Weekly Charts – July 26, 2025

Good Saturday Morning. ☕️

Another strong week for the major indexes.

SPY and QQQ made new highs.

DIA is looking for a breakout.

IWM and Bitcoin stayed boxed in.

Let’s take a look at the 📈Weekly Charts📉 for the signals that matter.

📊 Major Indices

SPY was strong and steady, booking another new high weekly close.

Bands pushing higher

MAs rising in a bullish stack

Volume inline and healthy

RSI ~65, bullish but not stretched

Bull market things. 🐂

QQQ is still singing the same song:

Bands pushing higher

MAs rising in a bullish stack

Volume inline and healthy

RSI ~65, bullish but not stretched

More bull market things. 🐂

IWM moved higher, but without running away, as it runs into a pivot area near 228. A little consolidation there as the 10-week MA gears up to cross the 40-week.

DIA bounced back strongly and looks ready to make new highs soon. 451.55 is the pivot just ahead. Volume was strong, and RSI still has plenty of room.

🌏 Global Stocks

ACWX – The Rest Of The World broke out. 📈

This bull market is global.

FXI – China made another new high on light volume and lower RSI.

🏦 Bonds

High-yield bonds made a new closing high, while aggregate bonds and treasuries remain under pressure—but hanging on.

HYG

AGG

TLT

🪙 Crypto Check:

BTC – still resting near the peak.

ETH – well above the trendline zone and near recent highs at 4093, while RSI grazes overbought status.

LTC – up and into the downtrend zone. Threatening a breakout while trading above the 114.01 pivot and ATH AVWAP.

XRP – has found some resistance at previous highs.

Unlock Market-Beating Options Trades with EpicTrades – Join The Winning Streak Today

💥 Real setups. Real follow-through.

📩 Want real trades like this — with structure, targets, and real-time alerts?

Join here → t3live.com/epicoffer

🛢️ Commodities

As a group – not running away.

GSG

DBB – Resting after last week’s breakout confirmation — but this week’s candle is worth noting.

🕯️ Potential reversal candle formed.

GLD – consolidation on the rising 10-week MA.

⚖️ Relative Strength

Its growth over value, discretionary over staples, and high beta over low volatility.

Risk on.

IWF vs. IWD

XLY vs. XLP

SPHB vs. SPLV

Can’t forget the Equal Weights:

RSP – Equal-weight S&P 500 is close to breaking out.

QQEW – Equal-weight Nasdaq is making new highs again.

Dollar Check – A slight bounce, but no evidence of lasting change yet.

📊 Market Breadth

The % of SPX stocks above the 50- and 200-day moving averages remains healthy and moved higher this week.

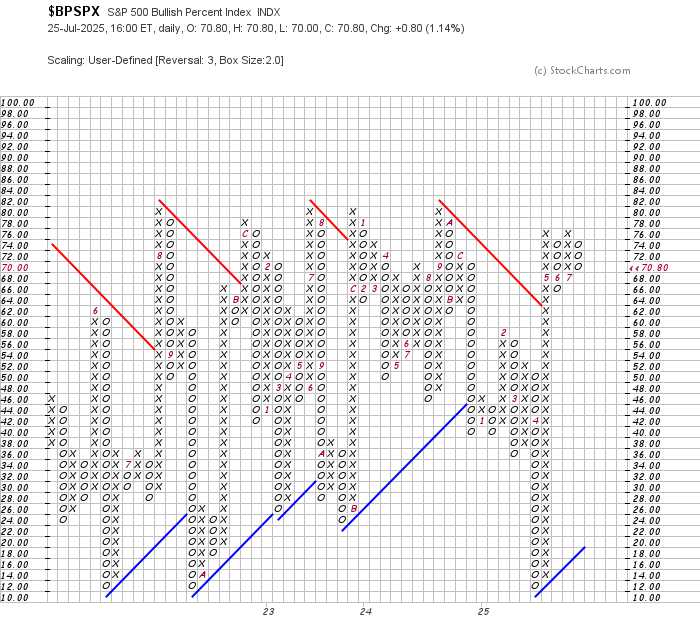

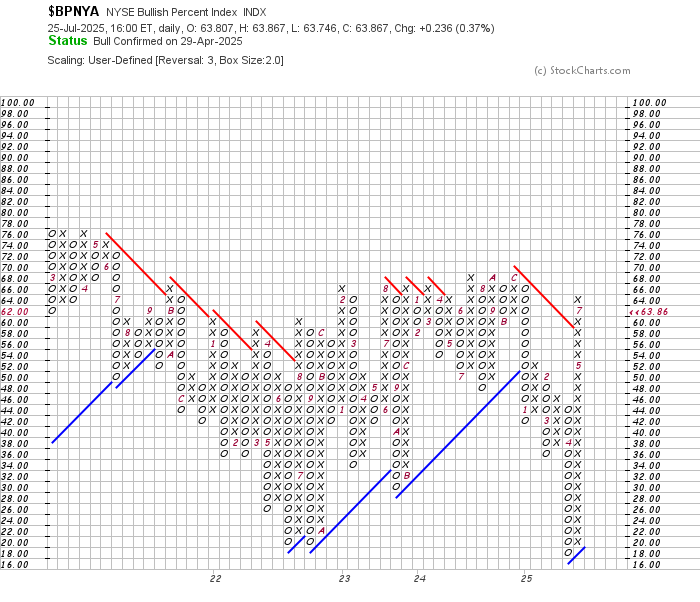

Bullish Percent Indexes:

BPSPX avoids the high-level breakdown — still hanging in there.

BPNDX added one O, but quickly reversed higher.

BPNYA still holding strong.

Last week's noted potential for weakness is still worth watching. But for now, breadth remains supportive beneath the surface.

If you’re new to these indicators or want a refresher, I broke down the key concepts earlier this week.

Check out the Chart School breakdown:

Understanding the Bullish Percent Index

A timeless signal of internal strength, built on point & figure roots.

Read the full article here.

🔍 Now What?

We track these weekly charts to stay grounded. To quiet the noise. To stay aligned with the market’s message.

And right now, that message is clear: strength continues—but it’s measured.

Major indexes are trending. Breadth remains healthy. Risk appetite is present. But not everything is breaking out. Some areas are consolidating. Others are stalling. The rotation is real—and it’s a gift for prepared traders.

That’s why we watch. So we don’t chase. So we stay ready.

Not to predict. But to position.

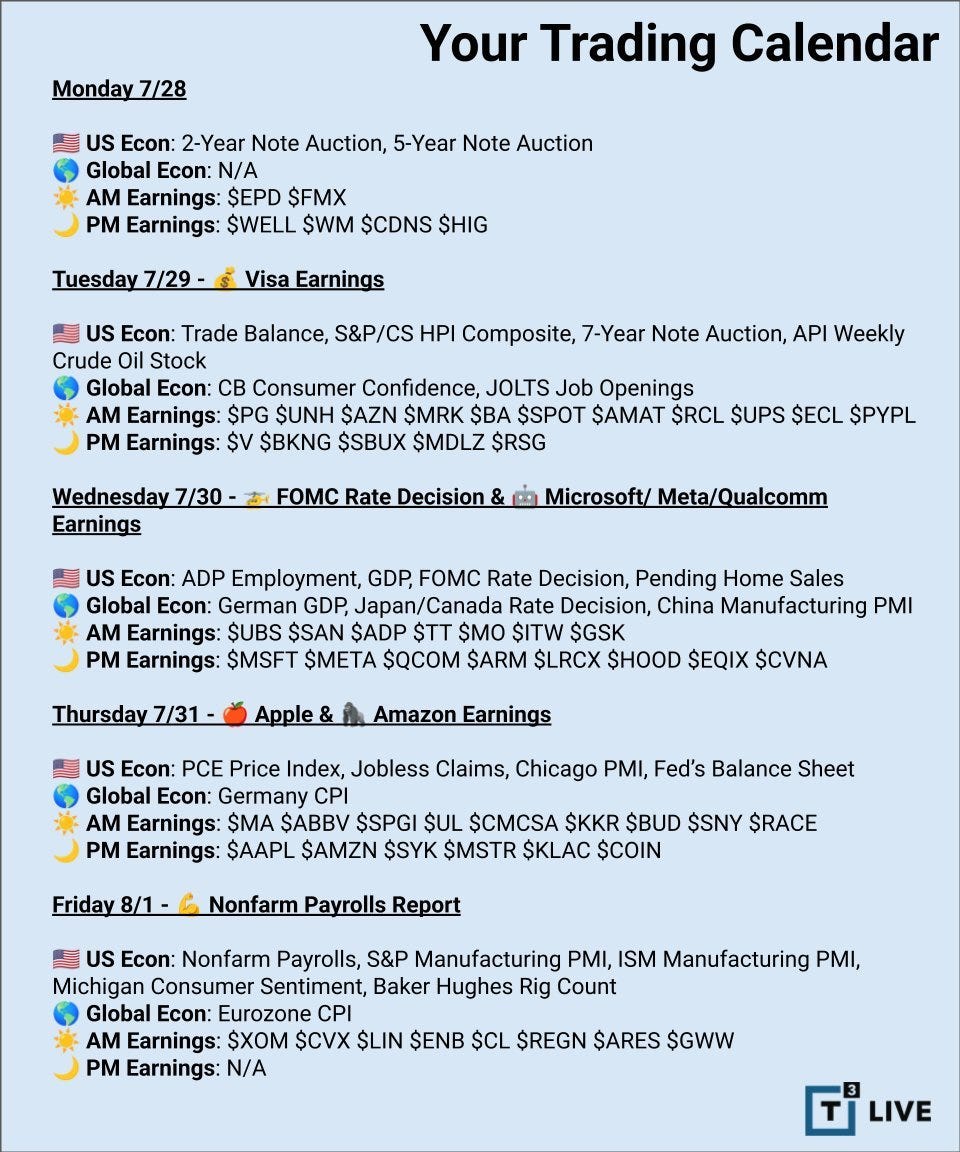

🗓️ Trading Calendar – Week of July 28

It’s a big one for earnings and economic data.

Mega cap tech — MSFT, META, AAPL, AMZN — and lots of econ data — GDP, PCE, FOMC — all in play.

Volatility is possible. Stay tuned and stay nimble.

Thanks, as always, for reading and following along.

These 📈Weekly Charts📉 are here to help you stay clear, consistent, and confident in your trading.

If you found this week’s charts and commentary helpful, consider subscribing to Trading Adventures — or sharing with a friend who’s navigating these markets too.

Paid subscriptions are optional, but deeply appreciated. They help keep the content flowing and the signals sharp.

See you in the next update.

Andy

📩 Enjoying these updates?

Consider a paid subscription — $7/month or $84/year helps keep the charts flowing and the signal strong.

No paywalls. No gated content. Just a way to say thanks.

Looking For More?

Elevate Your Trading Adventure Even Further With These Offerings.

EpicTrades Options Newsletter

Real-time trade ideas and insights, providing actionable trading insights focusing on options trades with short-term horizons, aiming to capitalize on weekly market movements.

The approach includes detailed reasoning for trades, specific options, and profit targets. It focuses on quick gains with a minimal time commitment from subscribers.

Click below to sign up!

The Inner Circle

The Inner Circle is a Virtual Trading Floor (VTF) at T3 Live. I’ve been working and trading with this group since 2022. You may have noticed the logo in the watermarks on my charts.

Founded by David Prince and led by him, Rick March, and Kira Turner, the Inner Circle is a community of elite traders, including hedge fund managers, family office heads, corporate executives, financial advisors, and even professional poker players.

Fundamental, Macro, and Technical Analysis all combine to find and discuss the best opportunities in current markets.

The Disclosures

***This is NOT financial advice. This is NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.