📈Weekly Charts📉 August 23, 2025

Momentum builds, breadth expands, and Powell doesn’t stand in the way.

After weeks of indecision, this week delivered a strong rotation and clear signals of improving risk appetite.

The Dow reached an all-time high. Ethereum surged to new yearly highs. Small caps broke out. And across the board, relative strength charts confirmed the shift.

We’ll dig into the major indices, key sectors, crypto strength, breadth indicators, and more — plus what it means for the week ahead.

Let’s go chart by chart.👇

📊 Major Indices

Dow Jones Industrial Average (DIA)

We’ll start with the Dow Jones again.

Last week’s note said:

“The more times a level is tested, the more likely it is to give way.”

This week?

A strong breakout to new all-time highs.

Volume is big

RSI is only 61

Price is coming out of a 7-week consolidation

This has all the markings of a new leg higher.

Russell 2000 (IWM)

Small caps finally broke out.

This chart has been building pressure for weeks — and now it’s resolving higher.

✅ Clean break above multi-week resistance

✅ RSI rising but not overbought

✅ Rotation confirmed

Another test of the all-time highs should occur in time.

S&P 500 / SPDR S&P 500 ETF (SPX / SPY)

SPX / SPY didn’t seem quite as exciting, but it quietly put in another new high.

🟢 Not stretched

🟢 Not extended

🟢 Just grinding upward, one week at a time

Momentum without mania.

Nasdaq 100 (QQQ)

And here’s the other side of that rotation.

As small-caps, housing, and other related sectors were charging higher, large-cap tech took a back seat.

Still, there was strong buying off the lows of the week — but no new high.

🌍 Global View

All Country World ex-US (ACWX)

The rest of the world had a good week, too.

New highs

RSI confirming

Price riding high in the rising Bollinger Bands

The only potential issue is the steadily declining volume. But there could be many sensible explanations for that.

China Large-Caps (FXI)

Even China was finally able to close at another new high for the year.

The RSI still needs to get over the line to confirm the move in the coming weeks.

If not, it could be a sign of trouble.

If so, the next upside target is 42.70.

🧳 Bonds

Core U.S. Aggregate Bonds (AGG)

Trending better

20+ Year Treasury Bonds (TLT)

Holding steady

High-Yield Corporate Bonds (HYG)

The clear standout, breaking out 📈

Currencies & Crypto

DXY – U.S. Dollar Index

The Dollar – DXY $DX1!

Stuffed again at the 20-week MA / Bollinger Band midline.

Goin’ nowhere.

BTC – Bitcoin

BTC is back in the box after threatening a move lower.

Earlier this week, I covered the likelihood of a ‘fake out’ move lower in this video:

ETH – Ethereum

ETH isn’t faking it. 📈

Tickling the ATH with a move up to $4,888 yesterday evening. That’s more than 250% higher than the April low.

What a move!

LTC – Litecoin

LTC has an incredibly bullish-looking chart, but similar to BTC, it’s having trouble getting moving.

If it ever does, it has the potential to double pretty quickly.

XRP – Ripple

Speaking of a double —

This bull pennant in XRP says that a move from ~$3 to ~$6 is doable. IF it ever breaks out.

🟡 This week, it threatened to negate this pattern as it moved lower to test the rising 10-week MA.

🟡 But, so far, it’s been able to get back in the pattern.

⚖ Commodities

Broad Commodities Index (GSG)

Bounced from the 40-week to the 10-week. Still no trend.

Agriculture ETF (DBA)

Breakout confirmed📈

Base Metals ETF (DBB)

Steady, slow, and getting stronger

Unlock Market-Beating Options Trades with EpicTrades – Join The Winning Streak Today

💥 Real setups. Real follow-through.

Recent winners include CRWD calls for a quick 29.9% gain, and CRWV calls for +62.5% in ONE day!

📩 Want real trades like this — with structure, targets, and real-time alerts?

Join here → t3live.com/epicoffer

Relative Strength 💪

Relative Strength, Sector Rotation, and the Power of Confluence

We’ve talked a lot about relative strength recently — and for good reason. It’s where leadership is born and confirmed.

Last week, we noted the potential for a technical shift toward value, as measured by the IWF/IWD ratio. Powell’s speech at Jackson Hole and broader macro signals added anticipation.

This week, we saw that shift begin to play out:

The IWF/IWD ratio reversed and followed through lower.

The test of the rising 10-week MA could become a pivotal moment.

Now we’ll see if this pause is just that — or if it marks a larger turning point.

Market Context and Confirmation

We also asked last week whether Powell would be dovish, hawkish, or stay neutral.

Now we know — dovish was the theme.

And with that came outperformance from rate-sensitive sectors, including:

Small caps

Housing

Value

Here’s the takeaway:

🟤 The technical setup was already leaning this way.

🟤 Price action started to show it last week.

🟢 And now, macro confirmation aligns — Jackson Hole, earnings, and fundamentals.

This is how a plan comes together.

Risk On? Risk On.

Another data point for the bulls: The XLY/XLP ratio continues to climb, while SPHB/SPLV — a pure ‘risk on vs. low vol’ metric — also made a sharp recovery.

Momentum in these ratios supports the broader market strength we’ve been tracking.

Consumer Discretionary vs. Staples (XLY/XLP)

High Beta vs. Low Volatility (SPHB/SPLV)

Cap Weight vs. Equal Weight — The Rotation Broadens

Another important lens on what’s happening beneath the surface:

Cap-weighted vs. Equal-weighted indexes.

SPY/RSP and QQQ/QQEW are both showing signs that smaller names are gaining traction.

This reinforces the value and small-cap leadership themes we’ve already covered.

Breadth is improving — and participation is expanding.

For more on Relative Strength, see the Chart School lesson:

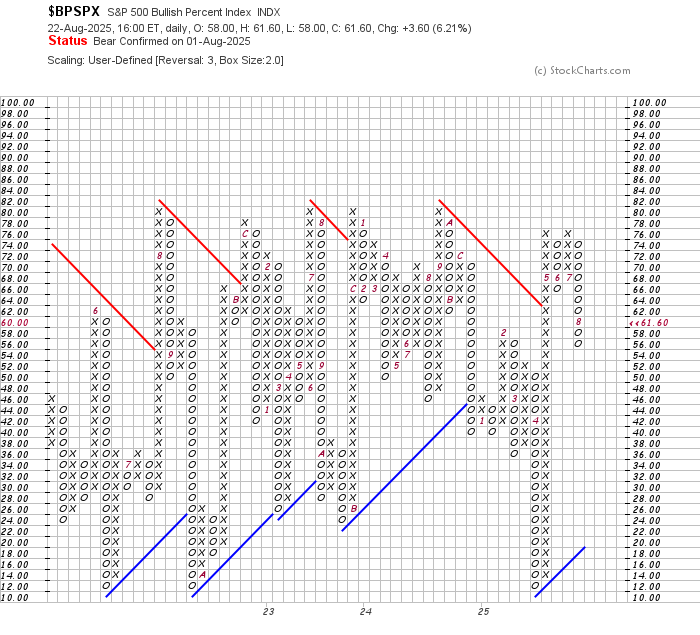

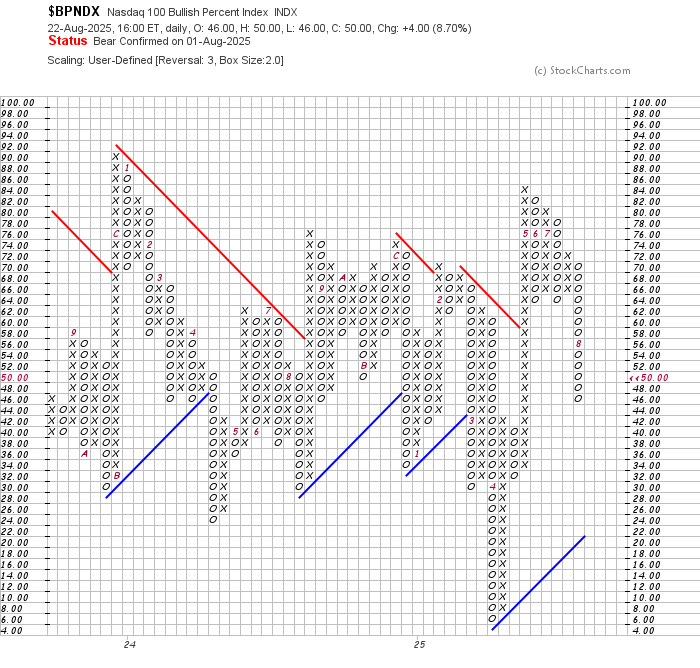

🧮 Breadth & Participation

Participation Metrics Are Surging

In case there was any doubt about internal strength:

✅ Rotation into DIA

✅ Value strength via IWF/IWD reversal

✅ Small-cap momentum — IWM and equal-weight comparisons (SPY/RSP, QQQ/QQEW)

And now, to add more fuel:

📈 A sharp jump in the percentage of S&P 500 stocks trading above key moving averages:

Last week: ~58% above 50-day, 60% above 200-day

This week: 70% and 68%, respectively

This is precisely the kind of broadening participation we want to see when market conditions are improving.

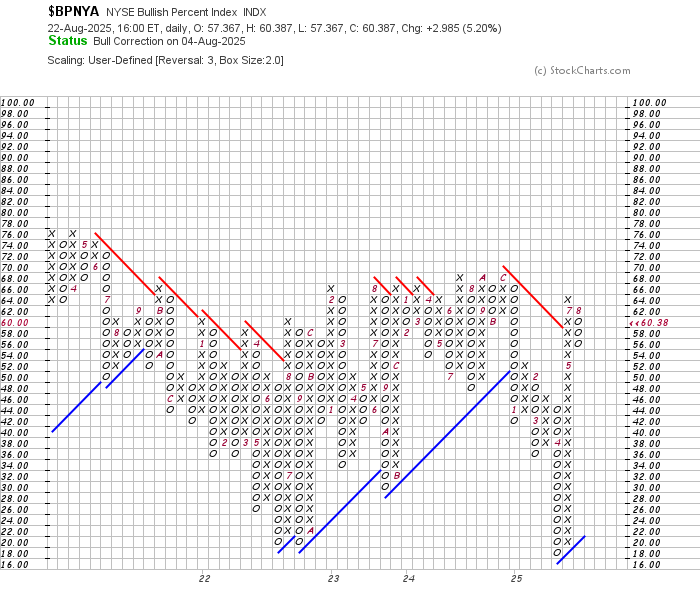

Bullish percent indexes paused their decline.

Still healthy under the surface.

Understanding the Bullish Percent Index

A timeless signal of internal strength, built on point & figure roots.

Read the full article here.

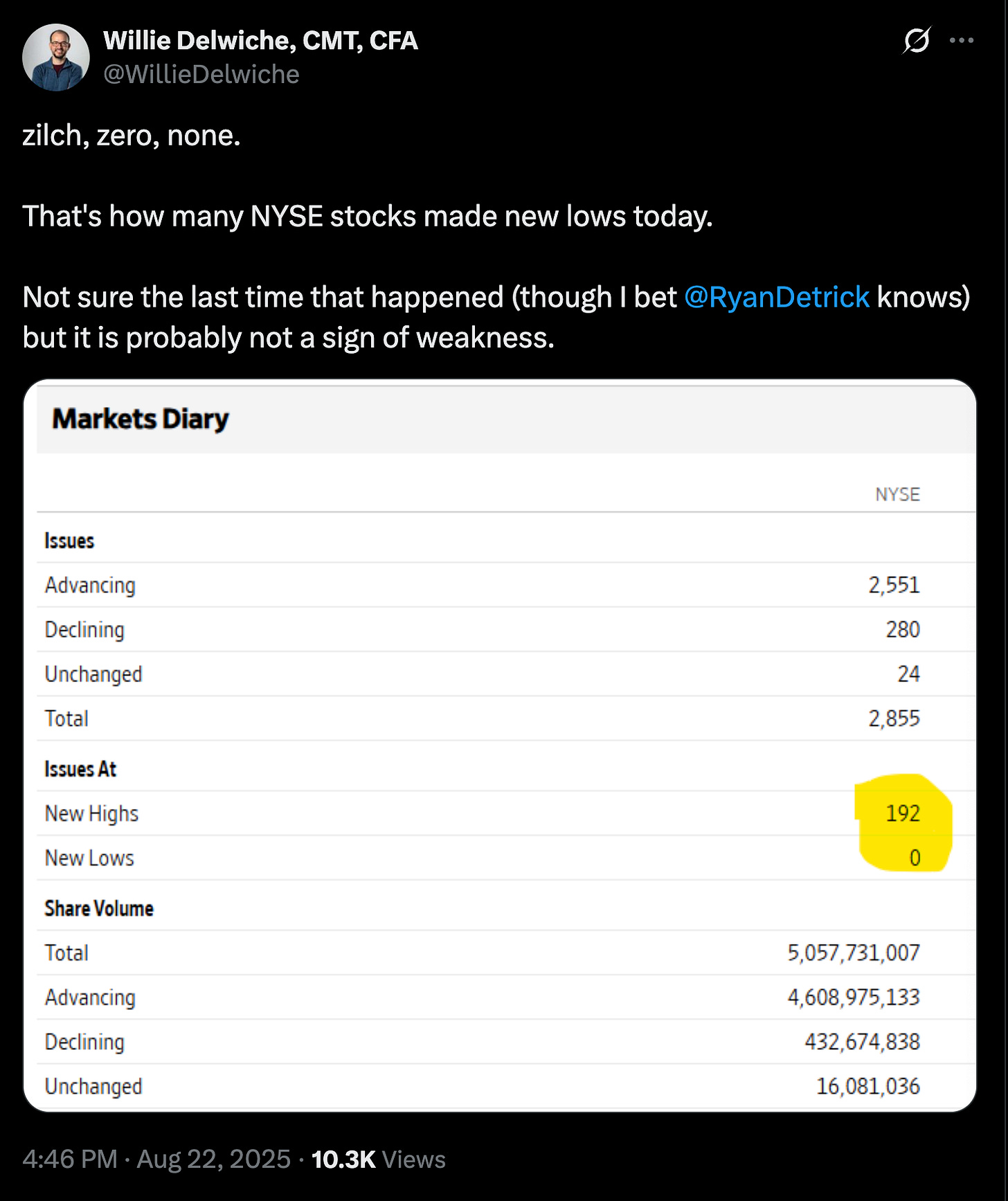

From Willie Delwiche:

“Zilch. Zero. None.

That’s how many NYSE stocks made new lows on Friday.”

A rare occurrence.

📊 192 stocks hit new highs, 0 hit new lows.

This kind of participation expansion is the foundation of sustainable rallies. It’s not just tech or mega-caps — it’s broad, and it’s growing.

✅ Breadth is strong.

✅ Participation is expanding.

✅ Internal momentum is confirming price action.

Now What?

All of these signals continue to point in the same direction.

It’s not just price strength — it’s the alignment of participation, breadth, and macroeconomic support.

☑️ Technical confirmation

☑️ Fundamental tailwinds

☑️ Improving sentiment and leadership rotation

This is what healthy markets do.

🔷 They broaden.

Let’s see if the market continues to lean in.

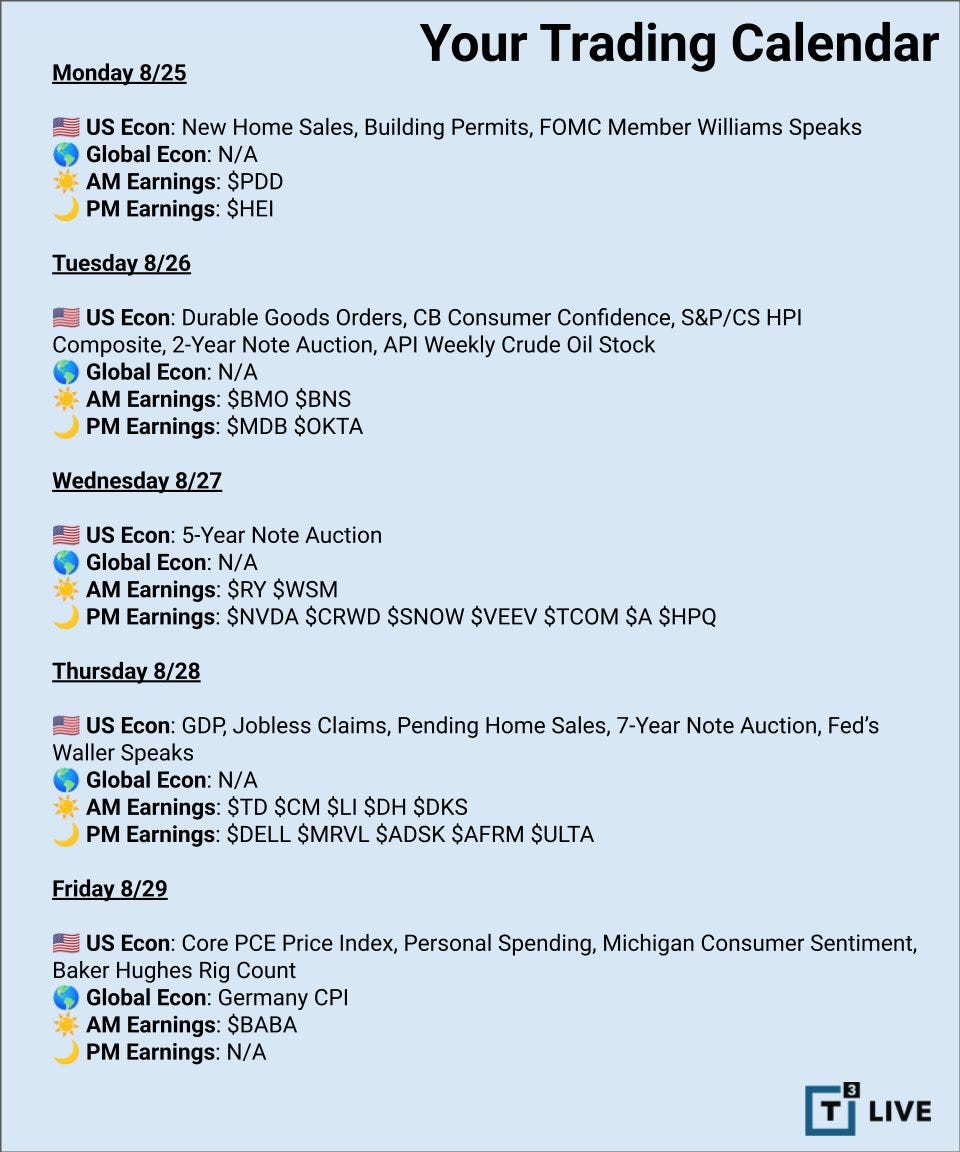

📅 The Week Ahead

📍 Expect volatility to pick up mid-to-late week — especially with GDP and Core PCE due.

💻 Big tech earnings on deck:

→ NVDA, CRWD, SNOW, MRVL

📢 Fed speakers could ripple sentiment depending on tone — dovish or hawkish shifts will be key.

I’m Speaking at the TSAA-SF Annual Conference

I’m honored to share that I’ll be speaking at the 2025 TSAA-SF Annual Conference on Friday, September 5th, at Golden Gate University in San Francisco.

This annual gathering brings together some of the top minds in technical analysis. I’ll be joining Katie Stockton, Jeff Hirsch, Scott Richter, and Zoë Bollinger.

Attendance is free with TSAA-SF membership and is available both in‑person and via Zoom.

📍 Golden Gate University, San Francisco

🗓 Friday, September 5, 2025

Full details → www.tsaasf.org

🧠 Final Thought

If you’ve made it this far — thank you.

Each week, I share this to help you see what I’m seeing and prepare for what’s ahead.

📈 Market structure

📊 Breadth and participation

🧠 Sentiment, macro shifts, technical confirmation

It’s all part of a process. And preparation is everything.

Remember!

☑️ Always manage risk

❌ Don’t get complacent

The market’s been generous lately.

But the moment you start to feel too smart — like this is easy —

That’s when it humbles you.

So let’s keep showing up — with clarity, with patience, and with a plan.

That’s if for this week’s look at the 📈Weekly Charts📉.

That’s the setup — now let’s see what the market delivers.

Thanks for Reading

If you’ve found these weekly breakdowns useful, here’s how you can help keep them coming — consider a paid subscription:

All posts remain public. No locked content. Just charts, signals, and steady updates to help you navigate markets with confidence.

And don’t forget to Like ❤️ Comment 💬 Share 🔁 too.

—Andy

Looking For More?

Elevate Your Trading Adventure Even Further With These Offerings.

EpicTrades Options Newsletter

Real-time trade ideas and insights, providing actionable trading insights focusing on options trades with short-term horizons, aiming to capitalize on weekly market movements.

The approach includes detailed reasoning for trades, specific options, and profit targets. It focuses on quick gains with a minimal time commitment from subscribers.

Click below to sign up!

The Inner Circle

The Inner Circle is a Virtual Trading Floor (VTF) at T3 Live. I’ve been working and trading with this group since 2022. You may have noticed the logo in the watermarks on my charts.

Founded by David Prince and led by him, Rick March, and Kira Turner, the Inner Circle is a community of elite traders, including hedge fund managers, family office heads, corporate executives, financial advisors, and even professional poker players.

Fundamental, Macro, and Technical Analysis all combine to find and discuss the best opportunities in current markets.

The Disclosures

***This is NOT financial advice. This is NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.