Revisiting Volatility

Monday Market Update - July 22, 2024

The Markets

“The constant lesson of history is the dominant role played by surprise. Just when we are most comfortable with an environment and come to believe we finally understand it, the ground shifts under our feet.”

Peter Bernstein

“Things that have never happened before happen all the time.”

―Morgan Housel, The Psychology of Money

Over the weekend, President Biden announced that he would not seek reelection and instead pledged his endorsement of Vice President Kamala Harris as his successor.

This was not an unprecedented event, but it has been unseen since Lyndon Johnson in 1968.

Then, on Friday, a defective update to software from CrowdStrike CRWD (a cybersecurity firm) rendered Microsoft $MSFT Windows-based computers worldwide inoperable. The effects were far-reaching, forcing air travel to a halt while disrupting banking, healthcare, and many other services.

And all this came on the heels of the failed assassination attempt on US Presidential Candidate Donald Trump barely more than a week ago.

While these types of events are not entirely unheard of, they are all unique in specifics and timing. And they came (mostly) without warning, the combined impact re-introducing volatility to the marketplace.

The VIX volatility index had been low and trending lower for many weeks before jumping up 38%.

Interestingly, it has turned back from a trendline area that has produced similar downturns in the past.

The VIX hasn’t gotten a lot of mention on these pages recently. And as long as it stays below the red line, chances are it won’t be mentioned much more.

However, if it moves above and stays there, perhaps it would be worth keeping a closer watch.

The Charts

SPY is back in the middle ground — between the 8 and 21-day MAs — after the RSI perfectly held the 50% level. The direction from here remains TBD.

QQQ remains below the short-term momentum indicators - the 8 and 21-day MAs - but did get back over the swing low anchored VWAP. That’s a start. It will need to get north of $487 first.

Or, below is potential support near the 50-day MA at $471, accompanied by a gap.

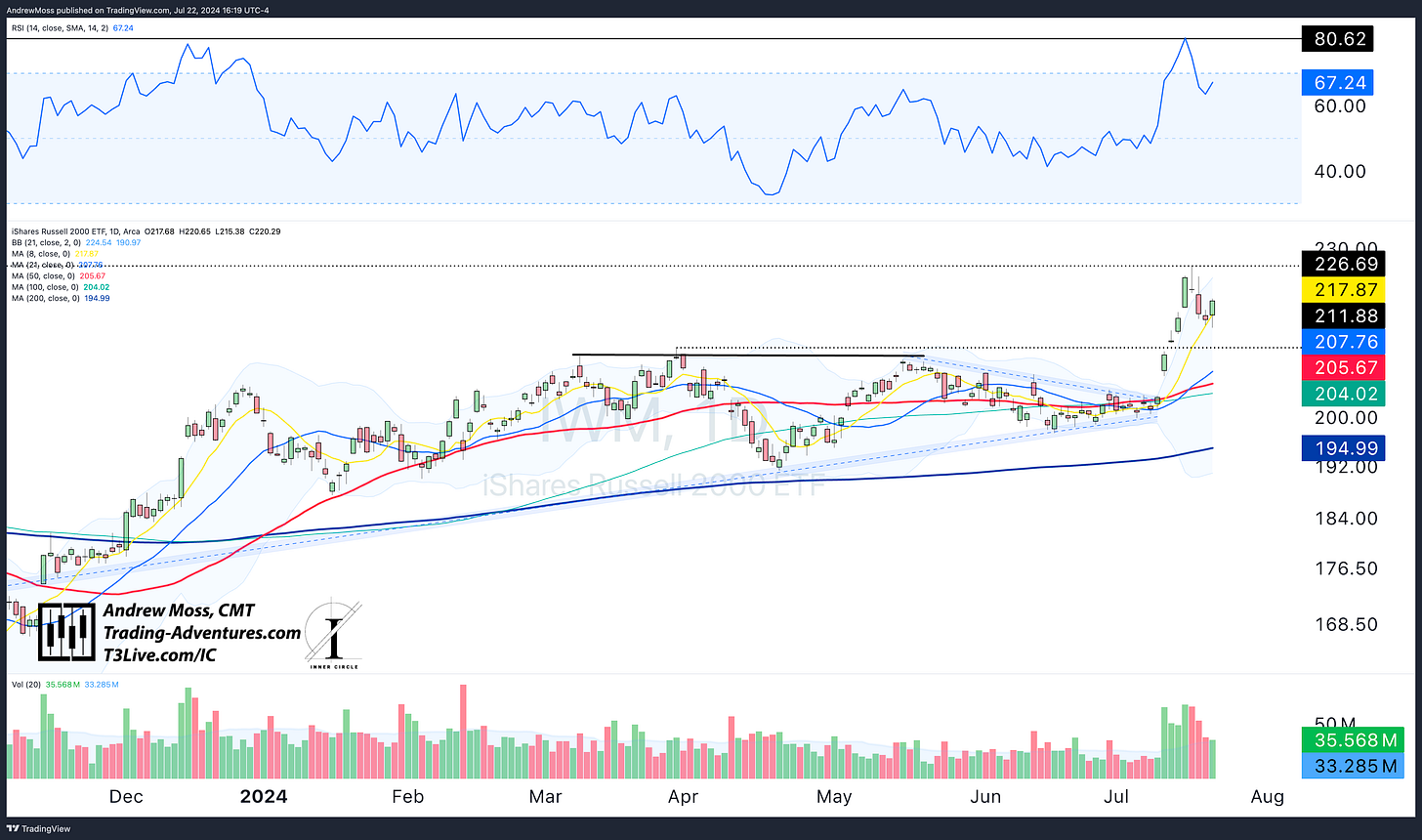

IWM so far is exhibiting a textbook test of the 8-day MA after a very strong, quick move higher. Strength is intact.

DIA put the brakes on the move lower today, just before hitting the $401 pivot high.

TLT touched both the 8-day MA above and the 50-day MA below as it tried to choose a direction.

DXY US Dollar futures were again held below the 200-day MA and swing low AVWAP.

BTCUSD keeps grinding higher, now less than 10% away from recent highs.

The Trade

AAPL, NVDA, SPY (mentioned here last week), and many others have gotten a bounce from noted support levels. Now we see if they hold and continue. Or do they come back down to test the lows again?

These bounces give the tactical, cash-flow-oriented trader a chance to take some profit and reduce the position size. The emerging political uncertainty and increased volatility will have some traders thinking similarly.

Elevate Your Trading

Education, training, and support for your Trading Adventure.

Options Trades - Weekly trade ideas are delivered to your email or text messages in language you can easily understand.

Check out EpicTrades from David Prince and T3 Live. Epic Trades from David Prince

Community - Are you an experienced trader seeking a community of professionals sharing ideas and tactics? Visit The Inner Circle, T3 Live’s most exclusive trading room - designed for elite, experienced traders.

The Inner Circle at T3 Live

Prop Trading - Or perhaps you are tested and ready to explore a career as a professional proprietary trader? 3 Trading Group has the technology and resources you need.

Click here to start the conversation:

T3TradingGroup.com

The Disclosures

***This is NOT financial advice. This is NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.

Andrew Moss is an associated member of T3 Trading Group, LLC (“T3TG”), an SEC-registered broker/dealer and member of FINRA/SIPC. All trades placed by Mr. Moss are done through T3TG.

Statements in this article represent that person’s opinions only and do not necessarily reflect those of T3TG or any other person associated with T3TG.

Mr. Moss may hold an investment position (or may be contemplating holding an investment position) that is inconsistent with the information provided or the opinion being expressed. This may reflect the financial or other circumstances of the individual, or it may reflect some other consideration. Readers of this article should consider this when evaluating the information provided or the opinions being expressed.

All investments are subject to the risk of loss, which you should consider in making any investment decisions. Readers of this article should consult with their financial advisors, attorneys, accountants, or other qualified investors before making any investment decision.

POSITION DISCLOSURE

July 22, 2024, 4:00 PM

Long:

Short:

Options symbols are denoted as follows:

Ticker, Date, Call/Put, Strike Price

Example: VXX1218C30 = VXX 12/18 Call with a $30 strike