Rotation or Retreat?

Staples and metals rise while mega caps break down

Subscriber Note:

A quick reminder that the Alphatrends offer is currently open for a limited time. Details were shared directly with subscribers and can be found here.

The Markets

Tuesday’s session brought heavy selling across the board, with major indexes closing sharply lower — a move attributed to renewed tariff threats and geopolitical tension.

DIA: -1.73%

SPY: -2.04%

QQQ: -2.12%

IWM: -1.20%

Bitcoin: -3.15%

VIX: +7.7%

That’s broad-based weakness, and it’s being led lower by the names that dominate headlines and index weightings.

Within MAGS, the damage was widespread:

AAPL: -3.46%

AMZN: -3.40%

GOOGL: -2.42%

META: -2.60%

MSFT: -1.16%

NVDA: -4.38%

TSLA: -4.17%

This ties back to a post shared last week, outlining a core tension in the market: strong structure, breadth, and rotation beneath the surface — but a notable lack of participation from the MAG7.

Two key questions presented themselves:

Would the leaders catch up and complete the puzzle?

Or would their continued weakness start to weigh on everything else?

Today’s action leans decisively toward the latter.

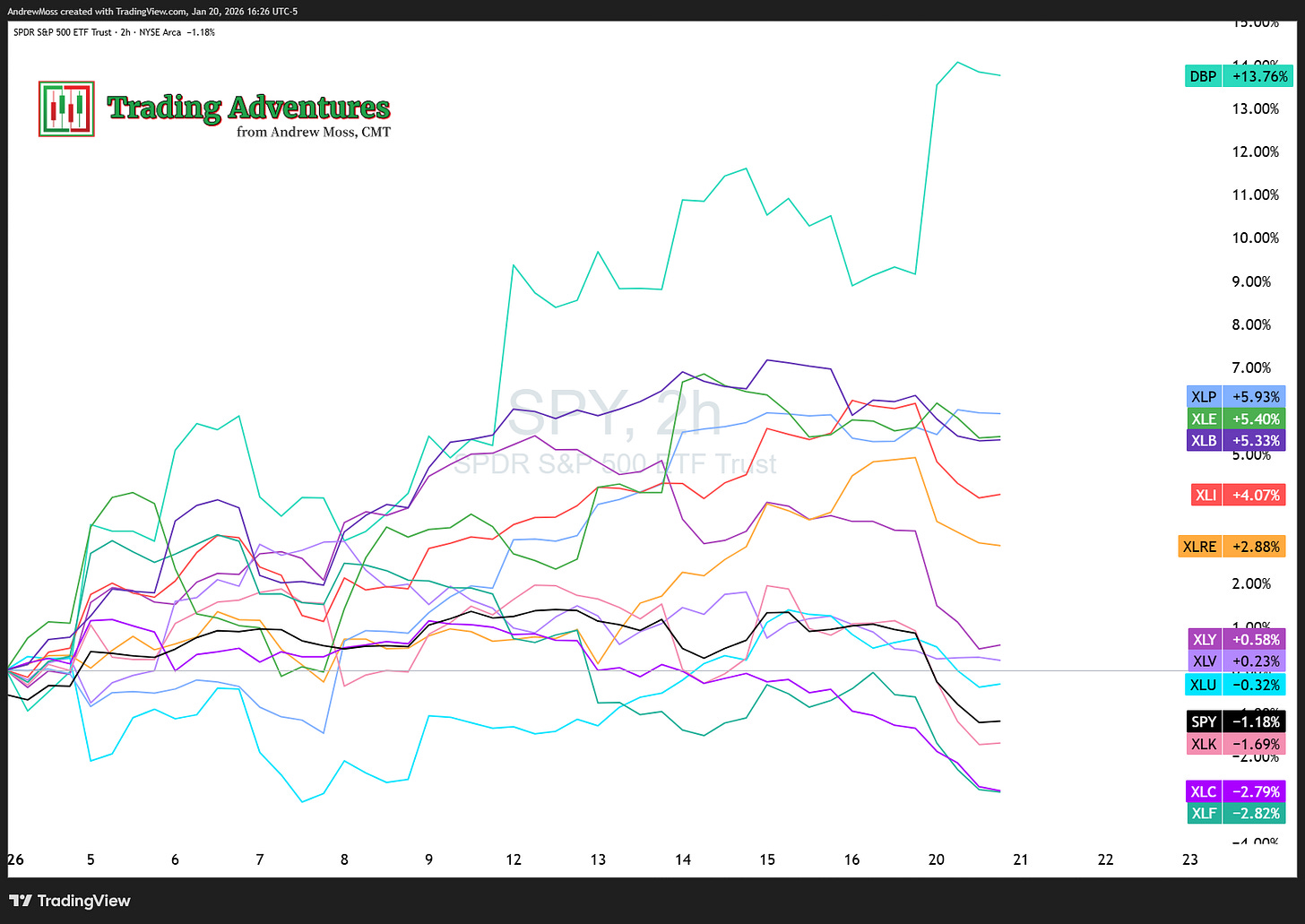

At the same time, the sectors leading YTD are all classic defensive groups:

Precious metals

Staples

Materials

Energy

Industrials

This isn’t aggressive risk-on rotation — it’s (at least temporarily) a move toward safety.

To highlight one example: XLP (Consumer Staples) recently bottomed at 76.51 and moved to an intraday high of 82.56 today — a 7.7% gain in just seven trading sessions. That kind of move from a defensive sector deserves attention.

So the puzzle continues to evolve.

We’re seeing strong YTD performance from areas of the market typically associated with caution.

And now the mega caps — which had already been lagging — are actively pulling the tape lower.

Whether this is a brief shakeout or a more meaningful change in tone, we’ll let price tell the story.

Let’s go to the index charts.

The Charts

SPY is now below the 8, 21, and 50 day moving averages, and the VWAP anchored from the November low. RSI has crossed down into the bearish bottom half. And today’s selling came on heavy volume. The next reference points below are the recent December low at 671.20 and the AVWAP from the August dip, currently near 667.

QQQ has broken sharply lower from the consolidation pattern, also on heavy volume and falling RSI. ~602 and 601.40—the August low AVWAP and December low— are potential levels of interest on further decline.

IWM continues to show strength, battling back from the opening gap down to close back above its rising 8-day MA. RSI is back below 70 while staying firmly in the upper half of the range. Volume was heavy. ~257.77 is the VWAP anchored from the December low, and the 21-day finished at 255.47 today.

DIA Add this one to the list of consolidation patterns now broken lower. It was able to stop the slide near the level of the Nov. high, 484.40.

TLT opened below recent support and stayed below for the session, exemplifying the importance of noting not only where price is in relation to the moving averages, but also the slope of those averages. Declining.

DX1! - Dollar futures once again failed to sustain the move above the declining 200-day MA.

BTCUSD was squarely rejected at the AVWAP from the high in October and is still moving lower.

The Trade

We’re seeing early signs of risk-off rotation into defensive sectors, with staples and hard assets leading while mega caps break down.

Index structure remains intact for now, but leadership has shifted.

If sellers maintain control beneath those levels, expect continued pressure — especially from the names that had been masking underlying strength.

No need to predict. Let price confirm. Respect risk. And let the strongest trends emerge.

The rest is noise.

Subscribers received a private Alphatrends update this week.

Important: This content is provided for educational purposes only. If you’re reading this online, please review the full disclosure here.

I am gonna miss reading these sir 🫡 I wish the best!