From Breakdown to Balance

Volatility cools, futures stabilize, and earnings take the spotlight—but risk remains active under the surface.

Just five days ago, momentum broke down.

Futures sliced through the anchored VWAPs, volatility surged, and conviction faded fast. Key leaders like Apple, Meta, and Microsoft were drifting lower, and former hot spots like Quantum, Rare Earths, and Drones showed the first signs of real damage. Breadth thinned. Sentiment cracked. The message was clear: risk appetite was fading.

Fast forward to today, and conditions have stabilized—if not fully recovered.

The Markets

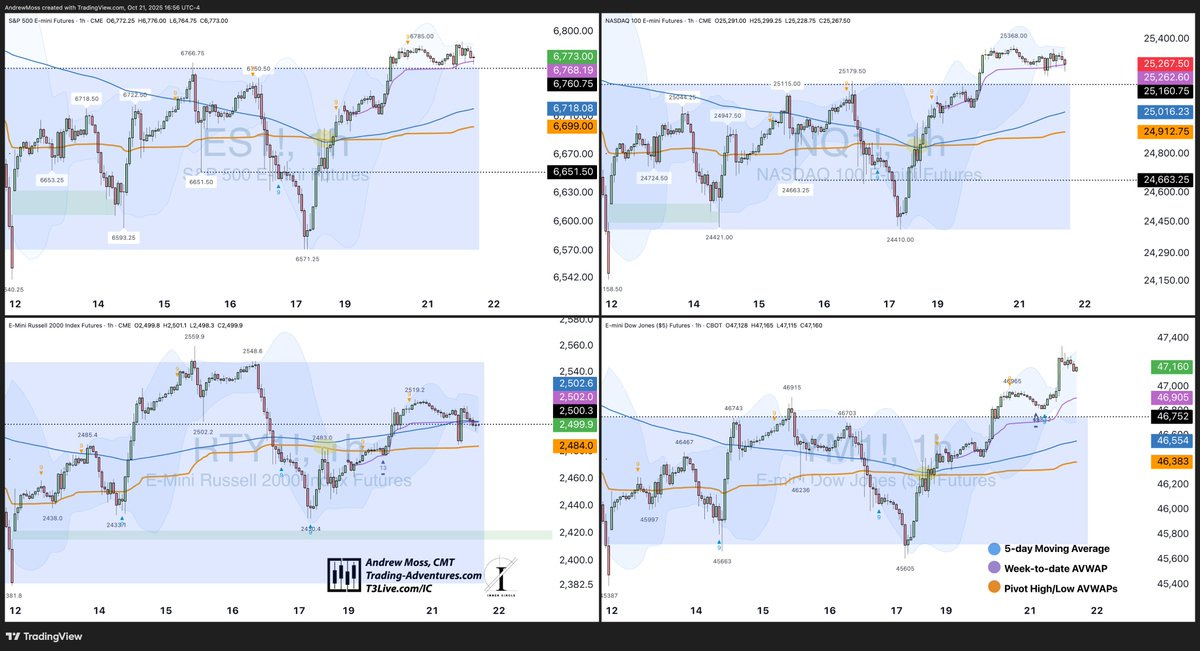

SPY and QQQ finished flat on the session, but the underlying structure has improved. Futures are holding above last week’s range and respecting the week-to-date anchored VWAPs. That’s a notable improvement from last Thursday’s close beneath those same reference points.

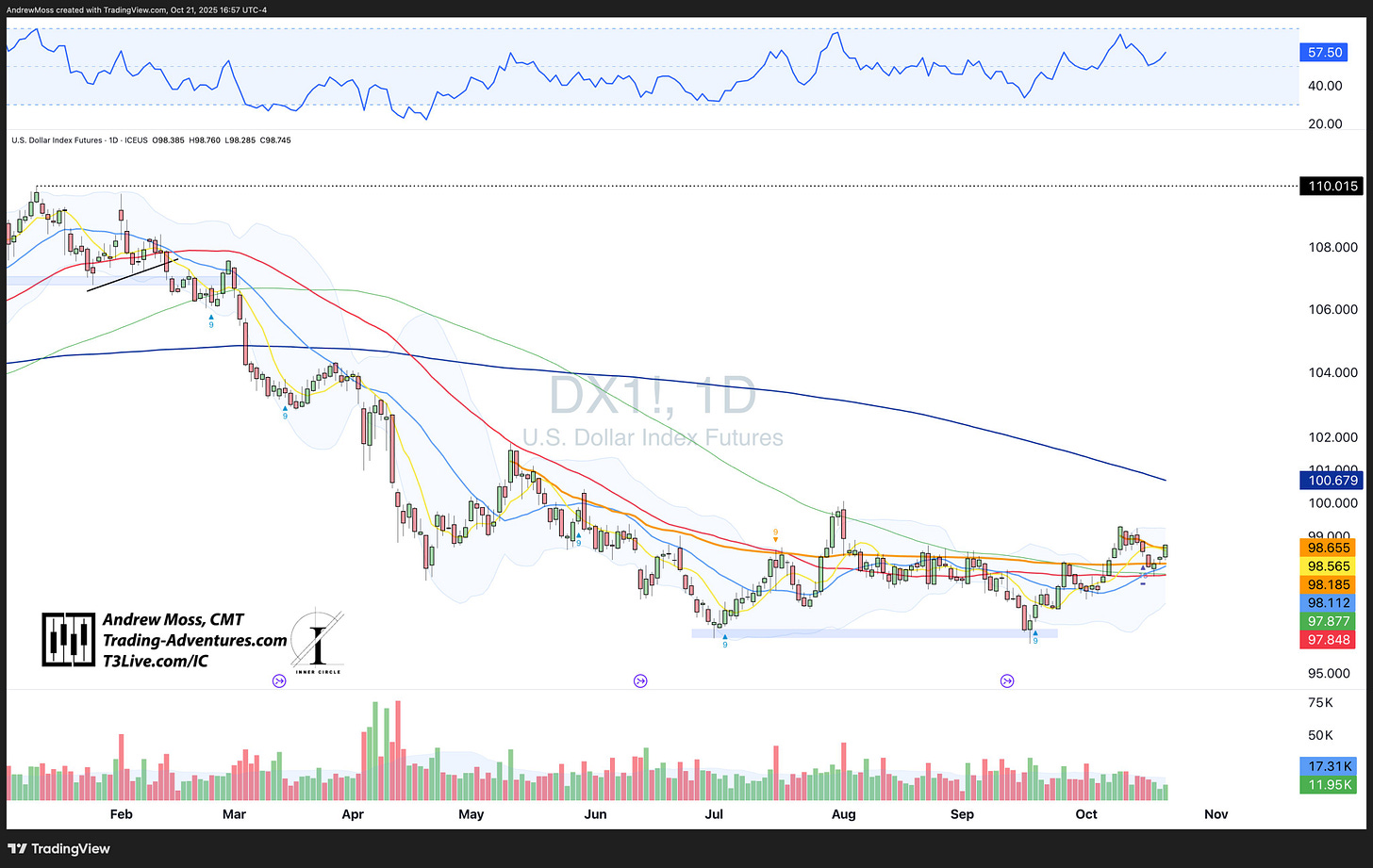

The U.S. Dollar climbed for a third straight session.

Volatility has cooled significantly. The VIX, which had spiked near 25.5, has now dropped for several sessions. It’s back near the “comfortable” range traders have grown used to. That reset helps reduce pressure across the board.

Crypto remains status quo. Earlier this morning, Bitcoin, Ethereum, and Solana all reversed from anchored VWAP resistance—levels mapped out in advance and respected in real-time.

No breakout. No breakdown. Just more range-bound, corrective behavior.

Apple has reasserted leadership, closing today at 262.77 and holding most of Monday’s breakout gains. That’s a key shift from Thursday’s “drift lower” tone. Apple’s strength helps lift the broader tech tone—especially with Microsoft and Meta still in neutral zones.

Gold, however, has reversed hard. After a parabolic run, GLD fell 6.5% today, confirming the inflection point highlighted earlier. The move resets that trend and introduces a new layer of uncertainty.

Earnings Shift the Focus

On the earnings front, the tone has worsened.

Netflix missed and dropped over 5.5% after hours. Texas Instruments followed with a poor report of its own, losing more than 8%.

These reactions signal that expectations are elevated—and that disappointment still carries a heavy cost.

Tesla is next up, reporting Wednesday after the close. As of now, the chart looks constructive, but earnings will determine whether that strength holds.

The Takeaway

Since Thursday, the surface has improved:

volatility has eased

futures have lifted

leadership looks steadier

But underneath, catalysts remain active.

Earnings are front and center now. And while the market hasn’t broken down further, it hasn’t broken out either.

This is still a trader’s tape—event-driven, level-sensitive, and short-term reactive.

Know what’s reporting. Define your risk. Stay focused on what’s moving—not what’s supposed to.

💬 If you’d like to see more of these short daily recaps here on Substack, drop a quick comment or tap the ❤️ at the top of the page. Your feedback helps shape what I share next.

Looking For More?

Elevate Your Trading Adventure Even Further With These Offerings.

EpicTrades Options Newsletter

Real-time trade ideas and insights, providing actionable trading insights focusing on options trades with short-term horizons, aiming to capitalize on weekly market movements.

The approach includes detailed reasoning for trades, specific options, and profit targets. It focuses on quick gains with a minimal time commitment from subscribers.

The Inner Circle

The Inner Circle is a Virtual Trading Floor (VTF) at T3 Live. I’ve been working and trading with this group since 2022. You may have noticed the logo in the watermarks on my charts.

Founded by David Prince and led by him, Rick March, and Kira Turner, the Inner Circle is a community of elite traders, including hedge fund managers, family office heads, corporate executives, financial advisors, and even professional poker players.

Fundamental, Macro, and Technical Analysis all combine to find and discuss the best opportunities in current markets.

The Disclosures

***This is NOT financial advice. This is NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.

This article comes at the perfec time! What if Apple hadn't reasserted leadership like that?