What A Save

Monday Market Update June 3, 2023

Process + Discipline + Hard Work = Works Every Time

Three cheers for the RedDog, Scott Redler, — Co-Founder and Cheif Strategic Officer of T3 Live and T3 Trading Group — as he recovers from a successful heart operation.

If you don’t know Scott, he is the epitome of process, discipline, and hard work. Even though I don’t know him personally, I’ve been familiar with his trading for years. His consistent hard work, and the public sharing of that work, is a massive part of why I’m a trader, why I chose to join T3 as my trading home, and why I write and share my market thoughts on these pages.

Every day, he shares dozens of charts, ideas, and comments to help those navigating the markets. Much of it is available for free on his X/Twitter feed. If you haven’t seen it, it’s well worth a look.

So keep up the work, the discipline, and the process of your healing and recovery, Scott, just as you do with your market work.

You’ll be back to 100% in no time!

The Markets

Friday afternoon, just as things were looking pretty grim, buyers stepped in and produced an impressive, day-saving rally. The resulting daily candles had a strong look. These are some of the comments from my morning notes.

Strong move at the close Friday w/ some follow thru so far this AM.

Massive $QQQ hammer on the 21-day MA

$IWM w/ a potential failed breakdown of the triangle consolidation

$SPY w/ a potential failed breakdown below the March pivot high

$BTC still trying to break higher. $69k and beyond.

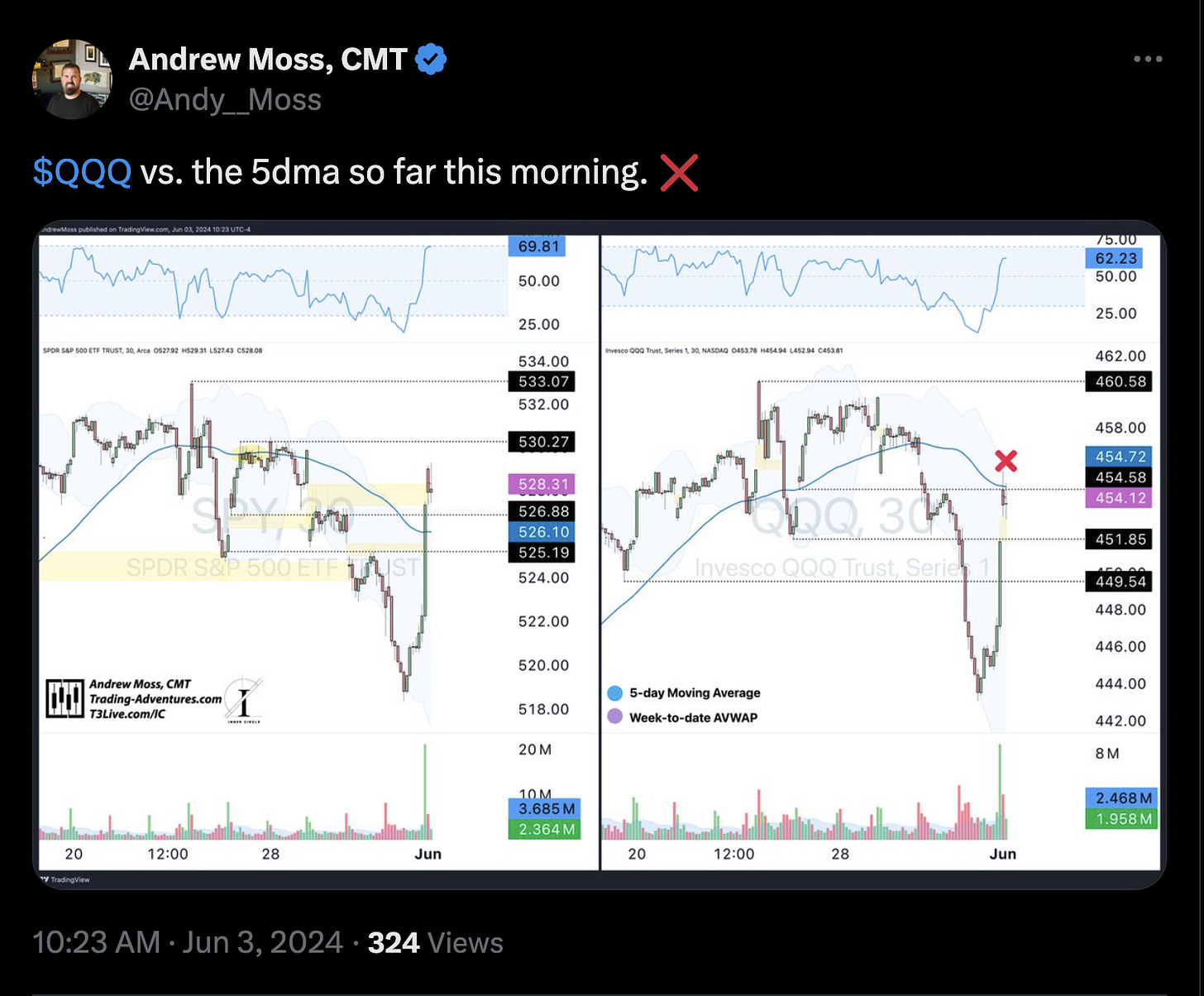

Things looked pretty good this morning. Then, this showed up.

To be sure — it is not a dire warning sign in and of itself.

But it is another good example of process, discipline, and hard work, and why it pays to look at multiple indicators and timeframes.

QQQ moved lower by nearly -1.5% from that rejection and was looking a bit more troublesome before another afternoon rally arrived.

Let’s look at the daily charts.

The Charts

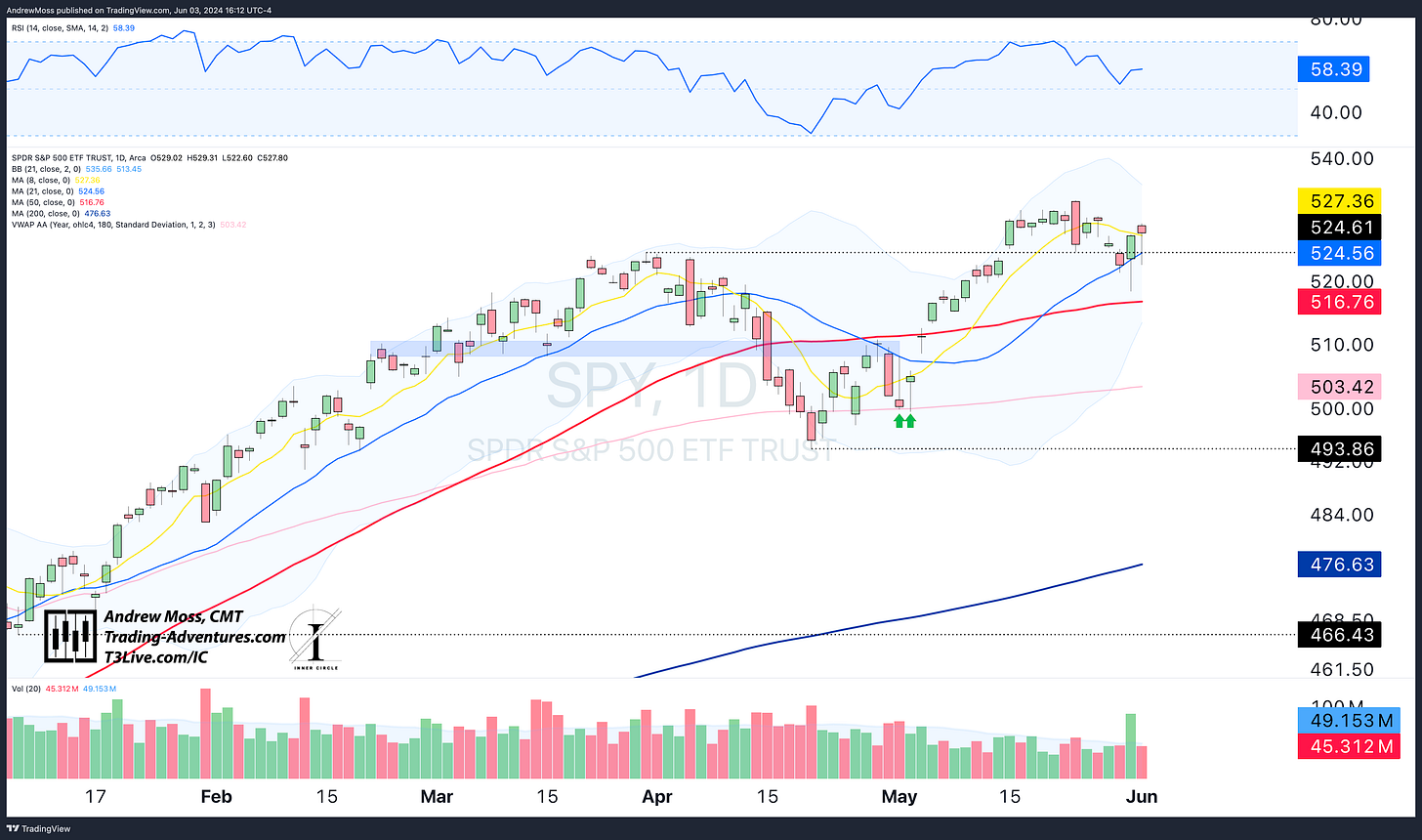

SPY got another late rally today to lift it back over the 8 and 21-day MAs by the close. So far, the save is still in place.

QQQ also managed a close above the pivot level and 21-day MA, though it fell short of the 8-day MA. Again, the save is impressive so far. But if these MAs and the March pivot highs are lost again, it will look much worse.

IWM’s price range nearly eclipsed all of the action from 4 of the previous 5 days of trading. Is it a failed breakdown? Or a failed breakout? Or, maybe just a failed pattern altogether.

~$207.50 is still a key level above, and its the 50-day MA below.

DIA is still working on repairs, but so far, it remains below the 8, 21, and 50-day MAs.

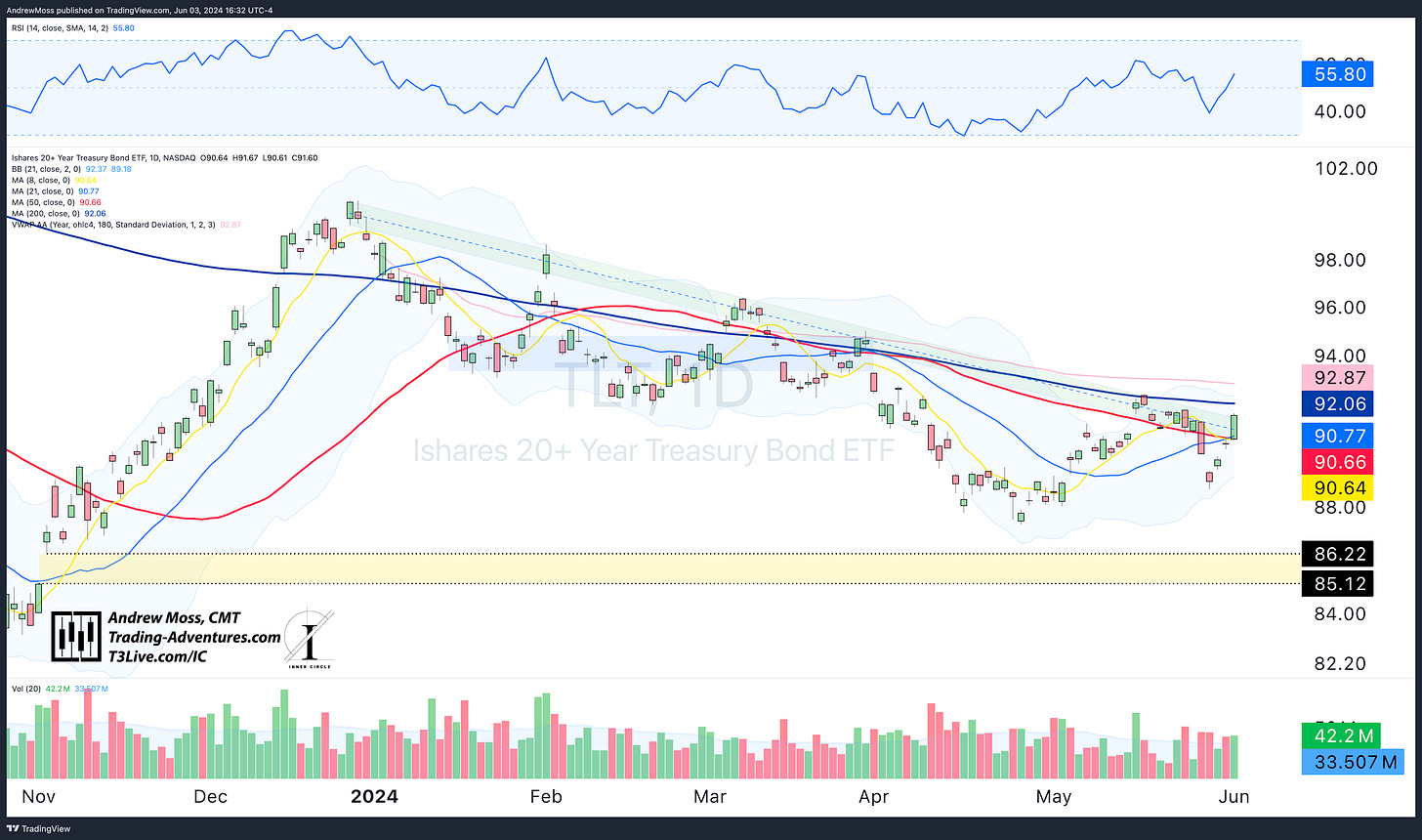

TLT has also put in a great save over the last four days. Today adds some oomph as it closes above the downtrend channel and closer to the 200-day MA, the next test overhead.

DXY US Dollar futures continue to be an integral piece of the puzzle, nearly breaking down today below the YTD AVWAP and the May pivot low. A sharp move lower from here, combined with some continued interest rate relief (TLT moving higher), should give a nice tailwind back to the stock indexes.

BTCUSD is breaking out, and it seems like it wants to move up. But it still moves in fits and starts with little follow-through or momentum so far. Getting over $73,835 would likely change that.

The Trade

Be ready for anything.

Changes in direction can be swift and sharp. And there’s no way of knowing with certainty when they will show up. That’s true in life, sports, markets, trading, and anything else you can imagine.

And we have absolutely zero control over it.

The only logical thing to do is focus on what we can control.

What is our process?

How disciplined are we in pursuit of that process?

How hard do we want to work?

That’s it.

Elevate Your Trading

Education, training, and support for your Trading Adventure.

Options Trades - Weekly trade ideas are delivered to your email or text messages in language you can easily understand.

Check out EpicTrades from David Prince and T3 Live. Epic Trades from David Prince

Community - Are you an experienced trader seeking a community of professionals sharing ideas and tactics? Visit The Inner Circle, T3 Live’s most exclusive trading room - designed for elite, experienced traders.

The Inner Circle at T3 Live

Prop Trading - Or perhaps you are tested and ready to explore a career as a professional proprietary trader? 3 Trading Group has the technology and resources you need.

Click here to start the conversation:

T3TradingGroup.com

The Disclosures

***This is NOT financial advice. This is NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.

Andrew Moss is an associated member of T3 Trading Group, LLC (“T3TG”), an SEC-registered broker/dealer and member of FINRA/SIPC. All trades placed by Mr. Moss are done through T3TG.

Statements in this article represent that person’s opinions only and do not necessarily reflect those of T3TG or any other person associated with T3TG.

Mr. Moss may hold an investment position (or may be contemplating holding an investment position) that is inconsistent with the information provided or the opinion being expressed. This may reflect the financial or other circumstances of the individual, or it may reflect some other consideration. Readers of this article should consider this when evaluating the information provided or the opinions being expressed.

All investments are subject to the risk of loss, which you should consider in making any investment decisions. Readers of this article should consult with their financial advisors, attorneys, accountants, or other qualified investors before making any investment decision.

POSITION DISCLOSURE

June 3, 2024, 4:00 PM

Long: ENVX0621C10, HOOD0621C20, IBIT, IMNM, LLY, SQQQ, VKTX0621C85

Short:

Options symbols are denoted as follows:

Ticker, Date, Call/Put, Strike Price

Example: VXX1218C30 = VXX 12/18 Call with a $30 strike