📈Weekly Charts📉 August 31, 2025

Breadth quietly improves while markets digest gains

Happy Labor Day weekend. Time to zoom out and take a level-headed look at what’s happening across markets — indexes, sectors, crypto, and internals.

Here’s what stood out this week.

📊 U.S. Indexes: Resting Near Highs

S&P 500 (SPX): Small range, slight pullback after a new high. Price action remains indecisive — and weak September seasonality looms. A breakdown here could trigger a deeper pullback.

Nasdaq 100 (QQQ): Inside week with healthy volume and RSI. Still above the 10-week MA.

Dow Jones (DIA): Holding above the key $451.55 pivot as the 10-week catches up.

🌍 Small Caps & International

Russell 2000 (IWM): Stronger this week, moving toward the $244 pivot area.

ACWX (All Country World ex-US): Taking a breather after a strong three-week run. Watch ~$61 as potential support.

FXI (China): Late-week strength brings it near resistance. Still waiting for a decisive breakout.

Bonds & Commodities: Quiet Strength

Bonds remain steady — and that’s constructive.

AGG / TLT / HYG: Boring, stable, and holding ground.

Commodities:

DBA (Agriculture): Continues higher after breakout.

DBP (Precious Metals): Gold and silver strength drives a new high.

U.S. Dollar: Stuck in the Same Struggle

U.S. Dollar Index (DX1! / DXY):

Another week, another long upper shadow. Price action shows persistent selling pressure. The dollar remains trapped — unable to gain traction.

That persistent weakness supports both risk assets and commodity strength.

Crypto Check: Cooling Off

Bitcoin (BTC):

Weekly: Lazy around the ~$109k pivot and Bollinger Band midline.

Monthly: Still within a broad channel

Ethereum (ETH):

Weekly: DeMark 9 sell setup just below ATHs. Briefly overbought.

Monthly: Still coiled in a multi-year consolidation.

Litecoin (LTC): Weekly DeMark 9 at downtrend resistance.

Solana (SOL): Holding near $215 resistance; $175 support.

XRP: Failed breakout from bull flag; now under pressure.

Relative Strength & Participation

Value > Growth Value continues to gain strength over growth, preserving the excellent record of an overbought RSI as the signal.

Consumer Discretionary (XLY) remains stronger than Consumer Staples (XLP).

High Beta (SPHB) surged relative to Low Volatility (SPLV).

For more on Relative Strength, see the Chart School lesson:

Unlock Market-Beating Options Trades with EpicTrades – Join The Winning Streak Today

💥 Real setups. Real follow-through.

Recent winners include CRWD calls for a quick 29.9% gain, and CRWV calls for +62.5% in ONE day!

📩 Want real trades like this — with structure, targets, and real-time alerts?

Join here → t3live.com/epicoffer

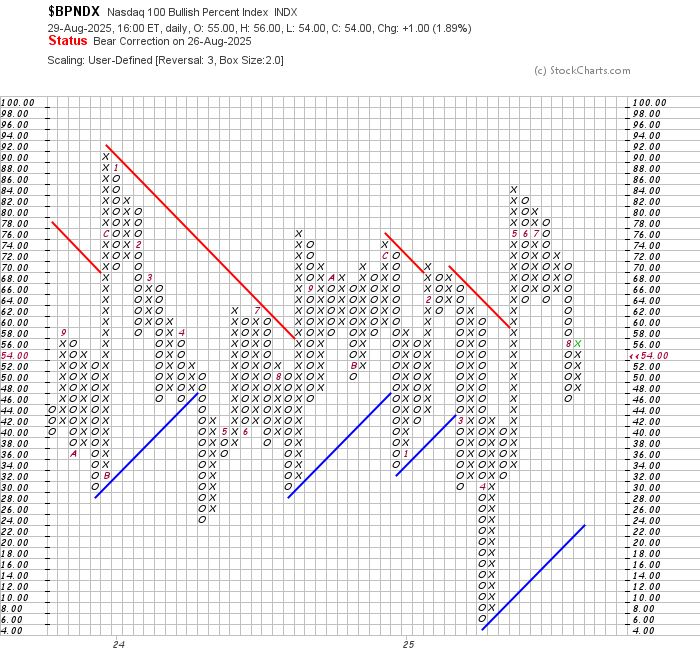

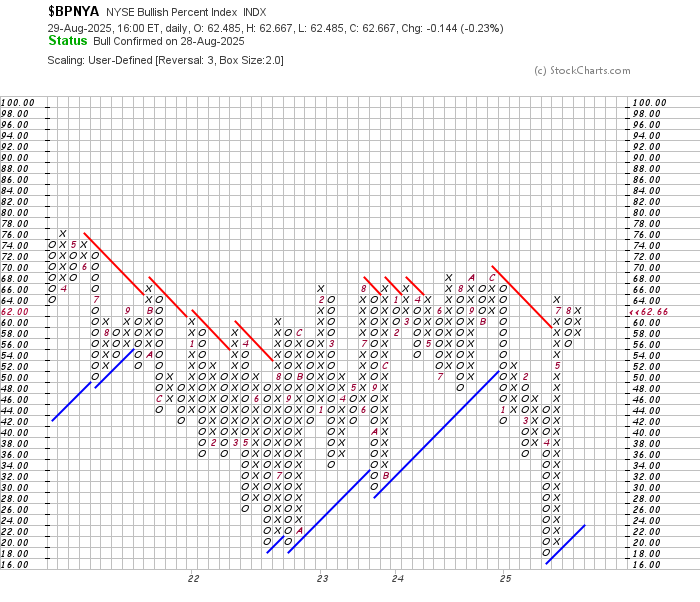

Breadth: Quiet Strength Under the Surface

The Bullish Percent Indices (BPIs) have reversed higher into Xs — not from extreme lows, but from mid-range. That’s a subtle signal of sustainable accumulation.

Watch:

$BPSPX – S&P 500

$BPNDX – Nasdaq 100

$BPNYA – NYSE

Meanwhile, the percentage of S&P 500 stocks above their 50- and 200-day moving averages took a breather after a solid three-week run higher. No breakdown here — just rest.

Understanding the Bullish Percent Index

A timeless signal of internal strength, built on point & figure roots.

Read the full article here.

Now What?

Short-Term:

Stocks are resting near highs

Crypto is cooling off

September seasonality is weak

But… breadth is improving and risk appetite is intact

Medium-Term:

September is often messy — chop, fakeouts, and false starts.

We could see near-term weakness, but no signs of panic or breakdown yet.

This feels like digestion in trend — not distribution.

Long-Term:

Still incredibly bullish.

Trends are strong. Participation is broad. Leadership is clear.

This is the time to watch, not flinch.

Let price confirm. Keep an eye on $SOX (Semiconductors) — it could be an early indicator. Does it break out into new territory first?

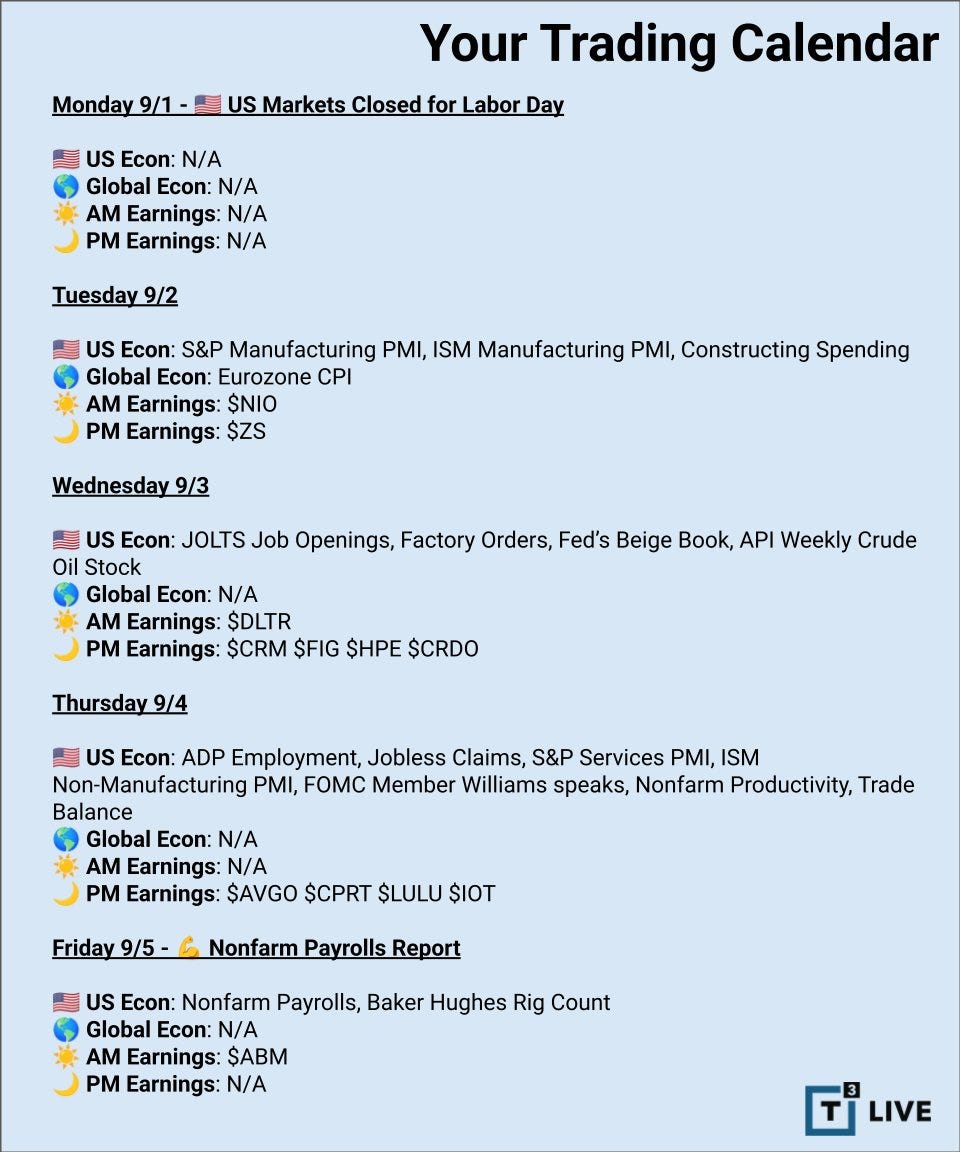

🗓 Next Week: Light Start, Big Finish

Monday: U.S. markets closed (Labor Day)

Tues–Thurs: PMI data, Beige Book, earnings

Friday: Nonfarm Payrolls → key macro event

Expect positioning and chop early. Clarity comes later.

I’m Speaking at the TSAA-SF Annual Conference

I’m honored to share that I’ll be speaking at the 2025 TSAA-SF Annual Conference on Friday, September 5th, at Golden Gate University in San Francisco.

This annual gathering brings together some of the top minds in technical analysis. I’ll be joining Katie Stockton, Jeff Hirsch, Scott Richter, and Zoë Bollinger.

Attendance is free with TSAA-SF membership and is available both in‑person and via Zoom.

📍 Golden Gate University, San Francisco

🗓 Friday, September 5, 2025

Full details → www.tsaasf.org

🧠 Final Thought

If you’ve made it this far — thank you.

Each week, I share this to help you see what I’m seeing and prepare for what’s ahead.

📈 Market structure

📊 Breadth and participation

🧠 Sentiment, macro shifts, technical confirmation

It’s all part of a process. And preparation is everything.

That’s it for this week’s look at the 📈Weekly Charts📉.

That’s the setup — now let’s see what the market delivers.

Thanks for Reading

If you’ve found these weekly breakdowns useful, here’s how you can help keep them coming — consider a paid subscription:

All posts remain public. No locked content. Just charts, signals, and steady updates to help you navigate markets with confidence.

And don’t forget to Like ❤️ Comment 💬 Share 🔁 too.

—Andy

Looking For More?

Elevate Your Trading Adventure Even Further With These Offerings.

EpicTrades Options Newsletter

Real-time trade ideas and insights, providing actionable trading insights focusing on options trades with short-term horizons, aiming to capitalize on weekly market movements.

The approach includes detailed reasoning for trades, specific options, and profit targets. It focuses on quick gains with a minimal time commitment from subscribers.

Click below to sign up!

The Inner Circle

The Inner Circle is a Virtual Trading Floor (VTF) at T3 Live. I’ve been working and trading with this group since 2022. You may have noticed the logo in the watermarks on my charts.

Founded by David Prince and led by him, Rick March, and Kira Turner, the Inner Circle is a community of elite traders, including hedge fund managers, family office heads, corporate executives, financial advisors, and even professional poker players.

Fundamental, Macro, and Technical Analysis all combine to find and discuss the best opportunities in current markets.

The Disclosures

***This is NOT financial advice. This is NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.

Love the XRP chart