Profit Taking Arrives

Market Update May 23, 2024

The Markets

NVDA posted blockbuster earnings.

It was another ‘beat and raise’ quarter for the third-largest company in the world, which also announced a 10 for 1 stock split. The stock was up 12% at its highest point today.

Meanwhile, most other stocks sold off after gapping higher at the open. This is what we call ‘a day to take notice.’ The charts aren’t exactly broken. QQQ is just now testing its 8-day MA for the first time since it crossed above it three weeks ago.

But the selling is notable. As are the large, bearish engulfing candles. Let’s go to the charts.

The Charts

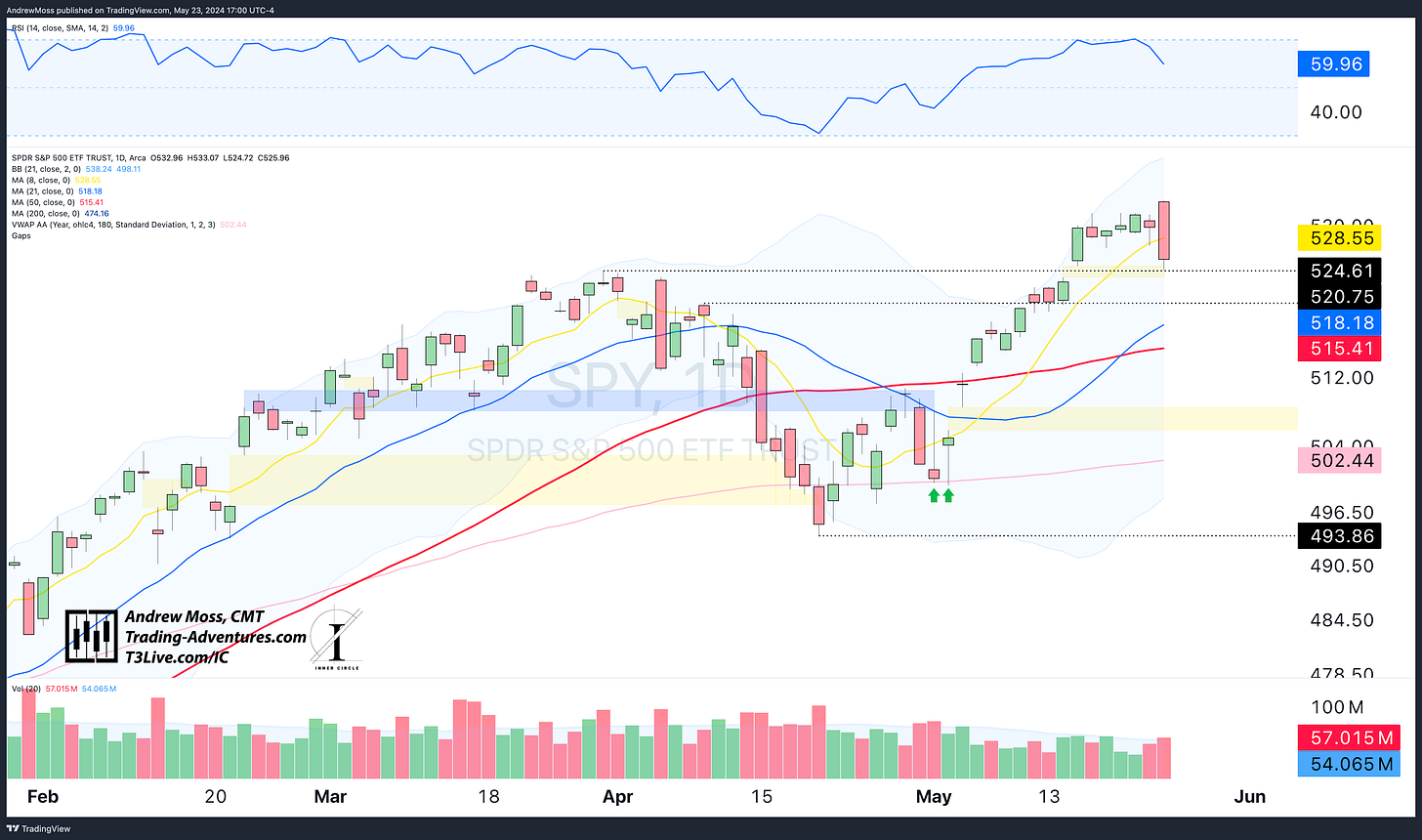

SPY Today’s move completely eclipsed all price action of the previous six days. The pivot high of $520.75 on March 28 held the first test. The bearish engulfing candle closed below the 8-day MA and near the slight gap from May 15.

Now, we see if the pivot test will be enough to send prices back up. Does it need to fill the gap first? Or, potentially, even a deeper test toward the 21- and 50-day MAs.

QQQ held up a bit more strongly, closing above its 8-day MA, but persistent selling remained the dominant theme for the day. The $449.34 pivot high, also from late March, is the next potential support level below.

IWM opened at the underside of its 8-day MA and moved steadily lower from there, reaching both the 21- and 50-day MAs before the close. That’s a lot of chart damage in two days, and now this one will likely take time to rebuild and repair.

DIA It’s a nasty move for the Dow 30 today as they bridge the gap between the 8 and 21-day MAs.

TLT held up better than stocks today and is still resting at resistance. There’s still a chance for this one to break higher. Staying above the 50-day and 21-day MAs will be the key.

DXY US Dollar futures were stronger but stayed below the falling 21-day MA. Stocks will want a Dollar reversal lower very soon.

BTCUSD is possibly giving up a bit too much of the breakout move. The nearby pivot and 8-day MA are the spots to watch overnight.

The Trade

The trade now is caution and an open mind. But those are two things that should always be kept close.

Before today, SPY and QQQ showed about as bullish a consolidation as possible. Both were in a tightening range, with breakout potential above recent pivot highs and without an extended RSI in overbought territory.

Then we find out that the NVDA earnings report is a ‘sell the news’ event — for just about everything except NVDA stock.

Surprising? Perhaps.

Caught off guard? Some certainly were.

A damaging sequence? It shouldn’t have been.

‘Trim and trail’ and ‘Always manage your risk’ often sound cliché and overused. But there is much truth and utility in those words. These are the tools that help minimize the damage of days like this.

When we remember them alongside these thoughts from Mark Douglas, we’re a step closer to excellent, profitable trading.

—Anything can happen.

—You don’t need to know what is going to happen next in order to make money.

Mark Douglas

Now, as always, we see what comes next while remembering that this doesn’t have to be an all-or-nothing scenario. Exposure can be adjusted more like a volume knob than an on/off switch.

Adding to positions in pieces or tiers is helpful. The same is true when taking them off. Trimming some into strength and securing some profit makes it easier to add back on the dips.

So we’ll take it in stride and follow the process. If you missed that article on Tuesday, you can find it here.

Plan > Prepare > Proceed - A Note About Process

See you Saturday morning for the Weekly Charts.

Elevate Your Trading

Education, training, and support for your Trading Adventure.

Options Trades - Weekly trade ideas are delivered to your email or text messages in language you can easily understand.

Check out EpicTrades from David Prince and T3 Live. Epic Trades from David Prince

Community - Are you an experienced trader seeking a community of professionals sharing ideas and tactics? Visit The Inner Circle, T3 Live’s most exclusive trading room - designed for elite, experienced traders.

The Inner Circle at T3 Live

Prop Trading - Or perhaps you are tested and ready to explore a career as a professional proprietary trader? 3 Trading Group has the technology and resources you need.

Click here to start the conversation:

T3TradingGroup.com

The Disclosures

***This is NOT financial advice. This is NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.

Andrew Moss is an associated member of T3 Trading Group, LLC (“T3TG”), an SEC-registered broker/dealer and member of FINRA/SIPC. All trades placed by Mr. Moss are done through T3TG.

Statements in this article represent that person’s opinions only and do not necessarily reflect those of T3TG or any other person associated with T3TG.

Mr. Moss may hold an investment position (or may be contemplating holding an investment position) that is inconsistent with the information provided or the opinion being expressed. This may reflect the financial or other circumstances of the individual, or it may reflect some other consideration. Readers of this article should consider this when evaluating the information provided or the opinions being expressed.

All investments are subject to the risk of loss, which you should consider in making any investment decisions. Readers of this article should consult with their financial advisors, attorneys, accountants, or other qualified investors before making any investment decision.

POSITION DISCLOSURE

May 23, 2024, 4:00 PM

Long:

ENVX0621C10, HOOD0621C20, IMNM, LLY, PANW, PANW0621C325, VKTX0621C85

Short:

Options symbols are denoted as follows:

Ticker, Date, Call/Put, Strike Price

Example: VXX1218C30 = VXX 12/18 Call with a $30 strike