📈Weekly Charts📉 August 9, 2025

From Warning to Watchful: Markets Pause — But Don’t Reset

Good morning!

And welcome to this week’s edition of the 📈Weekly Charts📉.

Last week, we talked about markets digesting a bout of selling and searching for support.

This week?

Not only did all four major indexes close green — but they did so with calm, steady strength.

There was no panic bottom. No reversal drama. Just a quiet grind higher.

Big Tech led the way with AAPL breaking out, and TSLA flirting with a breakout level.

In other names, PLTR surged post-earnings and BMNR rocketed higher by more than 60%.

Add in seasonality headwinds, some improving internals, and a notable rebound in risk appetite… and the picture becomes more nuanced.

This isn’t reckless risk-on behavior — but it’s not rolling over either.

Let’s dig into this week’s charts…

📊 Major Indices

S&P 500 (SPX)

Strong green candle, opened higher and never looked back. No slippage. Inside week but closed near highs—solid strength. RSI and volume remain healthy.

NASDAQ 100 (QQQ)

Another big green candle. Made a new high, confirming leadership and momentum in tech.

Russell 2000 (IWM)

Inside candle, but holding above the 10- and 40-week MAs. Healthy digestion of recent gains. And RSI stayed above the halfway mark on last week’s selloff.

Dow Jones Industrial Average (DIA)

Similar to IWM—an inside candle that held above the rising 10-week MA. Stability is key. RSI is still > 50.

🌏 Global Stocks & Macro

Rest of World (ACWX)

Snapped back hard. Recaptured last week’s loss and sits just below highs.

China (FXI)

Still quiet. Inside week, holding above the 10-week MA. No breakdown, no breakout.

U.S. Dollar Index ($DXY)

The dollar pulled back slightly but hasn’t given up the recovery effort.

🧳 Bonds & Credit

20+ Year Treasury Bonds (TLT)

Stuffed by the falling 40-week MA and June pivot high as RSI struggles near the center line. So far it looks ‘double topish,’ but there is a chance for a ‘higher high, higher low’ sequence to evolve.

AGG (Core U.S. Aggregate Bond ETF)

Also hit some pivot resistance, but it’s doing so while above the moving averages and an AVWAP.

⚖️ Commodities

GSG (iShares GSCI Commodity Index)

Continued selling pushed it down below the 10-week MA. RSI is barely above 50, but volume is light.

DBB (Invesco DB Base Metals)

Holding onto the recent breakout move after last week’s erratic action.

₿ Crypto Corner

Bitcoin (BTC/USD)

Still consolidating, holding above key moving averages. The bounce this week was constructive, but no major changes to the trend.

Ethereum (ETH/USD)

Over the key 4100 level. Bulls will want to see a breakout confirmed by staying up here, followed by a quick move to 4900.

Litecoin (LTC/USD)

Still threatening a breakout, but hasn’t sealed the deal. Keep watching this one for a move over the trendline and beyond ~$140.

🧮 Breadth & Participation

% of S&P 500 > 50-Day MA – 56%

% of S&P 500 > 200-Day MA – 56%

Healthy enough. No extremes. Broad market participation is holding with a slight bounce this week.

Unlock Market-Beating Options Trades with EpicTrades – Join The Winning Streak Today

💥 Real setups. Real follow-through.

Recent winners include CRWD calls for a quick 29.9% gain, and CRWV calls for +62.5% in ONE day!

📩 Want real trades like this — with structure, targets, and real-time alerts?

Join here → t3live.com/epicoffer

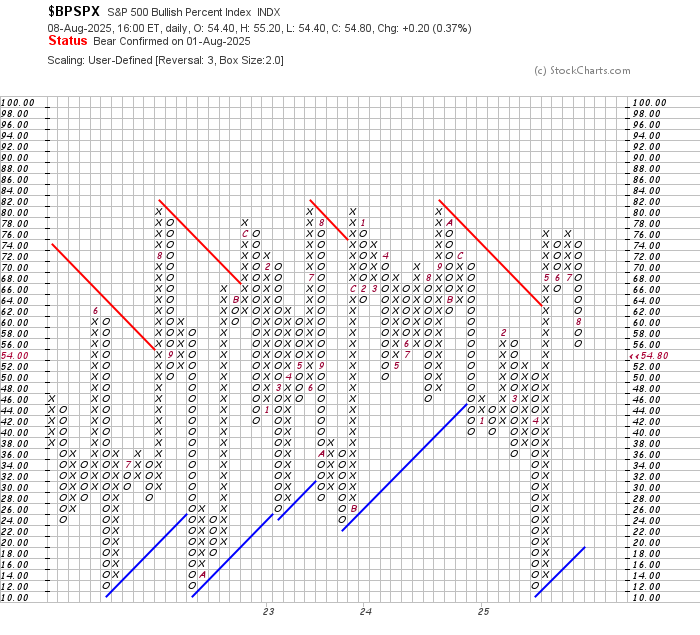

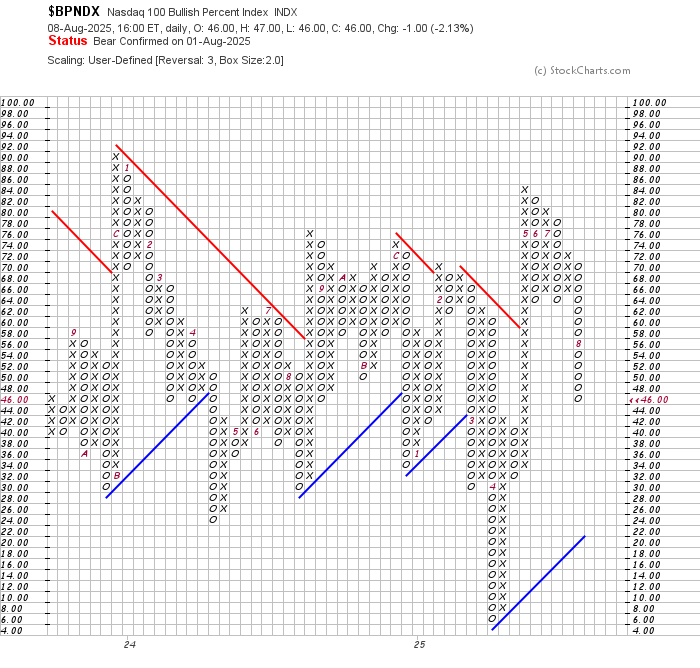

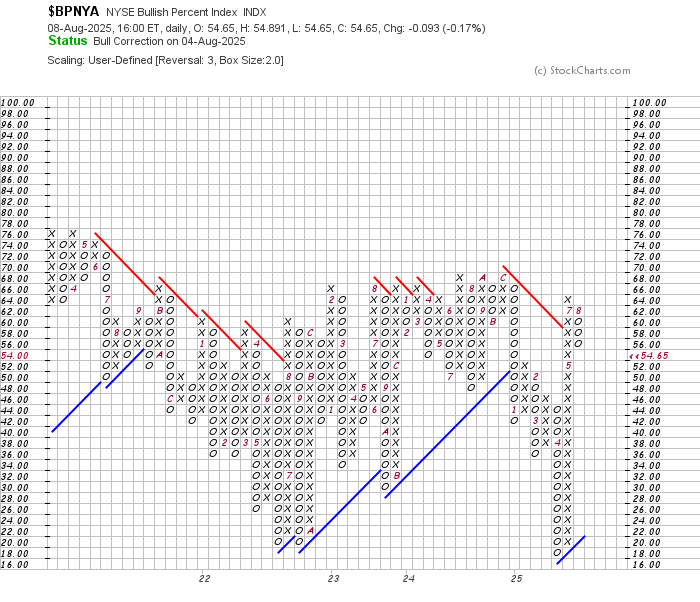

Bullish Percent Indexes

All continued lower and are near the halfway point. More signs of caution beneath the surface.

$BPSPX

$BPNDX

$BPNYA

Understanding the Bullish Percent Index

A timeless signal of internal strength, built on point & figure roots.

Read the full article here.

🔄 Relative Strength

IWF/IWD (Growth vs. Value)

Growth continues to dominate. Another week of runaway strength.

XLY/XLP (Discretionary vs. Staples)

Holding steady. No decisive move, but still leaning risk-on.

SPHB/SPLV (High Beta vs. Low Volatility)

Slight rotation into low volatility this week. Worth noting as a potential subtle shift in tone.

For more on Relative Strength, see the Chart School lesson:

🔍 Now what?

No crash. No collapse. No summer swoon.

Seasonal headwinds remain a factor, but they’re no match for price action so far. Breadth isn’t screaming higher, but participation remains healthy. Crypto continues to build just under recent highs or breakout levels.

The message? Don’t fight the trend — but stay selective.

Favor strength. Avoid chop. Respect setups.

It’s still a bullish tape—but not without friction.

📅 The Calendar

Next week is lighter as earnings season slows. But we do have inflation data coming.

CPI next Wednesday

PPI next Thursday

More earnings, including AMAT, CRCL, CRWV, CSCO, DE

So the calendar is light, the tape is mixed, and the slowest part of summer is upon us.

Don’t let that bring complacency. There were many amazing setups and opportunities this past week, if you knew where to look.

Keep your gameplanning sharp, and your trade execution chops sharper.

One more thing:

Special Announcement:

I’m Speaking at the TSAA-SF Annual Conference

I’m honored to share that I’ll be speaking at the 2025 TSAA-SF Annual Conference on Friday, September 5th, at Golden Gate University in San Francisco.

This annual gathering brings together some of the top minds in technical analysis. I’ll be joining Katie Stockton, Jeff Hirsch, Scott Richter, and Zoë Bollinger.

Attendance is free with TSAA-SF membership and is available both in‑person and via Zoom.

📍 Golden Gate University, San Francisco

🗓 Friday, September 5, 2025

Full details → www.tsaasf.org

Thanks for Reading

If you’ve found these weekly breakdowns useful, here’s how you can help keep them coming — consider a paid subscription:

All posts remain public. No locked content. Just charts, signals, and steady updates to help you navigate markets with confidence.

And don’t forget to Like ❤️ Comment 💬 Share 🔁 too.

—Andy

Looking For More?

Elevate Your Trading Adventure Even Further With These Offerings.

EpicTrades Options Newsletter

Real-time trade ideas and insights, providing actionable trading insights focusing on options trades with short-term horizons, aiming to capitalize on weekly market movements.

The approach includes detailed reasoning for trades, specific options, and profit targets. It focuses on quick gains with a minimal time commitment from subscribers.

Click below to sign up!

The Inner Circle

The Inner Circle is a Virtual Trading Floor (VTF) at T3 Live. I’ve been working and trading with this group since 2022. You may have noticed the logo in the watermarks on my charts.

Founded by David Prince and led by him, Rick March, and Kira Turner, the Inner Circle is a community of elite traders, including hedge fund managers, family office heads, corporate executives, financial advisors, and even professional poker players.

Fundamental, Macro, and Technical Analysis all combine to find and discuss the best opportunities in current markets.

The Disclosures

***This is NOT financial advice. This is NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.