Put It In Neutral

The Markets

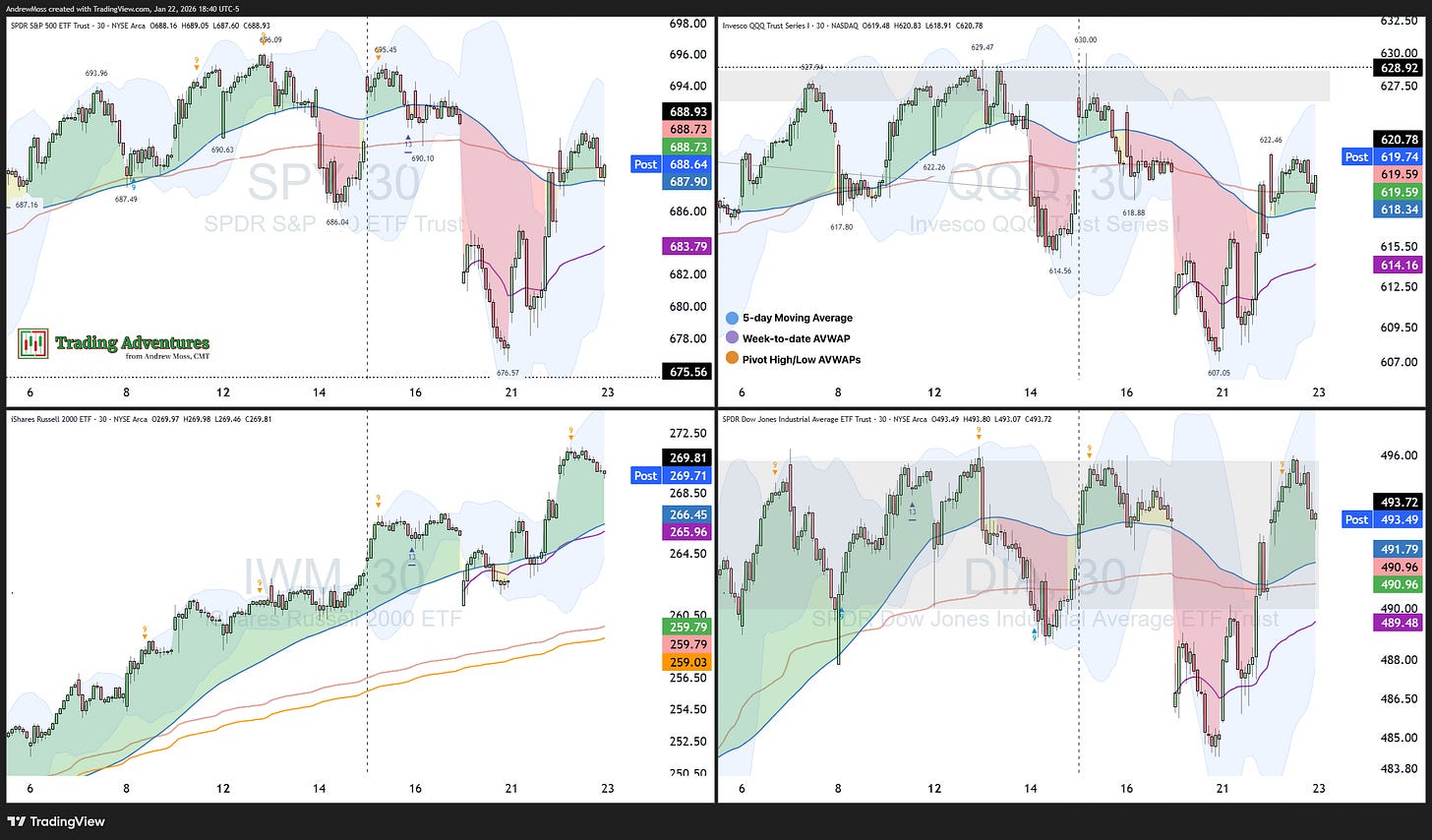

Large cap stocks (SPY & QQQ) have shifted back into neutral after hitting reverse briefly on Tuesday.

The sharp selloff has been largely recaptured, leaving the two headline indices just above their mostly flat 5-day moving averages and year-to-date anchored VWAPs. So they’ve made progress, but so far the roadmap is left in a state of indecision.

Meanwhile, IWM & DIA didn’t need any extra time to make up their minds. The small caps continue to show impressive leadership and resilience by hitting another new high today with the Dow 30 knocking on the door.

The Mag7 also jumped ahead leaving two days of selloff and consolidation behind and isolated with a gap on each side. It’s a start, but the 8, 21, and 50 day averages are all still declining and likely to provide a challenge for any further advance.

Over the last few updates we’ve considered:

The bullish nature of the markets from a structural standpoint.

The lack of participation from one key component.

And the recent favoritism toward traditionally defensive sectors.

Yet, the question remains—

Is this normal, healthy rotation or an early indication of something else.

Here are the daily charts to add to the story.

The Charts

SPY was positive on the day, but the price action signals indecision with the open and close near the middle of the range despite some movement above and below. The 8 and 21-day MAs sandwich the action, and RSI is in the center of 0-100.

QQQ opened and what would become the high of the day and managed to close just above the 8/21-day MAs. But the indecision persists here as well, indicated by a flat 50-day MA and Bollinger Bands (accentuated for this chart) that haven’t moved meaningfully higher or lower in months.

IWM still has the leadership spot. But it did print a potential reversal candle today. We’ll see how that resolves.

DIA is back in the box, probing recent highs today, but unable to pass above.

The Trade

While the broad market still has something to prove in terms of recovering from Tuesday’s selloff, the story beneath the surface is more nuanced.

There’s clear disparity. Many names — FTAI, NOC, SNDK, ULTA, WDC — are showing standout strength. Others, like AAPL, MSFT, and NFLX, remain rangebound or susceptible to further weakness.

This page is a Market Update — that’s the focus. But don’t let the neutral tone of the indices suggest there’s nothing to do.

This environment rewards selectivity. Focus on setups with structure, trend alignment, and relative strength. The indices may be murky, but the opportunities are there.

For steady, idea-driven setups in this type of market, we’re sharing plenty at Alphatrends.

Important: This content is provided for educational purposes only. If you’re reading this online, please review the full disclosure here.

Solid take on navigating choppy conditions. The emphasis on selectivity when broad indices are stuck is really the key, alot of people freeze up when SPY/QQQ go neutral but that dispersion you mentioned creates way more alpha opportunities than a trending market. I've noticed the same thing with small caps lately, they just keep grinding while everyone watches mega cap tech spin its wheels.