You've Got Red On you

Markets React to Powell’s Tough Talk

📸 Note on today’s image

If you recognize the reference, Congratulations. You are hereby awarded 100 imaginary internet points. Don’t spoil it in the comments — DM me instead. I’ll reveal the answer in tomorrow’s update.

What I will say: just like the image, today’s selling looked dramatic at first glance… but it wasn’t true panic. More of a move we’ve been watching for, rather than a shock.

The Markets

Markets finally “got a little red on them” today.

After a resilient run, Chair Jerome Powell’s remarks re‑centered the conversation on valuation, restrictive policy, cooling labor, and sticky inflation. None of this was truly new, but the timing and tone were enough to take some air out of the recent strength.

Importantly, the message on the path ahead remained data‑dependent: there is no pre‑ordained easing schedule.

Price action reflected a controlled de‑risking rather than panic.

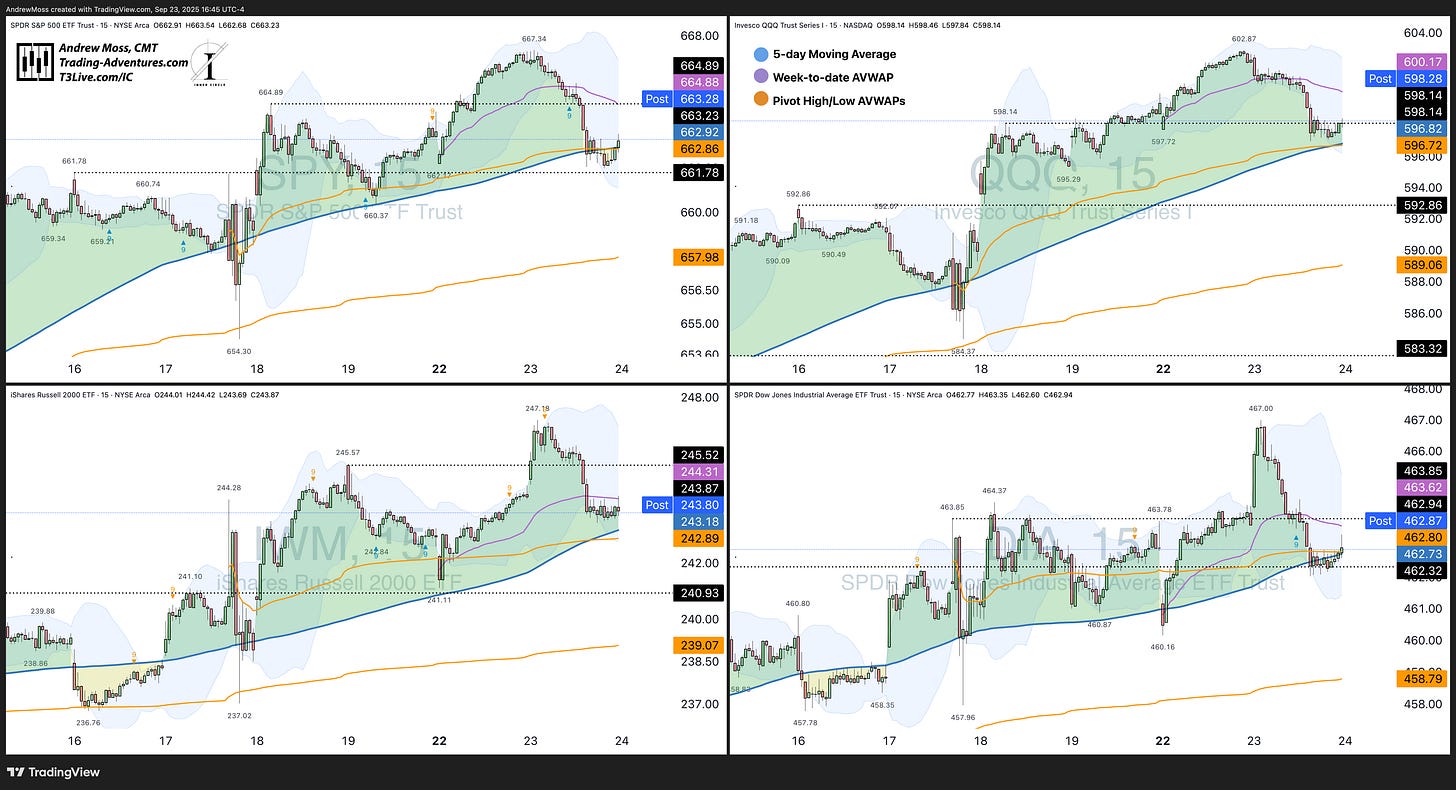

QQQ slid from roughly 602 into 598, and attention now turns to a cluster of reference levels near 596 where the Fed‑day anchored VWAP aligns with the 5‑day moving average.

SPY pressed into its own Fed‑day anchors around the mid‑660s, also more rotation than rout.

IWM is now getting pinched by its WTD AVWAP above and the rising 5-day MA below.

DIA moved sharply off recent highs and is at risk of losing all three short-term indicators - WTD AVWAP, Fed Day AVWAP, and the 5-day MA.

Under the surface, leadership split quickly: quantum names (RGTI, QUBT, QBTS) remained bid, while a pocket of recent high‑flyers (BMNR, TEM) continued mostly lower for the second consecutive day.

Housing XHB/NAIL, DHI gave back early strength, then regained some of it late in the day. Mega‑caps were mixed with AMZN cracking well below its 50‑day and earnings anchored VWAP, and MSFT failing to attract fresh buyers as it moved back below its 50-day MA.

Taken together, the session read like a necessary reset of momentum rather than a shock.

Liquidity will not always ride to the rescue of stretched valuations, and today’s message—monetary policy still doing its job, progress on inflation incomplete—was a reminder of that. If buyers can defend the nearby anchored zones, this can be a healthy step down within an ongoing trend. If they cannot, a deeper unwind will follow as extended names re‑price.

The Charts

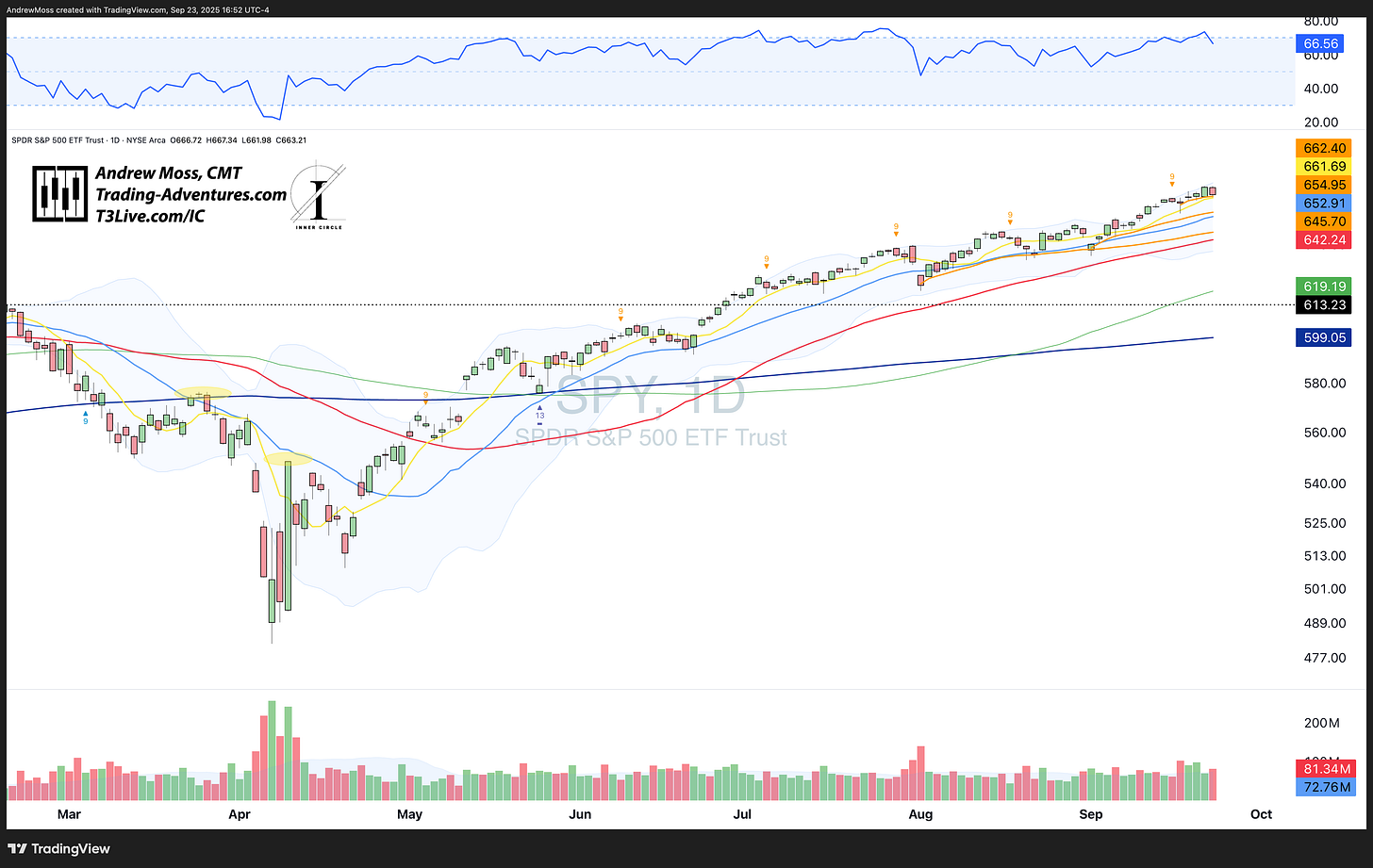

SPY gave back most of yesterday’s gains, coming back down to test a pivot low AVWAP and the 8-day MA. Momentum remains as long as price holds those levels. RSI has resolved the overbought status.

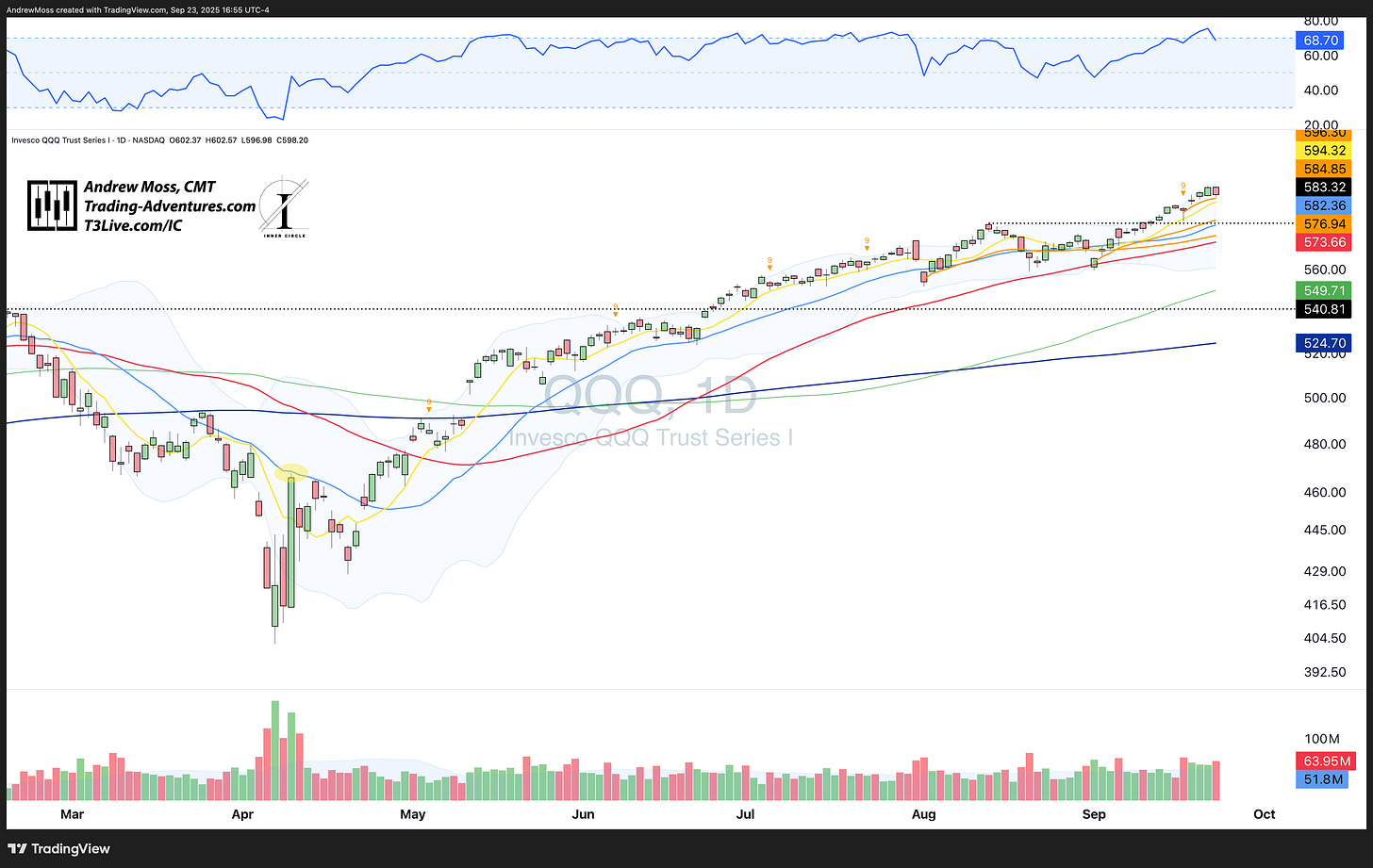

QQQ also has a nearly equal but opposite candle yesterday to today. It too is still above the short-term momentum levels — pivot low AVWAP and 8-day MA. RSI is back < 70.

IWM left a long upper shadow today, illustrating the selling pressure. But as long as it’s above the pivot and 8-day MA, strength isn’t gone, just taking a break.

DIA can copy/paste the IWM comments. That’s not lazy commentary. Rather, pointing out the similar and simultaneous action in these two indices.

BTCUSD could not stay in the box and is below all key MAs except the 200-day MA. Stagnation continues.

Chart takeaways

The indices backed into well‑defined reference zones, which is where digestion should appear if trend is intact.

The action in housing names reads like rotation as long as XHB, DHI hold the 50‑day MAs. In single names, AMZN around $220.50 remains a clean tells‑and‑levels case—respect that pivot.

TSLA is taking a well-deserved break after the monstrous run and holds well between the ~$420-$440 pivots.

Overall, follow‑through on the down move was selective, not indiscriminate, favoring reset over liquidation.

The Trade

Today’s action reflected the market acknowledging known constraints rather than discovering new ones.

The immediate hinge sits at QQQ 596–594 where Fed‑day AVWAP meets short‑term moving averages. Stabilization and higher‑low construction there argue for digestion and a path to rebuild longs with defined risk. A break with momentum shifts the character from reset to stress and expands fade‑the‑rips opportunities in prior leaders.

Secondary tells matter.

Housing remains rotation‑like while XHB holds the 50‑day. AMZN at $220.50 is the decision point: reclaim and hold to rebuild, or fail to keep sellers in control. The quantum cluster’s relative strength is notable; if the tape were truly breaking, those should crack as well.

Bottom line: a little red, not a panic. Respect the levels, let price confirm, and stay flexible.

Looking For More?

Elevate Your Trading Adventure Even Further With These Offerings.

EpicTrades Options Newsletter

Real-time trade ideas and insights, providing actionable trading insights focusing on options trades with short-term horizons, aiming to capitalize on weekly market movements.

The approach includes detailed reasoning for trades, specific options, and profit targets. It focuses on quick gains with a minimal time commitment from subscribers.

The Inner Circle

The Inner Circle is a Virtual Trading Floor (VTF) at T3 Live. I’ve been working and trading with this group since 2022. You may have noticed the logo in the watermarks on my charts.

Founded by David Prince and led by him, Rick March, and Kira Turner, the Inner Circle is a community of elite traders, including hedge fund managers, family office heads, corporate executives, financial advisors, and even professional poker players.

Fundamental, Macro, and Technical Analysis all combine to find and discuss the best opportunities in current markets.

The Disclosures

***This is NOT financial advice. This is NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.