Fed Day

Checking the charts ahead of the FOMC meeting tomorrow

The Markets

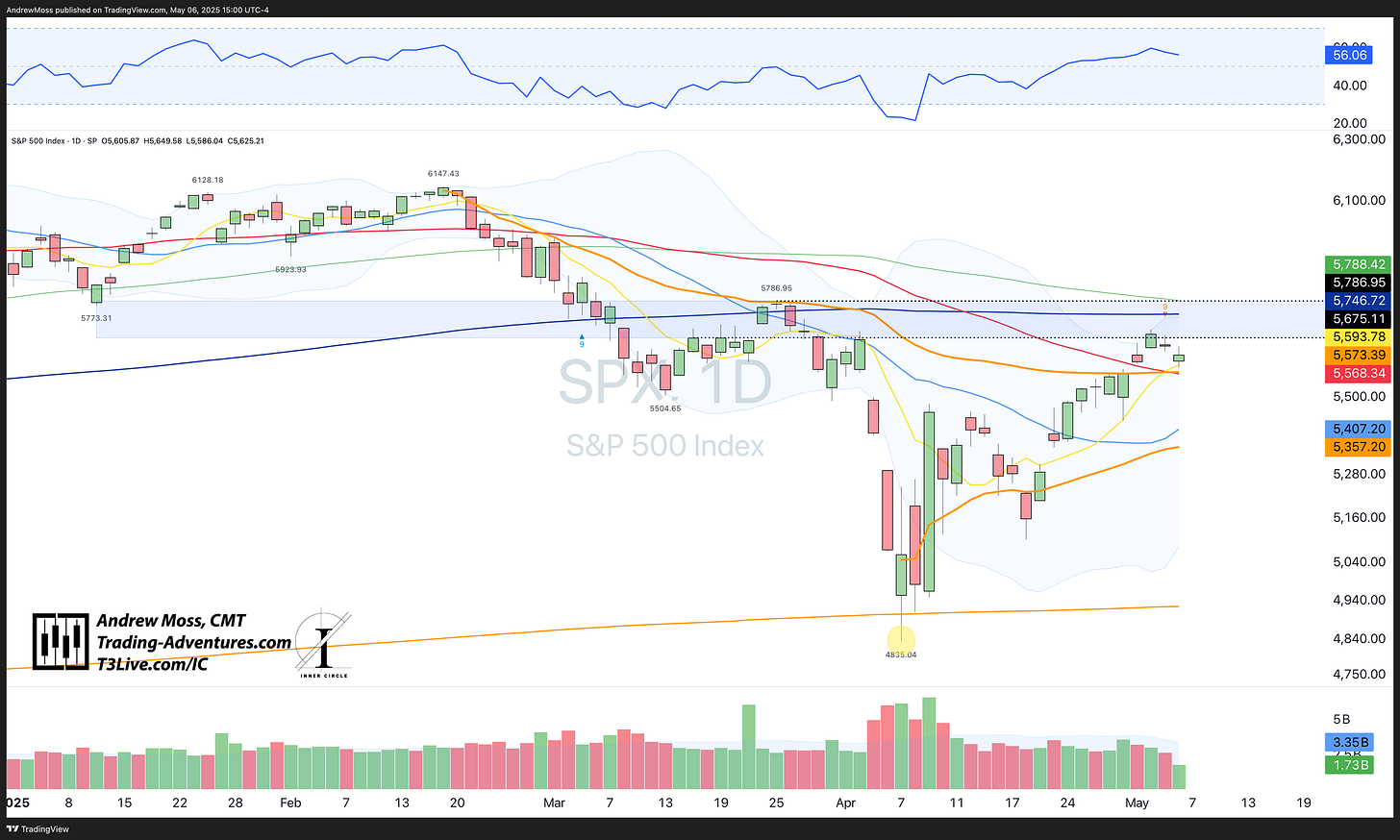

Stocks are resting and retesting “The Line” ahead of tomorrow’s FOMC meeting.

After moving Over The Line last week, the S&P 500 has found resistance to send it back lower for a retest. As that happens, we will hear the latest from Jerome Powell and the Federal Reserve. A rate cut announcement is not expected, and instead, the focus will be on what he says during the press conference.

Will he hint at rate cuts later in the year? Will he give in to the President’s calls for immediate monetary relief? Or will he stand his ground and continue to claim ‘data dependent decision making?’

Until now, he’s been a master at threading the needle and not spooking the market.

Here are the charts showing the technical view leading up to the event.

The Charts

S&P 500 Stocks are back to The Line day, making a low of 5586, just above the 8 and 50-day MAs, and the pivot high anchored VWAP we’ve been watching so closely. This combination is a critical support level. If it doesn’t hold, a trip down the 21-day MA and the pivot low AVWAP could happen quickly. Both of those indicators are near 5400.

US Dollar - The Dollar has failed to move beyond its falling 21-day MA for the last four days while it continues below the $100.32 pivot. No lasting resumption of confidence in the Greenback, yet.

Gold - Gold stayed close to its pivot high AVWAP for many days of the latest selloff before jumping back over today. Safety is still a preferred place to be.

Oil has bounced in a potential ‘double bottom’ pattern accompanied by a slight bullish divergence in RSI. The 8 and 21-day MAs and pivot high AVWAP are still acting as a lid so far, though.

Bitcoin is back in a box. The mid $95,000s has been home for a couple of weeks and doesn’t show any desire for that to change. The 21-day MA is catching up from underneath. Maybe it can boost prices up and out of the range later this week.

The Trade

There have been some notable earnings moves (PLTR -12%, HIMS +18%) to provide action. But on the whole, stocks have come a long way in a short while. So now they regroup and wait for the next catalyst.

From the 📈 Weekly Chart 📉 analysis.

We’ll see what JPow has to say and how the markets react, and we will send a follow-up on Thursday.

Looking For More?

Elevate Your Trading Adventure Even Further With These Offerings.

EpicTrades Options Newsletter

Real-time trade ideas and insights, providing actionable trading insights focusing on options trades with short-term horizons, aiming to capitalize on weekly market movements.

The approach includes detailed reasoning for trades, specific options, and profit targets. It focuses on quick gains with a minimal time commitment from subscribers.

Don’t miss the next trade! Hit the link to get your real-time alerts.

QQQ puts were a well-timed home run last week, gaining 130%! Don’t miss the next one!

The Inner Circle

The Inner Circle is a Virtual Trading Floor (VTF) at T3 Live. I’ve been working and trading with this group since 2022. You may have noticed the logo in the watermarks on my charts.

Founded by David Prince and led by him, Rick March, and Kira Turner, the Inner Circle is a community of elite traders, including hedge fund managers, family office heads, corporate executives, financial advisors, and even professional poker players.

Fundamental, Macro, and Technical Analysis all combine to find and discuss the best opportunities in current markets.

The Disclosures

***This is NOT financial advice. This is NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.