Focus

Mid-week Market Update February 1, 2023

Everyone is watching everything. You might even say, the whole world is watching.

The last CPI report was the most important one ever.

This earnings season will tell us more than ever about corporate health and the likelihood of a recession.

The 200-day moving average was The Most Important Indicator last week.

Followed quickly by “The Line”. (written about here, here, and here.)

Everything is The Most Important Thing Ever.

And Everyone is watching every single detail.

Can it all really be that important?

Well, yes. It can be for some. And short-term oriented traders occupy a very large portion of that group of “some.”

At some point though, the severity starts to wane. Does it not? Or maybe it’s that we get desensitized.

Whatever the case, it feels more important than ever to step back from the minutiae and take a good look at the bigger picture.

Two and five-minute charts can be very rewarding, but also exhausting. Especially on Fed days, CPI days, and earnings announcement days.

Daily and weekly charts are the go-to choice for many.

And monthly charts are fantastic. If you didn’t see them yesterday, take a look now. You may find them refreshing.

Multiple time-frame analysis is an essential tool.

Now with JPow and The Fed behind us, we’ll move quickly on to the next Most Important Thing ever; earnings reports from AAPL, AMZN, GOOGL, and META.

As we do, keep the bigger picture in mind. Yes, there are concerns. Yes, there are reasons to be cautious. There always will be. Managing risk has been and will always be one of our most important jobs.

At the same time, the markets are changing. Charts are looking different than they have in quite a while.

More on the FOMC reaction and the subsequent outlook for the rest of the 1st quarter coming in the Weekend Market Review, due out Friday.

The Charts

click to enlarge

SPY - The reaction to JPow and the Fed is favorable, so far. SPY has now passed all the short-term tests we’ve been watching: The Line, the 200-day MA, and $410 pivot. Prices above all of those leave room to go higher and could trigger some FOMO buying from those still underweight stocks. The day after the Fed has been a different picture sometimes though. Let’s see if we get some follow-through tomorrow. Earnings reports will have an impact.

QQQ - QQQs have had some catching up to do, and they are doing it well as rotation into big tech has been forceful.

IWM - Small caps are now well above the 189-191 resistance zone and looking much better to the bulls.

DIA - The Dow 30 continues its slower, methodical grind upward.

DXY - Just when the US Dollar looked to slow its decent, it puts in another big red candle. Helpful for stocks.

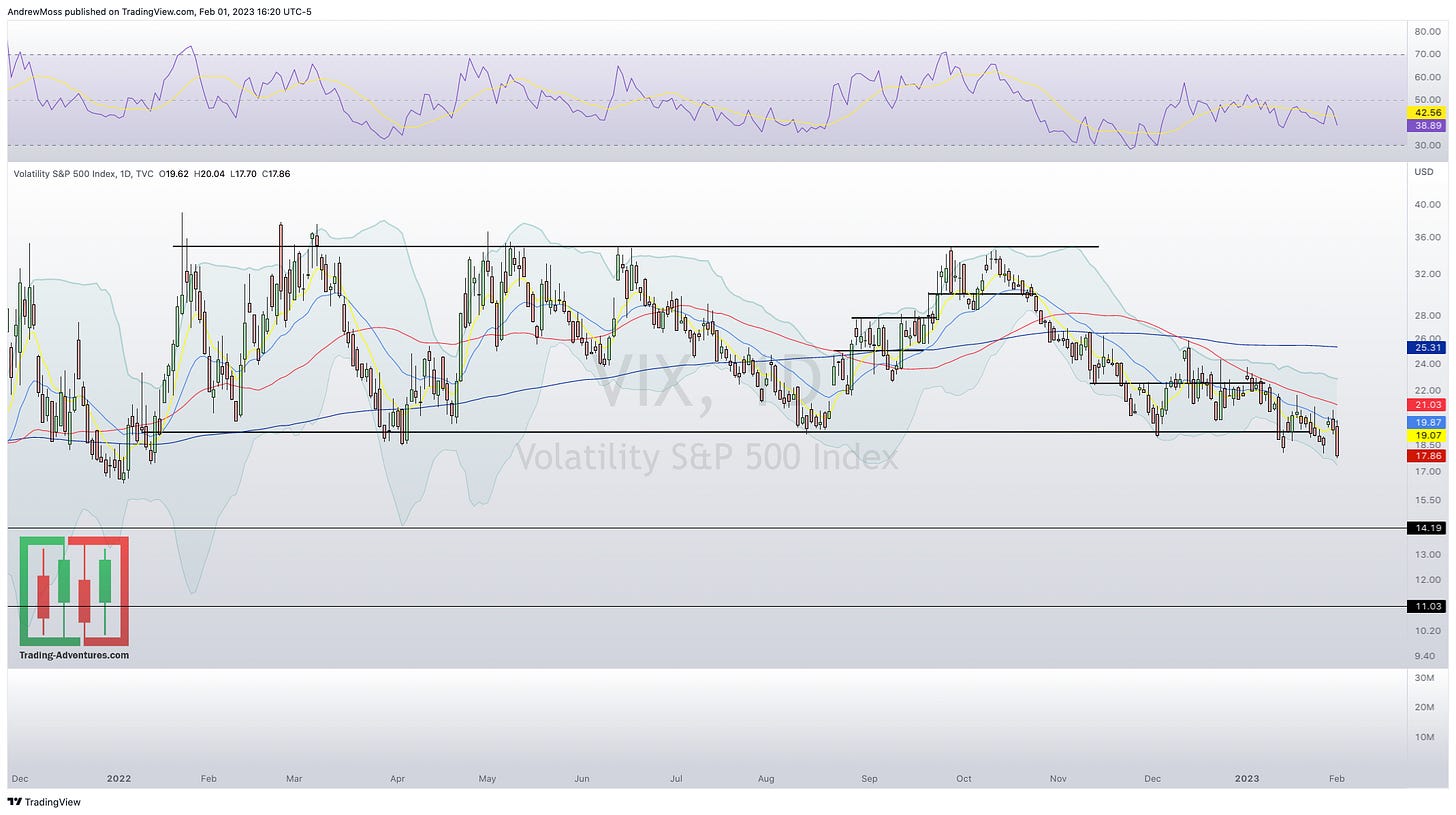

VIX - lower and lower

Thanks for reading and sharing. That’s another Most Important Thing for me, and I appreciate you all.

What’s your most important thing?

***This is NOT financial advice. NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.

Andrew Moss is an associated member of T3 Trading Group, LLC (“T3TG”) a SEC registered broker/dealer and member of FINRA/SIPC. All trades placed by Mr. Moss are done through T3TG.

Statements in this article represent the opinions of that person only and do not necessarily reflect the opinions of T3TG or any other person associated with T3TG.

It is possible that Mr. Moss may hold an investment position (or may be contemplating holding an investment position) that is inconsistent with the information provided or the opinion being expressed. This may reflect the financial or other circumstances of the individual or it may reflect some other consideration. Readers of this article should take this into account when evaluating the information provided or the opinions being expressed.

All investments are subject to risk of loss, which you should consider in making any investment decisions. Readers of this article should consult with their financial advisors, attorneys, accountants or other qualified investors prior to making any investment decision.

POSITION DISCLOSURE

February 1, 2023, 4:00 PM

Long: BBY0317C90, PINS0203C27.50, PINS0217C27.50, QQQ, SNAP0203C11, WHR0317C160

Short: BBY0317C100, SNAP0203C15, WHR0317C180

Options symbols are denoted as follows:

Ticker, Date, Call/Put, Strike Price

Example: VXX1218C30 = VXX 12/18 Call with a $30 strike