📈Weekly Charts📉

June 23 - June 27, 2025

Good morning!

Markets continued their melt-up this week — steady, smooth, and quiet. Major indexes notched fresh weekly highs, breadth is improving, and several key leadership ratios are rotating higher.

The major indexes closed strongly. Market breadth is improving. Leadership is concentrated but stable. Several relative strength ratio charts are pushing back toward their highs.

Let’s take a closer look…

📊 Major Indices

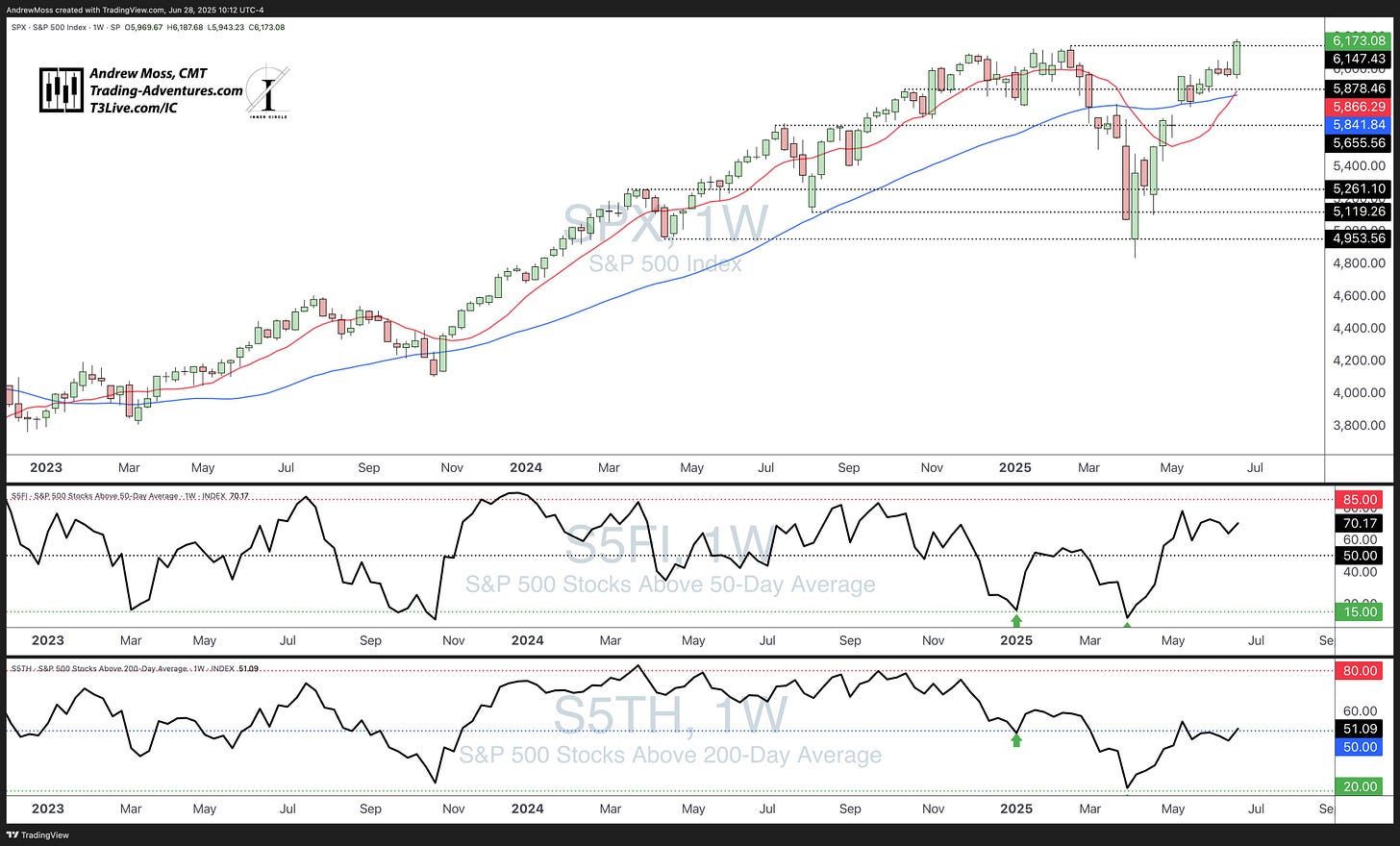

S&P 500 (SPX)

A brand new weekly closing high — clearing the mid-February pivot and pushing higher. RSI at 61 with Bollinger Bands starting to curl upward. Momentum continues to build off the early June higher low. The path of least resistance remains up.

NASDAQ 100 (QQQ)

Another weekly closing high. Edging above prior resistance at 540.81. RSI is ticking up at 63. MAs are catching up to the 1.618 Fib extension near $500, adding to support. Textbook momentum breakout. Tech leadership continues.

Russell 2000 (IWM)

$IWM stopped precisely on its 40-week MA after teasing a close higher. That level, combined with the 61.8 Fib retracement, has kept small caps in check for weeks. But RSI continues higher above 50, volume is solid, and the Bollinger Bands are contracting. Maybe it gets the push next week.

Dow Jones (DIA)

Quiet strength. $DIA broke out above its recent range and closed at its best level since mid-May. Volume was solid. RSI is rising near 58. Still not leading, but no longer lagging. Dow participation is catching up.

📈 Bitcoin & Macro

Bitcoin (BTC)

Another week holding just below all-time highs. A weekly close above $ 100,000 keeps bulls in control. Short-term MAs are rising, and the 1.618 Fib near $91K continues to hold as support.

Momentum is firm. Eyes on 109K and 112K.

U.S. Dollar Index ($DXY)

Still weak. Closed under 100 for the first time since March. RSI at 29.89 — deeply oversold but no real bounce yet. Sellers are still in control.

🌍 International & Emerging Markets

Global ex-US (ACWX)

Printed an outside week (bullish engulfing) reclaiming the breakout zone near $59–60. RSI above 60. 10-week MA rising underneath. A reset week, not a reversal.

China Large-Cap (FXI)

Grinding against resistance near $37.50. Coiled above rising MAs with RSI above 60. No breakout yet, but not backing off either. Watch for a move through that ceiling.

🧳 Bonds

Bonds showed meaningful progress this week:

Aggregate Bonds (AGG)

Moved back above its 40-week moving average and the pivot high AVWAP — a spot that had capped prices earlier this month.

Long-Term Treasuries (TLT)

Stabilizing near mid-Bollinger Band levels — still below the 10-week MA but no longer trending down.

High-Yield Bonds (HYG)

Tracking more like an equity index, pressing up against recent highs and threatening a breakout.

While not explosive, the tone across fixed income continues to improve — signaling stability, not fear.

🌾 Commodities & Energy

The commodity complex stumbled — right at resistance:

Commodities Index (GSG)

Pushed into new territory above its multi-year range, but was quickly rejected on big volume. The reversal candle marks a failed breakout attempt.

Crude Oil ETF (USO)

Looked ready to extend — but reversed hard at 83. That level has capped rallies repeatedly (April, March, January). Monster volume underscores the rejection.

Momentum trades need fuel. Commodities ran out of gas — for now.

⚖️ Metals

There may be a shift underway in metals:

Precious Metals ETF (DBP)

Broke its trendline and slipped below the 10-week MA. That doesn’t mean a full reversal, but it does break the rhythm of higher lows and rising support.

Base Metals ETF (DBB)

Cleared its 40-week MA and is now testing a downtrend zone that’s been in place for months.

Could this be the beginning of a new phase for the base-vs-precious narrative?

📊 Breadth & Internals

Percent Above MAs:

• SPX > 50-day: 70.17%

• SPX > 200-day: 51.09%

Broadening out. Still not overbought.

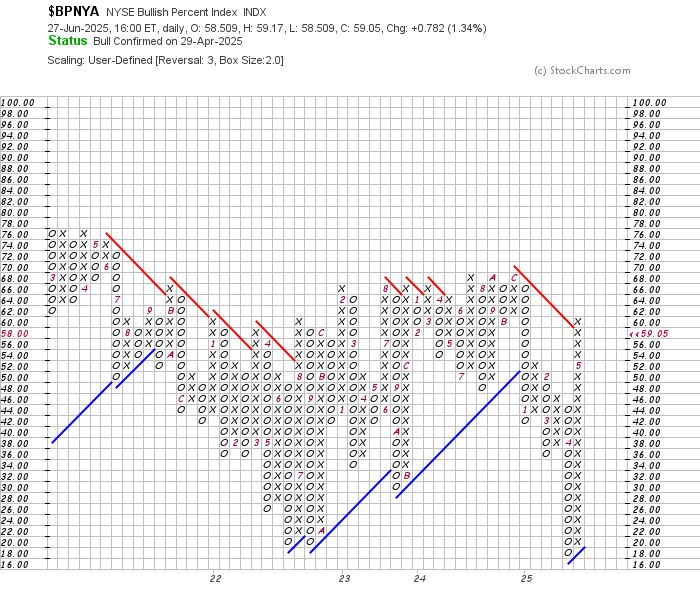

Bullish Percent Indexes:

• BPSPX and BPNYA unchanged

• BPNDX reversed up into Xs

Unlock Market-Beating Options Trades with EpicTrades – Join The Winning Streak Today

🔥 Epic Trades This Week: $CRCL & $OSCR

CRCL — The Inner Circle crew got short for the reversal of the parabolic move. Then, as it came into support, we flipped long and sent an options alert for EpicTrades. The calls hit a 120%+ win on the rebound.

And that's not all! We also caught OSCR calls for a nearly 40% winner!

💥 Real setups. Real follow-through.

📩 Want real trades like this — with structure, targets, and real-time alerts?

Join here → t3live.com/epicoffer

🔄 Relative Strength

Ratio charts showing renewed momentum:

IWF:IWD (Growth vs Value) – climbing

XLY:XLP (Discretionary vs Staples) – firming up

SPHB:SPLV (High Beta vs Low Vol) – breakout

SPY:ACWX (US vs Global) – still basing

Curious what all this means? Read this week’s Chart School:

🔍 Now what?

Last week, we were on the lookout for potential caution.

This week? Smooth strength, quiet confidence.

Markets are rewarding discipline and preparation. New highs. Participation is expanding. Rotation is doing its job — quietly and effectively.

What to watch this week:

• Can IWM finally clear its 40-week MA?

• Will commodities and energy reclaim Friday’s drop?

• Do base metals extend their push?

• Are RS breakouts confirming?

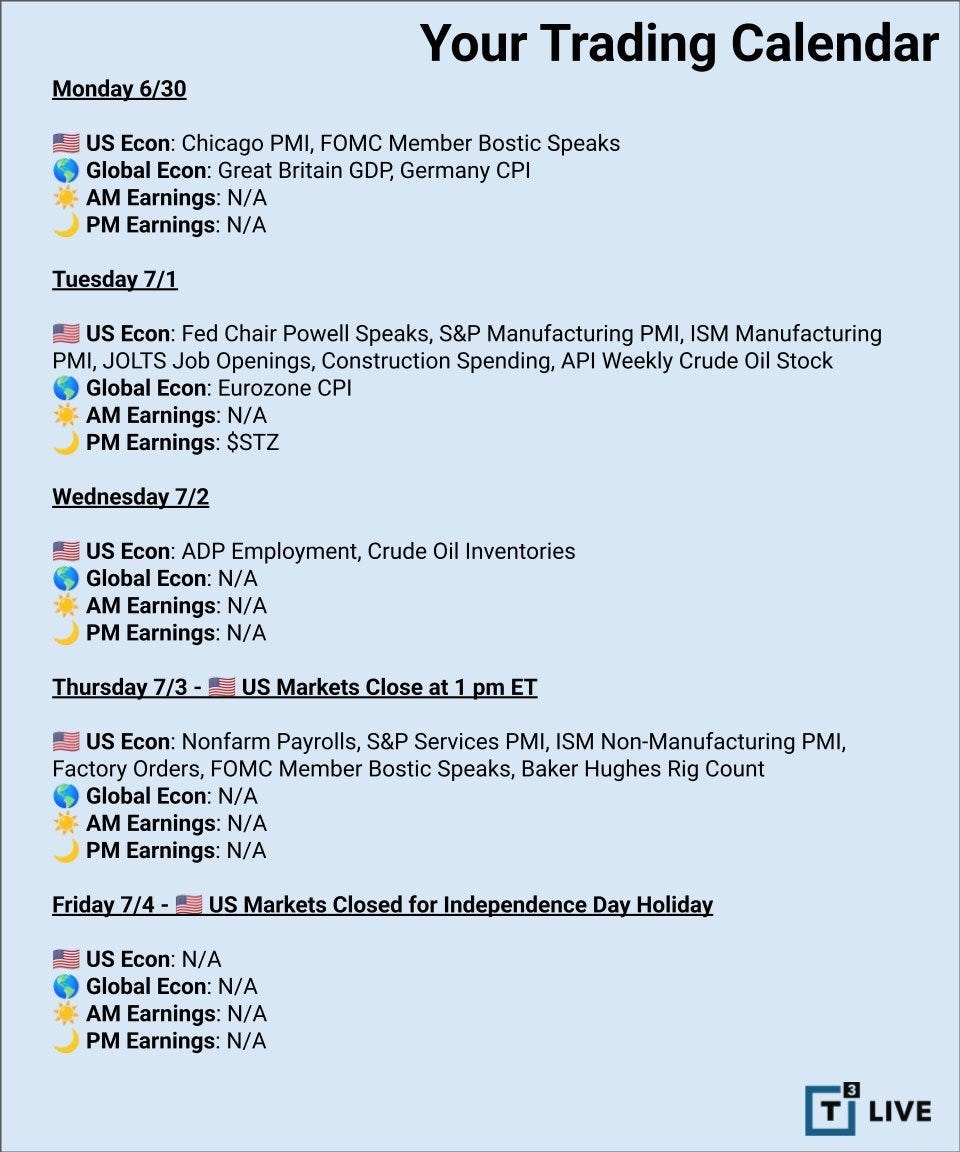

Calendar Highlights:

• Powell testifies Tues & Wed

• Bond auctions mid-week

• Early close Thursday (1 PM ET)

• Markets closed Friday (July 4th)

🙏 Thanks for Reading

The continued support for these 📈Weekly Charts📉 has been incredible — I’m grateful for every read, share, and comment.

As long as they’re helping you stay focused, structured, and sharp… I’ll keep publishing.

If you haven’t already:

❤️ Tap the heart below

📤 Forward to a trader you know

📝 Reply with what stood out to you this week

Until next time —

Andy

Looking For More?

Elevate Your Trading Adventure Even Further With These Offerings.

EpicTrades Options Newsletter

Real-time trade ideas and insights, providing actionable trading insights focusing on options trades with short-term horizons, aiming to capitalize on weekly market movements.

The approach includes detailed reasoning for trades, specific options, and profit targets. It focuses on quick gains with a minimal time commitment from subscribers.

Click below to sign up!

The Inner Circle

The Inner Circle is a Virtual Trading Floor (VTF) at T3 Live. I’ve been working and trading with this group since 2022. You may have noticed the logo in the watermarks on my charts.

Founded by David Prince and led by him, Rick March, and Kira Turner, the Inner Circle is a community of elite traders, including hedge fund managers, family office heads, corporate executives, financial advisors, and even professional poker players.

Fundamental, Macro, and Technical Analysis all combine to find and discuss the best opportunities in current markets.

The Disclosures

***This is NOT financial advice. This is NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.