📈Weekly Charts📉

June 52 - June 6, 2025

📈 This Week in the Markets – June 8, 2025

More charts. More signal. More alpha. Delivered right here.

Every Saturday I post the Weekly Charts thread on X — a detailed look at market structure, breadth, and price action heading into the new week.

Then I share the link here on Trading Adventures.

That’s worked fine… but let’s take it up a level.

Starting today, I’m delivering the full analysis directly to you — right here in your inbox — complete with charts, context, and insights. No link clicks required.

If you’re here for the signal, this is the place to get it.

Let’s dive in 👇

📊 Major Indices

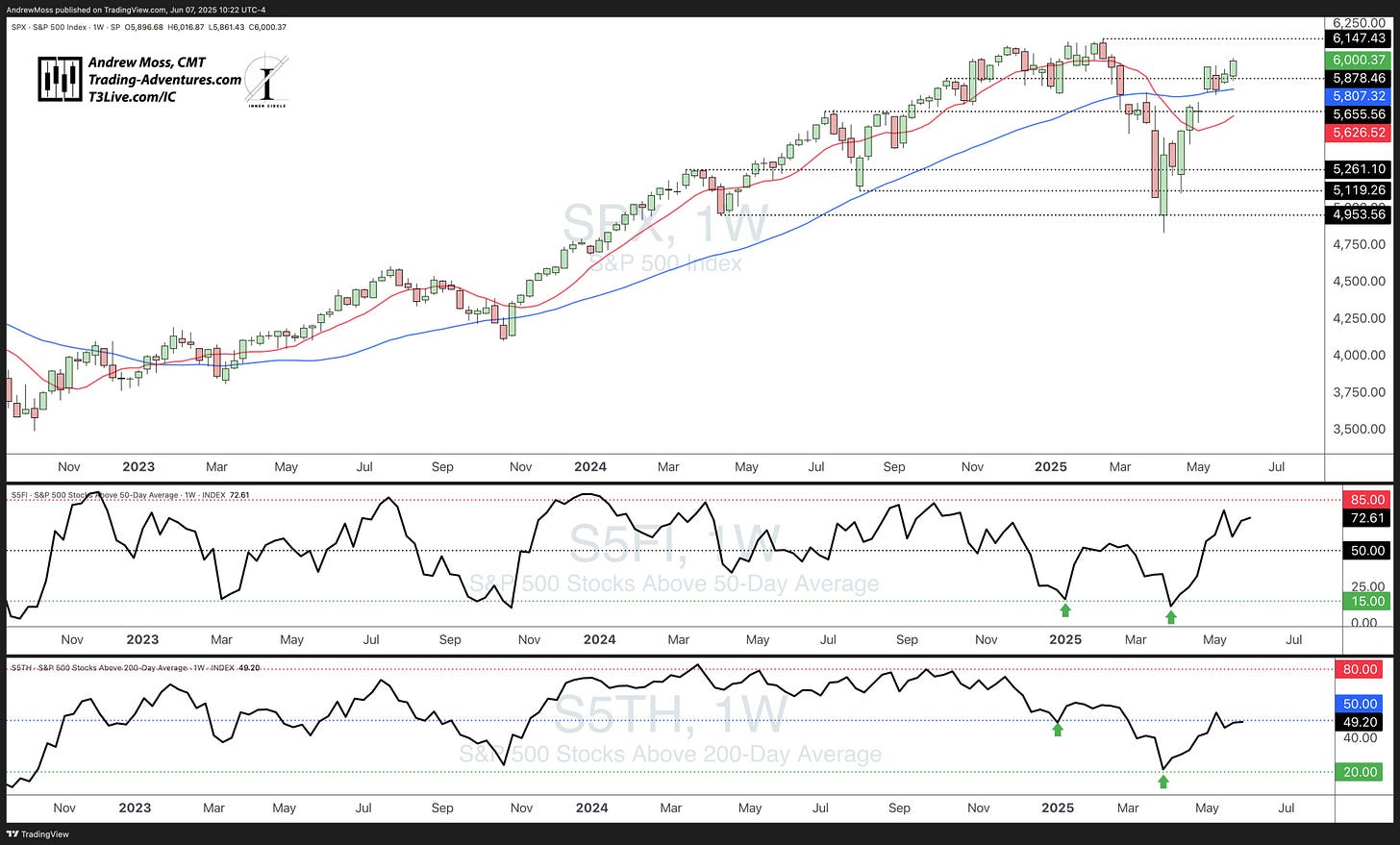

SPX

A month ago, the S&P printed an indecision candle just below the 40-week MA. What looked like a potential pause point instead resolved with strength:

Gap-and-go over the 40-week

Into the upper Bollinger Band

RSI > 50

After a few weeks of consolidation, price has now pushed through the 5958 pivot and broken out of the recent 3-week range. The uptrend is back in motion.

QQQ

QQQ had an even bigger gap and a stronger move up. New highs are less than ~2% away.

Like the S&P:

Above 10/40-week MAs

Both MAs rising

In the upper half of the BBands

Healthy volume

RSI > 50

IWM

Still has work to do, but this week’s action was constructive:

Strong move above the pivot AVWAP

Back in the upper half of the BBands

RSI > 50 and rising

Volume is healthy

Price is approaching potential resistance in the 213–215 range — where a Fibonacci level overlaps with the declining 40-week MA.

DIA

Closed back above the 40-week MA but remains in a congestion zone below ~430.

That could be the final hurdle before a move back to the highs.

Above both the 10- and 40-week MAs

Both MAs are rising

RSI > 50

Volume slightly below average

BTCUSD

Bitcoin is holding its recent breakout after tagging new all-time highs two weeks ago.

Last week’s candle pushed through the ~109K pivot, but couldn’t stick. This week, a retest of ~100K was quickly bought — a strong show of demand.

🎉 By the Way…

There are now over 10,000 of you following along on X!

That’s very cool. But what’s even better is the community — chart lovers, patient traders, and lifelong learners, all building together.

If you’re reading this here on Substack — thank you. You’re getting the most structured and in-depth version of my weekly analysis.

But if you want even more charts, quick setups, live trade ideas, and commentary throughout the week…

Follow me on X → @Andy__Moss

🌎 Global & Macro

ACWX

Third straight week of new closing highs:

Above MAs

BBands sloping upward

RSI strong but not extended

Volume slightly light

FXI

Reversal higher after testing mid-BBand:

RSI strong

Room toward 37.50–39 resistance

DXY

The Dollar Index is once again clinging to the bottom of a 2.5+ year range.

Bonds

AGG is trying to hold trendline support

TLT remains weak

HYG testing its trendline from below

🔶 Commodities

GSG

Commodities as a group are showing progress.

Price pushed above the flat 40-week MA and the pivot high AVWAP🟠, pausing just above the BBand centerline (still sloping lower).

Inside the group:

GLD continues to coil and looks ready for a breakout

SLV already broke out and surged through recent highs

🧭 Breadth & Relative Strength

SPX Breadth

72.6% of SPX stocks above the 50-day MA

49.2% above the 200-day MA

Both are rising — strength is expanding beneath the surface.

Unlock Market-Beating Options Trades with EpicTrades – Join The Winning Streak Today

Struggling to Find Reliable Options Ideas? Epic Trades Delivers.

We work hard every week to deliver solid, actionable ideas.

I bring deep chart analysis expertise, while David Prince and Kira Barr’s unparalleled market intuition take our strategies to the next level—delivering consistent, high-probability trades.

The results speak for themselves.

Join Thousands of Smart Traders – Subscribe Now at http://t3live.com/epicoffer for Exclusive Access to Our Winning Strategies!

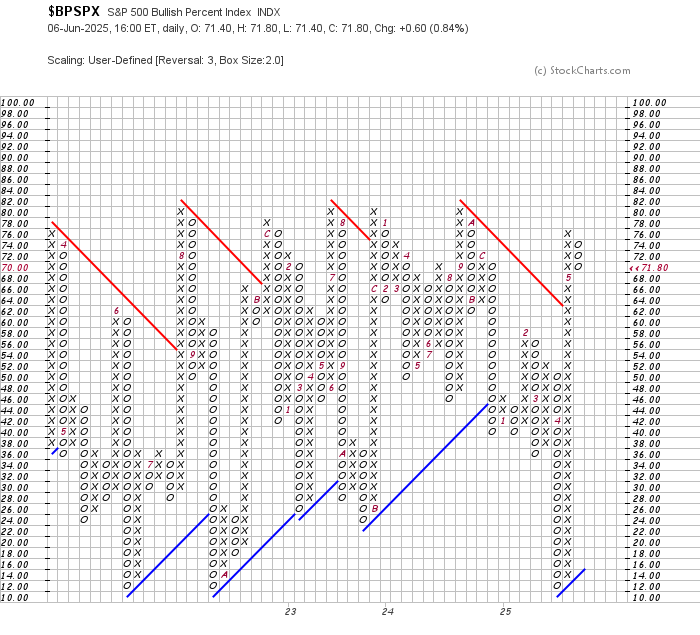

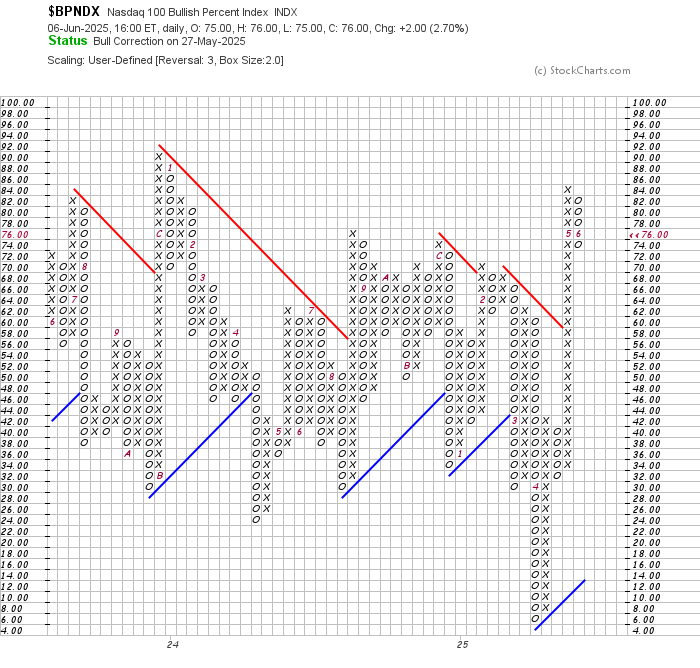

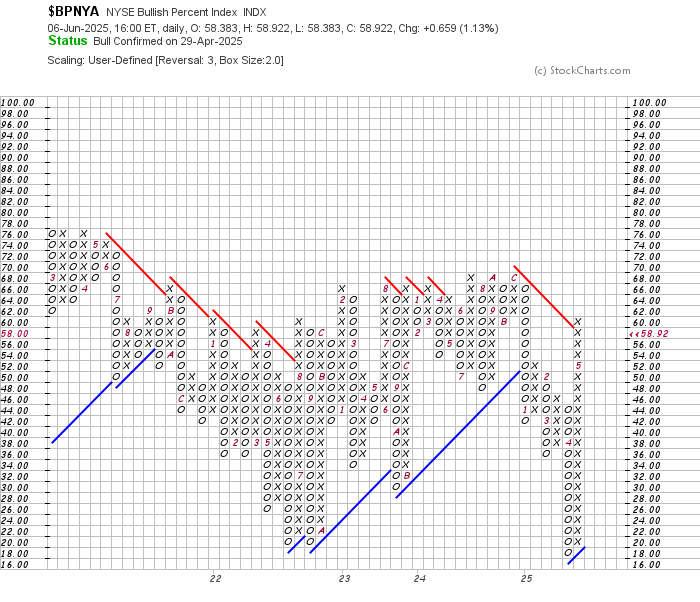

Bullish Percent Indexes

BPSPX: still in a column of Os, but made a gain

BPNDX: similar picture

BPNYA: hovering near bearish resistance

Relative Strength Snapshots

IWF / IWD – Growth still leading, nearing prior highs

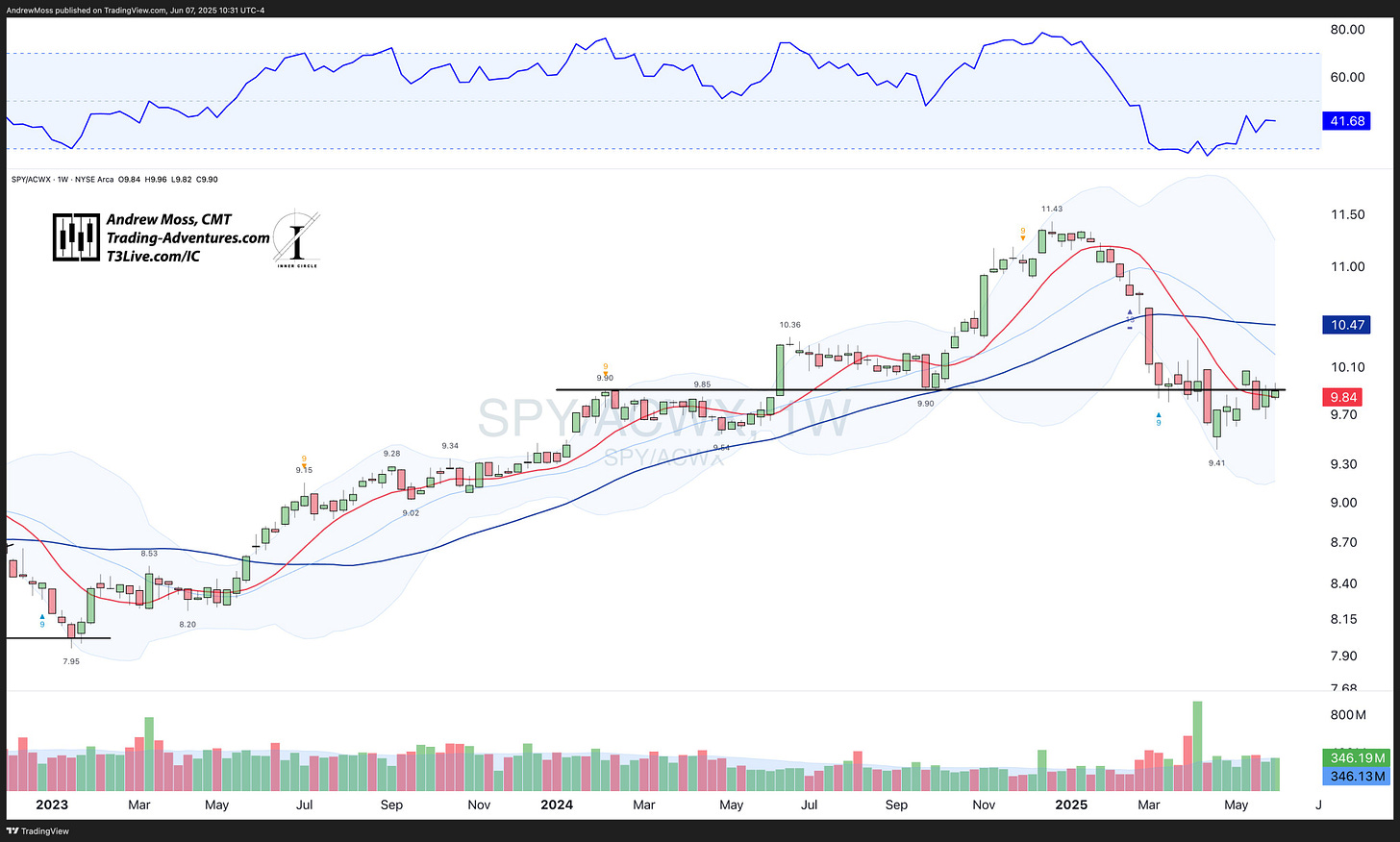

SPY / ACWX – Global equities aren’t outperforming the US

XLY / XLP – Consolidating tightly — risk appetite on watch

🧠 So… Now What?

After a month of sideways chop in May, SPY and QQQ kicked off June with clean breakouts.

DIA and IWM are behind the leaders but showing improvement.

Breadth is strong — but not stretched. We’re not at euphoric levels.

Here’s the big picture:

The market is structurally sound

Price action is constructive

Breadth is broadening

Leadership is stable

No obvious defensive rotation

That’s bullish. But it’s also a reminder to stay prepared.

There’s been no shortage of negative catalysts — and yet:

Every dip is bought

Weakness doesn’t stick

Strength keeps showing up

That’s a trend. Trust your process. Stick with strength. Stay flexible.

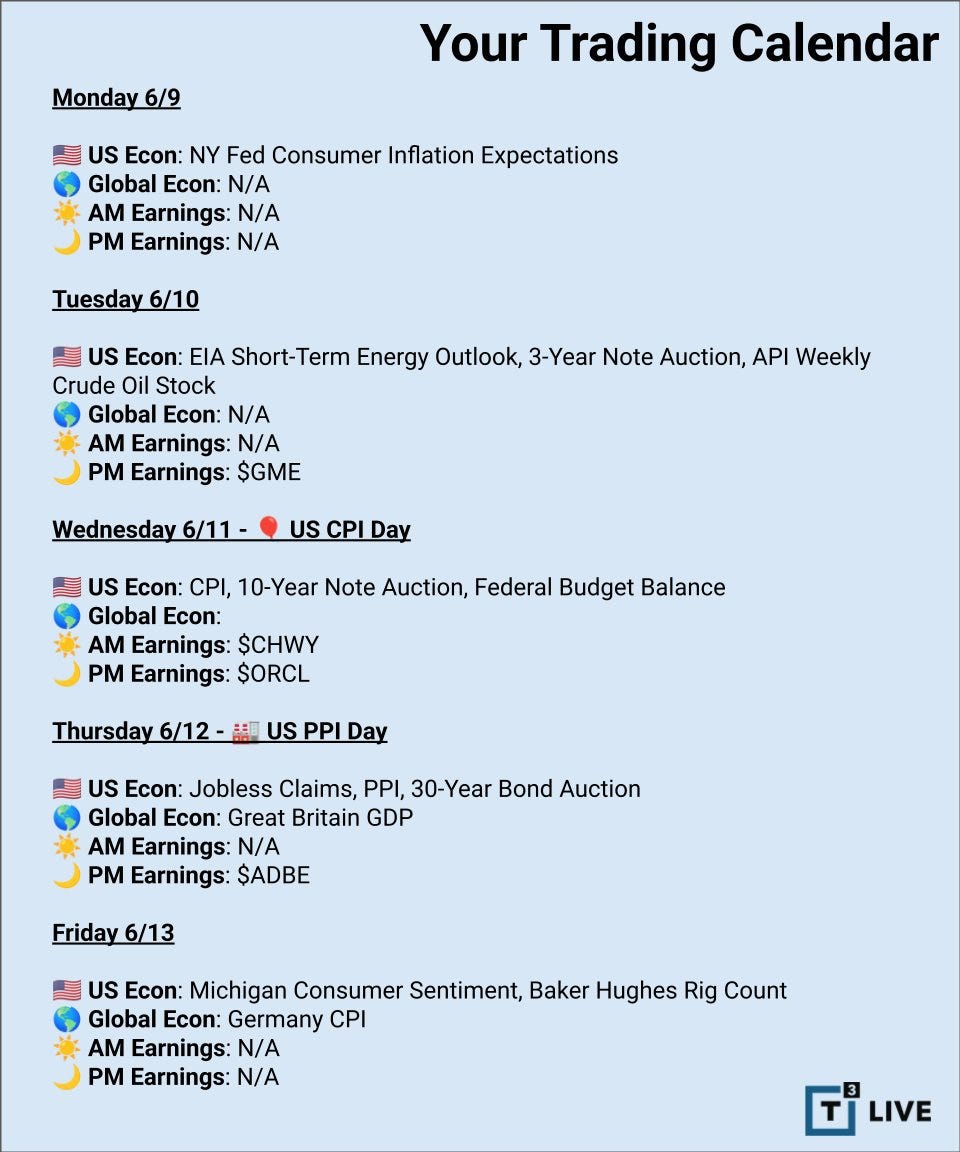

📅 Week Ahead – June 10–14

Key Events:

Wednesday: CPI

Thursday: PPI

Friday: Consumer Sentiment

Earnings to watch: CHWY, ORCL, ADBE

🧪 How I Traded It – A New Series

This week I tested something new: a transparent, educational breakdown of a real trade.

The TSLA setup had it all —

Gap down. Bounce. Hedge. Plan. Execution.

And most importantly: a lesson worth learning.

Read it here:👇

If it helps — let me know. If the response is strong, I’ll keep them coming.

🙏 Thanks for Reading

If you’ve made it this far — congrats.😂 You are truly a dedicated trader and market enthusiast.

And thank you. This post is the result of years of trading, observing, writing, and refining.

If you found it helpful:

Tap the ❤️ below

Share it with a trader you know

Reply and let me know what stood out

Catch you next week,

—Andy

Looking For More?

Elevate Your Trading Adventure Even Further With These Offerings.

EpicTrades Options Newsletter

Real-time trade ideas and insights, providing actionable trading insights focusing on options trades with short-term horizons, aiming to capitalize on weekly market movements.

The approach includes detailed reasoning for trades, specific options, and profit targets. It focuses on quick gains with a minimal time commitment from subscribers.

Click below to sign up!

The Inner Circle

The Inner Circle is a Virtual Trading Floor (VTF) at T3 Live. I’ve been working and trading with this group since 2022. You may have noticed the logo in the watermarks on my charts.

Founded by David Prince and led by him, Rick March, and Kira Turner, the Inner Circle is a community of elite traders, including hedge fund managers, family office heads, corporate executives, financial advisors, and even professional poker players.

Fundamental, Macro, and Technical Analysis all combine to find and discuss the best opportunities in current markets.

The Disclosures

***This is NOT financial advice. This is NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.

Thanks! Great work as usual. Love it having all the weekly publication on the email or here.