Weekend Market Review and 2023 Outlook - January, 6 2023

Tug-of-war

2023 Outlook

On May 22, 2022, $SPY moved briefly below the volume-weighted average price anchored to the March 2020 low. That line (in purple on the charts below) has been flat since that time. For more than half a year prices have been oscillating on either side of that line.

Today's price is, you guessed it, trading almost equal ranges on either side of the line.

Stock prices don't know which way to go. Which is to say stock buyers and sellers aren't sure what to think of the situation. There have been ideas, projections, bottom callers, and doomsday prognosticators. But each attempt to deviate prices from this average has failed.

What does that mean for 2023?

On one side there is a seasonal tendency for stocks to do well for the upcoming year.

The third year of a presidential term has a high percentage instance of positive returns.

A recession has never started during the 3rd year of the election cycle.

Santa Claus successfully delivered his Rally, underwhelming as it may be at +0.80%.

Today’s rally increases the probability that the first 5 days of January end in positive territory, adding weight to the bullish seasonal bias.

On another side, there are bearish economic and technical signals.

Many charts are in downtrends.

Most of those charts have heavy potential resistance overhead.

The Fed is still hawkish and says there will not be rate cuts this year.

Big bank strategists have given mostly bearish projections for the year.

And then there's earnings. Consensus says there will be many earnings projection misses, revised and lowered guidance, and a significant slowdown in business.

The results for the last several months have been flat markets. Nobody knows what's coming. And even fewer are willing to stake money on their opinions, at least not for very long. When that changes, then maybe a trend can emerge.

Until then, the name of the game is choppiness and indecision.

To simplify, SPY above 390 starts to ease the door open to higher prices. But again, there is significant overhead supply to work through.

Prices below SPY $370 would likely lead stocks lower, including the possibility of revisiting the 2022 lows near $350.

Here are the charts.

Click to enlarge.

SPY - For this first chart most indicators have been removed to emphasize the various anchored VWAPs (purple lines).

SPY - Here is SPY with the usual indicators.

QQQ - Lagging behind a bit as it hasn’t yet gotten back to the December 13 AVWAP. Its also still beneath a very long-standing trendline.

IWM - Is above the December 13 AVWAP, the 8 and 21-day EMAs, but beneath the 50 and 200-day SMAs.

DIA - Continues to lead and with today’s rally is back above all of the key moving averages and the December 13 AVWAP.

DXY - The US Dollar tried to bounce but found resistance and reversed emphatically lower.

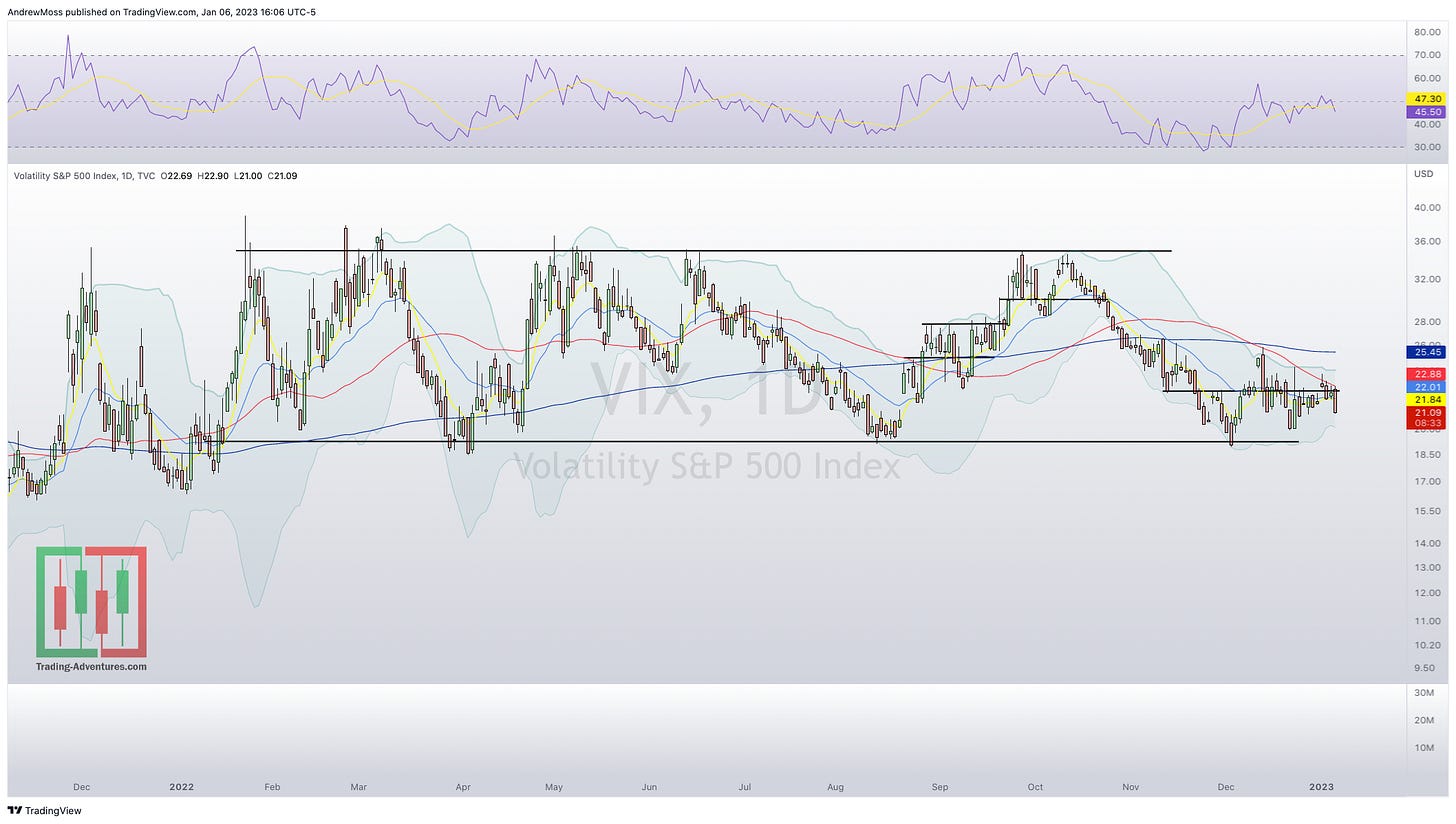

VIX - Volatility also continues its choppy decline.

What I'm reading

I said Brian Shannon's book would be my first read of 2023. I'm eagerly awaiting its availability.

In the meantime, my friend Mark McGrath reminded me of the prolific author and master wordsmith, Steven Pressfield. I've read "The War of Art" before, and now it’s time for a reread. I'm also reading his latest work, "Gov't Cheese." And then I will get to "Turning Pro."

Also in the rotation is one that I've had in my library for a while but somehow didn't get started. "Once Upon a Time in Russia" by Ben Mezrich reads like a James Bond screenplay. Bribery, corruption, betrayal, murder, it's all in there. And it's a true story!

Finally, I bought "That Great Heart" which is the story about the life of Ignatius Aloysius O'Shaughnessy; grandfather of James P. O'Shaughnessy (O'Shaughnessy Asset Management, O'Shaughnessy Ventures, Author of “What Works on Wall St.”) and possibly one of the most successful oil men you've never heard of. His philanthropic work is some of the most generous you will ever hear of. O'Shaughnessy is known to have given away most of his wealth. I can't wait to read about him.

From Twitter:

So, welcome to 2023!

Who knows what this year will bring? Whatever comes, I’m delighted you’re here with me.

As we progress into the 2nd year of this publication ideas are swirling for additions, changes, and improvements. If you have ideas or suggestions too, I’d love to hear them.

Thanks for the continued growth in readership. And don’t forget to join me each Saturday morning for Weekly Charts on Twitter. If you missed the monthly charts last weekend, take a quick look at those too, by clicking here.

Cheers to the New Year!

***This is NOT financial advice. NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.

Andrew Moss is an associated member of T3 Trading Group, LLC (“T3TG”) a SEC registered broker/dealer and member of FINRA/SIPC. All trades placed by Mr. Moss are done through T3TG.

Statements in this article represent the opinions of that person only and do not necessarily reflect the opinions of T3TG or any other person associated with T3TG.

It is possible that Mr. Moss may hold an investment position (or may be contemplating holding an investment position) that is inconsistent with the information provided or the opinion being expressed. This may reflect the financial or other circumstances of the individual or it may reflect some other consideration. Readers of this article should take this into account when evaluating the information provided or the opinions being expressed.

All investments are subject to risk of loss, which you should consider in making any investment decisions. Readers of this article should consult with their financial advisors, attorneys, accountants or other qualified investors prior to making any investment decision.

POSITION DISCLOSURE

January 6 , 2023 4:00 PM

Long: UNG 0113C13

Short:

Options symbols are denoted as follows:

Ticker, Date, Call/Put, Strike Price

Example: VXX1218C30 = VXX 12/18 Call with a $30 strike