Pullback in Progress: Is This the Start of Something Bigger?

Heavy selling hits risk assets, but major indexes hold key levels. Selectivity and structure take the lead.

The Markets

Sellers took control today. SPY -1.19%, QQQ -2.03%, IWM -1.73%.

Risk was off across the board, with broad weakness in mega caps, small caps, and especially crypto, where selling accelerated into key breakdowns. Bitcoin plunged 5.5%, now down 14.5% over the last eight sessions. Ethereum fell 11%. Solana dropped 8%.

These moves took crypto majors below all key moving averages and through important technical levels.

In equities, the MAG 7 was mostly red, with AAPL the lone standout at +0.37%.

The rest of the group slid between 1–5%. GOOGL -2.18%, META -1.63%, MSFT -0.52%, NVDA -3.96%, now closed below its 8-day MA. TSLA gave up early strength and dropped 5.21% heading into expected news on Elon’s pay package. Speculative pockets got hit hard—many Quantum names fell as much as -10%, with RDDT also deep in the red at -8.35%.

Financials (XLF) printed an outside day but remain below all key MAs. Housing (XHB) was flat, barely hanging onto its 200-day MA.

And yet, despite the bloodbath tone echoed on financial media and X, the broader context helps. From recent highs, SPY is down just 2.19% and still above the 21-day. QQQ is down 2.91%, 7 points above its 21-day.

This isn’t a crash. It’s a pause—and potentially a reset.

Saturday’s 📈Weekly Charts📉 thread flagged two important dynamics:

“Internal breadth indicators are lagging… a caution flag that not everything is participating.”

We’re seeing that play out now. Breadth remains narrow. Crypto exploded—to the downside. Momentum is still present, but it’s increasingly selective.

From a weekly candle perspective, there were clues:

SPY printed a doji just under an extension level, signaling indecision or exhaustion.

QQQ gapped higher but closed well off the highs, forming a potential shooting star—now getting confirmed.

DIA showed a similar weekly setup, also confirming today.

IWM remained a laggard and continues to struggle for traction.

Taken together, these weekly candles suggested that short-term exhaustion is surfacing across multiple leadership areas.

The Charts

SPY settles back between the 8 and 21-day MAs while still holding above the October highs. Short-term momentum has been extinguished. But this is far from being a broken chart.

QQQ fell a little further, nearly closing the gap, but is still further above its 21-day MA and the October high.

IWM has fared worst, dealing with a smoother and steadier decline that has taken below the 8, 21, and 50-day MAs.

DIA like the other large-cap indices, now sits between the 8 and 21-day MAs.

BTCUSD has endured two days of relentless selling. It has lost the 200-day MA and all other key MAs. It’s down -14.5% from the late October pivot high and -21% from the all-time high.

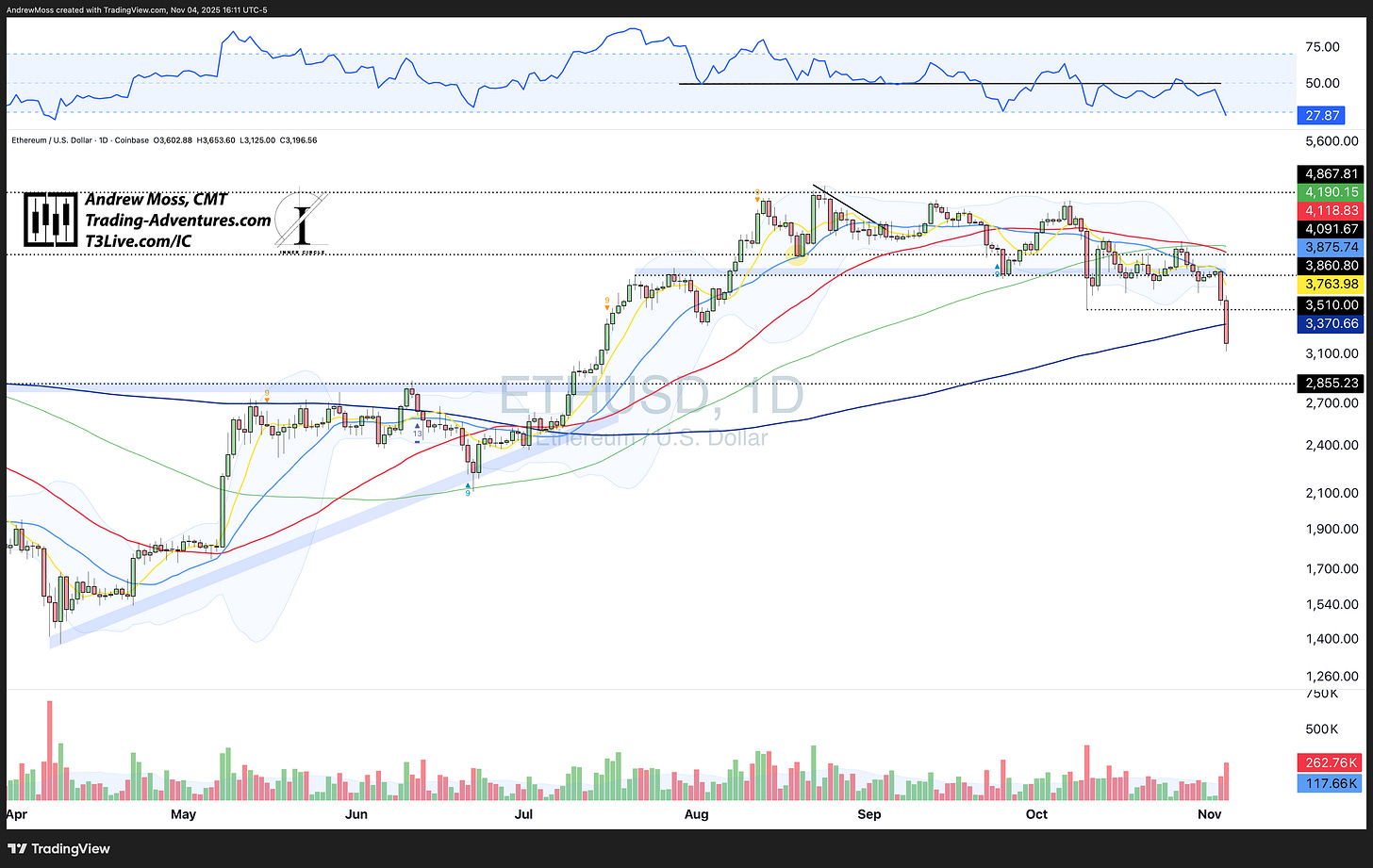

ETHUSD is also down sharply and is below all key MAs. There is a pivot at $2855 for potential support. Testing that level would mean a -42% move from the August high — a reminder that cryptocurrencies are still swift and volatile movers.

DXY meanwhile, continues to climb, now nearly testing the $100.055 pivot and 200-day MA.

The Trade

This is where opportunity and caution collide.

The charts are pulling back—some in orderly fashion, others more sharply—but not breaking down en masse. This environment still favors selectivity. There’s momentum in places, but it’s thinning. Breadth deterioration and failed breakouts make that clear.

My approach here: reduce exposure where setups are breaking, tighten up risk, and stalk clean structures near key support for new longs entries or strategic re-entries.

Choose wisely. Manage risk. Stay nimble.

Note: there will not be a regular Market Update or Weekly Chart article this week due to some pre-planned time away. There may be brief, intermittent updates if the market situation dictates.

Looking For More?

Elevate Your Trading Adventure Even Further With These Offerings.

EpicTrades Options Newsletter

Real-time trade ideas and insights, providing actionable trading insights focusing on options trades with short-term horizons, aiming to capitalize on weekly market movements.

The approach includes detailed reasoning for trades, specific options, and profit targets. It focuses on quick gains with a minimal time commitment from subscribers.

The Inner Circle

The Inner Circle is a Virtual Trading Floor (VTF) at T3 Live. I’ve been working and trading with this group since 2022. You may have noticed the logo in the watermarks on my charts.

Founded by David Prince and led by him, Rick March, and Kira Turner, the Inner Circle is a community of elite traders, including hedge fund managers, family office heads, corporate executives, financial advisors, and even professional poker players.

Fundamental, Macro, and Technical Analysis all combine to find and discuss the best opportunities in current markets.

The Disclosures

***This is NOT financial advice. This is NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.

The timing on TSLA's drop is interesting considering the pay package uncertainy. Even with the broader selloff, that 5.21% move feels more event driven than macro. If the pay package gets resolved favorably, we could see a quick snapback.

The pullback feels sharp but not yet destructive. Markets are digesting stretched momentum while leadership narrows and risk appetite fades around the edges. Beneath the noise, structure still matters. SPY and QQQ holding above key moving averages keep this a controlled reset, not a breakdown.