Weekly Market Recap

$SPY $QQQ $DXY $GSG $HYG $XLE $XLP $XLC

Some quick thoughts on an eventful, positive week.

First, welcome to all the new subscribers. There are quite a few of you this week, which is always encouraging. My goal is to share useful thoughts and observations on trading and technical analysis. The subscription rate is clearly in an uptrend. As readership grows it tells me that you all are enjoying the work and sharing it with others. Thank you.

It’s been a very busy week in life and the markets. I have a son and a nephew graduating high school this week. So parties, party planning, baccalaureates, graduation ceremonies, and visiting family have filled the schedule. It’s been wonderful. Every time I get to see a group of our young people compete, perform, or celebrate I am encouraged. These kids are so smart. And great public speakers! Very impressive.

And while all of that is going on, the stock market managed to put in a green week. And the timing is very interesting. Bearish sentiment has been at incredible lows. The macro-economic picture is riddled with crises and challenges. No one wanted to own stocks a week ago. And it seems the majority of people are saying there’s no way that could be the actual bottom. Is this “the rally that no one wanted?”

Greg Harmon had this to say on Twitter:

You’ve heard the quote from Mark Twain,

“Whenever you find yourself on the side of the majority, it is time to pause and reflect.”

I think there will be a lot of people “pausing and reflecting” after this bounce.

Or, after seven red weeks in a row, maybe a bounce was inevitable. Price doesn’t go in a straight line forever. Of course, the question is (the question always is), what next? There’s only one way to know. Follow the charts. Let’s look at a few.

Weekly charts

SPY — This was a great week for stocks. Still, 1 green week out of the last 8.

QQQ — same. 1 in 8. It’s a start

DXY — Dollar down

GSG — commodities up

HYG — High-yield bonds had quite a week. It hasn’t put in a green candle this big since the Covid low. Growing risk appetite in the bond market is usually good for stocks too.

XLP — Staples put a pretty good dent in the destruction of last week.

XLE — Energy is still the strongest SP sector. And it’s extending its lead.

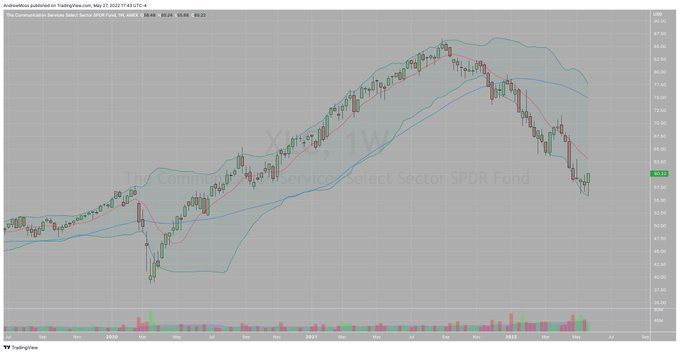

XLC — Communications is still the worst.

Conclusion: There are still some uptrends out there. But even the relative strength leaders can be vulnerable as we’ve witnessed last few weeks with Staples and Utilities. The bounce is encouraging, but there are still bear market characteristics at work that can attack and eat up profits seemingly without warning.

So the plan doesn’t really change. Continue to try to focus on strength and trade with the trend while managing risk very closely. Leave biases out and put plans together in terms of “if/then” thinking. Be ready for anything.

Have a great Memorial Day weekend. Thank a Veteran. And congratulate the young ones around you as they get ready for the next stages of life.