Zooming In While We Wait

Monday Market Update July 29, 2024

The Markets

Major stock indexes are little changed since last Thursday’s article, (read here —Putting The Pieces Together) except that SPY is (barely) back above its 50-day MA.

QQQ is still below a falling 8-day MA. IWM is still consolidating in front of recent highs. DIA is down very slightly on the day, but still above all key MAs.

Stocks are waiting.

On what? A whole slew of economic data and earnings reports.

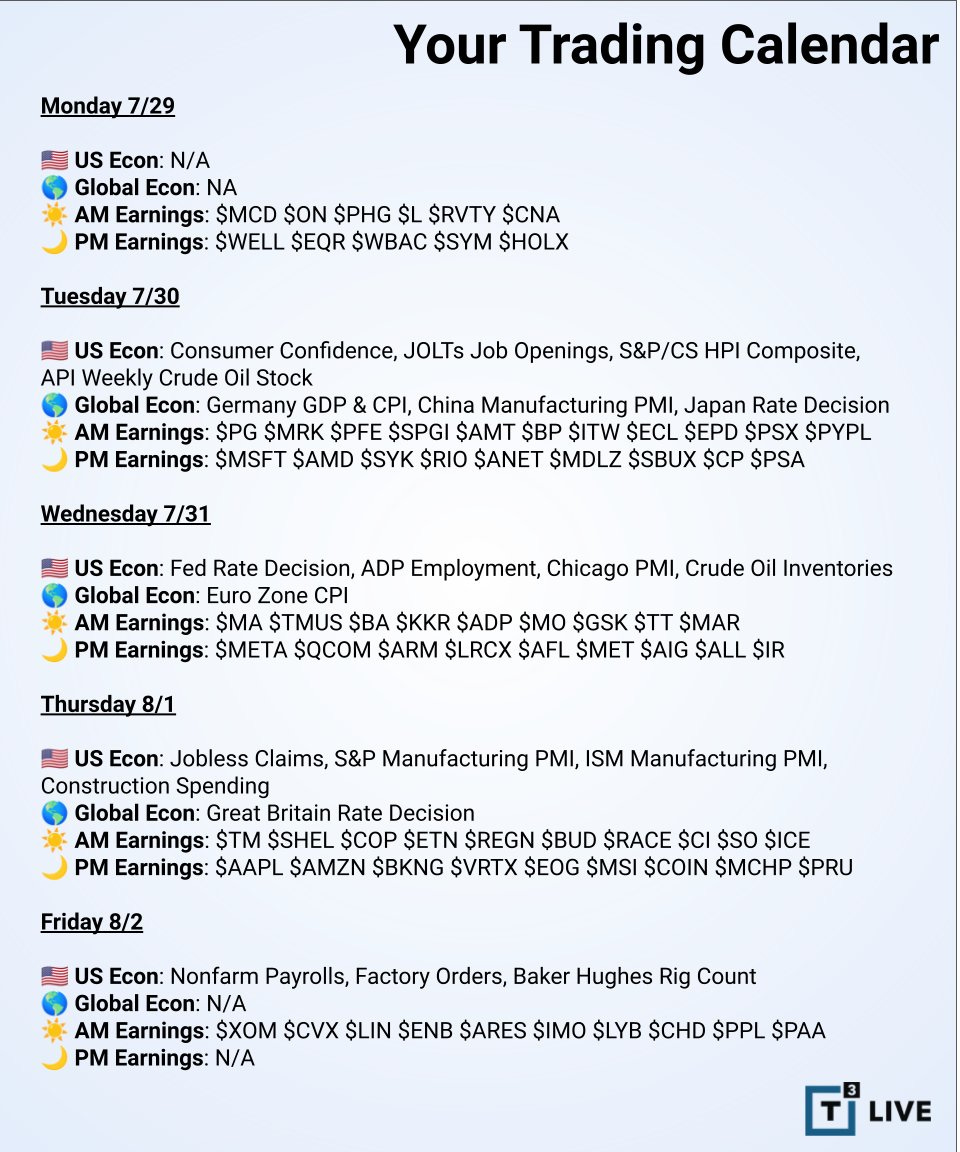

The announcement calendar is incredibly packed this week.

On Tuesday, we’ll get the latest update on job openings with the JOLTs report.

Wednesday brings us to The Federal Reserve meeting. Most expect no changes in the interest rate policy, but the market will be closely watching Jerome Powell for any hints of a potential rate cut in September.

Then, on Thursday, we’ll have the Jobless Claims report.

Finally, to wrap up the week, we’ll see the Nonfarm Payrolls (NFP) data on Friday.

Why are these so important?

Amidst all these updates, we’ll also see earnings announcements from some major players. Over half of the ‘Magnificent 7’ stocks will report — AAPL, AMZN, META, and MSFT.

Additionally, we’ll get a full slate of news from the semiconductor sector, with AMD, ARM, LRCX, and QCOM all releasing earnings.

Here’s the complete schedule:

The Charts

So, the markets are chopping around while we wait. Again, the daily charts don’t look much different.

So, instead of the usual lineup of daily charts, here is a combined view of SPY, QQQ, IWM, and DIA in a 30-minute timeframe.

Notice that three out of four are below their 5-day MAs. Only DIA is above.

30m charts

5-day MA is the blue line

Anchored VWAPs are in orange

Also notable is that the 5-day MA of SPY and QQQ is declining.

Brian Shannon often reminds us that stocks (or indexes) below a declining 5-day MA are

‘guilty until proven innocent.’

For prospective long positions, focusing on names in a positive trend makes sense - the definition of which depends on the preferred time frame.

The 5-day MA is typically the shortest moving average I use and the most sensitive gauge of momentum. It gives the earliest indications of the presence of a trend and potential change of trend.

From there, we can add VWAPs (volume weighted average price) anchored from recent highs, lows, or other specific points in time, such as a major news event or earnings announcement.

These offer additional points of interest and potential support or resistance areas.

Notice that the DIA chart above has a confluence of the 5-day MA and an AVWAP from the recent high and low, all within a very tight range. That range may offer significant support in the near future.

Caveat: True support or resistance cannot be known until after the fact. Hence, the qualifier “potential.”

Moving to the four M7 names reporting this week, AAPL, AMZN, META, and MSFT are in a similar situation. Which is unsurprising given their outsized weightings in the indexes). All are below declining 5-day MAs, with AMZN closest to a change in short-term trend.

Here's one more look at the smaller companies. This chart shows the equal-weighed SP 500 and NASDAQ 100 - RSP and QQEW—along with the Mid-cap and Micro-cap index ETFs—MDY and IWC.

Only RSP and MDY are above the 5-day MA, QQEW is butting up against it, and IWC just recently crossed below.

Bearish?

Not hardly.

Stock indexes are still mostly strong, with good participation across many different sectors and company sizes.

However, zooming in on the shorter time frames is another useful view of the recent pullback and pause we’re seeing.

Perhaps the economic data and earnings announcements this week will shake things up — or maybe they won’t.

If not, we can go back to looking at daily and weekly charts for more potential support levels, whether from previous pivot highs and lows or longer moving averages.

But seeing prices get back above a 5-day MA would be our early warning sign that the slump is over and prices are resuming higher movements.

By the way, each morning at 9:00 AM, I post the daily roadmap—30-minute charts of SPY and QQQ just like the ones above—as a tool to help us know what to expect from stocks that day.

Follow me on Twitter/X if you’d like to see it. X.com/Andy__Moss

The Trade

Watching and waiting.

If you’ve followed along here and were able to buy the dips in some recent favorites last week, you’ve likely locked in some profits and reduced position sizes by now.

As stated previously, the next step is to look for names that move back over the 5-day MA. Then, do they stay above it? Does the 5-day cross above the 8-day, and so on?

We’ll see how things develop this week and get back to you with another update on Thursday.

See you then.

Elevate Your Trading

Education, training, and support for your Trading Adventure.

Options Trades - Weekly trade ideas are delivered to your email or text messages in language you can easily understand.

Check out EpicTrades from David Prince and T3 Live. Epic Trades from David Prince

Community - Are you an experienced trader seeking a community of professionals sharing ideas and tactics? Visit The Inner Circle, T3 Live’s most exclusive trading room - designed for elite, experienced traders.

The Inner Circle at T3 Live

Prop Trading - Or perhaps you are tested and ready to explore a career as a professional proprietary trader? 3 Trading Group has the technology and resources you need.

Click here to start the conversation:

T3TradingGroup.com

The Disclosures

***This is NOT financial advice. This is NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.

Andrew Moss is an associated member of T3 Trading Group, LLC (“T3TG”), an SEC-registered broker/dealer and member of FINRA/SIPC. All trades placed by Mr. Moss are done through T3TG.

Statements in this article represent that person’s opinions only and do not necessarily reflect those of T3TG or any other person associated with T3TG.

Mr. Moss may hold an investment position (or may be contemplating holding an investment position) that is inconsistent with the information provided or the opinion being expressed. This may reflect the financial or other circumstances of the individual, or it may reflect some other consideration. Readers of this article should consider this when evaluating the information provided or the opinions being expressed.

All investments are subject to the risk of loss, which you should consider in making any investment decisions. Readers of this article should consult with their financial advisors, attorneys, accountants, or other qualified investors before making any investment decision.

POSITION DISCLOSURE

July, 29 2024, 4:00 PM

Long:

Short:

Options symbols are denoted as follows:

Ticker, Date, Call/Put, Strike Price

Example: VXX1218C30 = VXX 12/18 Call with a $30 strike