Stonks!

Monday Market Update

The Markets

Stonks are back!

Stonks are back?

What the heck are stonks?

"Stonks" is a deliberate misspelling of the word "stocks" that's used in internet slang to comment on the stock market or financial decisions in a humorous or ironic way. It's often used to refer to financial losses. The term originated from a 2017 meme that shows a cartoon person in a suit standing in front of a stock market graph with the caption "stonks"

GME stock was up over 100% at the highs today as renewed speculation came after the (in)famous Roaring Kitty made comments on X.com (formerly Twitter) for the first time in three years. AMC, another bastion of the 2021 meme stonk craze, was also up nearly 100% at one point today.

Yes, the animal spirits are alive and well.

In real stock news —

The major indexes lightly tap the breaks today after a strong move higher over the last two weeks. The timing is just right for this action, too. PPI and CPI data will be announced tomorrow and Wednesday, and Fed Chairman Powell will also speak tomorrow.

A little back-and-forth action ahead of those announcements is usual and expected.

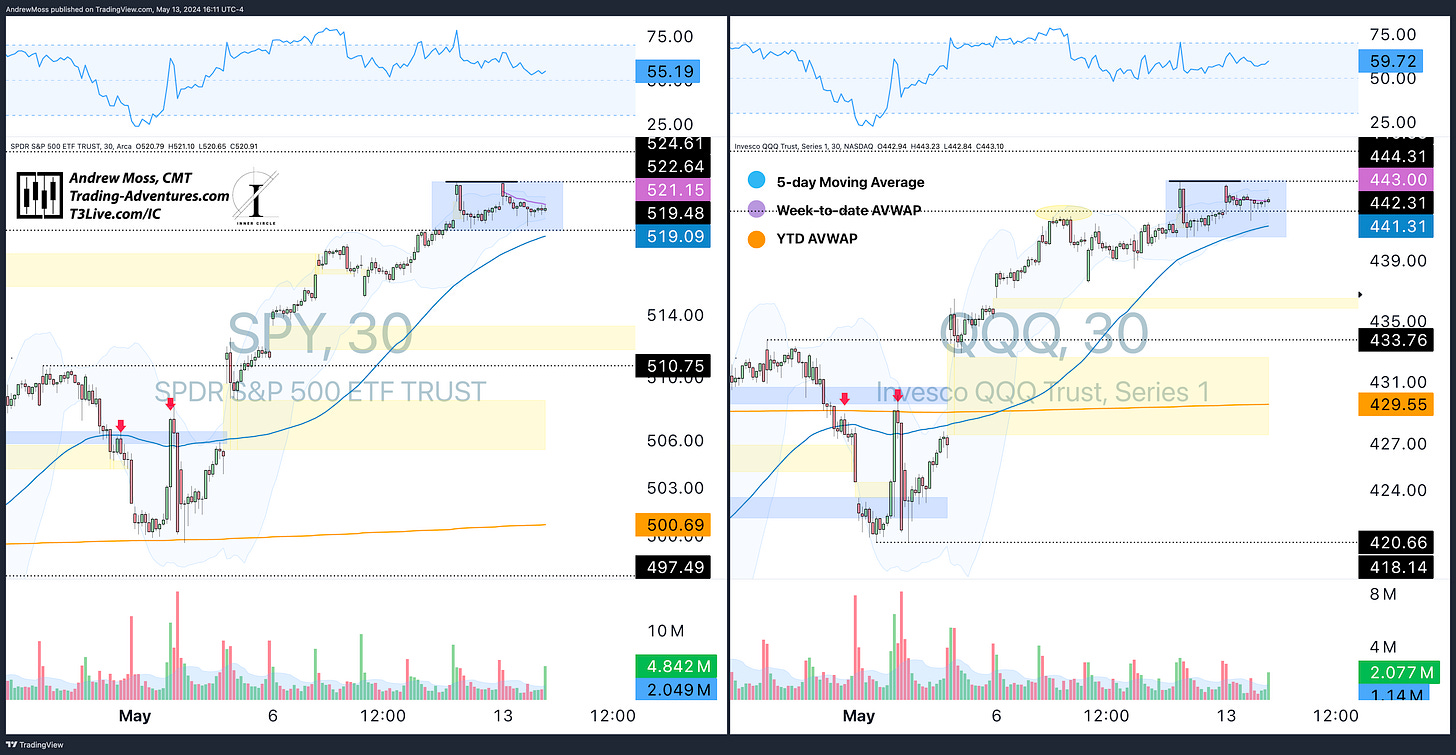

Here’s a look at the 30-minute chart of SPY and QQQ side by side —🗺️ The Roadmap.

Key components of this chart are the Week and Year-to-date anchored VWAPs, the 5-day Moving Average, and the various gaps and pivot points.

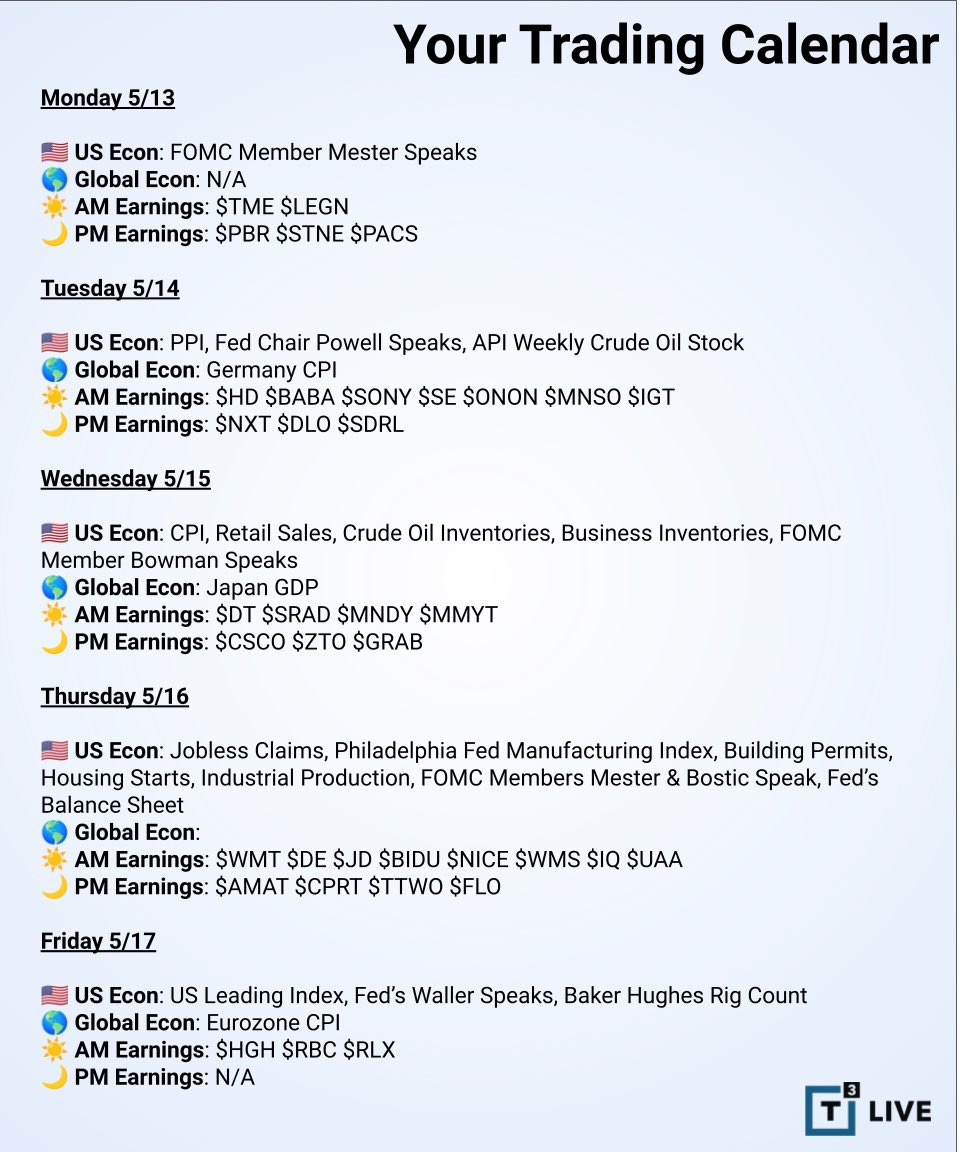

And the calendar for the week.

The Charts

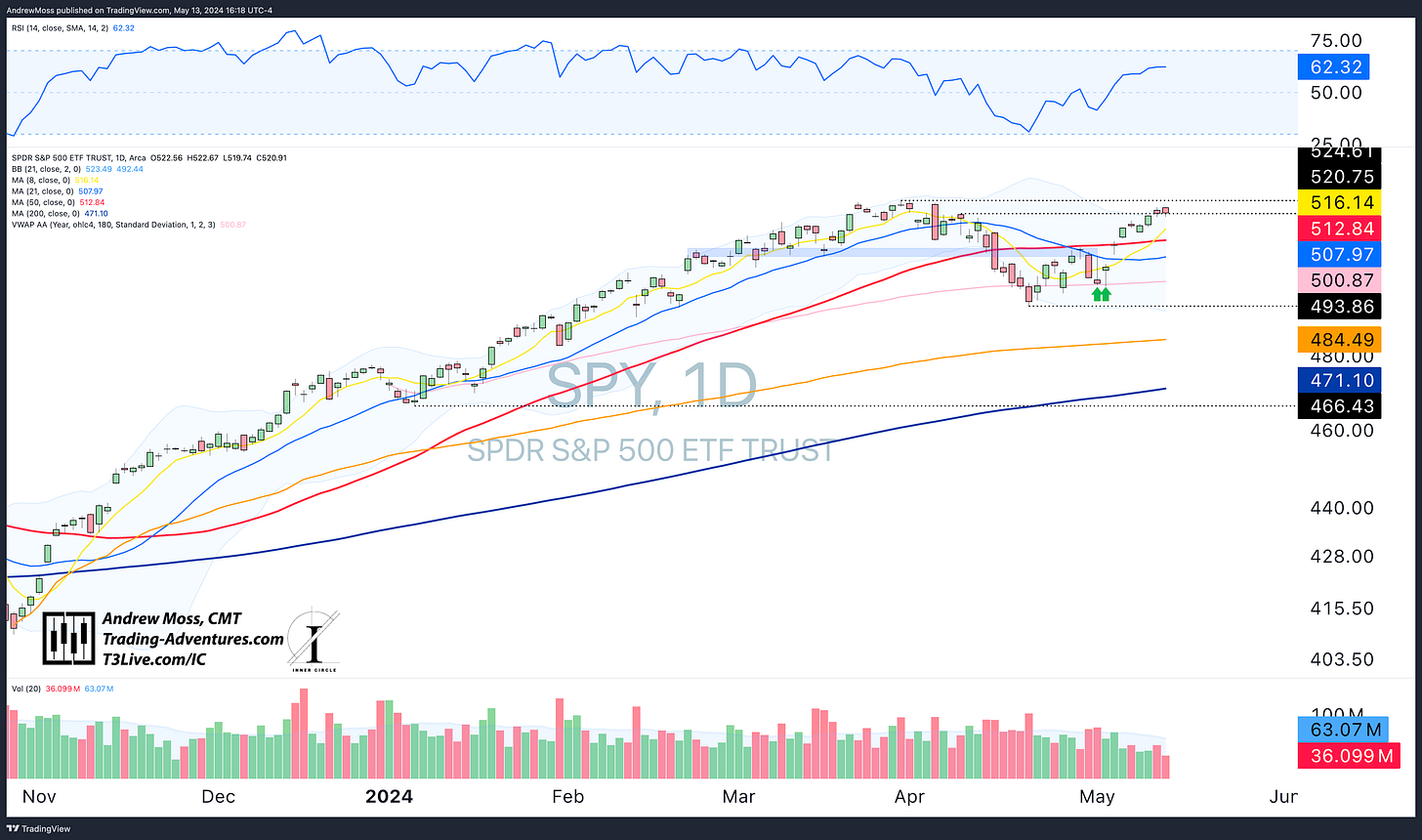

SPY managed to close just above the $529.75 pivot as we await PPI, CPI, and comments from the Fed Chairman.

QQQ is above the trendline and pivot level, technically confirming the breakout. Yet, it doesn’t feel very convincing as the price hovers just over the lines.

IWM printed an inside day with the 8-day MA continuing to rise underneath. It’s a bullish consolidation so far. Good economic news should help it clear the $206.97 pivot and improve the chart more. A bad reaction would likely result in a test of the 21-day MA and YTD AVWAP, both near $199.

DIA took a break and put in an outside day and bearish engulfing candle after moving higher eight days in a row. A close tomorrow that is below today’s would confirm the reversal pattern and put us on alert for a test of the various potential support levels below.

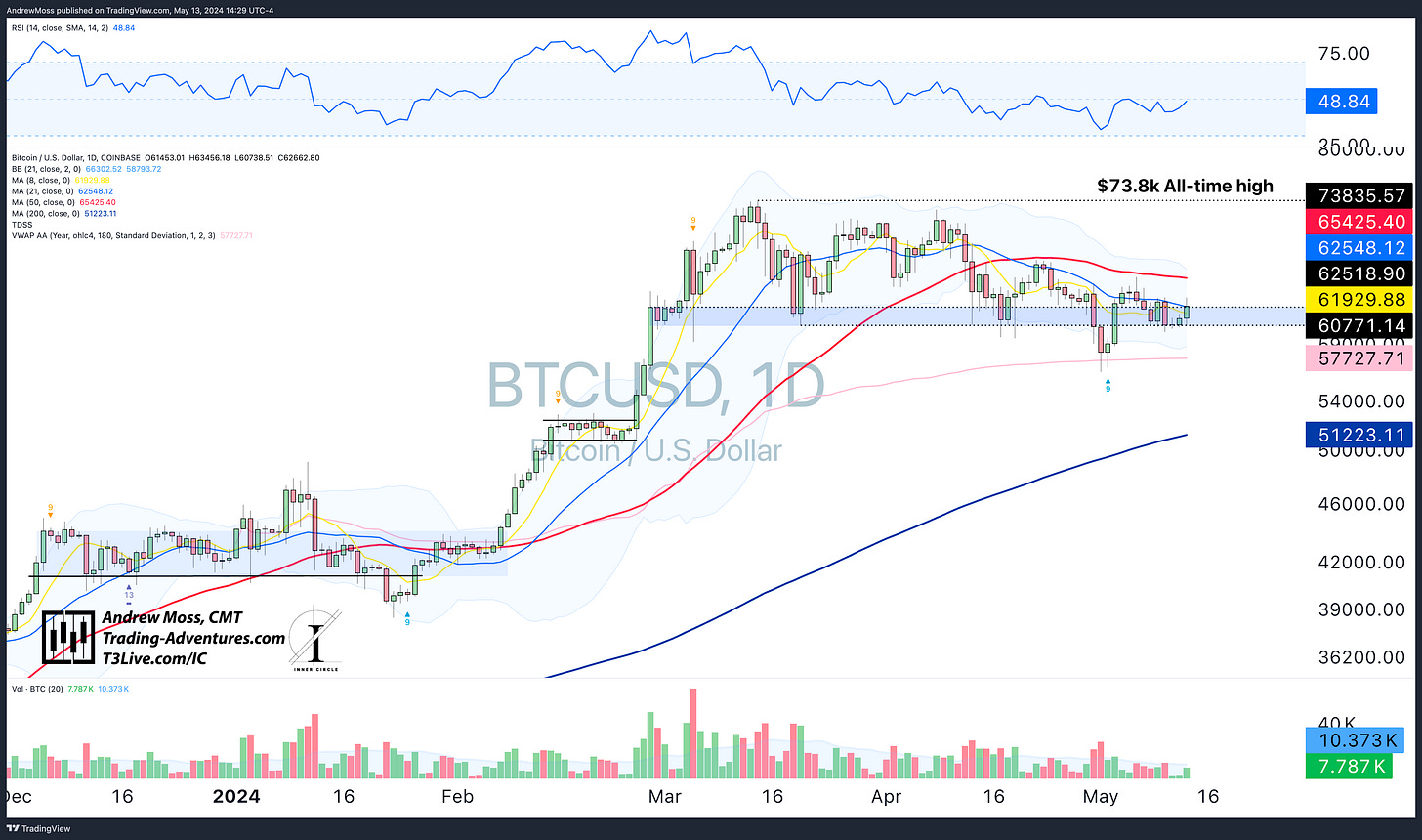

BTCUSD continues to find support, followed by a bounce, but so far, it has not been able to get back over the 50-day MA.

The Trade

A focus on specific trade ideas rather than broad market calls has been written about many times in the space over recent weeks. Other traders and analysts have made similar comments.

How many thought the specificity would drill all the way down to the meme stonks again?

Who knows?

A better question is: If this appetite for risk and speculation is back, will it spill over into other areas of the market?

And if the market goes on another meme-stonk-fueled rise, will the Fed be more or less inclined to cut rates in 2024?

Let’s hear your thoughts in the comments.

Elevate Your Trading

Education, training, and support for your Trading Adventure.

Options Trades - Weekly trade ideas are delivered to your email or text messages in language you can easily understand.

Check out EpicTrades from David Prince and T3 Live. Epic Trades from David Prince

Community - Are you an experienced trader seeking a community of professionals sharing ideas and tactics? Visit The Inner Circle, T3 Live’s most exclusive trading room - designed for elite, experienced traders.

The Inner Circle at T3 Live

Prop Trading - Or perhaps you are tested and ready to explore a career as a professional proprietary trader? 3 Trading Group has the technology and resources you need.

Click here to start the conversation:

T3TradingGroup.com

The Disclosures

***This is NOT financial advice. This is NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.

Andrew Moss is an associated member of T3 Trading Group, LLC (“T3TG”), an SEC-registered broker/dealer and member of FINRA/SIPC. All trades placed by Mr. Moss are done through T3TG.

Statements in this article represent that person’s opinions only and do not necessarily reflect those of T3TG or any other person associated with T3TG.

Mr. Moss may hold an investment position (or may be contemplating holding an investment position) that is inconsistent with the information provided or the opinion being expressed. This may reflect the financial or other circumstances of the individual, or it may reflect some other consideration. Readers of this article should consider this when evaluating the information provided or the opinions being expressed.

All investments are subject to the risk of loss, which you should consider when making any investment decisions. Readers of this article should consult with their financial advisors, attorneys, accountants, or other qualified investors before making any investment decision.

POSITION DISCLOSURE

May 13, 2024, 4:00 PM

Long: ENVX0621C10, GS0524P452.50, IMNM, IWM, SNAP06121C17, VKTX0621C85

Short:

Options symbols are denoted as follows:

Ticker, Date, Call/Put, Strike Price

Example: VXX1218C30 = VXX 12/18 Call with a $30 strike