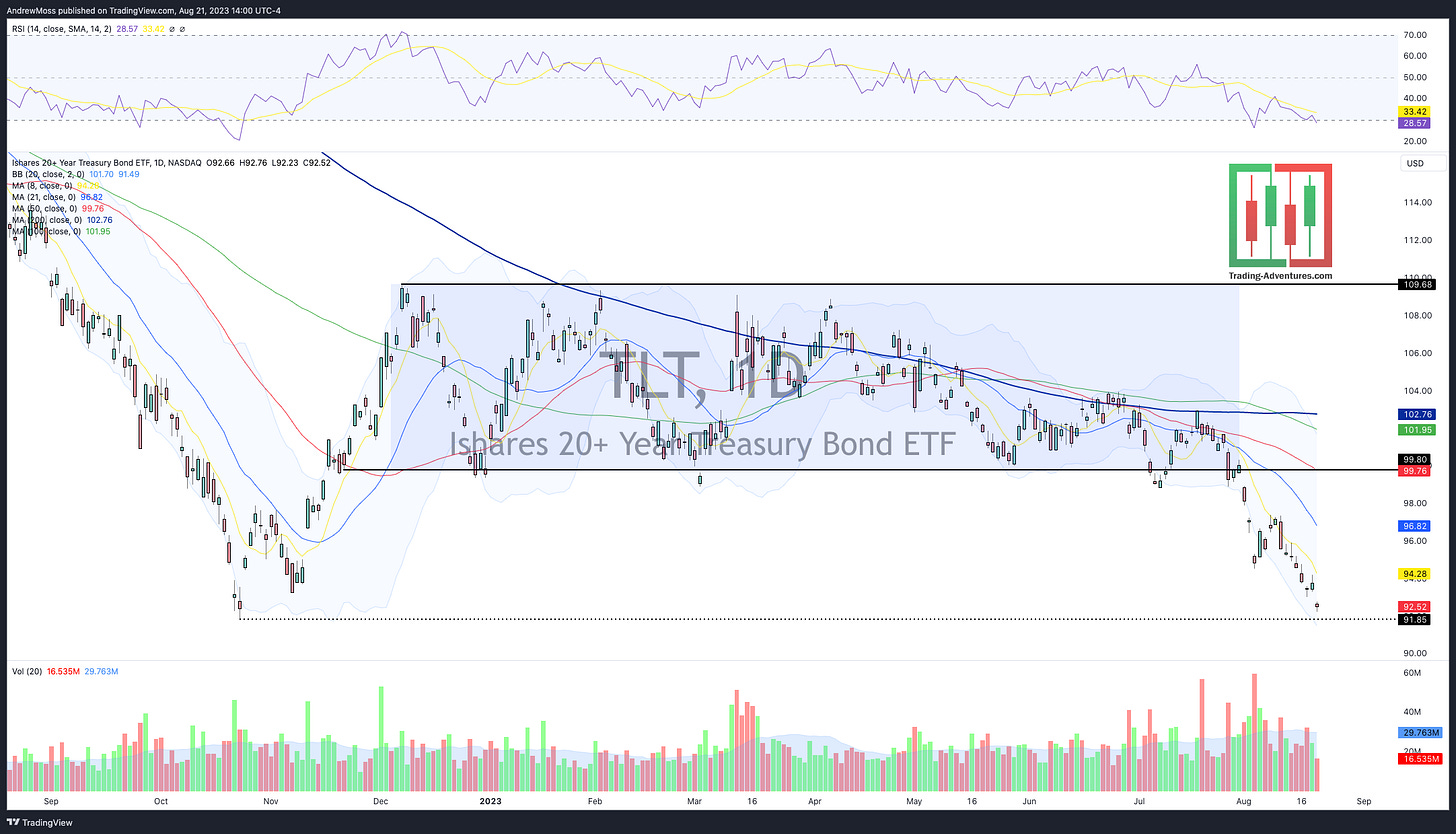

One more notable chart. TLT is making new lows for the year and approaching the 2022 low as long-term treasury yields move higher.

The Closing Bell

So the waiting game continues.

More to come later in the week.

The Disclosures

***This is NOT financial advice. NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.

Andrew Moss is an associated member of T3 Trading Group, LLC (“T3TG”) a SEC registered broker/dealer and member of FINRA/SIPC. All trades placed by Mr. Moss are done through T3TG.

Statements in this article represent the opinions of that person only and do not necessarily reflect the opinions of T3TG or any other person associated with T3TG.

It is possible that Mr. Moss may hold an investment position (or may be contemplating holding an investment position) that is inconsistent with the information provided or the opinion being expressed. This may reflect the financial or other circumstances of the individual or it may reflect some other consideration. Readers of this article should take this into account when evaluating the information provided or the opinions being expressed.

All investments are subject to the risk of loss, which you should consider in making any investment decisions. Readers of this article should consult with their financial advisors, attorneys, accountants, or other qualified investors prior to making any investment decision.

POSITION DISCLOSURE

August 21, 2023, 2:00 PM

Long: AMZN0915C140, CAVA0915C50, IWM, QQQ, RIVN, TWLO0825C60

Short:

Options symbols are denoted as follows:

Ticker, Date, Call/Put, Strike Price

Example: VXX1218C30 = VXX 12/18 Call with a $30 strike