📈Weekly Charts📉 February 14, 2026

Reminder: click on the first chart to open a bigger view. Then use your arrows keys to scroll through all the images.😉

Valentine’s Edition: Weekly Charts

Finding the Charts We Love — and the Trades That Love Us Back

Good morning,

It’s time for your Valentine’s Edition of Weekly Charts.

Let’s find the charts we love — and the trades that love us back.

Here we go.

S&P 500 — Too Easy, Right?

At first glance, the setup looks familiar.

From top to bottom, we can observe several similarities to prior inflection points:

RSI steadily declining

Price unable to reach and maintain new highs

Price below the 10-week moving average

A breached trendline

Expanding volume

Observation > prediction.

In my standard chart format, we also see:

Price below a declining 4-week moving average

Three tests in four weeks of the Bollinger Band centerline and the AVWAP from the November dip

Persistent resistance at the 1.618 extension

Repeated tests of resistance weaken it — until they don’t.

QQQ — Back to the Anchor

QQQ is now:

Below a declining 4-week moving average

Back to the June breakout AVWAP

In the lower half of flattening Bollinger Bands

RSI testing the midpoint near 50

Volume increasing

That’s a market at decision.

Meanwhile, the Dow continues to carry the torch.

DIA Dow Industrials — Leadership Remains

The Dow touched another new high this week.

Above all key moving averages

Moving averages rising in sequence

Bollinger Bands rising

RSI in bullish territory

Rotation, not collapse.

IWM Small Caps — Constructive Consolidation

Small caps are building a bullish consolidation pattern above key moving averages and anchored VWAP levels.

Still constructive.

ACWX — The Rest of The World

The Rest of the World continues to show strength:

Rising RSI

Rising price

Rising moving averages

Rising average volume

FXI — China

China tells a different story:

Below the 4-, 10-, and 40-week moving averages

Below trendline support

RSI below 50

Potential support sits near prior highs/lows, the 50% retracement, and the anchored VWAP from the April 2025 dip.

AGG TLT - Bonds

Bonds are gathering notable strength.

That aligns with the defensive rotation theme.

GSG — Commodities

Commodities are consolidating a breakout well, holding near a sharply rising 4-week moving average.

CL_F — Crude Oil Futures

Crude oil futures are back above a rising 40-week moving average.

GC_F SI_F — Gold and Silver Futures

Gold and silver are digesting record runs constructively.

Sector Rotation — Clear Divergences

IWD, XLP, RSP — Value, Staples, and Equal-Weight S&P are trending higher.

IWF, XLY, QQEW — Growth, Discretionary, and Equal-Weight Nasdaq 100 are trending lower.

Leadership is rotating — and it’s rotating defensively.

Relative Strength Ratios

IWF/IWD

Overbought and oversold readings in Growth vs. Value have often marked reaction levels — but rarely durable regime shifts.

XLY/XLP

Discretionary vs. Staples continues to tilt defensive.

SPHB/SPLV

High Beta vs. Low Volatility confirms that posture.

SPY/ACWX

U.S. vs. The Rest of The World has broken lower in what resembles a complex topping structure.

More Key Sectors

Semis, Software, and mega-cap growth

SOX, IGV, MAG7

Industrials, Materials, Utilities

XLI, XLB, XLU

Breadth & Participation

SPX % Above 50/200-day Moving Averages

The percentage of stocks above key moving averages remains elevated longer-term — but it turned lower this week.

Momentum in participation is slowing.

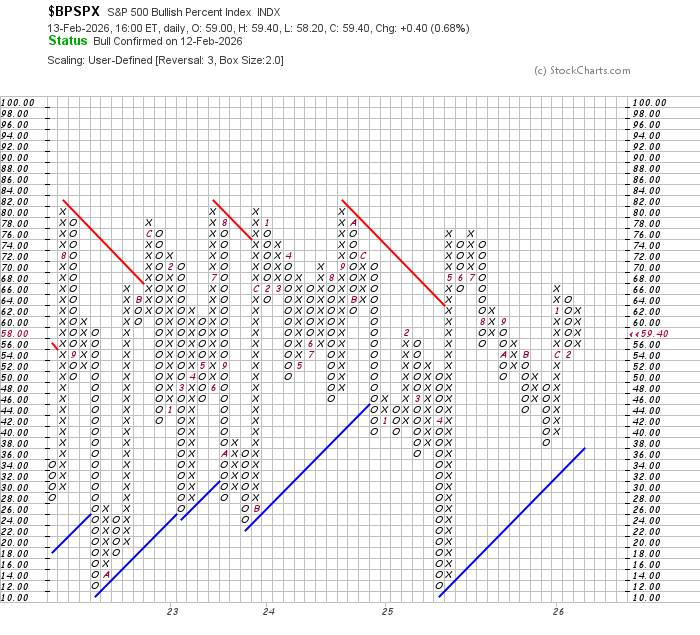

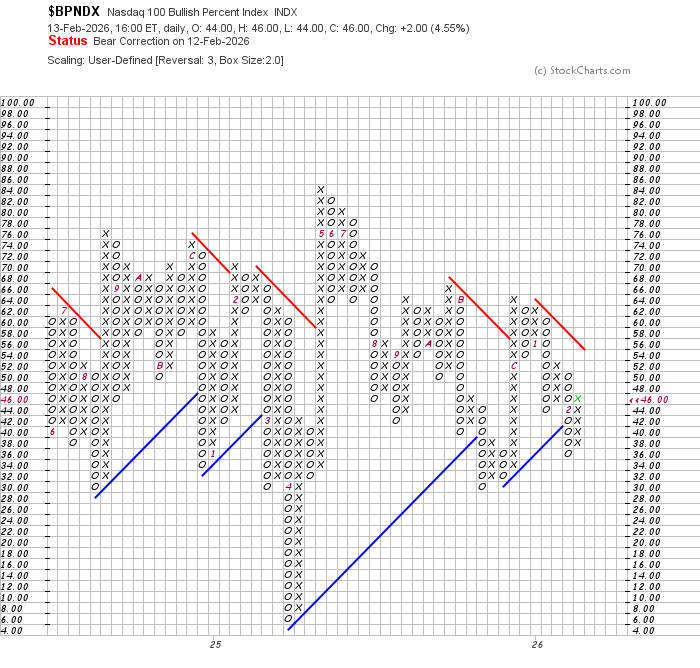

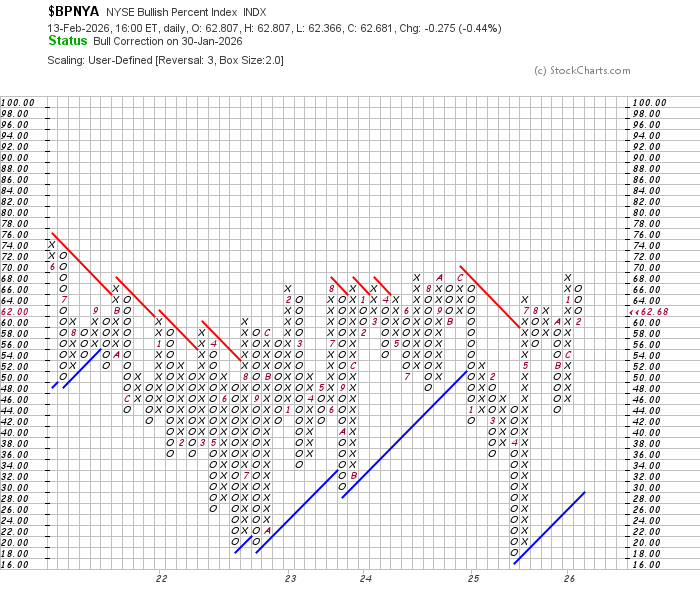

Bullish Percent Indices

BPSPX — Bull Confirmed.

BPNDX — Bear Correction.

BPNYA — Bull Correction.

Mixed signals.

Alignment is not clean.

Now What?

Last week, despite pressure and repeated tests, price was still above key levels and rising moving averages. That kept the benefit of the doubt with the bulls.

This week, that changed.

The benefit of the doubt is no longer automatic.

For months, SPY held above a rising 10-week moving average. That defined the uptrend.

Now we’re seeing:

Bonds strengthening

Risk-off ratios accelerating

Defensive sectors expanding

Repeated tests of resistance

Growth and discretionary breaking lower

QQQ leaning on a key anchored VWAP for a second week

The more times a level is tested, the more likely it gives way.

The Line That Defines the Trend

The recent SPY range highs define resistance.

Failure to get above them keeps pressure building.

Below last week’s low, the path opens toward:

The June breakout anchored VWAP

The rising 40-week moving average

That’s not prediction.

That’s structure.

If buyers reclaim control and growth rotates back into leadership, conditions improve quickly.

Until then:

Respect risk first.

Avoid style drift.

Trade the evidence.

Next Week’s Catalysts

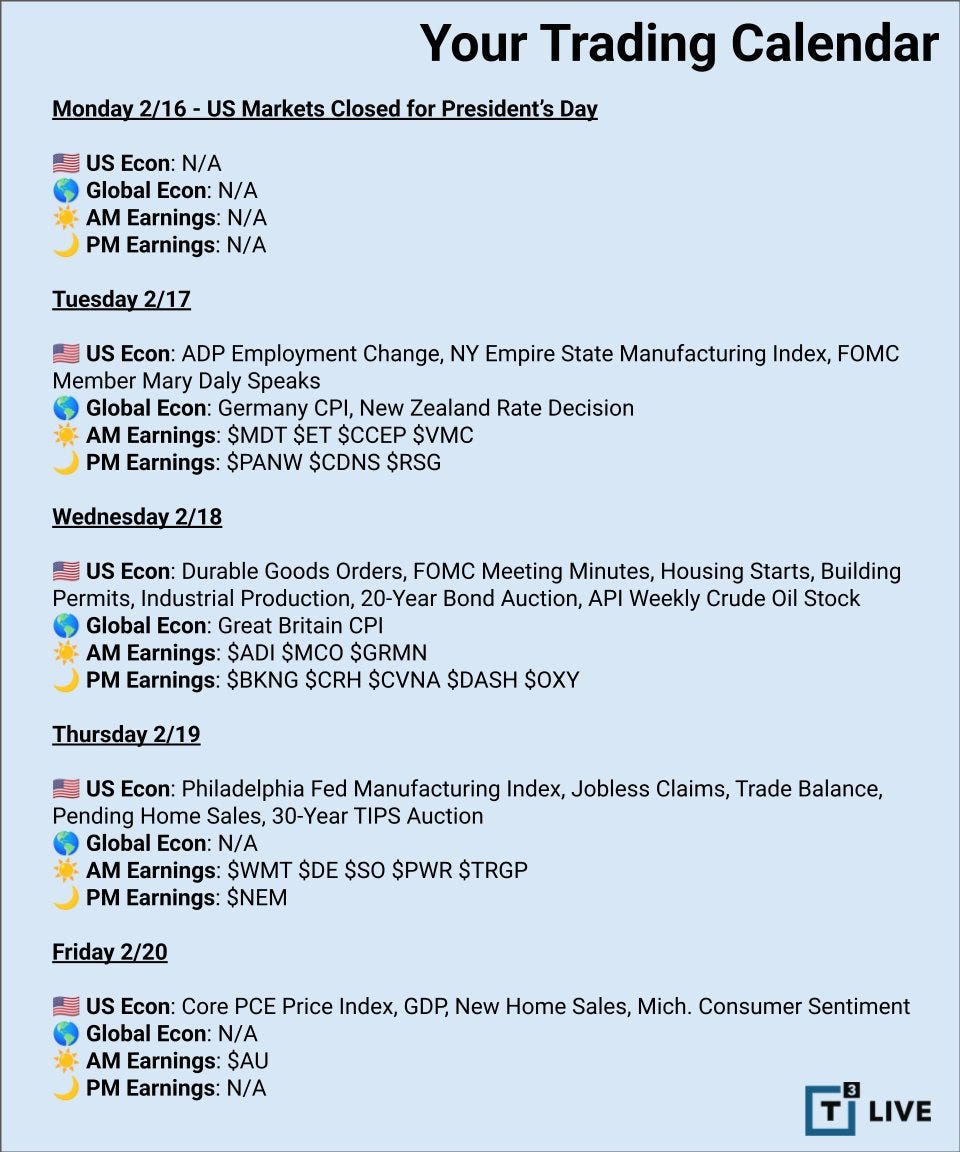

Markets are closed Monday for President’s Day.

Key earnings: PANW, OXY, WMT.

Key data: ADP Employment, Jobless Claims, Pending Home Sales, Core PCE, GDP.

When structure is vulnerable, catalysts matter.

Volatility expands when support weakens.

If you missed it earlier this week, I reviewed QQQ’s flat range, key divergences, and the latest AI leadership in:

“Flat Markets, Divergent Trends, and AI Curiosity.”

Thanks for Reading

Thank you all for reading!

For a deeper dive, check out Chart School — lessons on breadth, relative strength, AVWAP, and more.

If you found this week’s charts helpful, please -

📤 Share

💬 Comment

♻️ and Restack

It helps more traders see the work and join the discussion.

Have a great weekend!

Important: This content is provided for educational purposes only. If you’re reading this online, please review the full disclosure here.

Good ol’ Moss! I like those Bollinger bands too. I don’t see them often…