📈Weekly Charts📉 November 29, 2025

AVWAP Bounces And Follow-Through

Good morning/afternoon/or evening,

How about some charts?

Weekly or monthly? Why not both?

This will be shorter than usual. But we’ve seen some big turnarounds, so let’s take a look.

Reminder: click on the first chart to open a bigger view. Then use your arrows keys to scroll through all the images.😉

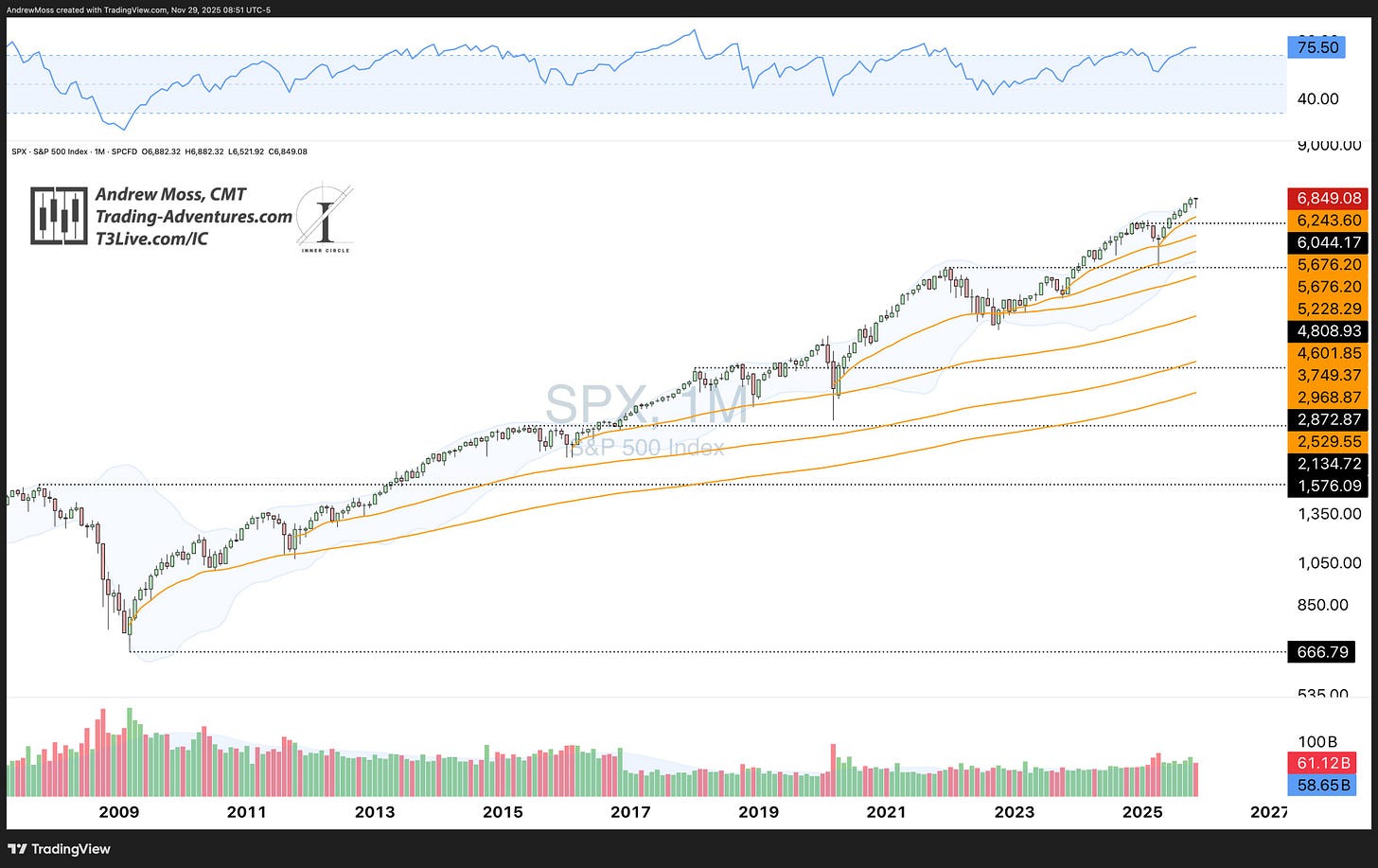

📊 U.S. Indexes

SPX weekly carried the AVWAP bounce to a new closing high. And the monthly, of course, hit new highs too, with a long lower shadow.

QQQ with strong buying all week. Large green candle with little or no shadows on the weekly.

The monthly just missed a new high close by ~$10.

DIA completes a trifecta of follow-through from the June 23 (week) breakout AVWAP bounces. New monthly closing high as well.

IWM weekly was a little messier (as usual), but the follow-through was just as real.

And look at that monthly chart! Is it loading the next leg higher?

🌍 Small Caps & International

The dip buying wasn’t limited to US Markets either.

ACWX weekly and monthly.

Although, China FXI wasn’t as strong. Contained to an inside week. And the monthly is still being contained at the Fib retracement.

🧱 Bonds & Commodities

Bonds still appear to be building strength through consolidation. Further upside coming?

AGG, TLT, HYG monthly.

Commodities:

Precious metals did not slow down.

SLV, Silver futures, SI1! broke out.

GLD, Gold, GC1! is still working on trendline resistance.

RSI remains extended for both.

💵 U.S. Dollar

DXY / DX1! The Dollar could go either way.

It’s a bearish consolidation below previous support/resistance. But the rising trendline has held, so far.

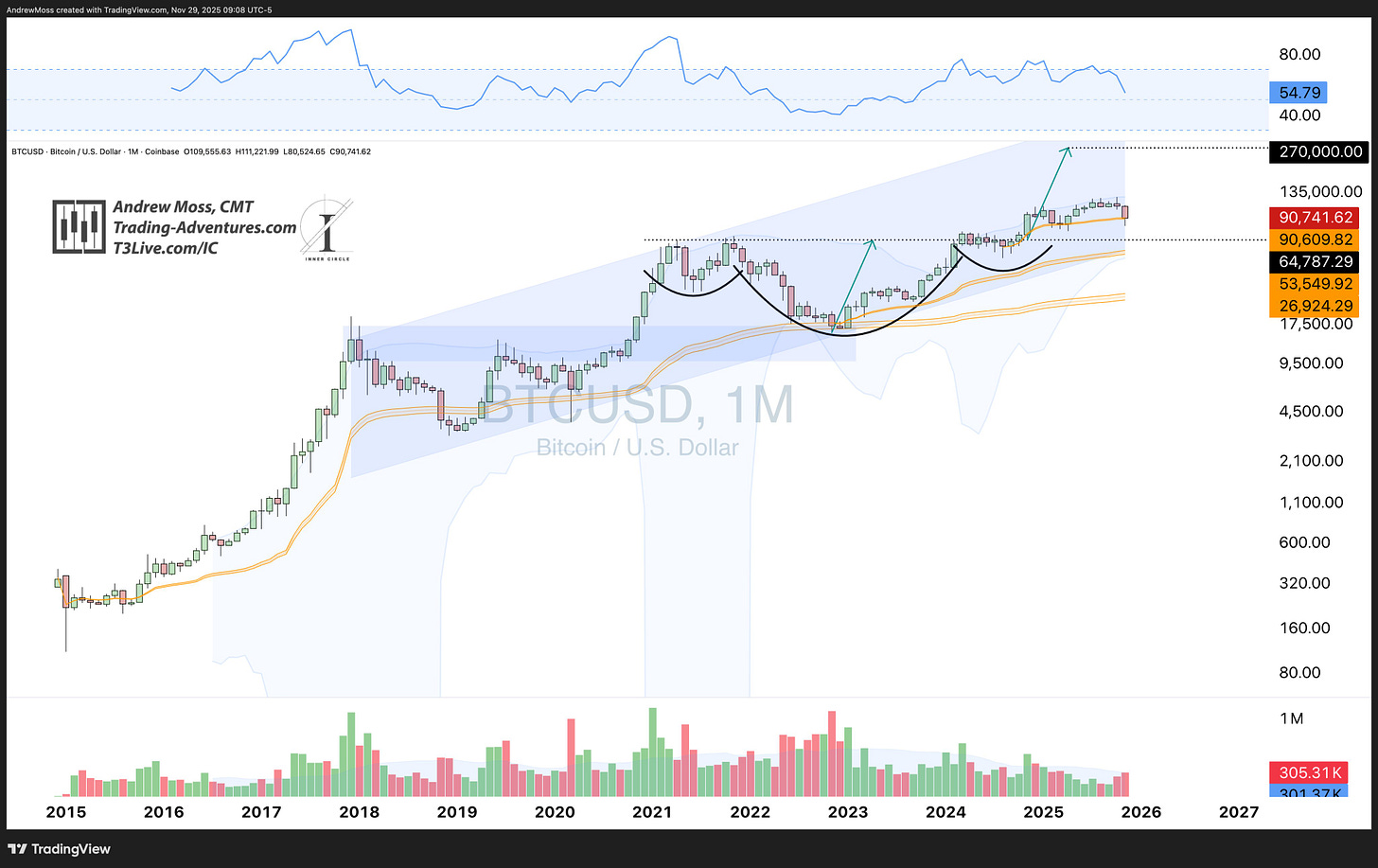

₿ Crypto Check

BTCUSD Bitcoin monthly is trying to hang onto AVWAP support.

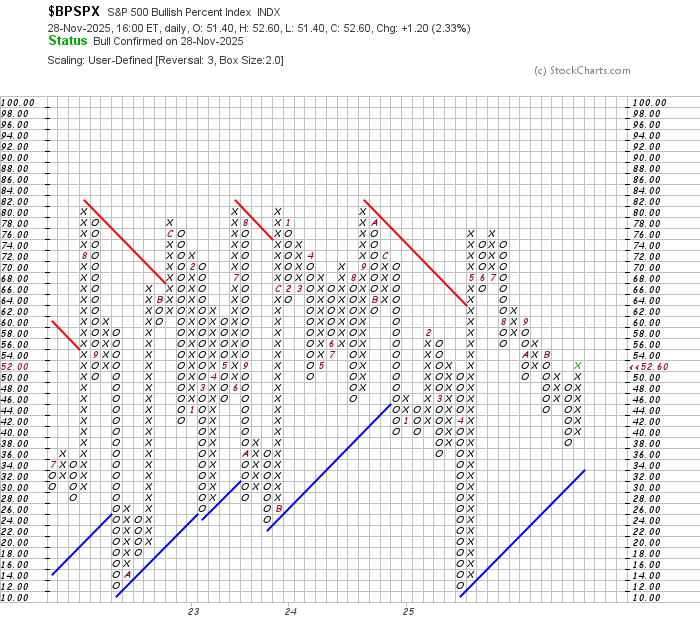

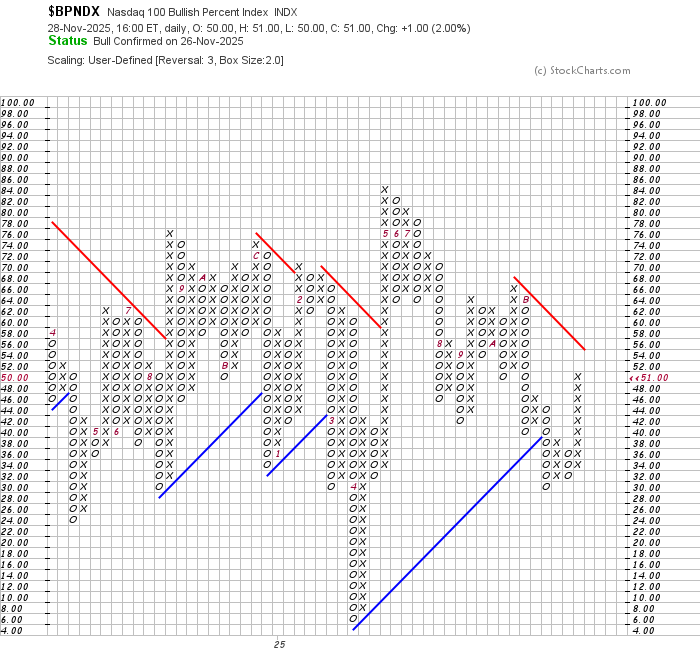

⚖️ Breadth

SPX stocks above a 50 and 200-day MA naturally took a sharp turn back to the upside.

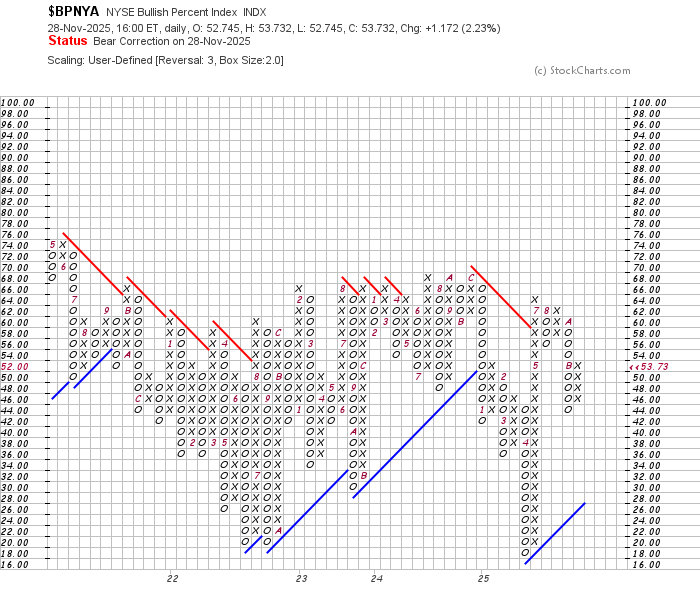

Bullish Percent Indices:

The Bullish Percent indices saw sharp turns higher as well, with the first two shifting back to “Bull Confirmed” status.

BPSPX, BPNDX, BPNYA

Read this for a refresher:

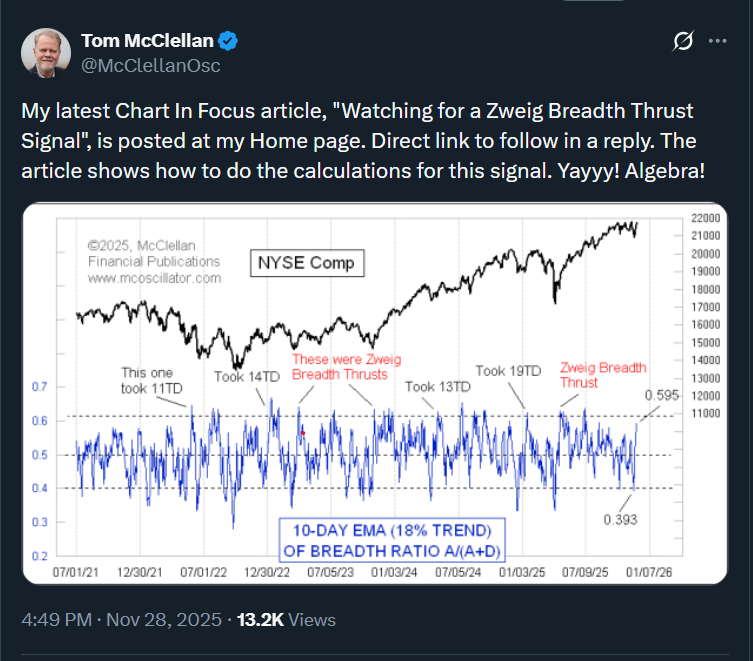

You likely heard a lot about Breadth Thrusts this week, too. The next two posts have the data and explanations from McClellan and SubuTrade.

Thanks to both!

Please click through on the image to view the original posts.

🧭 Now What?

Strong rallies, with broad/improving participation, on what was supposed to be a light volume, slow, holiday-shortened week.

The coast is clear?

Just buy everything and chase it higher?

Maybe.

As always - you do what fits your system and works for you.

Here’s what I’ll be watching.

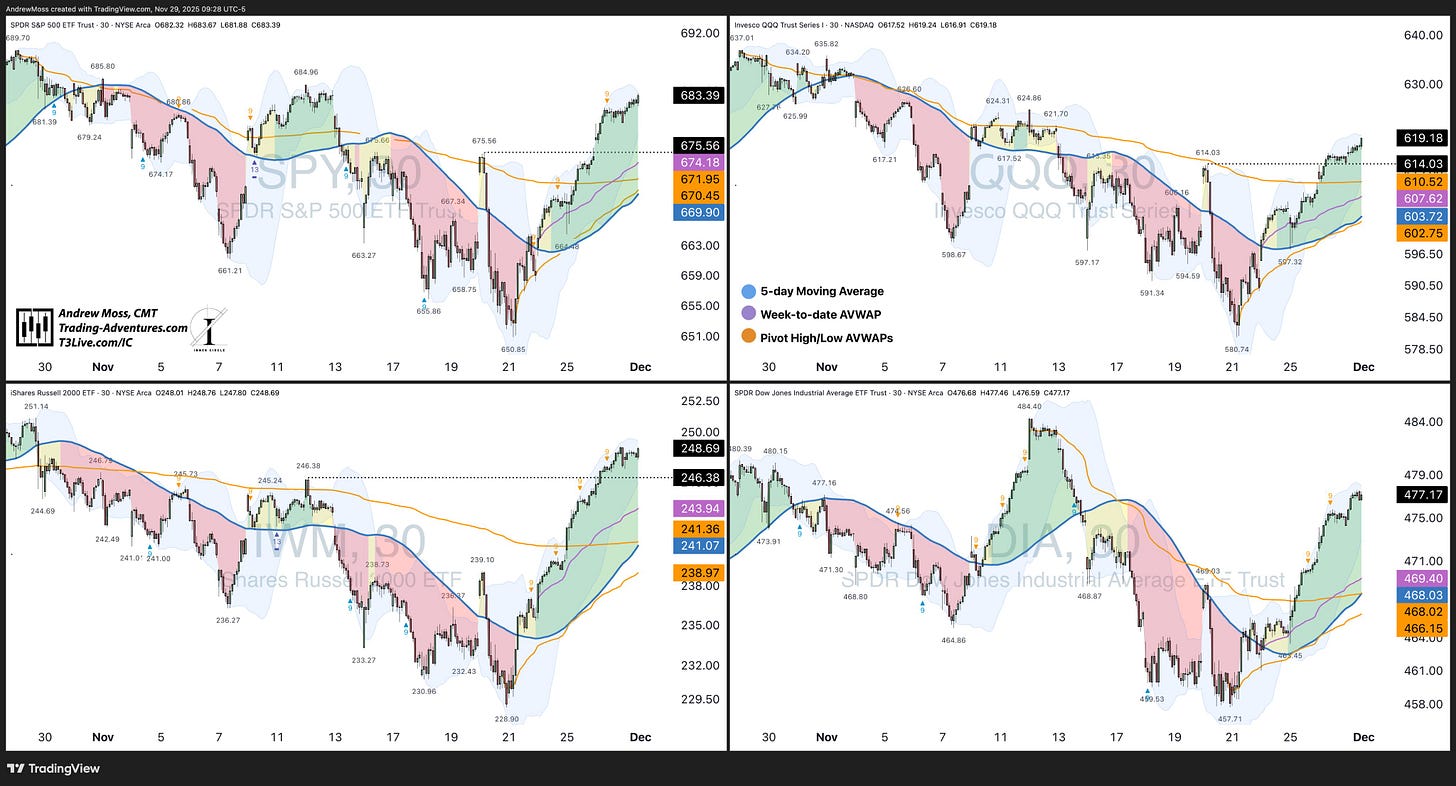

SPY has risen about ~4.5% in about ~4.5 days.

Taking it way back to the 30-minute timeframe, we see the shift to ‘higher-highs’ across all four major indexes—SPY, QQQ, DIA, IWM.

5-day MAs are rising. Prices are above those and the recent relevant AVWAPs.

Can we get a pullback to those areas that then resolves higher, putting in a new ‘higher-low’?

That would be a sensible sequence that may offer a suitable, low-risk entry.

One possibility out of an infinite pool. And the market doesn’t know or care what I want. 😂

We shall see.

🗓 The Week Ahead

Next week brings:

a new month

back to a regular full schedule

JOLTs, Jobless claims, and other employment data

as well as PCE

and earnings from MDB, CRWD, OKTA, CRM, SNOW, DLTR, DG and more.

We’ll be ready.

🧠 Final Thought

That’s it for this quick look at the Weekly Charts (and monthlies).

Thanks for reading. Comments, likes, and reposts are always appreciated.

Have a great rest of your weekend.

🙌 Thanks for Reading

Thank you all for reading and spending some time with me on a Saturday morning!

For a deeper dive, check out the new Chart School section — lessons on breadth, relative strength, AVWAP, and more.

If you found this week’s charts helpful, please -

📤 Share

💬 Comment

♻️ and Repost

It helps more traders see the work and join the discussion.

Also, consider supporting with a paid subscription to keep them coming.

All posts remain public — no locked content. Just charts, signals, and steady updates to help you trade with confidence.

—Andy

Looking For More?

Elevate Your Trading Adventure Even Further With These Offerings.

The Disclosures

***This is NOT financial advice. This is NOT a recommendation to buy, sell, or trade any security. The content presented here is intended for educational purposes only.