Counter Attack

Market Update June 6, 2024

The Markets

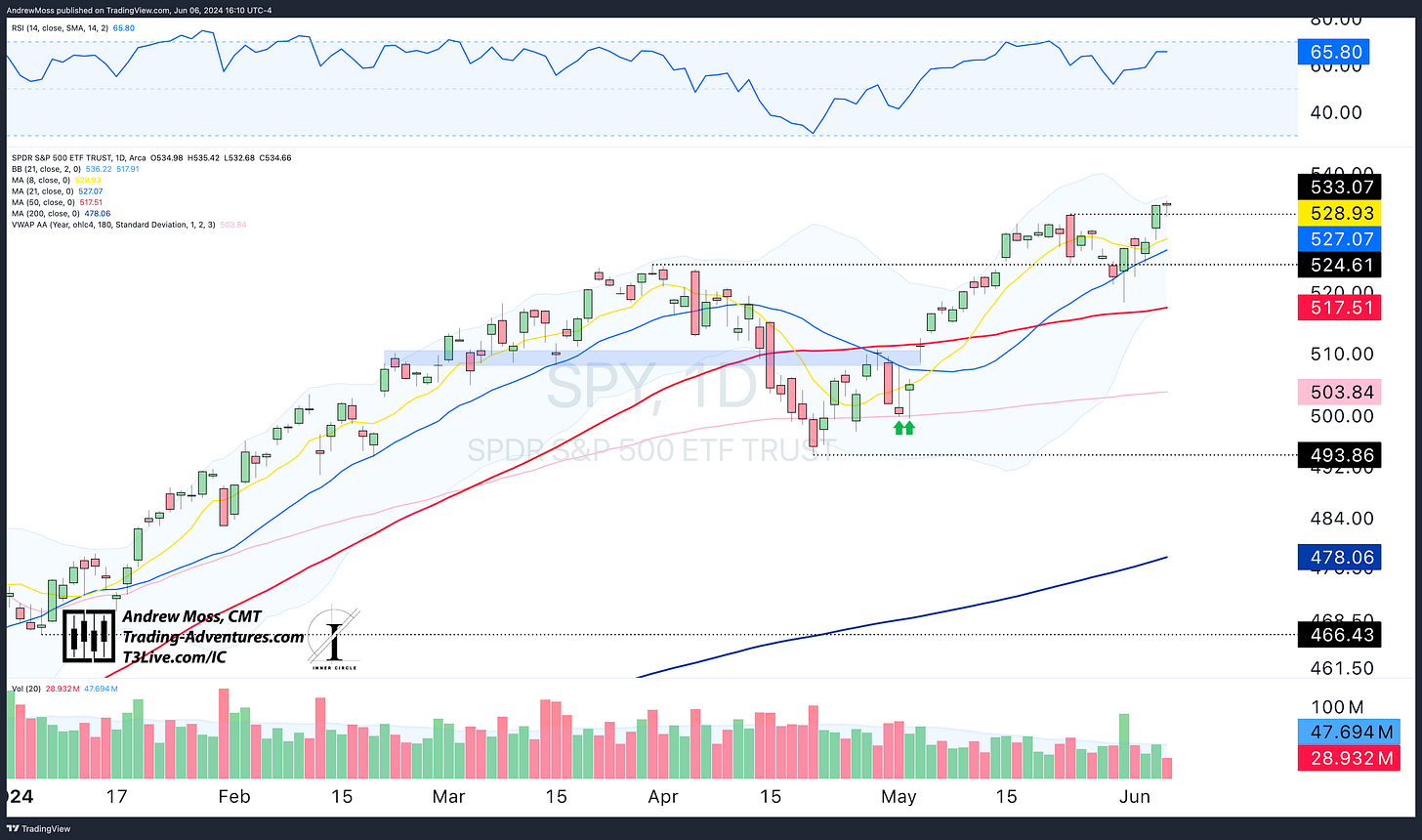

First, the save. Then, the counterattack.

Early in the week, we examined Friday’s late afternoon rally, The Save. The action produced hammer candles on SPY and QQQ. Hammers can be lovely actionable patterns on their own. When they happen at significant levels, that’s even better.

The Friday occurrence happened on the 21-day MA and the pivot high from late March. One pattern, indicator, or support/resistance level alone is ok. A combination of multiple factors adds layers of probabilities.

The results?

New all-time highs yesterday.

The Charts

SPY After making new highs, SPY dipped briefly today and found support precisely at the pivot high from May 23. Levels matter.

QQQ was a little stronger, not dipping all the way to the pivot level.

IWM continues to lag and remains constrained by the short-term downtrend line. We need to see a move that gets it above the 8 and 21-day MAs and the trendline and keeps it there.

DIA repair work continues but does show potential for a bearish rising wedge pattern.

TLT spends another day above the year-to-date anchored VWAP, adding to the tailwind for stocks.

DXY is still safe from breaking down, so far.

BTCUSD is taking a little rest in front of the ~$72k pivot level.

The Trade

Dips to support

Reversal candles

New highs

The bull market lives on.

Trim your positions (take some profit) along the way. And Trail (raise) your stops as the charts allow. And be ready for market-moving news.

We’ll get the latest Nonfarm Payrolls to report tomorrow morning. Indications of a slowdown would be interpreted as giving the Fed a nudge towards cutting rates.

Elevate Your Trading

Education, training, and support for your Trading Adventure.

Options Trades - Weekly trade ideas are delivered to your email or text messages in language you can easily understand.

Check out EpicTrades from David Prince and T3 Live. Epic Trades from David Prince

Community - Are you an experienced trader seeking a community of professionals sharing ideas and tactics? Visit The Inner Circle, T3 Live’s most exclusive trading room - designed for elite, experienced traders.

The Inner Circle at T3 Live

Prop Trading - Or perhaps you are tested and ready to explore a career as a professional proprietary trader? 3 Trading Group has the technology and resources you need.

Click here to start the conversation:

T3TradingGroup.com

The Disclosures

***This is NOT financial advice. This is NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.

Andrew Moss is an associated member of T3 Trading Group, LLC (“T3TG”), an SEC-registered broker/dealer and member of FINRA/SIPC. All trades placed by Mr. Moss are done through T3TG.

Statements in this article represent that person’s opinions only and do not necessarily reflect those of T3TG or any other person associated with T3TG.

Mr. Moss may hold an investment position (or may be contemplating holding an investment position) that is inconsistent with the information provided or the opinion being expressed. This may reflect the financial or other circumstances of the individual, or it may reflect some other consideration. Readers of this article should consider this when evaluating the information provided or the opinions being expressed.

All investments are subject to the risk of loss, which you should consider in making any investment decisions. Readers of this article should consult with their financial advisors, attorneys, accountants, or other qualified investors before making any investment decision.

POSITION DISCLOSURE

June 6, 2024, 4:00 PM

Long: BITO0621C27, CELH0719C75, IBIT, META, VKTX0419C80

Short:

Options symbols are denoted as follows:

Ticker, Date, Call/Put, Strike Price

Example: VXX1218C30 = VXX 12/18 Call with a $30 strike