📈Weekly Charts📉

June 9 - June 13, 2025

📈This Week in the Markets – June 14, 2025

More charts. More signal. More alpha. Delivered right here.

Every Saturday, I post the Weekly Charts thread on X — a detailed look at market structure, breadth, and price action heading into the new week.

Then I share the link here on Trading Adventures.

That’s worked fine … but let’s take it up a level.

Now I’m delivering the full analysis directly to you — right here in your inbox — complete with charts, context, and insights. No link clicks required.

If you’re here for the signal, this is the place to get it.

Let’s dive in 👇

📊 Major Indices

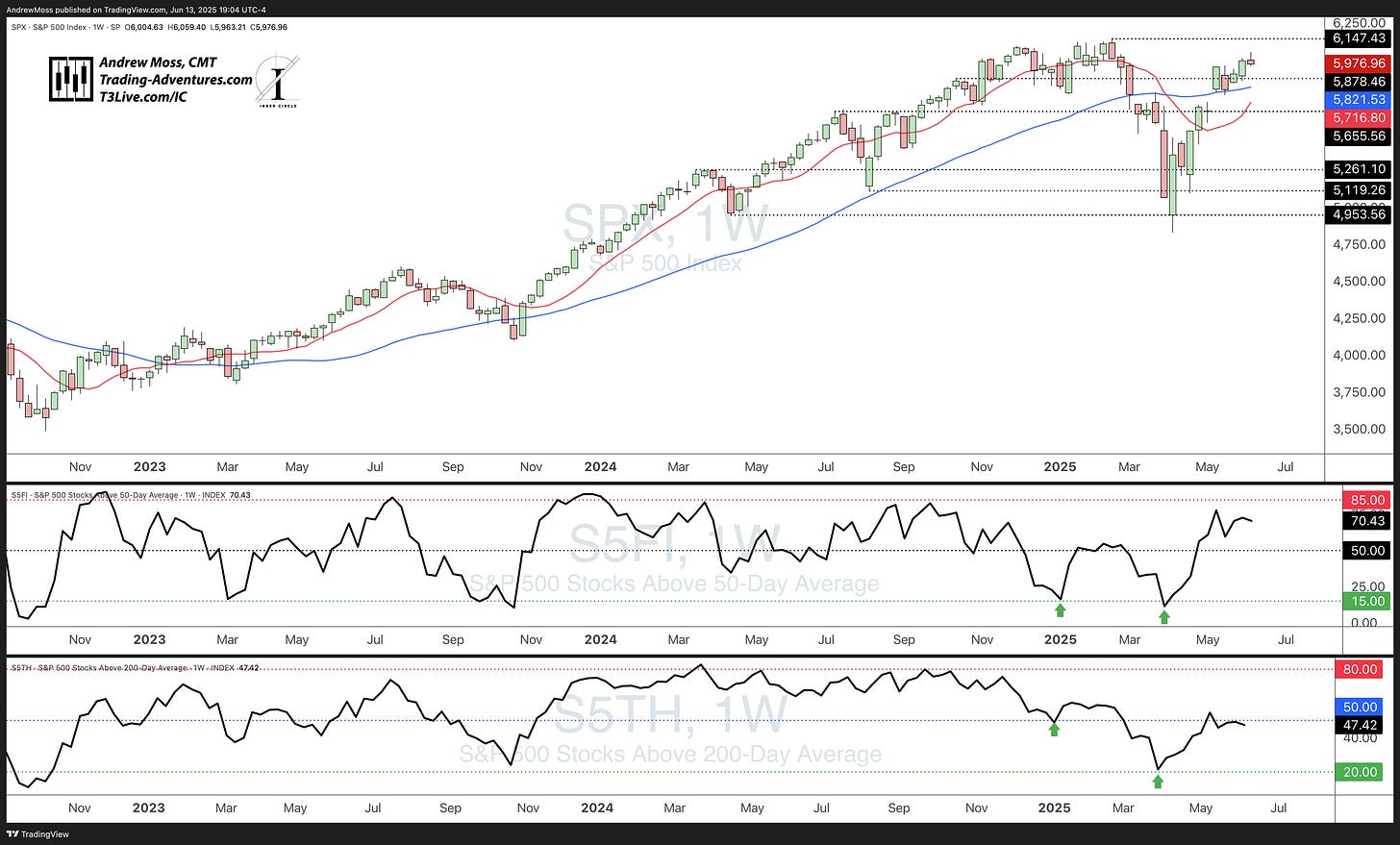

S&P 500 (SPX)

The index pushed higher early in the week, then faded with headlines from Israel and Iran. But the selling was short-lived, and SPX held above the key 5958 pivot.

Overhead levels haven’t changed. Potential support zones below:

5809 – 40-week moving average

5725–5750 – Bollinger Band centerline (20-week MA) and unfilled gap

~5566 – 10-week MA and pivot high anchored VWAP (AVWAP🟠)

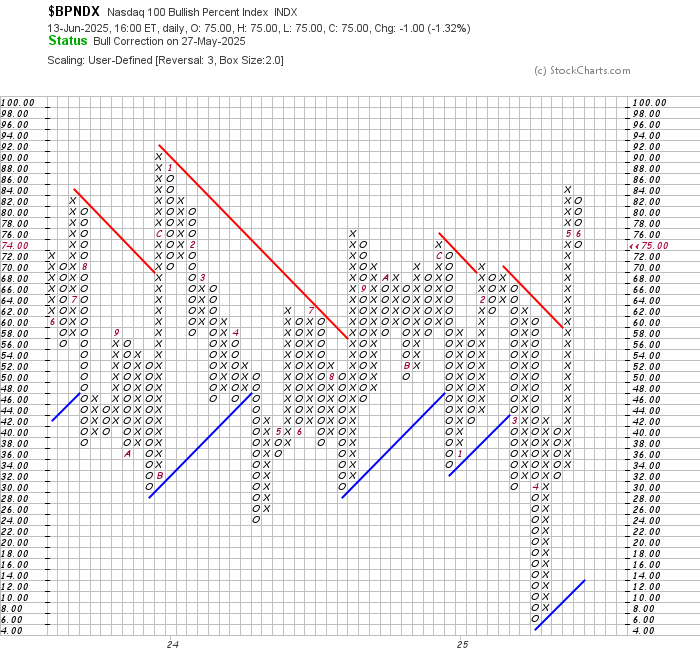

Nasdaq 100 (QQQ)

As noted in Thursday’s Market Update, QQQ and SPX have been tracking closely — same playbook, same price action.

Potential support:

504 – Fibonacci extension

499 – 40-week MA

490 – 10-week MA

484 – Pivot high AVWAP🟠

Russell 2000 (IWM)

IWM touched its 40-week MA before retreating to the pivot high AVWAP🟠.

It’s been a solid bounce from the May lows, but it’s worth noting:

Bollinger Bands are still pointing lower

Volume is slightly higher on this week’s selling

RSI worth watching — can it stay in the upper half?

Dow Jones Industrial Average (DIA)

Still stuck in the range.

DIA remains below its 40-week MA after failing again at the ~428 resistance zone.

Potential support:

417 – Pivot high AVWAP🟠

411 – 10-week MA

Bitcoin (BTCUSD)

Still consolidating in the $107K–$109K zone while moving averages catch up.

🎉 By the Way…

There are now over 10,000 of you following along on X!

That’s very cool. But what’s even better is the community — chart lovers, patient traders, and lifelong learners, all building together.

If you’re reading this here on Trading-Adventures.com, thank you. You’re getting the most structured and in-depth version of my weekly analysis.

But if you want even more charts, quick setups, live trade ideas, and commentary throughout the week…

Follow me on X → @Andy__Moss

International & Macro

ACWX – International Equities (ex-US):

First potential reversal in weeks. It closed off the highs and printed a long upper wick. Still near the upper Bollinger Band, but RSI is not yet overbought.

FXI – China Large-Cap ETF:

Tagged the pivot zone and turned lower. Is it a reversal or just a pause for consolidation? Still unclear.

DXY – US Dollar Index Futures:

Switched from Sly Stallone to Tom Petty — from Cliffhanging to Free Falling.

Bonds & Commodities

AGG – Core US Bond ETF:

Caught a bid on the flight-to-safety trade. Briefly reclaimed the 40-week MA and pivot high AVWAP before backing off.

TLT – Long-Term Treasury ETF:

Held support at the 84.89 pivot, then rallied to test the 10-week MA.

GSG – Commodities ETF:

Rallied into the $23.15 pivot on oil strength.

USO – Crude Oil Fund:

+12% on the week, closing into its upper Bollinger Band.

GLD – Gold ETF:

Broke out of its recent consolidation, lifted by the same safety trade that helped bonds.

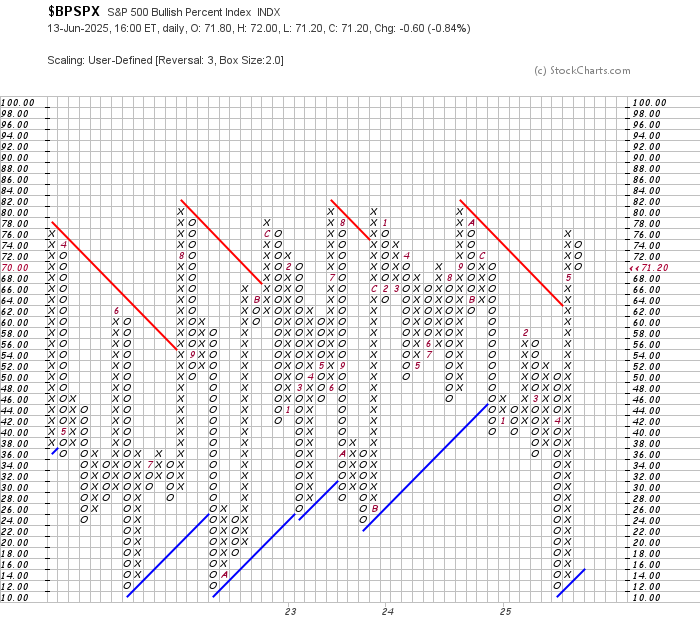

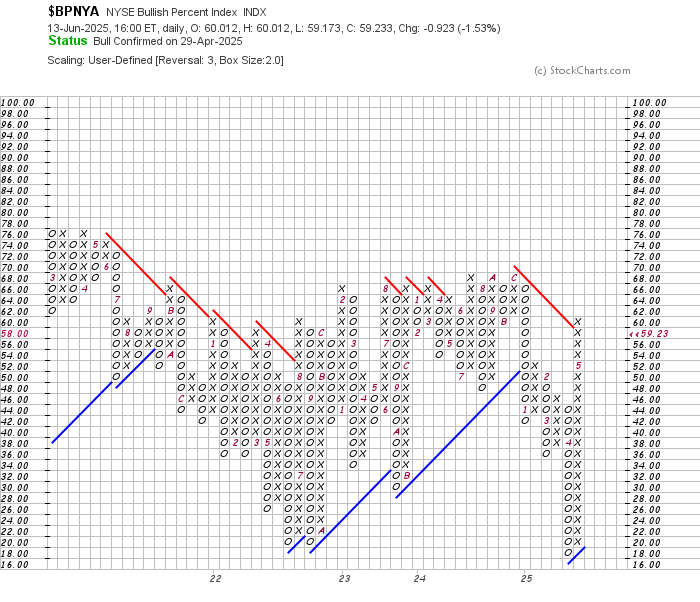

Market Breadth

Breadth ticked lower, but remains healthy in the short term.

The % of S&P 500 stocks above their 50-day MA remains constructive

The % above their 200-day MA has dipped below 50

Bullish Percent Indexes:

No major changes from last week.

Unlock Market-Beating Options Trades with EpicTrades – Join The Winning Streak Today

Struggling to Find Reliable Options Ideas? Epic Trades Delivers.

We work hard every week to deliver solid, actionable ideas.

I bring deep chart analysis expertise, while David Prince and Kira Barr’s unparalleled market intuition take our strategies to the next level—delivering consistent, high-probability trades.

The results speak for themselves.

Join Thousands of Smart Traders – Subscribe Now at http://t3live.com/epicoffer for Exclusive Access to Our Winning Strategies!

Relative Strength Ratios

Still in equilibrium. No meaningful shifts in relative leadership:

Growth vs Value – IWF / IWD

US vs International – SPY / ACWX

Discretionary vs Staples – XLY / XLP

So… now what?

The trend remains strong — but are we seeing early signs of waning near-term momentum?

The melt-up continues… until it doesn’t.

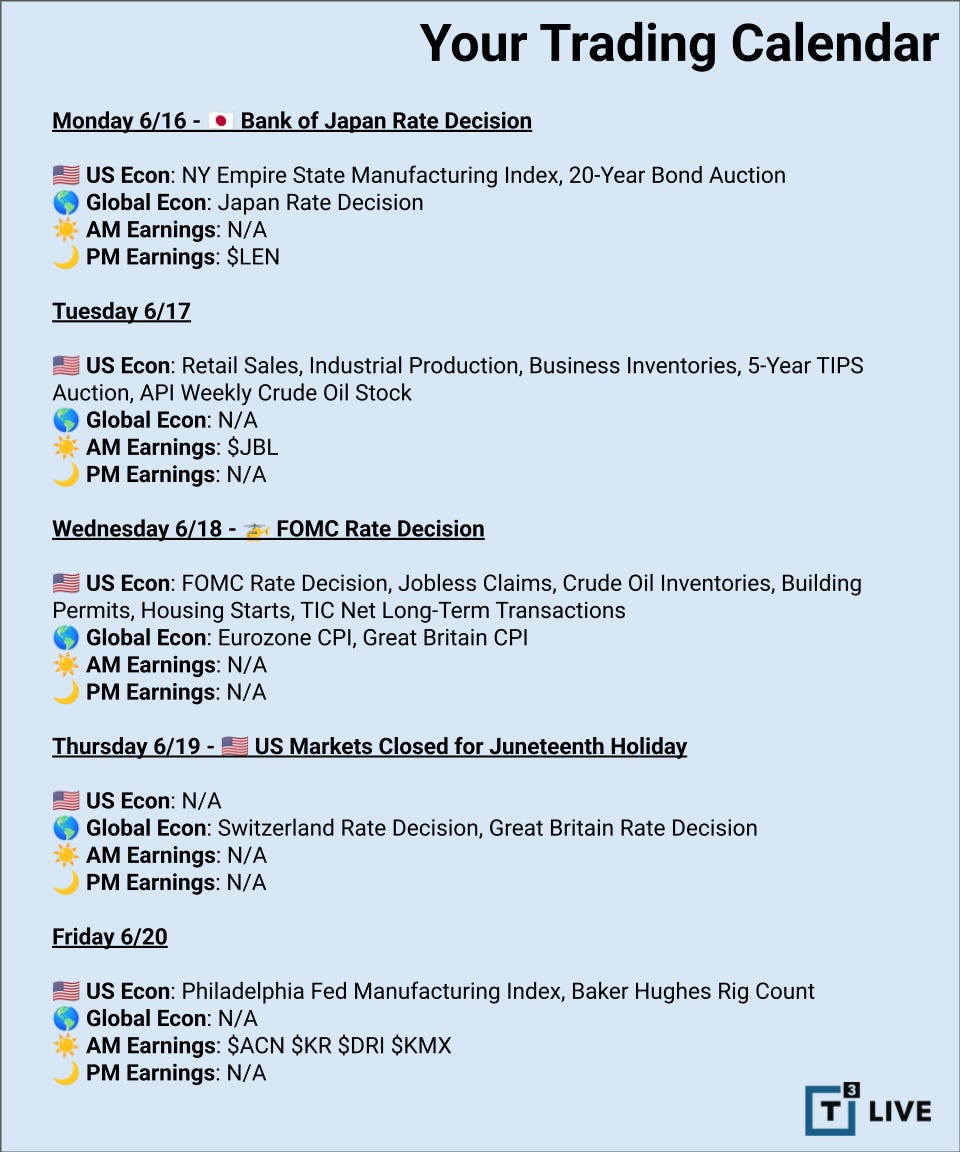

Next week’s calendar is light, but we do have an FOMC Day on Wednesday, followed by a market holiday on Thursday for Juneteenth.

As always:

Know your plan

Know your levels

Keep your patience

Manage your risk

And keep reading here at Trading Adventures to learn the markets, follow the setups, and stay ahead of the game.

✍️ ICYMI — Read the latest in the new “How I Traded It” series:

This week’s trade recap breaks down the surgical QQQ short called out by DP of the Inner Circle. A quick hit that delivered — thanks to clean execution and clear planning.

📖 Read the full breakdown here:

🙏 Thanks for Reading

Last week's response to this new format of the 📈Weekly Charts📉 was fantastic!

Thank you all for the kind words, excitement, and appreciation. It makes these articles easy to write. So, once again —

If you found it helpful:

Tap the ❤️ below

Share it with a trader you know

Reply and let me know what stood out

Catch you next week,

—Andy

Looking For More?

Elevate Your Trading Adventure Even Further With These Offerings.

EpicTrades Options Newsletter

Real-time trade ideas and insights, providing actionable trading insights focusing on options trades with short-term horizons, aiming to capitalize on weekly market movements.

The approach includes detailed reasoning for trades, specific options, and profit targets. It focuses on quick gains with a minimal time commitment from subscribers.

Click below to sign up!

The Inner Circle

The Inner Circle is a Virtual Trading Floor (VTF) at T3 Live. I’ve been working and trading with this group since 2022. You may have noticed the logo in the watermarks on my charts.

Founded by David Prince and led by him, Rick March, and Kira Turner, the Inner Circle is a community of elite traders, including hedge fund managers, family office heads, corporate executives, financial advisors, and even professional poker players.

Fundamental, Macro, and Technical Analysis all combine to find and discuss the best opportunities in current markets.

The Disclosures

***This is NOT financial advice. This is NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.