📈Weekly Charts📉

June 16 - June 20, 2025

Summary

A low-volume week in the indexes masked a quiet rotation into safety. With fresh DeMark sell setups, a bid in bonds, and commodities rising, the next move could come fast. Here’s what the Big Picture charts reveal.

Good morning!

I’m back on the desk after a beautiful beach week with family. I stayed mostly disconnected from charts and markets — now it’s time to catch up.

It was a short trading week, and the price action was mostly quiet. But global politics made plenty of noise with escalating tensions in Iran.

Let’s dive into the Big Picture 📈Weekly Charts📉 and see what they’re telling us about the road ahead.

📊 Major Indices

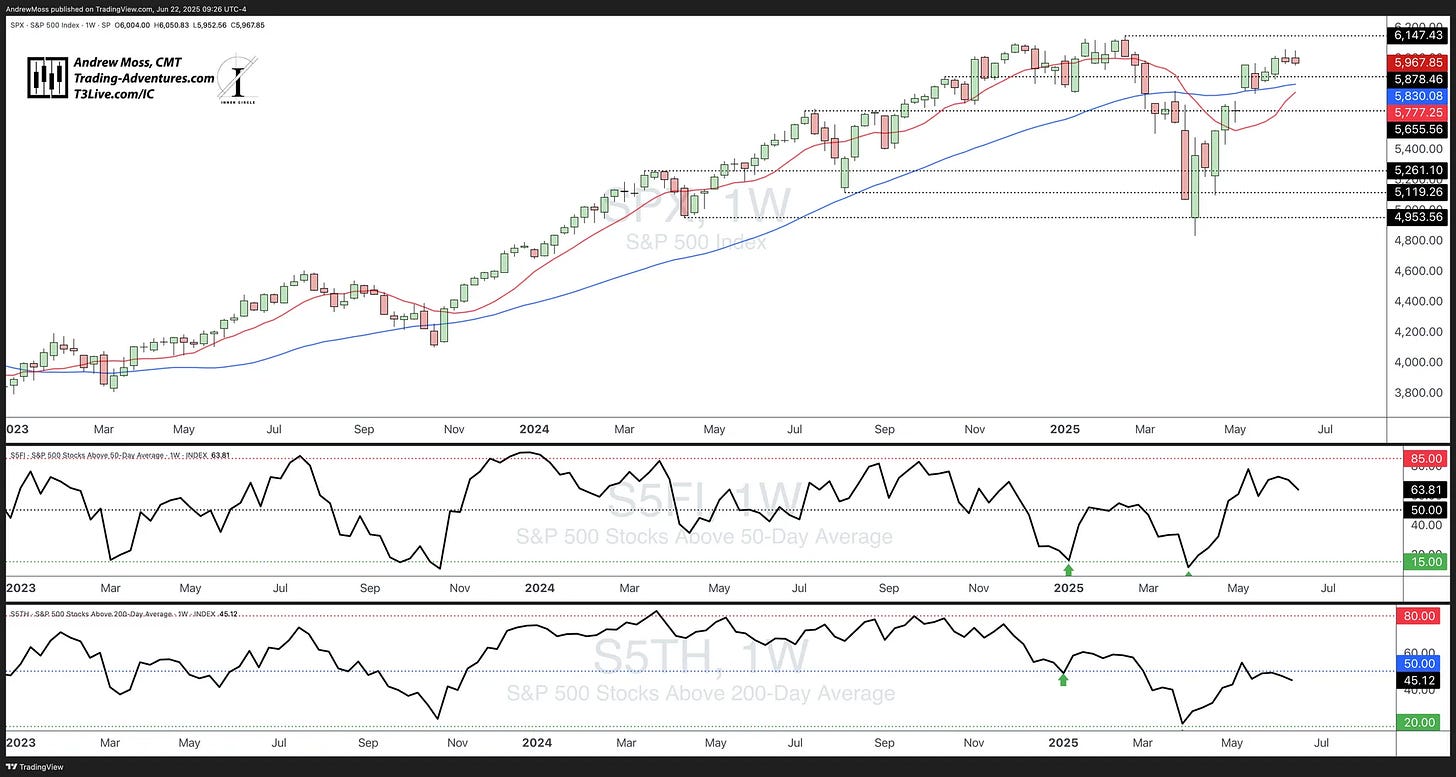

S&P 500 (SPX)

Another tight-range week with an upper wick — some buyer fatigue. But trend support is intact:

5958 – Pivot

5821 – 40-week MA

5750 – 10-week MA & BB center

5672–5680 – AVWAPs 🟠

NASDAQ 100 (QQQ)

Still leading… but this week brought a DeMark 9 sell setup. Watch Monday’s open for confirmation.

504 – Fib extension

499–500 – 10 & 40-week MAs

486–489 – AVWAPs 🟠

Russell 2000 (IWM)

Inside week under resistance. Holding AVWAP🟠 support.

215 – 40-week MA

208 – Pivot high AVWAP🟠

203 – 50% retracement

202 – 10-week MA

198 – Pivot low AVWAP🟠

Dow Jones (DIA)

Still rangebound between pivot and MA levels.

428 – Resistance

425 – 40-week MA

417 / 409 – AVWAPs 🟠

415 – 10-week MA

Bitcoin (BTC)

Still boxed in: $102K–$109K. Waiting for resolution.

100,305 – 10-week MA

97,265 – AVWAP🟠

89,460 – 40-week MA

🌍 International & Macro

Global Equities ex-US (ACWX)

Confirmed reversal, now testing MAs and BB center.

58.30 – 10-week MA

57.68 – AVWAP🟠

55.60 – 40-week MA

China Large-Cap (FXI)

Still stuck below resistance.

35.15 – 10-week MA

34.15 – AVWAP🟠

33.04 – 40-week MA

U.S. Dollar Index (DXY)

Slight bounce — still at the low end of the range.

99.26 – Pivot

99.33 – 10-week MA

🧮 Bonds

Aggregate Bond ETF (AGG)

Testing 40-week MA & AVWAP🟠 near 98.22

20+ Year Treasury (TLT)

Still suppressed under a falling 10-week MA

High-Yield Bonds (HYG)

Positive week, riding the trendline higher

🛢️ Commodities & Metals

Commodities Index (GSG)

Broke above 2-year range highs — watching for follow-through.

Crude Oil (USO)

Biggest weekly volume since April 2020. Key level: $83

Precious Metals (DBP)

Holding near highs with an inside week

📊 Breadth & Bullish Percent Indexes

% of SPX above 50 & 200-day MA continues to cool

BPNDX added to the column of Os

BPSPX & BPNYA unchanged

Unlock Market-Beating Options Trades with EpicTrades – Join The Winning Streak Today

Struggling to Find Reliable Options Ideas? Epic Trades Delivers.

We work hard every week to deliver solid, actionable ideas.

I bring deep chart analysis expertise, while David Prince and Kira Barr’s unparalleled market intuition take our strategies to the next level—delivering consistent, high-probability trades.

The results speak for themselves.

Join Thousands of Smart Traders – Subscribe Now at http://t3live.com/epicoffer for Exclusive Access to Our Winning Strategies!

🔄 Relative Strength

IWF/IWD and SPHB/SPLV = DeMark 9 sell setups

XLY/XLP = Still consolidating

🧠 Now What?

Stocks drifted while bonds, commodities, and the dollar all bounced.

Subtle rotation toward safety is underway — but it’s not full-blown risk-off… yet.

🔎 What to Watch This Week

Sell setup confirmation

Defensive follow-through

Fresh catalysts:

Powell testimony (Tues/Wed)

Bond auctions

PCE on Friday

✍️ ICYMI — 50 Years of Trading Lessons from Peter Brandt on the Words of Rizdom Podcast

This week, I shared some thoughts and notes on an excellent conversation from Peter Brandt and Words of Rizdom. Peter is a 50-year + trading veteran and generously shares his wealth of knowledge with all who are willing to listen and learn.

This is a great podcast episode, and I definitely suggest taking the time to listen to it yourself. Before you do —

📖 Read my take on it here:

🙏 Thanks for Reading

The response to this new format of the 📈Weekly Charts📉 continues to amaze me!

Many continued thanks to you all for the kind words. You keep reading and sharing, so I will keep hitting the ‘send’ button, delivering this in-depth weekly view straight to you and all your trading friends.

Don’t forget to:

Tap the ❤️ below

Share it with a trader you know

Reply and let me know what stood out

Until next time,

—Andy

Looking For More?

Elevate Your Trading Adventure Even Further With These Offerings.

EpicTrades Options Newsletter

Real-time trade ideas and insights, providing actionable trading insights focusing on options trades with short-term horizons, aiming to capitalize on weekly market movements.

The approach includes detailed reasoning for trades, specific options, and profit targets. It focuses on quick gains with a minimal time commitment from subscribers.

Click below to sign up!

The Inner Circle

The Inner Circle is a Virtual Trading Floor (VTF) at T3 Live. I’ve been working and trading with this group since 2022. You may have noticed the logo in the watermarks on my charts.

Founded by David Prince and led by him, Rick March, and Kira Turner, the Inner Circle is a community of elite traders, including hedge fund managers, family office heads, corporate executives, financial advisors, and even professional poker players.

Fundamental, Macro, and Technical Analysis all combine to find and discuss the best opportunities in current markets.

The Disclosures

***This is NOT financial advice. This is NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.