📈Weekly Charts📉 July 19, 2025

What the charts are telling us heading into a busy earnings week.

Clarity and confidence for the week ahead

Another big week of price expansion — even with mega-cap earnings still ahead and seasonality looming. SPX, QQQ, and Bitcoin all pushed further into blue-sky territory while market breadth and sector leadership stayed mostly intact.

Let’s dive into what’s working, what’s moving, and what might be shifting beneath the surface…

📊 Major Indices

S&P 500 (SPX)

Positive action returned this week after last week’s slight rest.

The index is holding gains above the 6147 pivot high while the 10-week moving average continues to catch up.

Volume picked up slightly, and RSI remains firmly bullish without being overbought.

The trend remains strong — steady, not euphoric.

NASDAQ 100 (QQQ)

Not much new to add — the QQQ chart continues to mirror SPX.

The uptrend remains firmly intact with steady gains, support from rising moving averages, and a bullish (but not stretched) RSI. New weekly closing highs keep confirming strength.

It’s a strong and steady move, with no excess showing up yet.

Russell 2000 (IWM)

Small caps have been a bit more erratic lately, but the chart still leans constructive.

Price continues to hold above the ~$212 pivot zone and the 40-week moving average. And with a couple more weeks of stability, the 10-week could reclaim its position above the 40-week — a notable sign of strengthening trend.

More work to do, but holding ground.

Dow Jones (DIA)

The Dow snaps the winning streak with a very slight dip this week, preventing the major indexes from going 4 for 4 on positive action.

But the chart shows no signs of real weakness. Price remains above all major moving averages, and RSI is still holding in bullish territory.

A minor pause — not a problem.

🪙 Crypto

Bitcoin (BTCUSD)

Bitcoin made a push to $123,231 this week — a new weekly closing high.

The breakout from the $112K–$119K range continues to hold, and momentum remains bullish. RSI is strong but not yet extreme.

With no signs of reversal, the 2.618 Fibonacci extension (around $155K) remains the next potential upside level to watch.

Ethereum (ETHUSD)

Ethereum followed Bitcoin’s lead this week, breaking out of its recent range and pushing to a high of $3,677.

This marks a decisive move above key resistance near $3,200. RSI confirms the momentum — and unlike BTC, ETH has more distance before testing prior cycle highs.

Next levels to watch: $4,093, followed by the all-time high zone around $4,867.

Litecoin (LTCUSD)

Litecoin joined the crypto surge — hitting $100 again and still wrestling with that level. This week’s high kissed AVWAP from the 2021 high at $110.26 — a key level to watch. Still below the long-term downtrend. Can it build on this strength?

🌏 Global Stocks

Global ex-US (ACWX)

Chipping away at that 61 zone for a fourth week.

Solid trend intact, and RSI is still trending bullishly.

Global participation continues to improve.

China Large-Cap (FXI)

A sharp move out of the recent range, but not quite above the big resistance box yet.

Watch for confirmation over 38+ in the coming weeks.

Momentum is building — but follow-through will be key.

💵 Dollar + Rates

U.S. Dollar Index ($DXY)

Even the Dollar wants in on the bullish action.

Second green week in a row — rare in 2025 — pushing back into the falling 10-week MA.

Far from a trend reversal… but it’s a start.

AGG / TLT / HYG – Bonds

Still hanging in there… but less convincingly.

Treasuries and IG bonds feel increasingly heavy.

High-yield remains relatively stable for now.

🛢️ Commodities

DBB – Base Metals ETF

Trying hard to breakout above multi-month resistance.

Still stuck in the range — but knocking louder each week.

This area has been tough to crack. Keep it on watch.

📊 Market Breadth

SPX Breadth

Percent of S&P 500 stocks above their 50-day: 65.4%

Percent above 200-day: 58.4%

These are strong and stable breadth levels — a good sign of healthy participation.

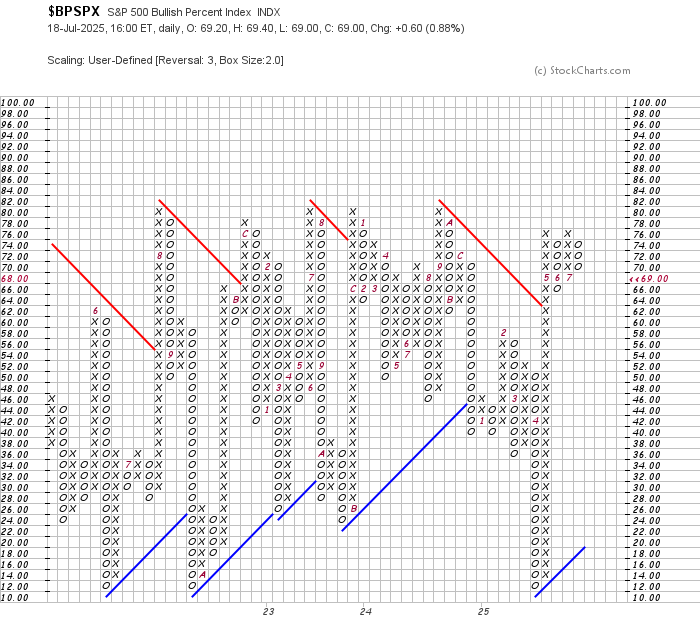

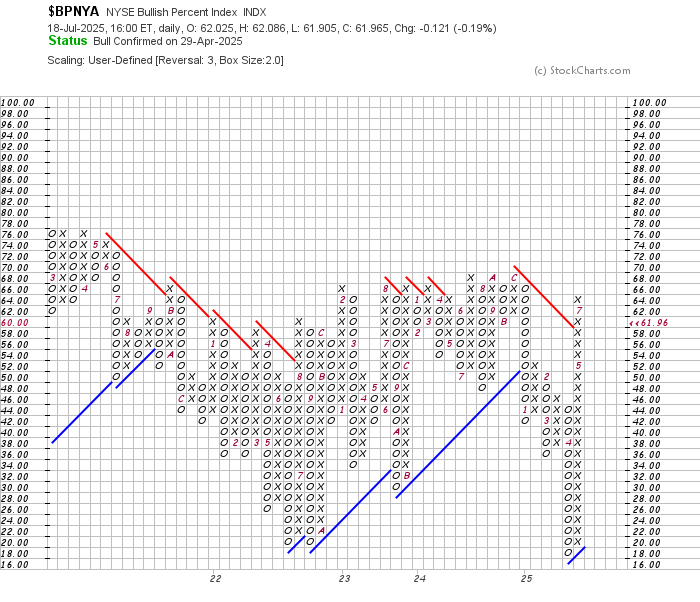

Bullish Percent Indices

Some early signs of potential caution.

BPSPX, BPNDX, and BPNYA are starting to crack from high-level consolidations.

While this isn’t confirmation of a reversal, high BPI levels mean there’s more room for downside if weakness emerges.

Stay alert. This could be the earliest sign of change.

⚖️ Relative Strength

Growth vs. Value

IWF vs. IWD is pushing toward a breakout — Growth continues to lead.

Discretionary vs. Staples

XLY vs. XLP remains strong. Consumers are still spending, for now.

High Beta vs. Low Volatility

SPHB vs. SPLV shows risk appetite is firmly intact.

Unlock Market-Beating Options Trades with EpicTrades – Join The Winning Streak Today

💥 Real setups. Real follow-through.

📩 Want real trades like this — with structure, targets, and real-time alerts?

Join here → t3live.com/epicoffer

👉 One more reminder: read all about Relative Strength in this Chart School lesson

🔍 Now What?

This week’s strength reinforces the trend, but it’s not a green light to ignore risk.

Breadth is solid. Leadership remains strong. Major indexes are making new highs.

But we’re also seeing early signs of potential caution via Bullish Percent Indices and bonds weakening under the surface. And seasonality suggests we stay on our toes.

👉 In Tuesday’s Market Update, we reminded readers: “Don’t get complacent.” That advice still applies.

The trend is your friend… until it bends.

🗓️ Trading Calendar – Week of July 21

📌 Powell speaks on Tuesday

📌 ECB decision Thursday

📌 Big earnings from Tesla, Google, IBM, Intel, and more

🙏 Thanks for Reading

These 📈Weekly Charts📉 are here to help you stay clear, consistent, and confident in your trading.

If this brought you value:

❤️ Tap the heart

📤 Share with a fellow trader

💬 Let me know what stood out to you this week

And to the many new paid subscribers — welcome!

Your support is both appreciated and motivating — a pleasant reminder and reinforcement that you find real value in these pages.

Until next time —

Andy

📩 Enjoying these updates?

Consider a paid subscription — $7/month or $84/year helps keep the charts flowing and the signal strong.

No paywalls. No gated content. Just a way to say thanks.

Looking For More?

Elevate Your Trading Adventure Even Further With These Offerings.

EpicTrades Options Newsletter

Real-time trade ideas and insights, providing actionable trading insights focusing on options trades with short-term horizons, aiming to capitalize on weekly market movements.

The approach includes detailed reasoning for trades, specific options, and profit targets. It focuses on quick gains with a minimal time commitment from subscribers.

Click below to sign up!

The Inner Circle

The Inner Circle is a Virtual Trading Floor (VTF) at T3 Live. I’ve been working and trading with this group since 2022. You may have noticed the logo in the watermarks on my charts.

Founded by David Prince and led by him, Rick March, and Kira Turner, the Inner Circle is a community of elite traders, including hedge fund managers, family office heads, corporate executives, financial advisors, and even professional poker players.

Fundamental, Macro, and Technical Analysis all combine to find and discuss the best opportunities in current markets.

The Disclosures

***This is NOT financial advice. This is NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.