Weekly Charts – August 2, 2025

SPX: Selling Arrives After the Warning

I’m away for the weekend with limited connection — but with so much happening, here’s a quick update.

For weeks, you’ve been reading a cautionary tone in these pages.

“Caution is warranted. Don’t overcommit.”

“The market is extended. Manage risk actively.”

“Breadth and internals are flashing early warning signs.”

Now, the selling has arrived — right into a flurry of major catalysts:

Fed decision

Mega‑cap earnings (MSFT, META, AAPL, AMZN)

PCE inflation data

Nonfarm payrolls

Where we are now:

SPX is about 2.5% off the highs, leaning on the 6147 pivot high.

Lose that, and we could see a quick drop into the 5800–5900 zone:

40‑week SMA

Anchored VWAPs

Bollinger Band midline

That’s roughly a -10% correction from the highs. A quick flush through that zone could shake out weak hands, satisfy the “correction” narrative, and set the stage for a recovery.

The tell we were watching for:

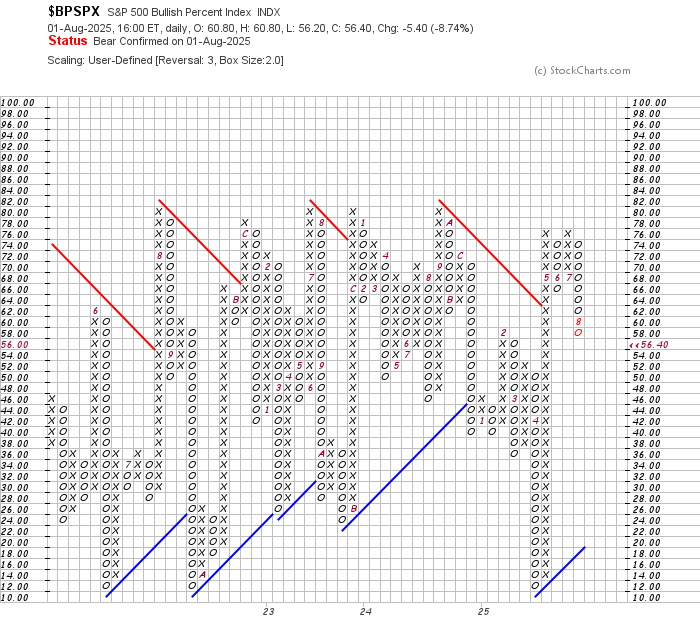

The S&P Bullish Percent Index (BPSPX) just flipped Bear Confirmed — the exact breadth signal I’ve been highlighting for weeks as the early caution light. It arrives right in sync with the seasonally weaker month of August.

Next week’s watchlist:

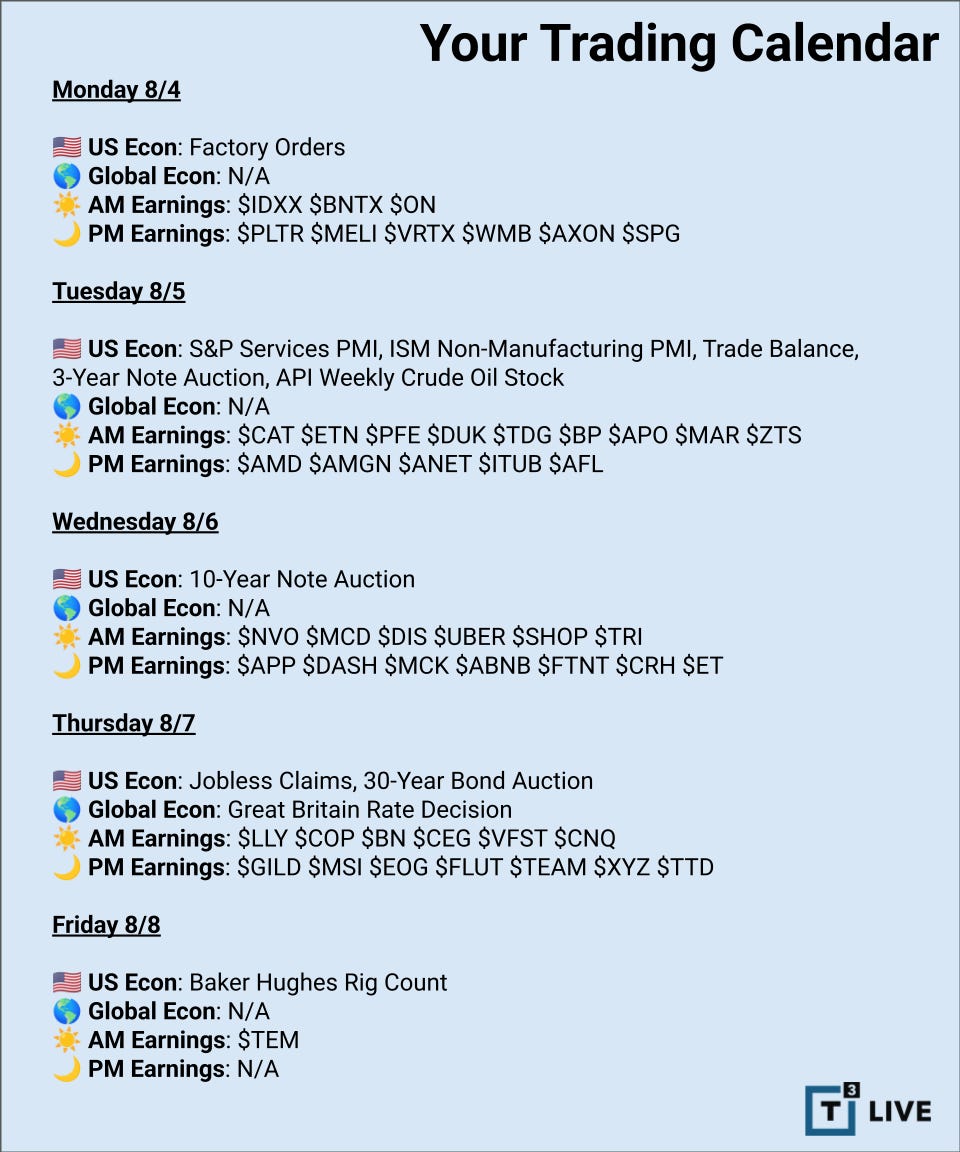

The heavy calendar continues — with earnings from PLTR, AMD, AMGN, MCD, DIS, UBER, LLY, TEAM, and more — plus key economic data:

ISM Non‑Manufacturing PMI

Jobless Claims

UK rate decision

Unlock Market-Beating Options Trades with EpicTrades – Join The Winning Streak Today

💥 Real setups. Real follow-through.

📩 Want real trades like this — with structure, targets, and real-time alerts?

Join here → t3live.com/epicoffer

No predictions.

No predictions. Just mapping logical paths.

Watch 6147 first. Then 5800–5900. That’s where the market will show its hand.

Thanks for reading and following along. Stay sharp, and I’ll see you next week.

Thanks, as always, for reading and following along.

These 📈Weekly Charts📉 are here to help you stay clear, consistent, and confident in your trading.

If you found this week’s charts and commentary helpful, consider subscribing to Trading Adventures — or sharing with a friend who’s navigating these markets too.

Paid subscriptions are optional, but deeply appreciated. They help keep the content flowing and the signals sharp.

See you in the next update.

Andy

📩 Enjoying these updates?

Consider a paid subscription — $7/month or $84/year helps keep the charts flowing and the signal strong.

No paywalls. No gated content. Just a way to say thanks.

Looking For More?

Elevate Your Trading Adventure Even Further With These Offerings.

EpicTrades Options Newsletter

Real-time trade ideas and insights, providing actionable trading insights focusing on options trades with short-term horizons, aiming to capitalize on weekly market movements.

The approach includes detailed reasoning for trades, specific options, and profit targets. It focuses on quick gains with a minimal time commitment from subscribers.

Click below to sign up!

The Inner Circle

The Inner Circle is a Virtual Trading Floor (VTF) at T3 Live. I’ve been working and trading with this group since 2022. You may have noticed the logo in the watermarks on my charts.

Founded by David Prince and led by him, Rick March, and Kira Turner, the Inner Circle is a community of elite traders, including hedge fund managers, family office heads, corporate executives, financial advisors, and even professional poker players.

Fundamental, Macro, and Technical Analysis all combine to find and discuss the best opportunities in current markets.

The Disclosures

***This is NOT financial advice. This is NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.